The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

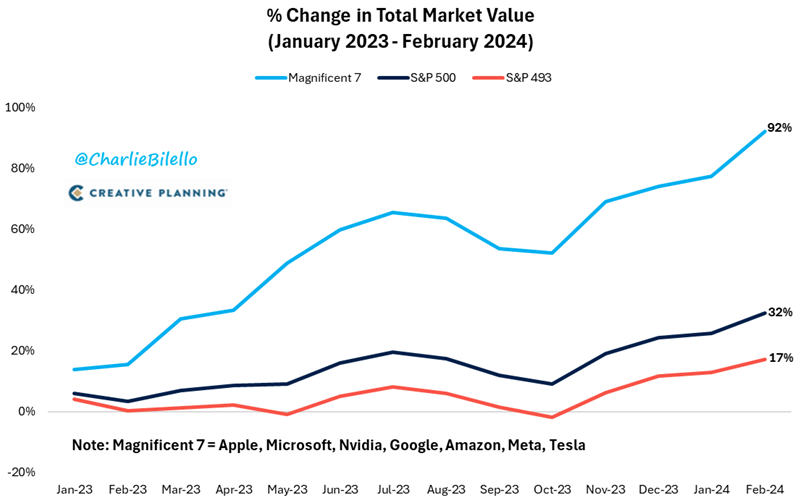

Equity markets are booming. The S&P 500 is up 7% year-to-date and has risen 16 of the past 18 weeks, something that hasn’t been seen since 1971. The so-called Magnificent Seven are the talk of the town, as key drivers to the upwards move. These stocks are up 92% since the start of last year, versus the rest of the S&P 500, which has increased by 17%.

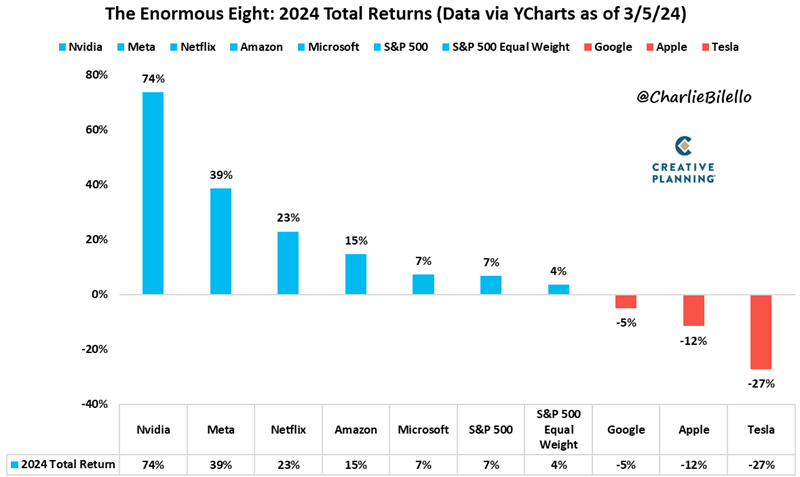

Yet, the Magnificent Seven may soon turn into the Magnificent Four, as the performance of the companies start to diverge. Three stocks, in Alphabet, Apple, and Tesla, have fallen this year. Tesla is the worst performer in the S&P 500 this year.

Apple and Tesla are being hurt by slowing China sales, a combination of a teetering economy there as well as both losing market share to local competitors. Meanwhile, Alphabet is being seen as behind the ball on AI compared to the likes of Microsoft and Amazon.

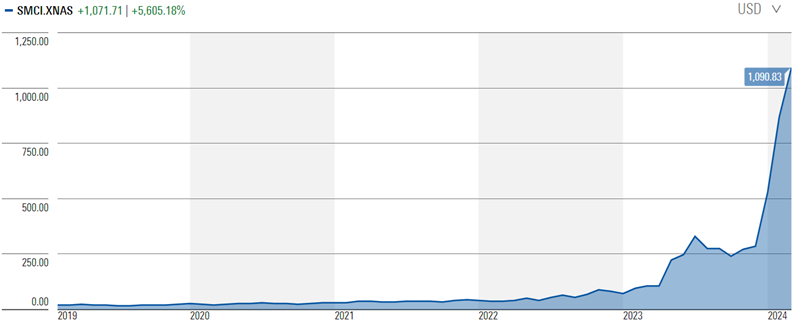

Frothiness is reaching other areas of market, with artificial intelligence server maker, Super Micro Computer, becoming the latest meme stock, rising 278% this year, surpassing its climb of 223% in 2023. The meteoric jump has led to the stock being included in the S&P 500 index. Who said indexes are passive?

Super Micro Computer now sports a market capitalization of US$61 billion, and it’s valued at a cool 84x earnings and on an EV/Ebitda multiple of 66x.

Source: Morningstar

And the optimism is reaching other markets too. This week, Japan’s Nikkei 225 crossed 40,000 for the first time ever, after breaching its 1989 record high in late February.

Nikkei 225

Source: Trading Economics

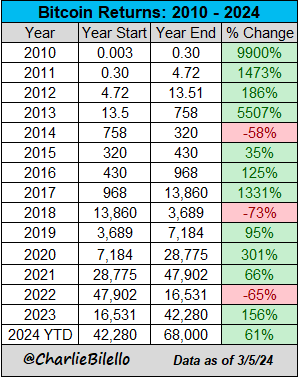

Outside of equities, other markets are feeling the love too. Bitcoin has jumped 61% this year, after a 156% gain in 2023.

Even the proverbial ‘pet rock’, gold is scaling all-time highs. It’s surged 5% this month and 17% over the past year in US dollar terms.

Source: Trading Economics

Optimism doesn’t stretch to economies

Much of the positivity in markets isn’t filtering down to economies. The world’s third largest economy, Japan, is already in recession. The fourth largest, Germany, will almost certainly join it when first quarter GDP statistics are released. Meanwhile, the second biggest economy, China, remains in the sick bay as its credit-fuelled property bubble deflates.

The UK has also recently joined the list of those in recession, along with Sweden, Ireland, and Finland. France, Spain, Italy, New Zealand, and Israel are expected to join them soon too.

Meanwhile, Australia isn’t in great shape either. GDP data released this week shows the economy here expanded by 0.2% during the December quarter. Meanwhile, annual GDP growth slowed to 1.5%, the lowest in 23 years.

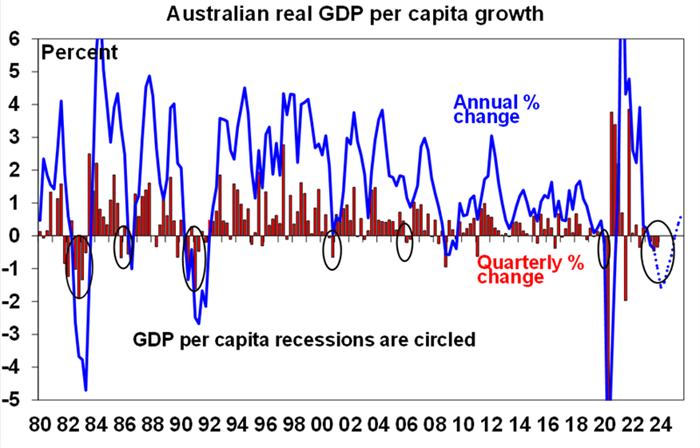

GDP was only in the black thanks to strong population growth. Per capita (or per person) GDP fell 0.3% during the quarter and was 1% down on the year. It’s the third consecutive quarterly decline in per capita GDP. So, we’re officially in a per capita recession.

Source: Shane Oliver, AMP

The big culprit for the poor economic data is a struggling consumer. CBA has this to say on the matter:

“Growth in real consumer spending over the past year has been incredibly weak given the squeeze in real household disposable income … Real household consumption grew by just 0.1%/qtr in Q4 24 [ed: this should read Q4 23] and is up by the same amount over the year. In other words aggregate consumer spend has essentially been flat for a year.

On a per capita basis real consumer spending is down by a very large 2.4% over the year. Such an outcome would normally be associated with a large negative shock or recession. The weakness in the consumer lies at the heart of the soft GDP outcomes. And it is the primary reason why the unemployment rate is on a firm upward trend (albeit from an incredibly low level).”

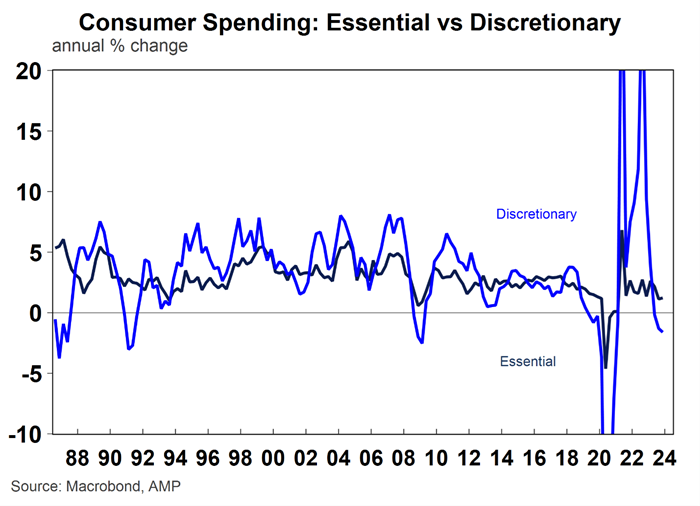

Spending on essentials increased 0.7% during the December quarter, but this was largely offset by discretionary spending declining by 0.9%. The data shows that people are cutting back on dining out, recreation and clothing.

It appears that savings built up from the pandemic period have been exhausted and people are reducing their spend on non-essentials to pay for essentials such rents, food, health, and electricity.

One curiosity is the extreme divergence between the data on consumer spending and the positive results and outlooks reported by consumer discretionary companies during the recent reporting season. Hugh Dive looks at this and all the earnings results in his article this week.

The other question that comes out of this GDP print is what it means for the RBA and rates moving forward. Could it be that the RBA is forced to cut rates before the Fed in the US? It’s an intriguing possibility, though time will tell.

Why are markets soaring, while economies are flailing?

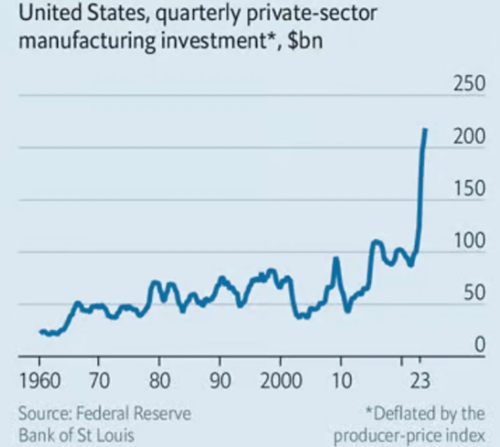

The one major economy that’s firing on all cylinders is the US. Buoyant consumer spending from Millennials, exploding industrial construction as domestic manufacturing moves onshore from China, and strong government spending, are driving an acceleration in economic growth.

The outlook for the US economy looks reasonable as well, given positive demographics, further onshoring of manufacturing, relatively cheap energy sources, and it being the world’s major technology innovation hub.

That contrasts with economies in Europe, North Asia, and China where populations are quickly ageing, domestic demand is stalling, energy prices are high, and innovation underwhelms versus America.

This perhaps explains why the US stock market has trounced most others over the past decade and continues to lead the way.

And even Donald Trump may not be enough to spoil that positive outlook…

***

What are the best ASX dividend stocks for the next decade? In my article this week, I look at 11 companies that may fit the bill.

James Gruber

Also in this week's edition...

For decades, governments have told people to save for retirement, and then hold onto their nest eggs at all costs. However, they're now concerned that retirees aren't spending enough. Kaye Fallick isn't happy with the way that the current government is handling the issue and she offers some alternative solutions to encourage reasonable spending patterns in retirement.

Meantime, retirement planning tends to focus on money. Yet a new study from Professor Joanne Earl and colleagues shows that other matters such as health and career are important too, and a more holistic planning approach can better equip people as they prepare for retirement.

Countless reports have told of how Australia is unprepared to meet the needs of its ageing population. Anne-Marie Elias and Dr. Abby Bloom say it's now crunch time and we urgently need to help older people to get work if needed, access community care, and connect with others.

It's International Women's Day this week, and to commemorate the occasion we have Dr. Tracey West exploring the issue of financial literacy among women. Unfortunately, the evidence shows that being a woman increases the likelihood of lower financial literacy scores, and that this gender gap widens over time. Dr. West says that by rethinking traditional approaches, we can find new ways to bridge the gap.

In Eastern cultures, the Year of the Dragon is a cause for optimism. Eric Souders from Payden and Rygel asks whether 2024 will be similarly auspicious for markets. He thinks strong labor markets and a loosening in financial conditions should help in the first half, though they may sow the seeds for a rockier end to the year.

Two extra articles from Morningstar for the weekend. Mathew

Hodge looks at 5 changes to ASX listed shares on Morningstar's best ideas list, while Shane Ponraj identifies the cheapest stock in Morningstar's coverage universe.

Lastly, in this week's whitepaper, Vanguard outlines how Australian ETFs, especially bond-focused ones, attracted huge inflows in the December quarter.

***

Weekend market update

On Friday in the US, stocks suffered a steep intraday reversal as the S&P 500 and Nasdaq 100 erased early gains to finish 0.6% and 1.4% lower, respectively. Nvidia slumped 10% intraday. Treasurys mostly consolidated their recent rally with the two-year yield edging lower to 4.48% from 4.5%, while WTI crude slipped below US$78 a barrel, gold advanced to US$2,178 per ounce for its eighth straight green finish, and bitcoin briefly topped US$70,000 before retreating somewhat. The VIX wrapped up the day just below 15..

From AAP Netdesk:

The Australian share market on Friday closed above 7,800 points for the first time, on signals rate cuts in Europe and the US could come sooner rather than later.

The S&P/ASX200 on Friday finished at 7,847.0, up 83.3 points, or 1.1% for the day and up 1.3% for the week. The broader All Ordinaries climbed 80.8 points, or 1.01%, to 8,107.5.

Every sector finished in the green except for industrials, which were basically flat.

The heavyweight financial sector was the biggest gainer, rising 2% and the Big Four banks hit their highest levels in years. Westpac rose 2.6% to a four-year high of $27.70, NAB advanced 2.3% to a nine-year high of $35.11, CBA climbed 1.8% to an all-time high of $121.45 and ANZ added 1.7% to a near-seven year high of $29.81.

Virgin Money UK also soared 32.9% to a five-year high of $4.08 after the UK's sixth-largest bank - a 2016 spinoff from NAB - tentatively agreed to be taken over by Nationwide building society for 2.9 billion British pounds ($A5.6 billion) in a tie-up that would remove it from the ASX. Australian shareholders would receive 2.20 pence ($4.26) per Chess Depository Interest.

The mining sector had a quieter day, rising 0.1%, with BHP adding 0.2% to $43.95 while Rio Tinto dropped 0.6% to $119.89 and Fortescue dipped 0.3% to $25.96.

Ramelius Resources rose 1% to $1.56 after the mid-tier gold producer confirmed it was in exclusive talks to acquire Toronto Stock Exchange-listed, WA-focused goldminer Karora Resources. Ramelius has a market cap of $1.8 billion while Karora is worth $C841 million ($A943 million).

From Shane Oliver, AMP:

- Major central banks still waiting for more confidence regarding the fall in inflation, but they are getting close to cutting. Both the Bank of Canada and the ECB left rates on hold as expected in the last week.

- Australia's economy is still growing but only just. December quarter GDP came in roughly in line with market expectations thanks to strength in public spending, non-dwelling construction and trade, but housing construction fell sharply and consumer spending remains stagnant. Consumer spending is up just 0.1% over the last year, which is below RBA forecasts for a 0.4% rise. Were it not for strong population growth the economy would have gone backwards as the per person (or per capita) recession continued.

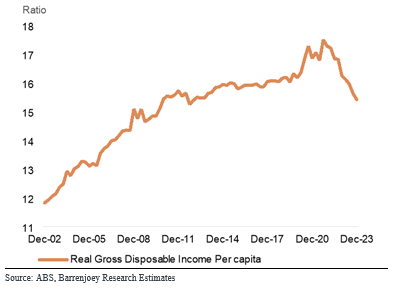

- Household income was given a welcome boost by strong public wages growth and a fall in tax payments allowing a slight rise in the household saving rate, but it looks unlikely to be sustained just yet as public wages were boosted by employment associated with the Voice referendum and tax payments fell due to timing issues. Also, the savings built up through the pandemic are continuing to run down and the tax and mortgage interest shares of household income remain very high. Tax cuts are coming but that’s still not till mid-year and they will only lower the tax share of income slightly leaving it well above levels of just two years ago. And weaker employment will likely start to weigh more in the months ahead. So expect consumer spending to remain depressed for a while yet, before picking up later this year and through next year helped by rate cuts.

- The slump in GDP growth combined with the rising trend in unemployment and falling inflation add to confidence that the RBA will cut interest rates this year. The slump in GDP growth is not likely to be enough though to see the RBA drop its mild tightening bias at its March meeting as it will likely still be waiting for “sufficient confidence that inflation would return to target within a reasonable timeframe.” But we are getting closer, and the consumer is notably weaker than the RBA has been forecasting. So we continue to see the RBA cutting from around mid-year (most likely June but it could be August) with three 0.25% cuts this year.

- Should the Australian Government consider boosting spending in the May Budget? Reports suggest that the Government is considering a pre-election spending boost. Shifting the focus of the budget from deficit reduction to providing stimulus may be appropriate at some point if the economy looks like its subsiding into recession and the RBA needs some help to get it going again. But we are not at that point yet and may not get there. While there may be some justification for a continuation of energy bill relief and a case to flag possible further tax cuts for say 2025-26, this is not the time to boost spending significantly: the best way to help the most vulnerable households right now remains capping public spending to help reduce inflation and interest rates; in the first instance the RBA is best placed to help stabilise the economy by lowering interest rates; and more government spending risks adding to what is already projected to be a far higher government spending share of GDP over the medium term which in turn risks depressing productivity and hence living standards.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website