The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Happy Easter, everyone.

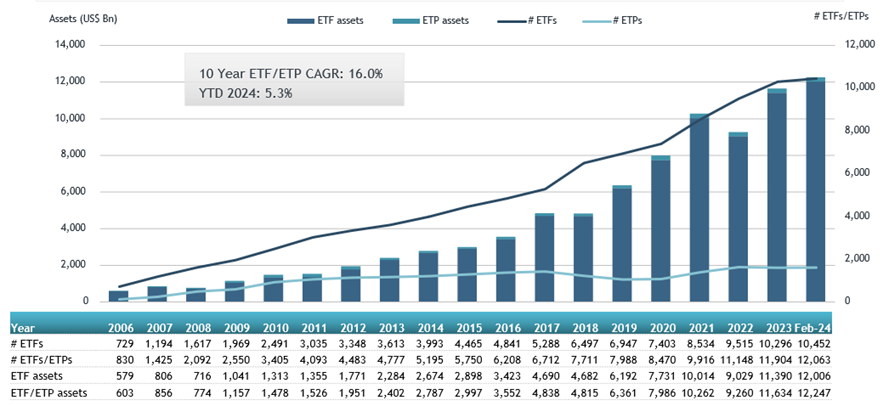

Market bulls are firmly in command. New data from research and consulting company, ETFGI, shows that exchanged traded fund (ETF) assets worldwide reached a record US$12.25 trillion last month. Global ETF assets saw US$116.3 billion in net inflows in February, the 57th straight month of net inflows.

Equities are the big winners. Equity ETFs reported net inflows of $80.4 billion during February, bring year-to-date net inflows to US$141.4 billion, close to 7x the amount recorded from the same period last year.

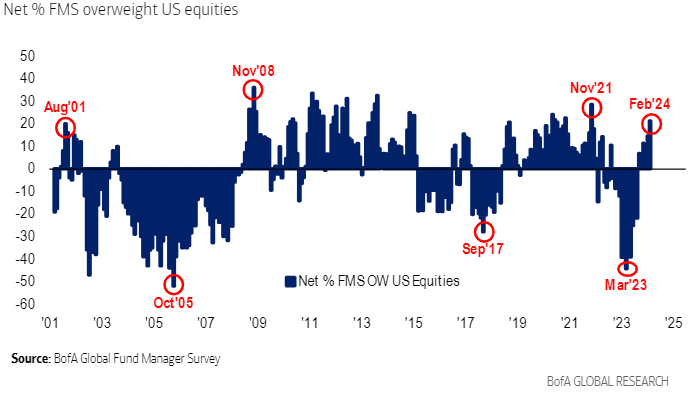

And where’s the money flowing into equities? It’s primarily the US market, and the technology sector. For instance, the Vanguard Information Technology ETF (NYSE: VGT) increased its assets by almost 10% in February alone – quite something for a fund with almost US$70 billion in assets.

It’s not only equities benefiting. Bitcoin is getting plenty of investor attention too. The iShares Bitcoin Trust (NASDAQ: IBIT) now has US$10 billion in assets under management, up from close to US$5 billion in January.

The bullish sentiment is a boon for the ETF industry. There are now more than 12,000 ETF products worldwide, up from 5,000 just five years ago. As Grant’s Interest Rate Observer notes, 3,000 global ETF products have launched over the past 15 months, nearly matching the 3,700 companies listed on US exchanges.

Record equity inflows

The ETF data mirrors broader market money flows. EPFR Global data reveals that investors tipped US$56 billion into US equities in one week through mid-March, besting the previous record set in March 2021. Of those weekly inflows, US$22 billion went to technology stocks, or 39% of the total.

Fund manager sentiment at two-year highs

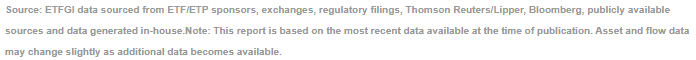

The positive market sentiment is echoed by fund managers. According to Bank of America’s latest survey of global fund managers, sentiment is the most bullish since the heady days of November 2021.

Meanwhile, US stock allocations are also the highest since November 2021.

US tech allocations are the highest since August 2020.

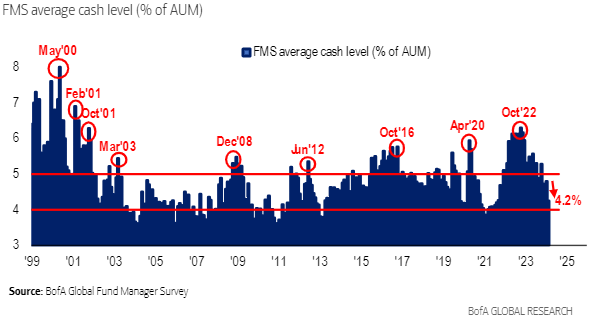

And fund managers have cut their cash levels to 4.2%. Bank of America says large cuts to cash allocations are typically positive on a three-month view, though if they dip to 4% or below, then it’s a ‘sell signal’.

4x leveraged stock ETNs flying

The optimism has worked wonders for the MAX S&P 500 4x Leveraged Exchanged Note (NYSE:XXXX), launched by Bank of Montreal in December last year. The exchange-traded product allows massively leveraged bets on the S&P 500. The ETN is up a cool 31% this year, bringing its market capitalization to US$106 million.

That the leveraged ETN was allowed to launch raised eyebrows initially, as it came after two 4x leveraged products proposed by ForceShares were blocked by the Securities and Exchange Commission back in 2017.

The IPO market rising from the dead

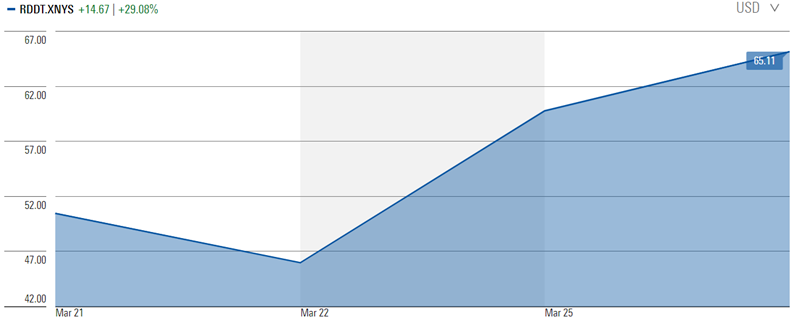

Meantime, the IPO market is getting a jump-start after being moribund for the best part of 18 months. Reddit (NYSE: RDDT) went public on March 21, the first social media company to IPO since 2019. Its IPO price of $34 valued the company at US$6.5 billion, 35% below its highest private market valuation of US$10 billion in 2021.

The stock jumped 48% on debut, is now up 91% since listing. The market cap of US10.35 billion eclipses that of the 2021 private market valuation.

Source: Morningstar.com

Not bad for a company that’s never made a profit since being founded 20 years ago. Last year, it reported US$801 million in revenue but had a net loss of US$91 million. At least it was better than the year before, where the net loss came in at US$159 million.

Reddit now sports quite the valuation, trading at a 12.9x price/sales ratio. That compares to the likes of Meta (NASDAQ: META) at 9.8x and Pinterest (NYSE: PINS) at 8.9x. To put it into context, Reddit has 73 million daily users, compared to Facebook’s 2 billion.

And just this week, Donald Trump’s company, Trump Media & Technology Group (NASDAQ: TMPTG) debuted on the Nasdaq, and rose intra-day 60% on day one before finishing up 16%. It came more than two years after its merger with a blank-cheque firm was announced. Trump’s stake in the company is valued at US$5.4 billion, meaning the Republican Presidential nominee may not go bankrupt after all.

Unsurprisingly, other companies are expected to line-up to IPO. Investors expect US listings from payments provider, Stripe, last valued at US$50 billion, and ‘buy now payment later’ operator Klarna, sometime in 2024.

Insiders selling

While investor go all-in on markets, corporate insiders appear to be heading for the exits. According to Verity LLC, the ratio of corporate insider selling to insider buying is at the highest level since the first quarter of 2021.

Some of the biggest sales have come from tech executives. Amazon founder, Jeff Bezos, sold shares worth US$8.5 billion in February. That’s noteworthy as Bezos has timed share sales well previously, especially in 2020-2021.

Meta CEO, Mark Zuckerberg, sold US$135 million worth of shares in early February, while Palantir co-founder, Peter Thiel, offloaded US$175 million of stock this month.

Is the bull market bubbly or maturing?

Investors love to see things in black and white, yet most are grey. One person’s market bubble can be another’s bull market.

While it’s beginning to feel like 2021, we’re probably not there yet. There are plenty of signs of froth in certain areas of markets - namely in US stocks, technology, Bitcoin, AI – yet that has filtered through to other areas. Whether it will or not remains to be seen.

***

There are a couple of related articles this week. Shane Woldendorp from Orbis looks at whether valuations for the Magnificent Seven stocks are realistic. He drills down into the numbers to reveal what history says about companies with high multiples and how they've subsequently performed.

And, Michael Howell investigates what's behind the surge in Bitcoin and gold prices. He suggests that US bank balance sheets are expanding again, driving increasing money supply that is finding its way into markets, including into Bitcoin and gold. He says that greater money supply will mean inflation remains higher for longer.

***

In my article this week, I suggest that Listed Investment Companies (LICs) could be close to bottoming. Investor disgust, consolidation, de-listings, price discounts, activist investors entering, are typically what happens at business cycle troughs, and it’s happening to LICs now. That may present a potential opportunity.

James Gruber

Also in this week's edition...

The ATO has released the superannuation rates and thresholds that will apply from 1 July 2024, and Julie Steed outlines what’s changing and what’s not, as well as some key considerations and opportunities in the lead up to 30 June and beyond.

VanEck's Russel Chesler runs through the pros and cons of borrowing to invest in the share market. He says gearing provides greater exposure to the share market and its potential gains or losses, as well as more associated franking credits. Yet, there are additional risks and costs to consider too.

What is factor investing and can it help investors deliver better returns? Blackrock's Andrew Ang says investors often express their current views on markets by tilting their portfolios towards certain sectors, in hopes of generating excess returns. But what they may actually be looking for are companies with specific characteristics – or factors - that add portfolio resilience.

ESG is a much-maligned topic in investing circles, yet fund managers have been using such tools to screen for quality companies for some time. UniSuper's Lou Capparelli says ESG can deliver portfolios that are aligned with investor values as well as better returns, and shows us how.

Two extra articles from Morningstar for the weekend. The research team look at three ASX stocks to avoid given their steep valuations, including Reece, while Shani Jayamanne outlines a quality small cap that screens as very cheap.

In this week's whitepaper, the World Gold Council goes through the key factors behind gold's recent rise and why investors should consider an allocation to gold in their portfolios.

***

Weekend market update

On Thursday in the US, stocks stayed flat to wrap up the first quarter with a hearty 10% on the S&P 500, its best start to the year since 2019. Short-term Treasurys came under some pressure with the two-year yield rising five basis points to 4.59% while the long bond edged to 4.34% from 4.36%, while WTI crude reached a fresh five-month high at $83 a barrel, gold notched a record $2,225 per ounce intraday price and the VIX crawled back above 13.

From AAP Netdesk:

The local share market on Thursday closed at a record high for the fifth time this year, finishing just under 7,900 after crossing above that level for the first time ever in intraday trading. The S&P/ASX200 on Thursday rose 77.3 points, or 1%, to 7,896.9, breaking its previous record close of 7,847 set on March 8. For the quarter, the benchmark index rose 4%. It was up 2.6% for the month, its fifth straight month of gains. The broader All Ordinaries on Thursday finished up 80.1 points, or 1%, to 8,153.7.

Every sector finished higher on Thursday, with materials the biggest gainer, climbing 1.8%. BHP rose 1.4% to $44.27, Fortescue added 2% to $25.70 and Rio Tinto finished up 0.7% at $121.76. Goldminers did well with Evolution up 1.7% to $3.58 and Newmont climbing 3.3% to $53.71.

The interest-rate-sensitive property sector rose 1.7% to finish the month up 9.6%, with Goodman Group advancing 1.9% to $33.81 and Mirvac up 2.2% to $2.36.

The Big Four banks were mixed, with ANZ up 0.5% to $29.40, Westpac up 0.4% to $26.10 and CBA adding 0.3% to $120.34. NAB was the outlier, dipping 0.1% to $34.64.

In health care, Fisher & Paykel dropped 2.8% to $23.66 after the Kiwi respiratory products company announced it had initiated a voluntary recall of two nasal high-flow therapy devices because of a speaker configuration issue that could result in inaudible alarms. Fisher & Paykel said the recall of the Airvo 2 and myAirvo 2 devices manufactured before 2017 would cost it around $12 million.

In energy, Beach grew 3.7% to a one-and-a-half-year high of $1.835 after the oil and gas producer said it was undertaking a strategic review of its operations and would cut staff by 30% across its business.

In small caps, Resonance Health went into a trading halt, with the medical imaging company saying it intended to announce a material new acquisition.

From Shane Oliver, AMP:

Australian inflation is continuing to surprise on the downside and is tracking below RBA forecasts. For the fifth month in a row monthly CPI inflation came in weaker than expected in February, with a monthly rise of just 0.2%mom and annual inflation unchanged at 3.4%yoy. While fuel and education costs rose sharply and housing costs continue to rise at a rapid rate this was offset in in the month by greater than expected weakness in costs for holiday travel (despite Swiftonomics boosting hotel prices in Sydney and Melbourne), utilities and many food items.

Trimmed mean and services inflation ticked up slightly, but March quarter inflation looks on track to be just 0.5%qoq or so, which will drop annual inflation to 3.2%yoy, which is well below the RBA’s forecast for 3.5%yoy. And on a six-month annualised basis inflation will have been just 2.2%, ie below target.

The continuing faster than expected fall in Australian inflation provides support for our view that the RBA will start to cut rates from June. However, in the interim the RBA is likely to remain cautious and the risk remains high that the combination of the economy still growing, the stronger than expected labour market, upside risks to wages growth (flowing from another large increase in aged care workers’ wages and the upcoming minimum and award wage cases), along with the revamped Stage 3 tax cuts will see the start of rate cuts pushed back to August or September.

What happened to Swiftonomics? No big impact on inflation or retail sales. Taylor Swift’s Eras Tour was huge, and its impact can be seen in February inflation and retail sales data, but it was never going to be big enough to significantly boost the economy or lead to higher interest rates. Our estimate was that it would amount to just 0.02% of Australian GDP. So, as we have seen, both inflation and retail sales actually came in weaker than expected in February as Swiftonomics was swamped by other factors. And now we have to live with the hangover as the Swift lift was temporary.

But won’t another big increase in Australian minimum and award wages just add to inflation? Sure, it’s a risk given the influencing effect they have on other wages, particularly if the Fair Work Commission grants unions’ request for a 5% rise coming on the back of last year’s 8.65% and 5.75% rises respectively for minimum and award wages. But if its in line with inflation (say 3.5-4%) as the Government appears to be supporting its unlikely to have an inflation threatening effect on wages growth and would be consistent with both slowing down this year.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website