It’s hard to think of a segment of the market that is more hated by retail investors than Listed Investment Companies (LICs). Hate may be too strong a word as LICs were hated a year or two ago, but now they’re mainly ignored.

Yet, institutions are getting increasingly busy in the sector, including:

- VGI Partners Global Investments’ (ASX:VG1) trading volume has recently shot up as speculation mounts that Regal may consider merging the $561 million LIC with the $826 million PM Capital Global Opportunities Fund (ASX:PGF). That comes after Regal acquiring both PM Capital and VGI Partners.

- Saba Capital, a US$4.4 billion global hedge fund known for pressuring funds to act to close discounts to asset values, has taken an almost 10% stake in Hearts and Minds Investments (ASX:HM1), the charity investment vehicle. Saba owns shares in several other LICs including MFF Capital Investments (ASX:MFF), Platinum Capital (ASX:PMC), and WAM Global (ASX:WGB).

- Wilson Asset Management has entered into a scheme of arrangement to merge with QV Equities (ASX:QVE) to create an almost $2 billion vehicle.

- Early this year, the board of small caps LIC, Spheria Emerging Companies (ASX:SEC), gave the manager a deadline of one year to close its discount to net tangible assets (NTA), or the LIC will be delisted.

The corporate activity follows a swathe of funds including Magellan, Bennelong, Antipodes Partners, Monash, Partners Group, Forager and others, who’ve pulled or intend to pull listed funds.

The comments from some of these funds has been instructive. When Forager announced its intention to delist the ~$145 million Australian Share Fund from the ASX in October last year, it stated that the fund had tried and failed to narrow the share price discount to Net Asset Vale (NAV):

“Investor apathy towards close-ended investment vehicles has become entrenched and … smaller, less liquid vehicles like FOR are unlikely to trade at NAV for the foreseeable future.”

It went on to suggest that it wasn’t fair for investors who wanted to redeem money that they’d have to do it at a +15% discount to NAV.

And, in August last year, unitholders voted to remove the $465 million Partners Group Global Income Fund from its ASX listing. Partners Group, a global fund manager, cited several reasons for the delisting:

- The lack of liquidity led to the fund trading at an NTA discount about 90% of the time.

- Unitholders had continued to give negative feedback on the discount and pushed the company to address it.

- Buy-backs were an unlikely panacea as while they might boost the share price in the near-term, they were unlikely to in the longer term.

- A change to an open-ended unit trust structure would give investors to ability to realise an investment at NTA and also give Partners Group the opportunity to increase the fund’s size.

How do we make sense of the retail investor apathy and de-listings on the one hand, and the hive of corporate activity on the other?

A $51 billion pool of money

Before getting to that, let’s first look at what LICs are and aren’t, and how they compare to listed investment trusts (LITs), and exchanged traded funds (ETFs). LICs are investments funds where money is pooled to buy assets. While LICs are companies that issue shares, LITs are trusts that issue units. This article will refer to LICs for both, for simplicity’s sake.

LICs are ‘close-ended’ as there are a fixed number of shares on issue. ETFs are ‘open-ended’, meaning they can issue new shares, or retire them.

As Graham Hand has previously mentioned in this newsletter, the strength of LICs is also their fundamental weakness. The strength is the committed, or permanent, capital means portfolio managers aren’t forced to sell assets to meet redemptions. The weakness is that without these managers providing liquidity, it must come from the market. If demand for buying is less than the supply of selling, then LIC prices fall and can trade at discounts to NTAs.

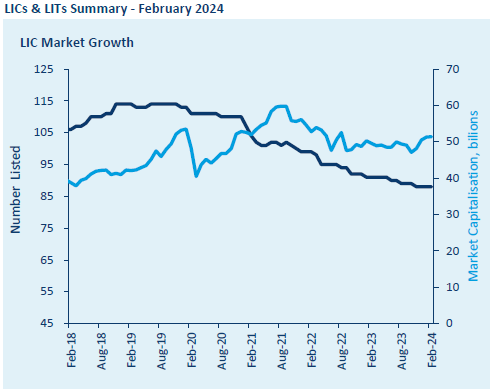

Putting the sector in context, LICs are small, though still significant. The market capitalisation of the sector stands at more than $51 billion. The number of LICs listed on the ASX peaked at 115 almost six years ago and is down to 88 now.

Source: ASX

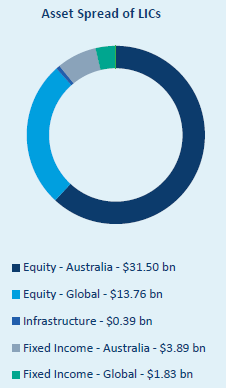

About 62% of LIC assets are in domestic equities and 27% in global equities.

Source: ASX

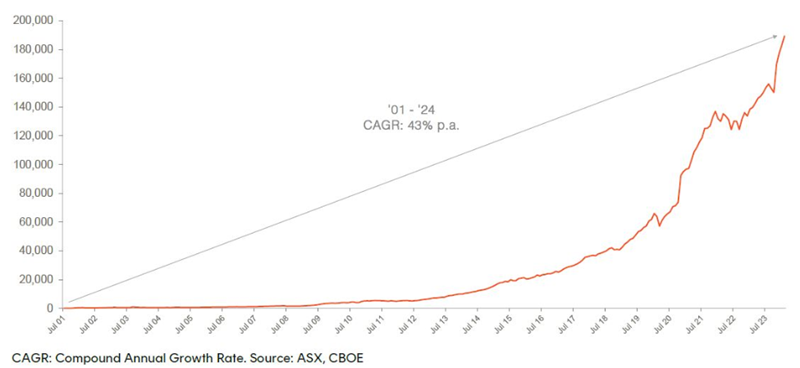

The LICs sector is dwarfed by ETFs and managed funds. ETF assets under management in Australia reached $189 billion last month.

Australian ETF Industry AuM: July 2001 – February 2024

Despite ETFs getting most of the press coverage, they are still small fry when compared with managed funds (including super, unlisted funds, life insurance funds), which have $4.8 trillion of funds under management, as at the end of last year.

Why the fuss over LICs, then, given their relatively small size? For fund managers, there’s the obvious attraction of having permanent capital and the associated management and performance fees that come with it. This can result in managers choosing to keep LICs listed even if a NTA discount persists, because they want or need the fees, among other reasons.

For investors, LICs can give them access to quality managers, with the ease of trading them on the stock exchange. Right now, they can also get these managers at potentially large discounts to NTAs. LICs can also be useful for income investors as they have the ability to smooth dividend payments via their profit reserves.

LICs struggling with large discounts

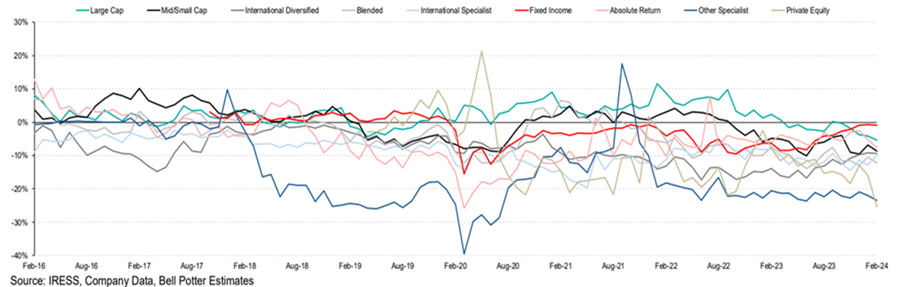

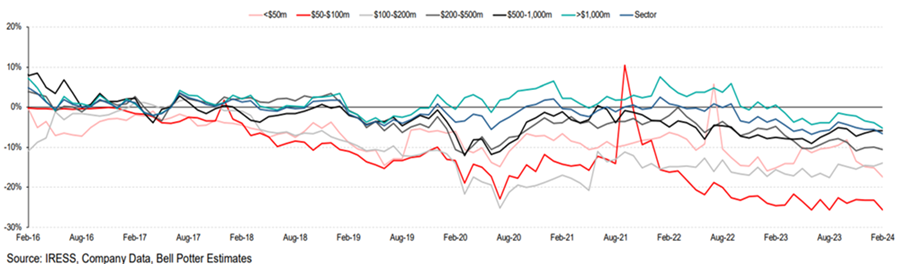

Currently, LICs are trading at some of their steepest NTA discounts on record. Whereas some segments of the sector have usually traded at premiums or close to NTA, now all of them are at discounts.

Premium/discount by investment mandate (market cap weighted)

The chart above shows that large cap LIC have traditionally traded at or above NTA, yet they are currently at discounts. The mid and small cap segment is in the doldrums, and has been for some time, reflecting their benchmark’s underperformance versus large caps. Private equity funds trade at the largest discount, perhaps indicating scepticism around valuations for their assets. Meanwhile, fixed income funds seem to be back in vogue.

Breaking it down by market cap, the smaller the LIC, the greater the NTA discount.

Premium/discount by market capitalisation band (market cap weighted)

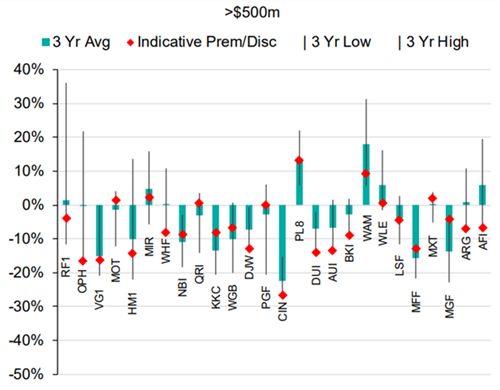

But even among large cap LICs, the current discounts appear extreme. The biggest LICs such as Australian Foundation Investment (ASX:AFI) and Argo Investments (ASX:ARG) are trading close to their widest discounts over the past three years.

Source: Bell Potter

Reasons for the discounts

Why are LICs trading at such large discounts? There are many reasons, some of them self-inflicted, such as:

Underperformance. Many LICs have underperformed their benchmarks in recent years. Their jobs haven’t been made easy by the concentration of market gains in large caps. Yet, that’s not an excuse as good managers will find a way to outperform over an investment cycle.

High fees. A number of LICs still charge high fees even when they consistently underperform. A little-known fact is that LICs charge the fees against NTA not their market value.

Lack of scale. Among the 88 LICs, there are a lot under the $200 million market cap mark that lack scale. Scale brings marketing power, and potentially lower management expense ratios.

Liquidity. Lack of scale can also bring liquidity issues, especially for institutions wanting to buy and sell.

However, there are other reasons, little mentioned, that are likely behind the LIC underperformance too:

LICs typically underperform during stock bull markets. As markets run up, investors are more willing to trade out of LICs to play the market directly.

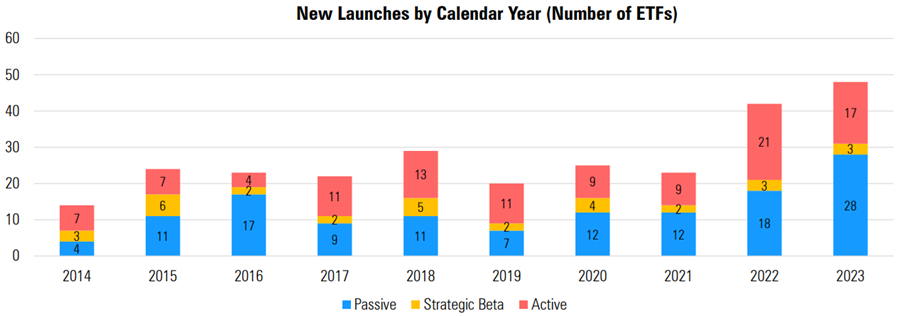

ETFs have acted as an accelerant to this trend. The inflows into ETFs in Australia over the past six months has been extraordinary. It’s led to 11 ETF products hitting the market in February alone, after a record for new ETFs in 2023.

Source: Morningstar

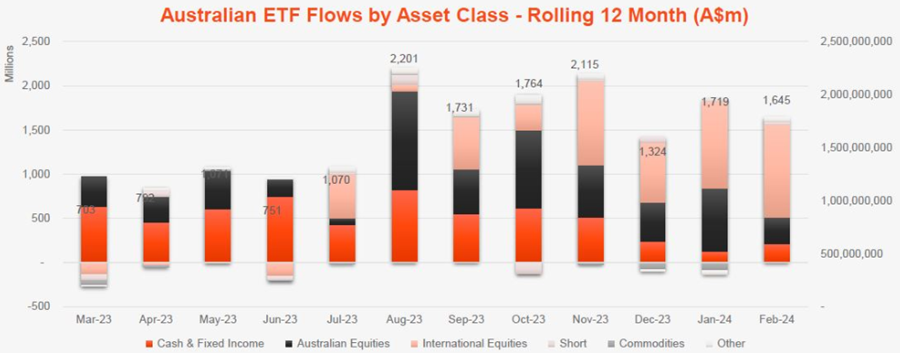

The ETF money has been flowing into the hottest areas of the market. Where once retail investors didn’t want to invest overseas, they are now piling in.

Source: Betashares

While ETFs have much going for them, including low costs, the above charts suggest that there is a lot of momentum trading happening as well.

LICs may offer value in a valueless world

What’s happening with LICs is akin to a normal business cycle of boom and bust. LICs were hot in the mid-2010s. In each of 2014, 2015, 2017, and 2018, there were 10 or more LIC IPOs. Many of the funds now delisting, or being taken over, were part of this wave.

Yet, like many industries, success brought oversupply and increased competition. The competition not only came from other LICs but ‘disruptors’ such as ETFs. That’s meant LICs have had to increase marketing and lower fees and costs, which have hit the small-scale funds especially hard.

We are now at the point in the cycle where savvy investors see value and are pushing for changes. That’s leading to increasing consolidation in the sector. From a business cycle perspective, these types of things typically happen at the bottom of cycles. It’s not unlike what’s starting to happen in the lithium and nickel sectors, though LICs are likely further along in the cycle.

There’s undoubtedly value in the sector. That’s why Geoff Wilson, Saba Capital, and Regal are diving into LICs. As retail investors chase momentum and growth stocks, LICs perhaps represent one of the few pockets of value left in the market.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au