The fundamental strength of Listed Investment Companies (LICs) and Trusts (LITs) is also their fundamental weakness. The strength of the structure is the committed capital which means portfolio managers are not forced to sell assets to meet redemptions. The weakness is that without the manager providing liquidity, it must come from the market. If there is insufficient buying demand for the selling supply, the price falls to meet investors prepared to buy at a discount to the value of the underlying Net Tangible Assets (NTA) or Net Asset Value (NAV). LICs are companies that issue shares whereas LITs are trusts that issue units, but this article will mainly use 'LICs' for both.

LICs are called ‘closed-end’ because there is a fixed number of shares on issue, as opposed to ‘open-end’ such as Exchange Traded Funds (ETFs) and unlisted managed funds, where managers create or retire units in the fund according to demand. Open-end funds can absorb shocks through the issuing and redeeming of units and trade around the value of their NTAs.

Kicking the can down the road

Managers have developed techniques to compensate for inadequate liquidity in their LICs, including:

- Buying back shares at a discount

- Increasing marketing efforts to improve buyer demand

- Committing to regular payment of dividends

Share buybacks are common but often fail, reduce the size of the company and increase the percentage cost of fixed expenses. Buybacks do not create new buyers but liquidity for sellers and they tend to simply kick the discount can down the road.

In frustration at the poor investor experience, and embarrassment that buyer support is insufficient, managers are giving up, moving their LIC money into another structure which allows investors to redeem close to NTA.

LICs struggling with large discounts

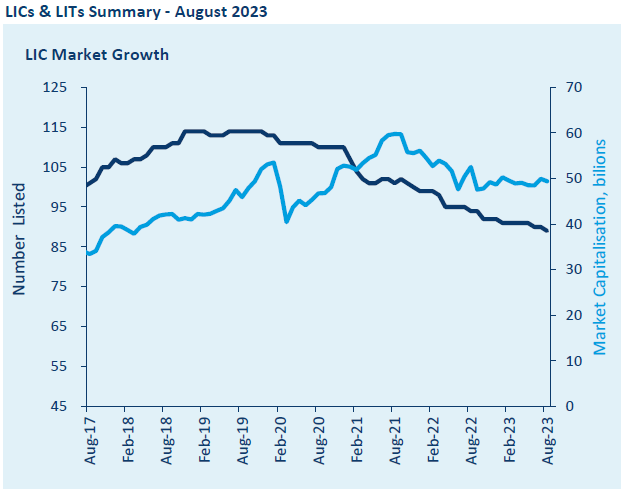

According to the Australian Securities Exchange (ASX), there were 89 LICs with a market capitalisation of $49.4 billion as at August 2023. Rival exchange Cboe offers 20 listed managed funds. The number on the ASX is down from a peak of 115 in 2019, a reduction of 26 LICs and LITs in four years.

Source: ASX Investment Products Summary, August 2023. Black line is number.

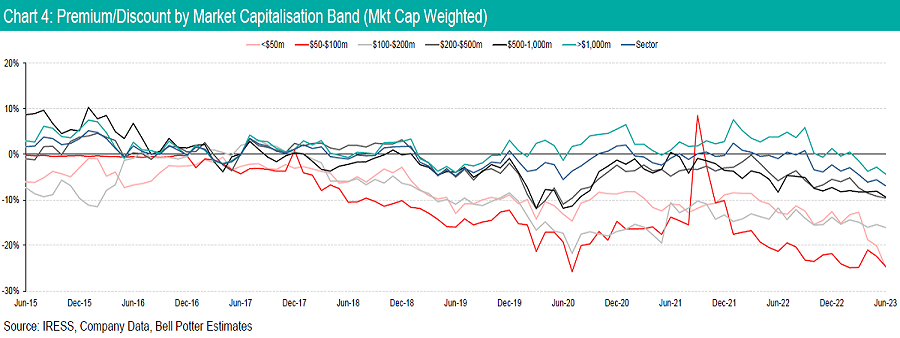

According to Bell Potter, as shown below, LICs are close to their widest discounts to NTA in history, with smaller LICs (less than $100 million) at around 25%. Even the large LICs which have traditionally traded around NTA due to decades of investor support and large shareholder bases are currently at discounts.

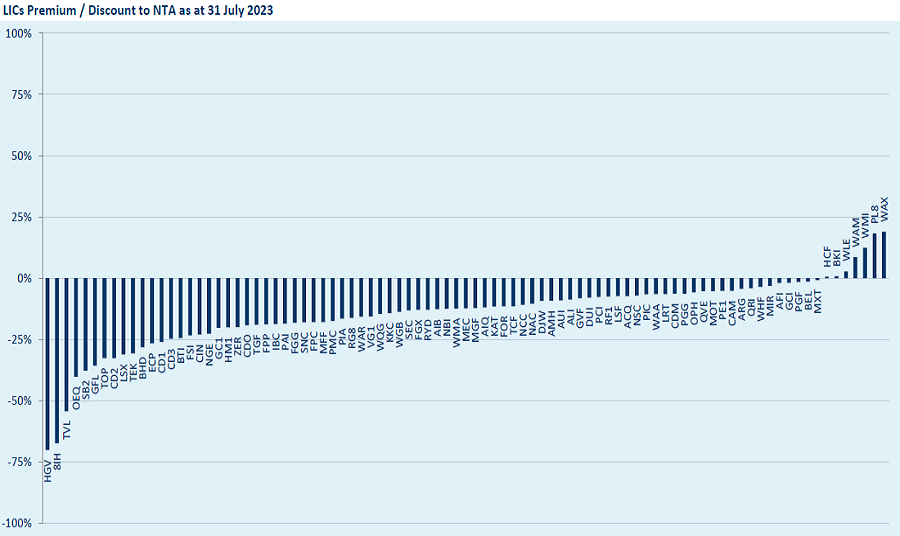

The table below identifies the discounts for many of the leading LICs. Two notable exceptions are Plato (ASX:PL8) and three of the Wilson funds (ASX:WAX, WAM and WMI), with the premium driven by a strong reputation for delivering income which encourages buyers to focus on the dividends rather than the premium, plus an ongoing commitment to marketing.

It’s a strange investment in Plato at a current premium of about 24% when the unlisted managed fund run with the same strategy is available at NTA and accessed easily via the ASX online mFund service.

Source: Bell Potter LIC Report, 1 September 2023

However, marketing is not a panacea for all funds, as Wilson also has as many funds trading at large discounts, such as WAM Active (ASX:WAA) -13%, WAM Strategic (ASX:WAR) -15% and WAM Global (ASX:WGB) -14%. It is ironic that WAR was launched to buy LICs and LITs at a discount and it suffers the same fate as its targets. In fact, Geoff Wilson says one of the joys of LICs is buying $1 of assets for 80 cents, and with WAR, they can be bought for 15% less, or 68 cents (disclosure, the author owns WAR in his SMSF for this very reason). But it's not much comfort for the investor who bought the initial offer at $1.

Why did Partners Group Global Income delist last month?

On 2 August 2023, unitholders voted to remove Partners Group Global Income Fund (ASX:PGG) from its listing on the ASX. This is not a market minnow shrinking away from its listing because its small size cannot cover listing costs. The fund has a market capitalisation of $465 million and is managed by a leading global fund manager with over $200 billion in assets under management globally (and another declaration, the author owns units in this fund).

Why did its investors who bought into the listed structure, which in theory offers on-market liquidity, vote to delist?

Here are some of the reasons given by Partners Group:

- The lack of liquidity on the ASX has resulted in PGG trading at a discount to its NTA about 90% of the time, with a discount more than 5% for about 40% of the time. Units have traded in the range of 18% discount to 3% premium, with an average discount of 15% in the last six months.

- Unitholders continue to give negative feedback about the discount and request Partners Group to address it.

- Alternatives such as share buy-backs would only increase the unit price in the short-term with no lasting impact.

- The proposed change to an open-ended unit trust gives an ability for investors to realise an investment at NTA and a better ability for Partners Group to increase the fund’s size.

Partners Group advised it will initially limit the liquidity in the new fund, which will give it time to arrange an orderly sale of its investments if needed:

“Currently the Fund is traded on the ASX with liquidity provided from the matching of buyers and sellers on price and volume on market. If the Fund is transitioned to an open-ended unit trust, it is anticipated that net withdrawals of Units in the Fund will be limited per month to 5% of NAV at the end of the preceding month (unless the Responsible Entity waives such restriction). This can potentially restrict Unitholders being able to withdraw their Units in the Fund for a significant period.”

Partners Group also said the “Regulatory changes to the way that LITs are distributed to investors” have compromised the merit of the LIT structure. Specifically, this is the ability to pay brokers and advisers a stamping fee to sell additional paper to their clients. This was always a highly-dubious distribution method, with sellers incentivised to put clients into new transactions based on the fee rather than the merit of the transaction. As firm evidence that it was the stamping fee driving the market, not genuine demand, the new issue market for LICs and LITs has almost disappeared without these payments.

Reasons for other delistings

Other managers have removed their LICs and LITs, and here are five examples and their reasons:

1. Simon Shields of Monash Investors closed his LIC (ASX:MA1) in 2021 in favour of an exchange-traded managed fund (ETMF) (ASX:MAAT). He told the AFR:

“LICs have been trading at a discount for a long time in Australia and it doesn’t seem like that’s going to change. We’ve come from first tier fund managers and stockbrokers. We just felt it was besmirching us to be managing a LIC that was trading at a discount and we weren’t prepared to have this situation continue.”

To Shields’ credit, he knew some large activist managers had bought the LIC at a discount and at least one-third of the fund would be redeemed. Unfortunately, redemptions have continued and the size of the fund is now $18 million from $64 million at the time of the restructure. Said Shields:

“ETMFs are a better solution for having a listed investment product. Any reputable fund manager with their LIC at a discount has got to be worried that that’s an unfair situation and reflects poorly on them as fund managers.”

2. One of the country's most prominent investors, Ellerston’s Ashok Jacob, previously manager of Packer family money, delisted his global equity LIC (ASX:EGI) in 2019, saying in a letter to shareholders:

"It's important to note that the discount, while unacceptable, is an industry-wide phenomena, with the listed global equity sector trading at an average discount of over 17% as at 30 September 2019, and is often a reflection of market sentiment volatility and other events which can reduce investor demand."

3. In 2021, Antipodes converted its LIC (ASX:APL) to its 'Quoted Managed Fund' (ASX:AGX1) after many previous attempts to close the discount. It advised:

"APL’s Board has over the past two plus years been actively considering a range of options to address the unacceptable position of the APL share price trading at a discount to its NTA. Initiatives undertaken have included an accelerated on-market buy-back program, enhanced shareholder communication and the Conditional Tender Offer (CTO) approved by shareholders in November 2020. Nevertheless, the discount has persisted."

4. Also in 2021, the Australian Leaders Fund (ASX:ALF) delisted after agitation from shareholders, and investors were converted into the unlisted Watermark Absolute Return Fund. In this case, the delisting was the prevent a takeover and a loss of funds for the manager.

The most common reason funds delist is either forced or voluntary merger or takeover. Wilson has absorbed Premium Investors, Wealth Defender, Century Australia, PM Capital Asia and Absolute Equity into WAM Leaders. The Templeton Global Growth Fund (ASX:TGG) was merged into Wilson's global LIC (ASX:WGB).

5. While in some cases the takeover has been unwelcome, such as the public fight with PM Capital, in other cases, such as Absolute Equity (ASX:AEG), the Board wanted to delist to remove the discount which was not viewed favourably by AEG’s portfolio manager, Sam Shepherd. He preferred to focus on his unlisted business. The Board entered a consultation process in February 2022 where:

“the AEG Board and its advisors evaluated a range of alternatives with a view to maximise value for all AEG shareholders.”

Alignment of interests

The managers at Monash, Absolute Equity, Ellerston, Antipodes and Partners Group should be applauded for elevating the rights of their investors. They all decided the discount was permanent and not a good reflection on their brand nor beneficial for clients. Investors who supported an IPO at a $1 take no comfort in seeing the price at 80 cents, even if new investors receive a low entry price.

Why are other managers not acting in the best interests of investors? Mostly, they want to retain the funds and fees of a closed-end vehicle. The heavy redemption experience at Magellan and Platinum in recent years shows how money can leak out of open-ended funds. There is market speculation that Magellan may convert its global LIC (ASX:MGF) after options expire in March 2024. Magellan has form after converting its High Conviction Trust (ASX:MHH) to an ETF. More on this in another article.

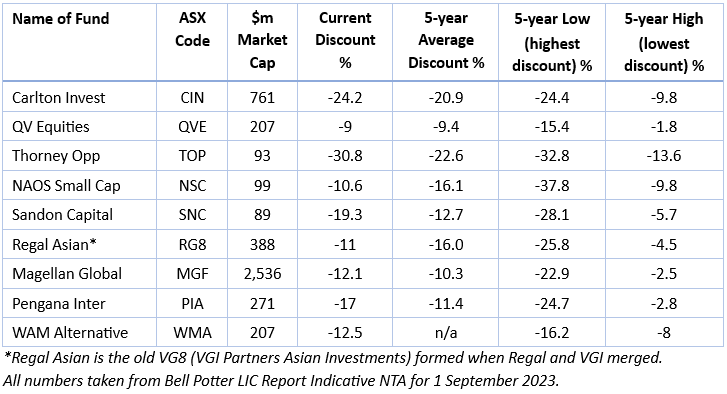

One way to judge who else should convert is to evaluate the long-term discount history, as reported for example by Bell Potter and featured in the Firstlinks Education Centre. It shows the average Premium/Discount over various time periods out to five years, and the five-year range of highest premium to lowest discount. If a LIC or LIT has been at a high discount for five years, it is unlikely to recover enough support to push towards its NTA, especially facing such intense pressure from cheaper ETFs.

Another factor rarely discussed is that managers charge fees on the full NTA, not the market value. This can grosses up the percentage fee versus an unlisted fund. For example, if a fund has an NTA of $100 million and a fee of 1% pa, the manager collects $1 million a year. If the LIC is trading at a discount of 20%, $1 million on $80 million is 1.25% pa, and to rub salt into the wound, there may be a performance fee as well.

Here are some funds which have (based on the Bell Potter numbers for 1 September 2023):

- A current large discount

- A five-year large average discount

- A range of high to low discounts over five years which are all negative

The boards and management of these LICs need to justify to their investors why they believe in a future turnaround in the discount despite little evidence for at least five years. There are many more in a similar position. It’s not that the managers have weak governance, little marketing or even poor reputations, but how are they balancing their own desire for fees against the ability of investors to realise full value?

A small manager such as NAOS or Sandon needs the funds to run their business. Some managers argue that the LIC or LIT structure suits less liquid assets which cannot be sold easily to meet redemptions. Sebastian Evans at NAOS told Morningstar that he needs the committed capital of a LIC structure:

“If we converted to an active ETF and needed to liquidate our holdings it wouldn’t work. We have a 30% holding in a business. I can’t sell that in a day or two."

But there are plenty of unlisted property funds which manage liquidity by limiting redemptions at NTA to a certain amount or time period.

Larger managers with far more in their unlisted funds should consider whether the hassle of listing a small part of their business is worth it. When I sat on the board of Peter Morgan's 452 Capital, the operations people spent as much time on the small LIC as the rest of the much larger unlisted fund business.

Where do LICs stand now?

The development of active ETFs or ETMFs is relatively recent, opening the way for LICs to convert to listed open-ended versions, as well as unlisted funds, to close the discount. Managers with large discounts face disgruntled investors, activist competitors and the rising demand for ETFs.

Although discounts are historically wide at the moment, many of the large, traditional LICs have a record of drifting in and out of discount, and these can present opportunities for investors. There is a role for the right managers with the right LICs but it's time for many other managers to move on.

Footnote

In a fascinating development for the King of LICs, Geoff Wilson has announced plans for an open-ended version of WAM Leaders, looking to raise $500 million to $1 billion. It will be his first move away from closed-end LICs since his initial fund about 25 years ago.

Then on 12 October 2023, Forager (ASX:FOR) announced:

"The Manager considers that the LIT structure served this purpose well through several market cycles in the subsequent seven years. In the past four years, FOR’s units have been trading at a meaningful discount to the underlying NAV. FOR has implemented a number of initiatives in an effort to address this gap, including a semi-annual distribution policy and undertaking a regular buyback.

Whilst there have been some periods of improved trading since those actions commenced, it has not been sustained and FOR’s units have recently been trading at an average discount of more than 15% to NAV.

It is the Manager’s view that investor apathy towards closed-ended investment vehicles has become entrenched and that smaller, less liquid vehicles like FOR are unlikely to trade at NAV for the foreseeable future. The Manager’s current view is that the magnitude and sustained nature of the discount to NAV now outweighs the portfolio management benefits of remaining a closed-ended fund.

The Manager has considered a range of additional measures to further improve the traded market price of FOR units. The Manager currently considers that the solution which will be in the best interests of FOR unitholders is likely to be the orderly transition of FOR back to an open-ended fund."

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor. Graham holds some of the securities mentioned in this article and was on the Board of Absolute Equity Performance Fund until two years before its delisting.