The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The Albanese Government delivered its third Budget on Tuesday, and we’ll take a brief look at the key numbers, policies, and economic forecasts, as well as draw some conclusions, including for superannuants and retirees.

Key budget numbers

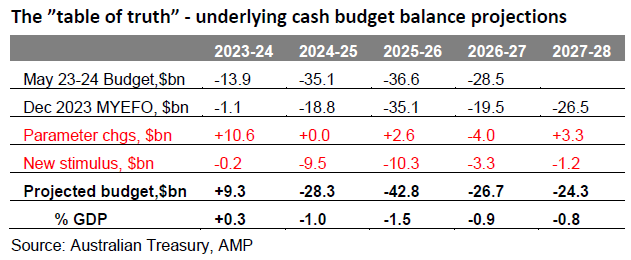

- This year’s Budget is forecast to be in surplus by $9.3 billion, or 0.3% of GDP. That surplus is higher than the December forecast of a $1.1 billion deficit, or 0.0% of GDP, and the original estimate for a deficit of $13.9 billion, equivalent to 0.5% of GDP. It means the Budget will be in surplus for a second year in a row.

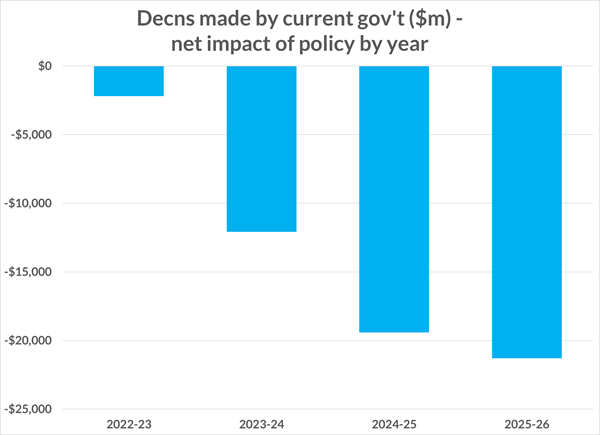

- However, future years are expected to slip back into deficit. The Budget estimates a 2024/5 deficit of $28.3 billion (1% of GDP). That’s larger than the deficit forecast in December of $18.8 billion. And the $9.5 billion difference entirely comes from new government spending.

- The budget deficits forecast to 2027/28 range from 0.8% to 1.5% of GDP. It partly comes from an increase in net spending of $24 billion over the next four years. Cumulative deficits of $112 billion are predicted to 2028, and the deficits will run for a decade.

Source: Chris Richardson

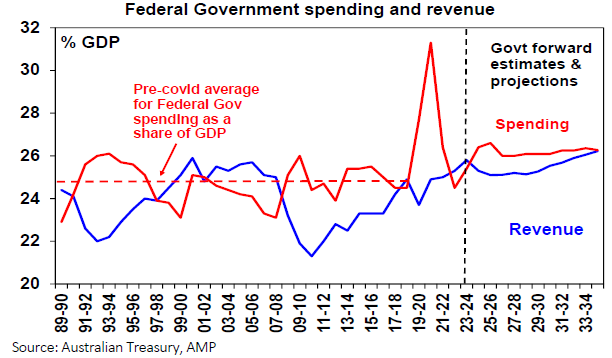

- It will result in spending as a percentage of GDP averaging close to 26% in the long term, compared to 24.8% prior to the pandemic. That’s due to the new policy announcements and higher spending from health and aged care, as well as the NDIS.

- Tax cuts will result in a dip in revenue, however the Budget forecasts that revenue will recover, mostly due to bracket creep.

Economic forecasts

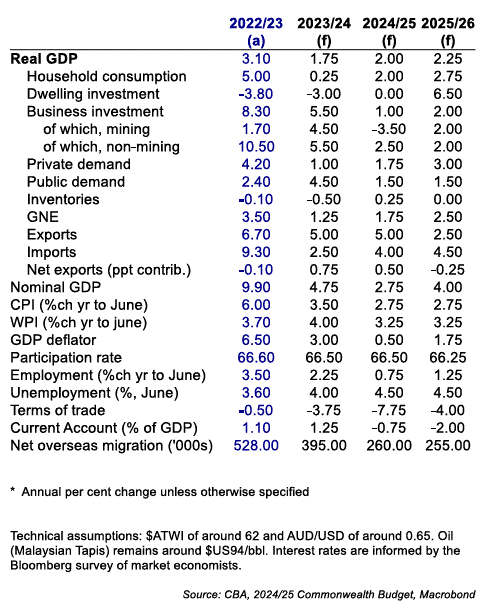

- The Government left its forecast for GDP growth unchanged for this financial year, but marginally lowered it for 2025-2026. GDP growth of 1.75% is projected this year, rising to 2% in 2025 and 2.75% in 2026. Interestingly, the bounce in growth is expected to mostly come from a rise in household consumption, which has been tracking poorly in recent months.

Government economic forecasts

- The Government has also lowered its inflation forecasts. It projects 3.5% for this financial year, and 2.75% next year. The upfront energy bill deductions for households and small businesses will reduce headline inflation by 0.5% in 2025. The Budget assumes a slowing in wages growth from 4% in 2023/24 to 3.25% over the next two years.

- The Government increased its forecast for net immigration this financial year to 395,000 from 375,000 in December. It expects international student cutbacks to reduce net immigration to 260,000 next financial year. That will result in population growth falling to 1.4% in 2024/25.

- The Budget maintained most of the Government’s commodity price assumptions. An iron price of $60/tonne is predicted from 2026 onwards, compared to the current price above $100/tonne. If iron ore prices continue near current levels, that would be a revenue windfall for future budgets.

Major policy announcements

The key spending initiatives were mostly announced prior to the Budget, and include:

‘Future Made in Australia’

This is one of the cornerstones of the Budget, with an estimated investment of $22.7 billon over the next decade. The investments will focus on “industries that contribute to net zero transformation where Australia has a competitive advantage, and in areas where Australia has national interest imperatives related to economic security and resilience.”

Here’s where most of the money will go:

- $7 billion in production tax incentives for the processing and refining of critical minerals.

- $6.7 billion production tax incentive to produce renewable hydrogen.

- $1.7 billion to promote net zero innovation, including for green metals and low-carbon fuels.

- $1.5 billion to strengthen battery and solar panel supply chains.

Cost-of-living relief

Key spending measures include:

- The previously announced personal income tax cuts. The modified stage three tax cuts will come into effect from July 1. The redesigned tax cuts will cost the Budget $106 billion over the next four years. A quick summary:

- Earn $100k, save $2,179 p.a.

- Earn $150k, save $3,729 p.a.

- Earn $200k, save $4,529 p.a.

- Earn $250k, save $4,529 p.a.

- Earn $300k, save $4,529 p.a.

* The figures don’t include the Medicare levy and other deductions.

- A 7.8 billion cost-of-living package, including:

- $3.5 billion in power bill discounts. This will start July 1, run for a year, and equates to $300 off for every household and $325 for small businesses.

- $1.9 billion for rent assistance. The Government will increase the Commonwealth Rent Assistance by a further 10% after last year’s 15% rise. This will increase the maximum rate for a single person living alone from $188.20 per fortnight to close to $200. For a single person in a shared house, it will rise from $125.47 to almost $138 per fortnight.

- Changing the indexation of student debt from the CPI to the lower of either the Wage Price Index (WPI) or CPI. The Government estimates that this will reduce the outstanding value of student debt by $3.3 billion.

Health

The price of medicines listed on the Pharmaceutical Benefits Scheme (PBS) will be frozen for everyone or at least two years, and longer for older Australians. The maximum price for any PBS-listed drug will be $31.60, and $7.70 for pensioners and concession card holders. The Government estimates the measure will cost $310 million over the next five years.

Aged care

The Government has budgeted a further $500 million this financial year for another 24,100 home care packages.

$610 million will go to the states to help long-stay older residential patients to leave hospital and live back in the community.

Age Pension

Deeming rates for people on government support payments, including the Age Pension, have been frozen at current rates until June next year. The upper deeming rate will stay at 2.25% while the lower deeming rate will remain at 0.25%.

Superannuation

There wasn’t a lot in the Budget on super. However, the Government has strengthened the Paid Parental leave (PPL) scheme. Funding includes $1.1 billion over four years to pay super on PPL for births and adoptions on or after 1 July 2025.

Housing

The Government has announced $6.2 billion build more homes. Some of this money will go to the states to unblock bottlenecks preventing houses being built.

$1 billion will go towards crisis accommodation for women and children, and $423 million will go the states to support social housing and homelessness services.

Defence

The Government had previously announced a $330 billion investment in the National Defence Strategy and the Budget allocates an additional $5.7 billion to 2028.

Infrastructure

The Government has committed an additional $2.9 billion over five years to increase its infrastructure investment, with most of the focus on Western Sydney, near the upcoming second airport.

Budget implications

Given that an election is likely not far away, this was a Budget that was always going to be as much about politics as policy. And the majority of economists seems to have given it the thumbs down, echoing the AFR’s screaming front-page headline, ‘Spending addiction fuels a new decade of deficits’.

They cite the increased spending and ‘bigger Government’ putting upward pressure on inflation and making it more difficult for the RBA to reduce inflation and interest rates. They also point to structural deficits being a bad thing when the terms of trade are at 100-year highs and unemployment is at 50-year lows. It won’t leave much wiggle room when a recession hits.

Also, many economists point to the ‘Future Made in Australia’ theme being protectionist and a case of the Government cherry-picking ones – things that have been tried in the past and failed.

Finally, they think the housing measures won’t be enough to plug the current shortfall in homes – nowhere near it.

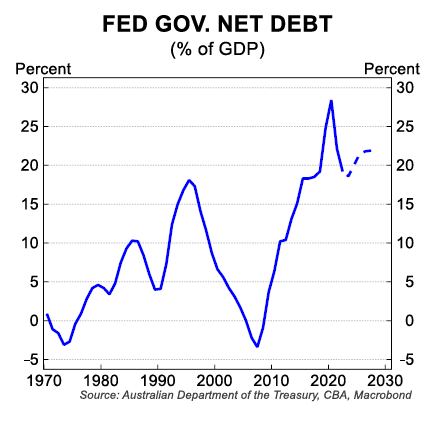

Yet, things aren’t as gloomy as the economic boffins make out. Australia remains in a sound economic position, and it balance sheet is vastly superior to most of the developed world. Federal Government net debt of 18.6% this year will rise to just under 22% of GDP by June 2028.

That said, the bigger picture is that Australia faces the same problem as much of the West: people are living longer, putting pressure on welfare budgets. The various Intergenerational Reports probably underestimate future longevity given continuing medical advances in the field.

Unfortunately, Governments everywhere, including in Australia, are not living within their means and are funding the welfare through borrowing. And Governments will struggle to keep up with ever-increasing welfare bills. To raise revenue, it’s likely that things like super and the Age Pension will continue to be tightening.

James Gruber

In this week's edition...

Graham Hand makes a welcome return to discuss a part of financial markets that's fascinated him over the past six months - and it's probably not what you think. It's residential real estate. The question that hits Graham every day is: where is all the residential money coming from? He looks into rising house prices and how they'll lead to new solutions to enable people to own a home.

When legislation for the proposed new tax on people with more than $3 million in super was first introduced to Parliament, it was referred to a Senate Committee. That Committee reported back last Friday (May 10) with a majority recommendation to pass it unaltered. Meg Heffron says it seems that the tax is coming and she outlines how you should prepare for it.

'Putting your affairs in order' is a term that is commonly used when people are approaching the end of their life. It is not as easy as it sounds, though Noel Whittaker says it should not be overwhelming, or consume all of your spare time. He suggests the key things that need to be considered.

Shoppers are cutting back spending at supermarkets, gyms, and bakeries to cope with soaring insurance and education costs as household spending continues to slump. CBA's Stephen Halmarick and Belinda Allen says renters especially are feeling the pinch.

Another banking reporting season is done, and Hugh Dive says the major banks all reported solid results, large share buybacks, and very low bad debts. He looks at the main themes from the results, and the winners and losers.

The most common question that Ophir's Andrew Mitchell gets from investors on the outlook for global small caps versus large caps is: “What is the catalyst for smalls caps to start outperforming?” He dives into the potential catalysts as well as why he thinks small caps will hold up better in any future economic downturn.

Last year, AUSIEX did a research report on how by 2028, all Baby Boomers will be eligible for retirement and the Baby Boomer bubble will have all but deflated. In the follow-up report, Te Okeroa addresses two key questions: where will the Boomer's money end up, and what are the implications for the wealth management industry?

Two extra articles from Morningstar for the weekend. Angus Hewitt explores whether Aristocrat is still attractive after a share price surge, while Mark LaMonica suggests 11 ASX shares offering great value right now.

Lastly, in this week's whitepaper, TD Epoch - an affiliate of GSFM - delves into November's US election and the potential implications for investors.

***

Weekend market update

On Friday in the US, the S&P 500 eked out a modest gain of 0.1% in the final session of another positive week as it extended its fast start to the month of May. The Dow also edged higher of 0.3%, closing above 40,000 for the first time. The Nasdaq Composite slipped by 0.1%. Copper surged to near a record in London, nickel leapt near 8%, gold retook US$2,400 an ounce and oil touched US$84 a barrel. The VIX slid below 12 for the first time since 2019.

From AAP Netdesk:

The Australian share market on Friday fell after potential profit-taking but still recorded its fourth straight week of gains. The benchmark S&P/ASX200 index on Friday gave back more than half of the previous day's rally - which had left it just 54 points from its all-time high - to finish 66.9 points lower at 7,814.4, a drop of 0.85%. The broader All Ordinaries on Friday dropped 67.8 points, or 0.83%, to 8,082.3. For the week, the ASX200 rose 0.8%.

Ten of the ASX's 11 sectors finished lower on Friday, with mining gaining 0.4%.

Technology was the biggest mover, dropping 3.1% as Wisetech Global fell 3.6% and Dicker Data plunged 13.2% to an eight-month low of $9.25 on a trading update. The technology distributor said the first quarter had been subdued following three years of growth.

On the flip side, Bendigo and Adelaide Bank was the largest gainer in the ASX200, climbing 8.2% to a 21-month high of $10.73 on a trading update that was better received. The country's sixth-largest bank said it had made $464 million in cash earnings in the 10 months to April 30, down 2.3% from a year ago but 9% better than analyst expectations.

Fellow regional lender Bank of Queensland rose 1.9% to $5.98, while the Big Four banks were mostly lower. CBA dropped 1% to $121.04, ANZ fell 0.5% to $28.13 and NAB edged 0.1% lower at $34.53, while Westpac rose 0.2% to $26.77.

In the heavyweight mining sector, gains for the iron ore giants and lithium companies outweighed losses for the goldminers. BHP rose 0.8% to $44.89, Rio Tinto climbed 1.4% to $132.15 and Fortescue added 1.2% to $26.94, while goldminers Evolution, Northern Star and Newmont dropped by 1.8%, 1.7%, and 1.3% respectively.

Lithium miner Pilbara rose 2.2%, Liontown grew 4.9% and smaller peers Vulcan Energy, Patriot Battery Metals and Latin Resources all posted double-digit gains.

Elsewhere, NextEd Group grew 12.2% to 27.5c as the tertiary education provider said its international student enrolment was up 11% to 3,528 in the March quarter, despite the government crackdown on foreign student visas.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website