The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

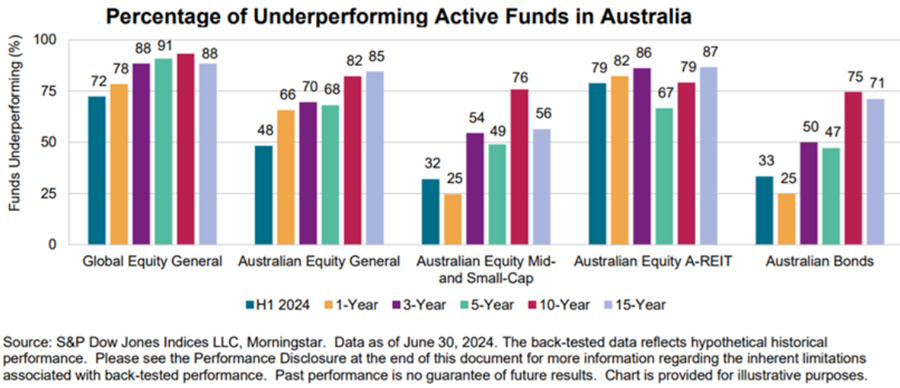

In recent years, fund managers have received a lot of bad press for their performance versus benchmark indices. In an editorial in October, I wrote of S&P Global’s new SPIVA report, which showed Australian fund managers performed better in the first half of the year, with most outperforming indices in local equities, small and mid-caps, and bonds. But their results were less impressive over longer periods.

Active vs passive

In a new report, Morningstar has measured fund managers’ success relative to the net-of-fee performance of comparable passive funds, rather than an index. And it turns out that active managers stack up pretty well.

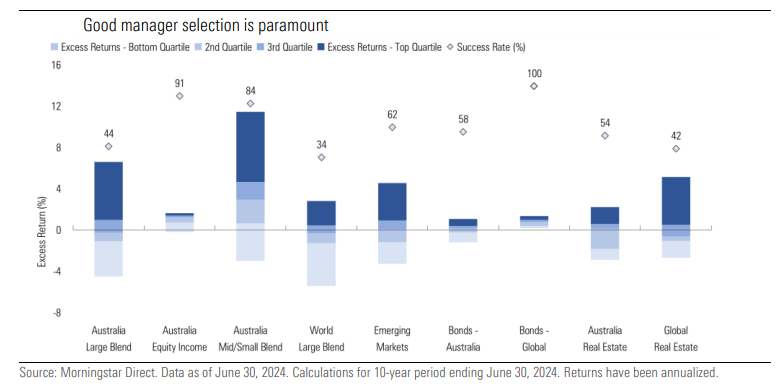

The study spanned more than 800 open-ended fund strategies across nine different categories. It found that the top quartile performers in every category have generated positive excess returns over their passive counterparts in the trailing 10-year period.

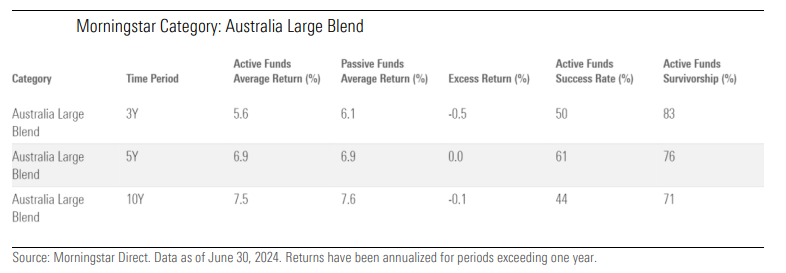

Some categories of fund managers did better than others. In the prominent ‘Australia Large Blend’ category, active funds performed worse over the past 10 years, better over five years, and were evenly split in the prior three years. Put simply, large cap managers have had periods of outperformance and underperformance.

Mid and small cap managers fared better. They performed in line with passive funds over three years, but significantly outperformed over longer periods. And, most of these managers beat passive across every timeframe.

This would suggest that there’s value in managers who can find pricing discrepancies in relatively under-researched mid and small caps.

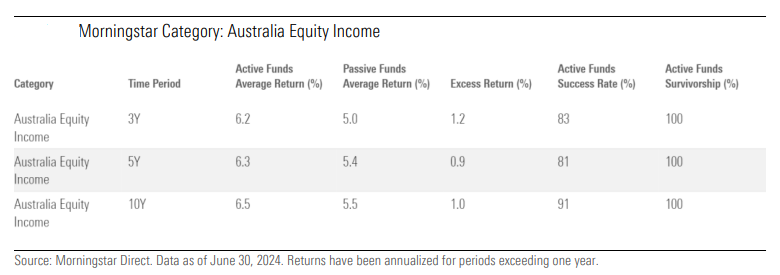

Similarly, Australian equity income has been a favourable area for active managers. They’ve had excess returns across all timeframes.

Most dividend-focused passive funds have strict rule-based mandates. It seems that active funds with more flexibility can generate significant outperformance in this space.

Investing overseas has been more of a problem for Australian equity managers. In the ‘World Large Blend’ equity category, passive dominates active funds. Undoubtedly, increasing market concentration, aka ‘The Magnificent Seven’, has made it more difficult for active managers to keep up with the performance of comparable passive funds.

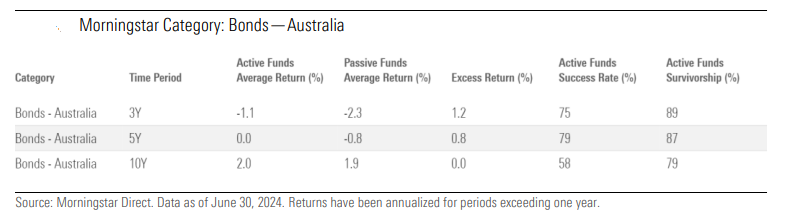

In fixed income, fund managers have added value both in Australian and global bonds. In local bonds, most managers have beaten passive counterparts over three, five and 10 years. Excess returns have been more positive in recent years with the normalization of the yield curve.

Managed fund fees are a key predictor of future returns

In a separate report, Morningstar has updated previous work which showed that fees were a reliable predictor of the future success of a fund.

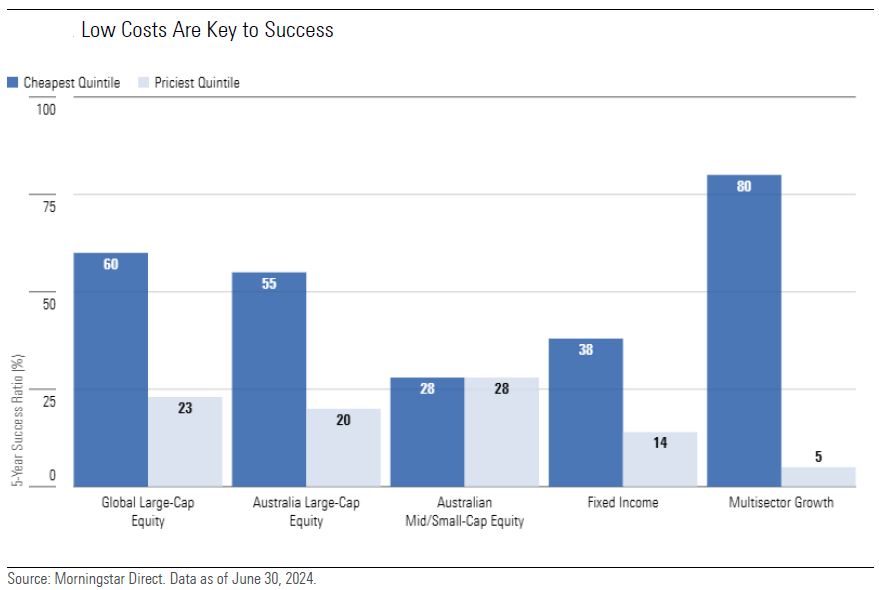

The report confirms that lower-cost funds in Australia have a greater chance of outperforming their more expensive peers, as the chart below indicates.

In four out of five categories, the cheapest quintile of funds, both managed and passive, produced better results than the priciest quintile over the trailing five years.

Breaking that down further, in Global Large-Cap Equity, 68% of the funds in the lower quintile of fees outperformed their category group. These funds had average expense ratios of 0.46%. And their average annualized total return was 11.73% in the five years to June 30, 2024.

That compares to funds in the highest quintile of fees, where only 23% beat the category group, with average annualised returns of 8.05%, and expense ratios of 2.58% being a key drag on performance.

In Australian mid and small cap equity, fees weren’t as big a factor in overall results. The success ratio of the cheapest and priciest quintile was equal at 28%. Perhaps this suggests cheaper isn’t better when it comes to selecting small cap managers, and it may be worth paying up for good ones.

Fees were a larger factor for fixed income managers. Yet the spread between the cheapest quintile’s success ratio and the most expensive was smaller than for other asset classes. The cheapest quintile’s success ratio of 38% compared to the 14% of the priciest quintile.

The report says that active managers in fixed income tend to underperform indices in risk-off conditions while outperforming in more sanguine markets. That’s because the managers tend to overweight corporate credit relative to the index, where conventional benchmarks have a considerable skew to government and government-related bond issuance. The report goes on to suggest that “although active fixed income managers are often able to outperform the index gross of fees, the outperformance does not always compensate for the corresponding fees.”

The largest disparity between the cheapest and priciest quintile of fund managers was in the multisector growth category. Here, the cheapest quintile recorded a success ratio of 80% compared to the most expensive quintile’s 5%. The dispersion in fees was comparable to other asset classes with the cheapest charging an average 0.56% compared to the dearest’s 2.53%.

In sum, cost is a big predictor of managed fund returns and should be a key consideration for investors.

----

Thanks to the relentless rise of the tech giants, America now accounts for a record high 66% of the MSCI world equity index. My article this week exmaines who America came to dwarf other markets, and what could change to slow or halt its momentum.

James Gruber

Also in this week's edition...

Housing affordability is likely to take centre stage as we head towards the next federal election. The Coalition has copped a lot of flak for its super for housing plan but Noel Whittaker thinks it has a lot of merit, albeit it's missing one key feature that could be a game-changer.

The transfer of wealth between generations is a pressing issue in Australia, with an estimated $3.5 trillion expected to be passed down from those aged 60 and over in the next 20 years. Peter Nevill presents a case study highlighting some of the challenges and opportunities with this shift in intergenerational wealth.

A new survey from The Association of Superannuation Funds of Australia suggests that most people aged 50 or over don't intend to stop work completely when they reach retirement age. And a significant proportion of those who delay retirement do so for non-financial reasons.

The relentless strength of the US dollar should be getting much more attention than it currently is, Clime's John Abernethy thinks. He says it shows that the US economy is excessively calling upon and draining the developed world’s capital. That's bad news for countries outside of America, including for Australia.

Gold has had a minor pullback after a ripping run this year. The rise in the yellow metal's price has happened despite a surge in the US dollar and fall in global inflation. So, what has driven the price over the past year or two, and what could happen next? The World Gold Council's John Reade gives us his insights.

A growing trend in recent years has been for experienced employees to develop what is known as a 'patchwork career', where they take on a number of roles, including consultancy work, as part of their transition to retirement. While it can be an attractive option, Peter Bembrick says there are some traps to be aware of, particularly when it comes to tax.

Two extra articles from Morningstar. Joseph Taylor highlights three high quality “buy the dip” candidates, while Simonelle Mody looks at ASX companies that could benefit from Trump’s win.

Lastly in this week's whitepaper, First Sentier explains how US utilities are ahead of the curve on decarbonisation and well on their way to achieiving net zero emissions.

****

Weekend market update

US stocks fell sharply, paced by the megacap techs, after October retail sales came in hotter than expected, lifting the bar for lower interest rates. Also, Federal Reserve Bank of Boston President Susan Collins said that another rate cut in December was on the table, but it's not a “done deal”. The S&P 500 fell 1.5% while the Nasdaq 100 dropped 2.4%. Crude oil finished 2.4% lower below US$67 a barrel, gold was down 0.3% to US$2,566 an ounce but Bitcoin leaped 4.2% to above US$91,000.

From AAP Netdesk:

The Australian share market climbed for a second day on Friday, but finished the week slightly lower. The benchmark S&P/ASX200 index rose 61.2 points, or 0.74% to 8,285.2 on Friday, while the broader All Ordinaries gained 59.1 points, or 0.7%, to 8,539.0. For the week the ASX200 dipped 9.9 points, or 0.1%, after a standout 2.2% gain the previous week following Donald Trump's victory in the US election.

Every ASX sector rose on Friday except health care, with utilities the biggest gainer, climbing 2.4% as APA added 2.5% and Origin expanded 2.4%.

The big four banks all finished higher, with CBA advancing 1.5% to a fresh all-time high of $155.13. Australia's biggest company has climbed 38.8% in 2024, which is set to be its sixth straight year of gains. ANZ rose 2.6% to $32.45, Westpac added 1.9% to a two-month high of $33.06 and NAB climbed 1.3% to $39.22.

In the heavyweight mining sector, goldminers posted gains. Evolution rose 2.9%, Northern Star added 1% and Capricorn Metals jumped 5% to $6.25 as the WA goldminer expanded its estimate of reserves as its Mt Gibson gold project.

Silver miner Adriatic Metals rose 9.2% and Silver Mines climbed 12.9%.

The iron ore giants were mixed, with BHP gaining 0.2% to $40.07, Fortescue dipping 1.2% to $17.73 and Rio Tinto dropping 0.2% to $113.75.

CSL was weighing down the health care sector as the blood products giant dropped 2.5% to $277.01.

In addition, Healius plunged 16% to a six-month low of $1.33 as managing director Paul Anderson warned the pathology company's annual general meeting about the potential impact of the 2024/25 federal budget. The government is exploring cuts to vitamin B12 and urine tests, Mr Anderson said, predicting the loss of funding would give pathology providers little choice but to introduce co-payments or close collection centres.

In the energy sector, Peninsula Energy plunged 25.3% to a four-year low of 6.2 cents after announcing cost overruns at its Lance uranium development site in the US state of Wyoming and its chief executive was stepping down.

From Shane Oliver, AMP:

Global share markets were weak over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. For the week US shares fell 2.1% and have now reversed 60% of their post-election rally, Eurozone shares fell 0.2%, Japanese shares lost 2.2% and Chinese shares fell 3.3%. Australian shares also fell, albeit only by 0.1%, reflecting the weak global lead along with a further pushing out of expectations as to when the RBA will start cutting rates and a further fall in iron ore and energy prices weighing on resources shares. Apart from falls in resources companies the falls were led by consumer staple and health care stocks, more than offsetting gains in IT, utility, property and retail stocks. Bond yields rose in the US, UK, Japan and Australia but fell in Europe. Oil, metal, gold, iron ore prices and the $A all fell not helped by a further rise in the $US. The 8% pull back in gold from its October high looks like a correction after a strong run higher but is not being helped by the surge in Bitcoin, as crypto is likely taking investors away from gold, along with prospects for less Fed rate cuts.

Donald Trump’s election win and implications remains the key focus for many investors. Firstly, it’s now confirmed that the Republicans have a Red Sweep with control of the House and the Senate making it easier to pass legislation. Some budget related measures will require 60 votes in the Senate to pass but with the GOP only having 53 the process known as “budget reconciliation” will likely be used again to pass the proposed tax cuts as it only requires a simple majority providing the measures can be “shown” to be budget deficit neutral, eg that the tax cuts will drive more tax revenue as people are inspired to work harder. They may also be partly offset by tariff revenue.

Secondly, Trump’s team appointees so far are consistent with his policies and suggest implementation will proceed quickly. For example: China hawks Marco Rubio as Secretary of State and Mike Waltz as National Security Adviser signal a tough on China approach including via tariffs; Tom Holman for border control signals a border shutdown from Day 1 and a quick move to deportations (although that will face several constraints); Elon Musk and Vivek Ramaswamy to lead a Department of Government Efficiency (this sounds like a joke play on Dogecoin but is for real) to cut federal spending and bureaucracy suggesting a big cut to public servants and regulation (we had something similar in Australia with the Abbott Government’s National Commission of Audit in 2013-14 but it didn’t get too far as the government did not control the Senate); and indications are that the process to impose tariffs will start from Day 1 using executive authority with protectionists Robert Lighthizer or Peter Navaro likely to head that up. In terms of the tariffs, indications so far appear to be that they will be phased in over time allowing US businesses to decouple and adjust, which suggests something more lasting than just using them as a maximum pressure bargaining tool. What is less clear is whether the Trump Administration leans more to populism (with a focus on tariffs) or more to Reagan like supply side reforms. The appointment of Musk to rationalise bureaucracy and possibly Wall Streeters like Scott Bessent to Treasury could be a sign of the latter and would suggest a Trump Administration will be sensitive to the message from higher bond yields (ie not to add to inflation and blow out the deficit). Its still too early to tell though.

We remain of the view that Australia will see minimal direct impact from US tariffs - as only 4% of our goods exports go to the US and we will likely be exempted maybe after some argy bargy because we have a trade deficit with the US. Rather the negative impact will come indirectly, via the impact on China of US tariffs (which will be partly offset by more stimulus in China) and a global trade war that Trump’s tariffs will likely trigger (with indications that China and Europe will retaliate more aggressively this time) all of which threaten weaker global growth and less demand for our exports. Trying to model this in advance is a guessing game though.

Curated by James Gruber, Joseph Taylor and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website