The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

S&P Global’s SPIVA Global Scorecard has become the industry standard for assessing active fund managers against their benchmarks.

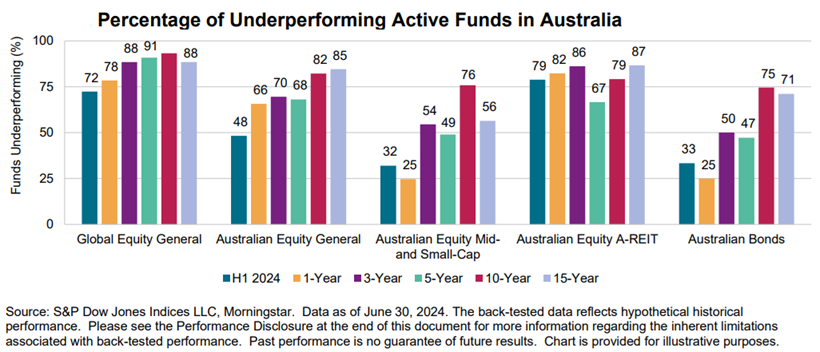

The scorecard shows that Australian active fund managers performed reasonably well in the first half of 2024. 52% of domestic equity funds outperformed their benchmarks. The number was even greater for small and mid-cap funds, with 68% posting returns better than the indices. Australian bond managers also did admirably, with two-thirds beating their benchmarks.

The news was less positive for Australian equity A-REIT managers, with almost 80% underperforming their benchmarks, and for global equity managers, where 72% trailed the index in the first half.

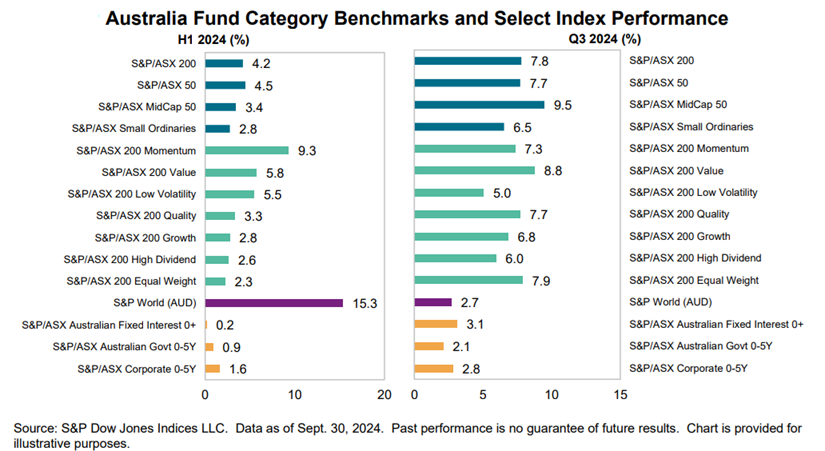

What accounts for the different results? It’s apparent that in local equities, better returns came from the large caps. The S&P/ASX 50 outperformed the S&P/ASX 200 as well as mid and small cap indices. It’s also apparent that momentum stocks were the huge winners of the first half of this year, returning 9.3% versus the S&P/ASX 200’s 4.2%. Therefore, to outperform, as most Australian fund managers did in local equities, they would have likely been overweight the largest companies and those with the most momentum in terms of price.

In small and mid-cap equities, S&P says that fund managers in this category tend to do well when there’s a tight spread between the performance between small and mid-caps. So it proved in the first half of the year, when the spread was minimal, and most of the managers outperformed their indices. S&P notes that the spread blew out to 3% in the third quarter, which may make the second half of the year more challenging for small and mid-cap managers.

Australian bond managers benefited by moving from local government bonds to investment grade corporate bonds. Taking on more credit risk paid off, and with credit spreads tightening further in the third quarter, it potentially augurs well for active bond managers in the second half of 2024.

Turning to Australian-based global fund managers, the six months to June were difficult. With mega-cap American tech companies vastly outperforming versus indices, it meant that managers with below benchmark exposure to these stocks invariably underperformed. Thus, the average weighted average return of Australian-based global funds was 11.8% versus the world index’s 14.8% in the first half in AUD terms.

The long-term results of Australian fund managers aren’t so good

The long-term track record of local active fund managers is less compelling. For Australian equity managers, two-thirds underperformed their benchmarks in the 2024 financial year. Over 10 and 15-year timeframes, that underperformance number increases to 82% and 85% respectively.

The statistics are similarly poor across all other categories. Some categories are better than others, though. First instance, as bond yields have normalized over the past 2-3 years, Australian fund managers have started to show their chops, with most outperforming during that time.

How did Australian fund managers compare to those overseas?

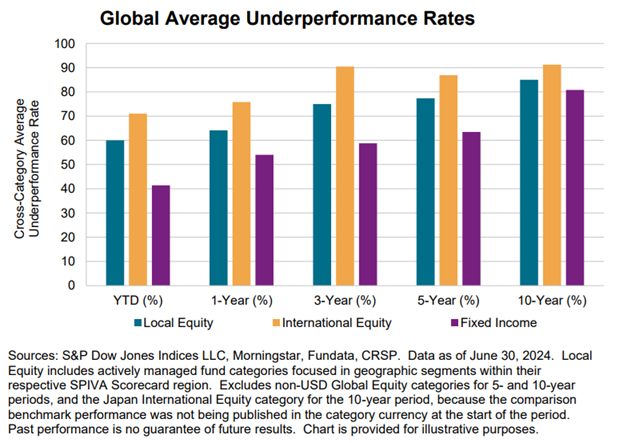

Australian fund managers performed better than their international counterparts in local equity and fixed income during the six months to June. However, their trailed in international equity.

Globally, 60% of local equity funds and more than 70% of international equity funds underperformed in the first half. Meanwhile, the majority of fixed income funds outperformed.

Again, the long-term results aren’t great. Over the past decade, more than 80% of managers in all three major categories have trailed their benchmarks.

Homing in on US fund managers

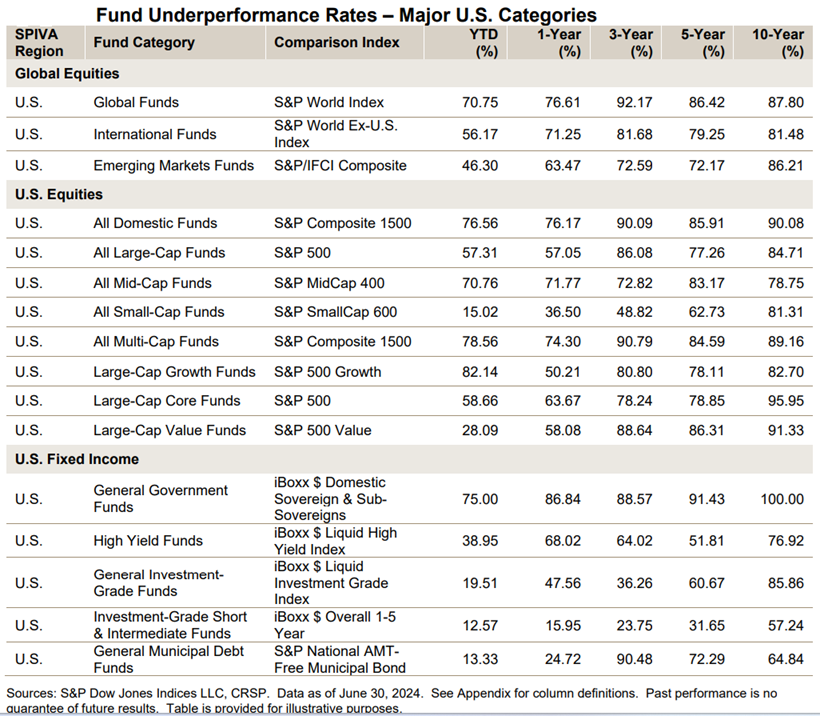

Broadly, US active fund manager performance has been pathetic over most timeframes.

In local equities, US small cap equity managers outshone the rest in the first half of 2024. 85% of them outperformed their benchmarks.

Large cap equity managers did ok. 43% did better than their index during the first half, as well as over the 12 months to June.

However, the long-term track records of US active equity managers in all categories are miserable.

In fixed income, the results are more positive in the short-term, but less so over five and 10-year periods.

What it means for the average investor

Undoubtedly, stock market conditions have been challenging for active equity fund managers of late. The outperformance of large caps both in Australia and overseas has meant managers have had a difficult time differentiating themselves and outperforming market cap weighted indices.

Ironically, ETFs have been taking market share from managed funds, yet it’s these same ETFs which may have contributed to the increasing market concentration and subsequent underperformance of fund managers.

For the average investor, the results show that small cap equities funds and fixed income funds may be your best shot for finding managers that can outperform benchmarks. Australia is lucky in having many high quality managers in these areas. However, choosing the right ones is a skill just like stock picking, and that’s a subject ripe for a future article.

****

In an article two weeks ago, I wrote of how preserving wealth through generations is hard. This week, I had the pleasure of meeting one family which has managed to endure and succeed over the past 220 years. The family in question, the Schroder family, and specifically meeting with Leonie Schroder, a 5th generation family member and Non-Executive Director of Schroders PLC in London. Ms Schroder was in town to celebrate Schroders Australia's 60th anniversary. As a Firstlinks sponsor, I'd like to congratulate the firm on the fantastic milestone.

****

In my article this week, I look into how many of us start to think about our legacies as we get older, but this may not be the best way to get the most out of lives and leave loved ones in good stead.

James Gruber

Also in this week's edition...

We hear a lot about how capitalism is failing and needs reform. That we need to kickstart the manufacturing sector. That more government subsidies are needed in a host of different areas. Stop, says Peter Swan and Dimitri Burshtein. Government isn't the solution right now; it's the problem, they suggest. They believe the recent cost of living crisis is borne of an inefficient and bloated government sector that continues to expand, hindering economic growth while fostering social and intergenerational tensions.

Does being informed make you more prone to poor investment decisions? Finance Professor Michael Finke recently discussed the double-edged sword of taking an interest in your investments, as well as other thought-provoking topics such as three predictors of panic selling and why nurses tend to be better investors than doctors. Joseph Taylor reports.

Is near enough good enough when valuing SMSF assets at market value? Not according to superannuation regulations, which require SMSF trustees to value all assets at market value when preparing financial statements. Shelley Banton details the challenges of getting it right and the repercussions if you don't.

British colonisation has come under heavy criticism in recent years. In Australia's case, some of that criticism is no doubt justified given what happened to Aboriginal people. However, Tony Dillon, says that we should at least be thankful for the Common Law system that we inherited from the British. It's fostered democracy and capitalism, helping to turn our country into a prosperous one. Without this legal foundation, Tony thinks our fate could have been very different.

There's been a big structural shift in Australia's labour market, with the 'care' sector significantly expanding vis-a-vis other areas. Matt Maltman analyses how it's happened and the impact that it's having on our economy.

Is there any value left in technology stocks? Platinum's Jimmy Su says there is. He believes that the real skill in investing is to be able to know when a stock priced at 30x earnings is cheap and when a stock on 10x is expensive. From this, he explains why the market is mispricing megacaps such as Amazon and Alphabet.

Two extra articles from Morningstar. Sim Mody asks whether Qantas’ inflated profits can continue and Esther Holloway highlights a quality mining name that looks undervalued.

Lastly, in this week's whitepaper, Fidelity provides a practitioner's guide to investing in the energy transition.

****

Weekend market update

In the US on Friday, stocks managed only a modest bounce after the prior day's sharp selloff, with the S&P 500 giving back much of its larger initial gains to finish higher by 0.4% on the day and 2% in the red for the week. Treasurys were smoked with the long bond jumping 10 basis points to 4.57% and the 10-year note finishing at 4.38% compared to 3.74% a month ago, while WTI crude edged below US$70 a barrel and gold remained under pressure at US$2,733 per ounce. Bitcoin retreated towards US$69,000 and the VIX settled just south of 22.

From AAP Netdesk:

The Australian share markeT suffered its worst week in three months, falling for a third straight session on Friday after global equities sank. The benchmark S&P/ASX200 index finished Friday down 41.2 points, or 0.5%, at 8,118.8 for its lowest close in seven weeks. For the week, the index was 1.13% lower. The bourse has not fallen by as much in the space of a week since August. The broader All Ordinaries fell 42.4 points, or 0.5%, to 8,379.7.

Financial stocks were among the worst performers on Friday, down 0.9%, after a disappointing earnings result from Macquarie Group. The financial services conglomerate sank 3.6% after its profit for the six months ended September 30 came in at $1.6 billion, up 14% from the prior corresponding period but 7% lower than analyst expectations. Increased income from its asset management and banking arms were offset by weaker performance in commodities and markets. Despite growth in its home loan portfolio, its banking and financial services margin was squeezed by ongoing competition for lending and deposits.

The banks were also in the red, with NAB down 1.5%, CBA falling 0.5%, ANZ 0.3% lower and Westpac dropping 0.1%. The big four, except CBA, will reveal their full-year financial results next week.

Of the 11 ASX sectors, only miners and energy stocks were in the black.

Australia's biggest oil and gas producer Woodside was 1.1% higher, while Santos rose 0.7%.

Despite a fall in the iron ore price, miners recovered amid signs China's economy is coming back to life, with manufacturing output returning to expansion after five straight months of contraction. BHP firmed 0.3% while Rio Tinto and Fortescue both climbed 1.7%.

Next week will be a consequential one for markets, with the outcome of the US election playing on traders' minds as well as central banks in Australia, the US and the UK meeting to set interest rates.

From Shane Oliver, AMP:

Global share markets remained under pressure over the last week not helped by mixed US earnings news and ongoing increases in bond yields not helped by uncertainty ahead of the US election. For the week US shares fell 1.4% despite a small rise on Friday after a messy jobs report, Eurozone shares fell 1.2% and Chinese shares fell 1.7% but Japanese shares rose 0.4%. Reflecting the weak global lead, along with slightly higher than hoped for underlying inflation dashing hopes for a pre-Christmas RBA rate cut, Australian shares fell 1.1% with falls led by consumer staples, utilities, health and financial shares. Bond yields rose, particularly in the UK on the back of concern about a rising budget deficit. Oil prices initially fell sharply as Israel focussed on military targets in its retaliation against Iran’s missile attack but then reversed some of their falls on reports that Iran may still counter-retaliate. Metal and iron ore prices fell and the $A fell with the $US up slightly.

Good news on Australian inflation – but not good enough for an RBA rate cut in the week ahead. September quarter CPI inflation fell to 2.8%yoy, down from 3.8%yoy in the June quarter, so its back in the target range. However, the plunge was largely driven by electricity rebates and lower petrol prices so it’s best to focus on measures of underlying inflation like the trimmed mean which fell to 3.5%yoy from 4%yoy, its lowest since the March quarter 2022. Headline and underlying inflation are both fractionally below RBA forecasts but are unlikely to be low enough to tip the RBA into a rate cut in the week ahead as it will regard underlying inflation as still too high and services inflation at 4.6%yoy still too sticky and with the labour market remaining tight will not see any urgency to cut rates just yet.

Our base case remains that the RBA won’t start cutting rates until February as it will want to see another quarter of lower underlying inflation before having enough confidence that inflation is moving sustainably to target. This means waiting for the December quarter inflation data which won’t come out till late January. That said we are heading in the right direction and a December rate cut is still possible, but it would require October monthly inflation data due late this month to show a further drop in trimmed mean inflation to less than 3%yoy and for unemployment to have another leg up.

Curated by James Gruber, Joseph Taylor and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website