Written with Hazel Bateman, Robbie Campo, David Constable, Isabella Dobrescu, Ailsa Goodwin, Junhao Liu, and Ben R Newell.

The COVID-19 Superannuation Early Release Scheme was one of the first pandemic-related policy changes made by the Australian Government. In April 2020, the Government announced that superannuation fund members experiencing loss of employment or financial hardship during COVID-19 could apply to the Australian Taxation Office (ATO) to withdraw up to $20,000 of their superannuation savings by 24 September, without giving formal proof of eligibility at application. On 23 July 2020, the Treasurer extended the Scheme to 31 December 2020.

The Scheme modifies otherwise very tight controls over superannuation withdrawals. The prevailing rules prevent most members from accessing their savings before reaching a minimum ‘preservation’ age (55-60, depending on birthdate) and retiring (or transitioning to retirement), with some limited exceptions in cases of extreme personal or financial hardship. The Scheme thus changes a fundamental element of the retirement savings system in Australia.

The pattern of withdrawals of funds by superannuation fund members since the start of the Scheme shows that the usual preservation rules play a critical role in preventing members from spending their mandatory savings before retirement. The ATO has received more than 3 million applications to withdraw early under the Scheme, and funds have paid out $34 billion. The number and size of withdrawals indicates that the scheme is likely to have extensive short- and long-term effects on individual and aggregate retirement savings in Australia.

Survey of super members

Many important questions about the operation and effect of the COVID-19 early release scheme remain unanswered. To better understand these issues, we analysed survey responses of early withdrawers from a large industry superannuation fund, Cbus. Cbus is a profit-for-members fund that primarily serves the construction sector. It has almost 760,000 members and manages around $56 billion in savings. By 9 August 2020, Cbus had made more than 229,000 early release payments with an average withdrawal of $8,408. Between early May 2020 and early July 2020, Cbus surveyed 3,047 members who had withdrawn superannuation savings under the Scheme.

Respondent characteristics

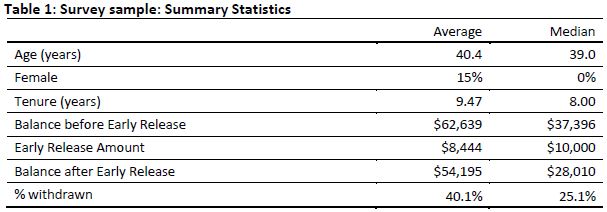

The median survey respondent was 39 years-of-age, male, and withdrew the full $10,000 (the Scheme allowed two tranches up to $10,000 each) from their account. Table 1 shows characteristics of the average and median survey respondent.

Amounts withdrawn

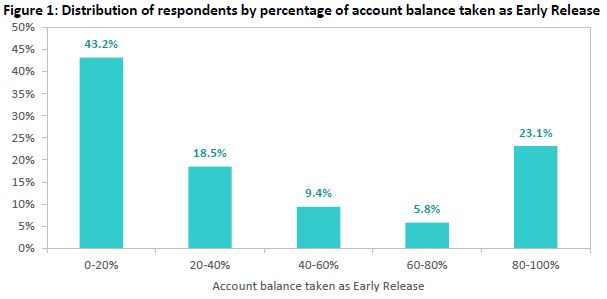

More than 20% of respondents virtually emptied their accounts; however, 43% reported they had withdrawn less than 20% of their entire balance as shown in Figure 1.

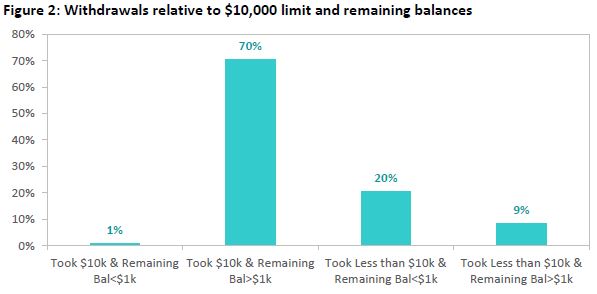

Most respondents withdrew either the $10,000 upper limit, or an amount very close to their account balance, if their balance was less than the upper limit. Those who left small residual amounts could have been preserving insurance cover or may have been working from slightly dated balance information when making their application. Figure 2 shows residual balances after withdrawals compared with the $10,000 limit. The fact that only 9% of respondents withdrew less than the limit while still preserving more than $1,000 in their account, demonstrates that respondents were strongly guided, and effectively constrained, by the $10,000 limit.

Reasons for withdrawal

The Government intended the COVID-19 Scheme would help people who were unemployed, made redundant or who were experiencing reduced work hours, to meet expenses during the COVID-19 restrictions.

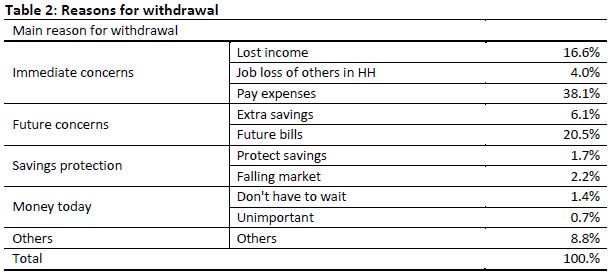

We find that more than half of respondents reported that they withdrew funds to meet immediate expenses or to cover lost income. Notably, results in Table 2 also show that around one quarter were thinking of future financial pressures. In other words, one in four respondents appear to be taking precautions. Then again, few respondents cited concerns about falling asset values or simple impatience as reasons for accessing their savings.

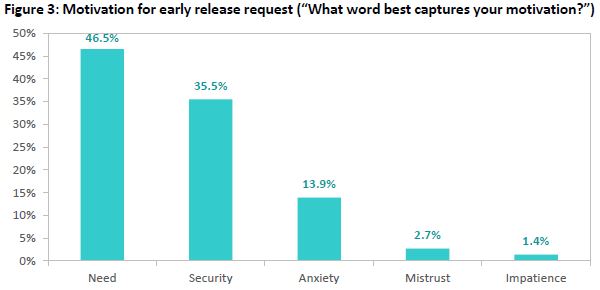

The focus on needing savings for expenses now or in the near future aligns closely with results in Figure 3, that shows that a sense of need motivated around 47% of early-withdrawers while a desire for security motivated around 35%.

Understanding the decision to withdraw

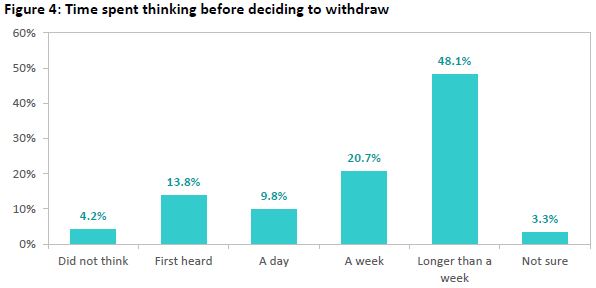

Around half the respondents report spending a week or less thinking before they decided if they would apply for early release, and 28% either made their minds up immediately or within a day of hearing about the scheme. Figure 4 reports the distribution of respondents’ deliberation times.

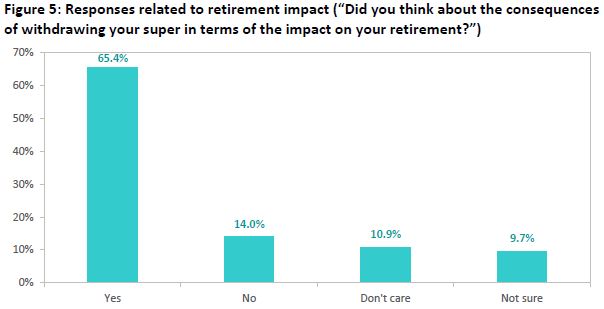

Surveyed members expressed a high degree of uncertainty or unconcern about the long-term implications of the withdrawal. Around one-third of respondents said that they were unsure about the impact of their withdrawal on their retirement balances or had not thought about that or did not care. Figure 5 shows how surveyed members answered questions related to retirement impact. These findings demonstrate that many withdrawers either could not, or did not, evaluate the impact of their decision.

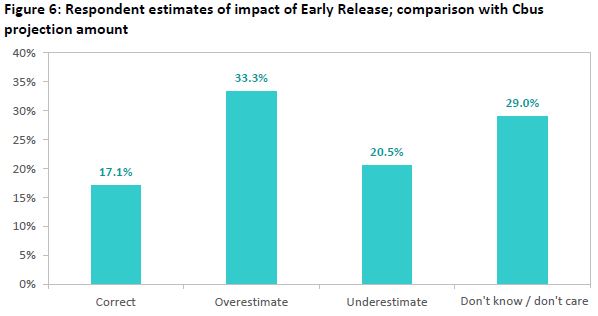

We also compared respondents’ estimates of the impact of their withdrawal with a projection of that impact based on assumptions made in a Cbus guidance on the early release scheme for members.

Figure 6 shows that 50% of respondents either underestimated the impact of the withdrawal on their superannuation accumulation at retirement or did not make an attempt to estimate the impact (categorised as 'Others' in Figure 6). The pattern of responses to the question on estimated impact, where each possible answer is chosen at approximately the same rate by respondents, is consistent with random selection of answers, and thus with general uncertainty among withdrawing members about long-term impact.

Employment status and the Early Release Scheme

To be eligible to make a withdrawal under the Scheme, members must be unemployed, receiving JobSeeker, Youth Allowance for job seekers, Parenting Payment, Special Benefit or Farm household Allowance, have been made redundant on or after 1 January 2020, or experiencing a 20% or more reduction in work hours or turnover for sole traders.

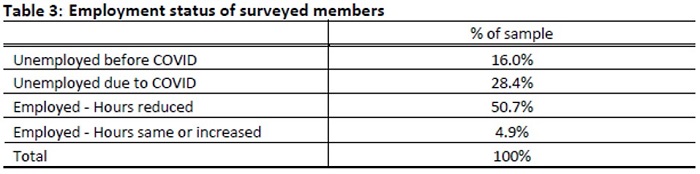

Of surveyed members, 28% had lost their jobs due to the crisis, and 51% had reduced working hours since the crisis (Table 3). Within the group of members who were employed, about 45% were not sure or did not think they would continue to be employed.

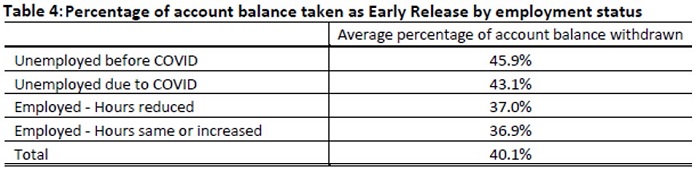

Members who were employed withdrew a smaller percentage of their account balances, on average (Table 4). (We note that those who were employed were likely to have had higher balances than unemployed members before withdrawing that may partly explain the lower average percentage.)

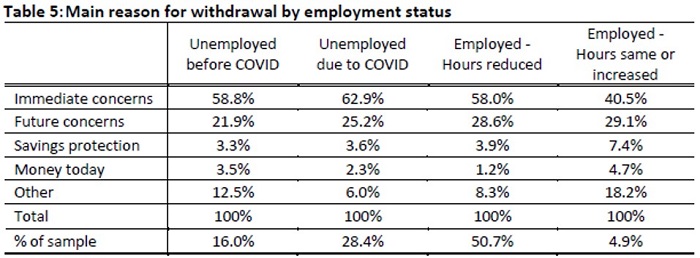

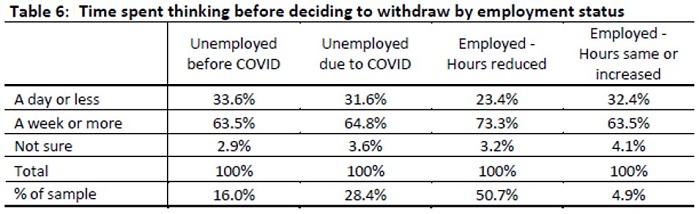

Those who are employed and maintaining their working hours are less likely to withdraw for immediate concerns and expenses, and more likely to anticipate future needs or the protection of their savings (Table 5). Those who are employed but experiencing reduced hours spent more time thinking about withdrawing their superannuation savings before they acted (Table 6).

Future survey work will examine whether these trends continue in the second phase of the early release scheme, which allows an additional $10,000 to be withdrawn from superannuation accounts in the period 1 July to 31 December 2020.

The full version of this report can be found here.

Hazel Bateman, School of Risk & Actuarial Studies, UNSW Sydney & CEPAR. Robbie Campo, David Constable, and Ailsa Goodwin, Cbus. Isabella Dobrescu, School of Economics, UNSW Sydney. Junhao Liu, Finance Discipline, The University of Sydney Business School, The University of Sydney. Ben R Newell, School of Psychology, UNSW Sydney. Susan Thorp, Finance Discipline, The University of Sydney Business School, The University of Sydney.

Thanks to Cbus, particularly Robbie Campo and David Constable for access to data from a survey of Cbus members. This article is general information.