A year ago, the idea that the Australian economy could maintain a steady pace against a backdrop of escalating interest rates and normalising inflation was viewed as an outside chance. However, the ‘Goldilocks economy’ – where growth is not too hot or too cold, but just right – looks increasingly possible (but not guaranteed).

Market commentators seem to have reached consensus that interest rates have passed their peak, and the subject of debate has turned to the speed and degree of interest rate reductions.

Given the resilience in economic conditions and strength of the labour market, central banks may maintain higher policy rates for longer than originally anticipated. This restrictive environment could also have a more detrimental slowing effect. However, falling inflation and the eventual transition to lower interest rates should support market confidence over the medium term.

Not too hot, not too cold – signals from the listed property market

The outlook for the global and Australian economy has strengthened with the sustained reduction in inflation and increased confidence in the downward trajectory for interest rates. Importantly, the easing in price pressures is unfolding, without a material deterioration of economic growth and labour markets. Australia’s growth has been solid, while the labour market has been resilient. For the commercial property market specifically, Australian Real Estate Investment Trusts' (A-REITs) performance can often serve as a litmus test and what we’ve seen in the most recent reporting period is driving a more positive outlook.

In the March quarter of 2024, the A-REIT sector outperformed in a transitioning economic landscape, demonstrating resilience amidst a backdrop of moderating inflation. A-REITs capitalised on the favourable ‘Goldilocks’ market conditions, which supported an impressive +16.8% return for the S&P/ASX 300 A-REIT Accumulation Index, outperforming the +5.3% for Australian equities (ASX200) and highlighting the sector's strong investor appeal following tough market conditions in 2023.

This is a significant shift in sentiment from 2023, where investor appetite for A-REITs waned given higher borrowing costs, valuation adjustments and a dearth of market transactions.

Further insights from the half-year reporting season

The Australian listed real estate market can also give us further insights into the outlook for commercial property valuations.

The February 2024 A-REIT reporting season highlighted that most sectors have been positively impacted by surging population growth and the consequent spike in consumption and real estate demand across the Retail and Industrial & Logistics sectors. Rental growth was particularly strong in the Industrial & Logistics sector, while leasing spreads (the difference between new rents compared to prior rents) turned positive for retail mall operators.

The March 2024 quarter witnessed the commencement of a series of strategic and corporate activities, including Bunnings (ASX:BWP) script bid for Newmark (ASX:NPR), bond issuances, and large property transactions. These events all signal a positive shift in market sentiment.

Optimism was further bolstered by expectations that interest rates in this cycle have now peaked, with speculation now turning towards the anticipated timing and magnitude of interest rate cuts. These outcomes, if they play out as anticipated, could enhance the sector’s investment appeal through potential capital gains and lower borrowing costs.

The listed A-REIT market and direct real estate investment

Central bank policies have made great progress in reducing inflationary rates from the recent peaks. However, it remains above their target range with the ‘last mile’ of reductions potentially more challenging.

For listed markets, the exact timing of any rate cut matters less than the overall trend, particularly due to the relationship between bond yields and real estate prices. Listed A-REITs, which are more liquid than direct real estate investments, can directionally lead the direct real estate market by six to twelve months. This predictive directional ability of A-REITs suggests that they will likely foresee and respond to shifts in direct real estate valuations before the actual underlying physical market rebound occurs. This pattern is evident, as despite cap rates in Australia not expected to bottom out until June 2024 (depending on specific property market sector it could be later in 2024), the listed market has already seen five months of positive returns since November 2023.

4 key factors that will influence commercial property valuations

1. Interest rates

The more positive market conditions have supported leasing demand across most real estate sectors, with low vacancy rates and strong rental growth evident for high-quality assets. Despite this, the adjustment to higher interest rates generated notable challenges across investment asset classes, including commercial property valuations.

Significantly higher borrowing costs coupled with an adjustment in valuation yields outweighed the positive impacts of higher rental growth over the past year.

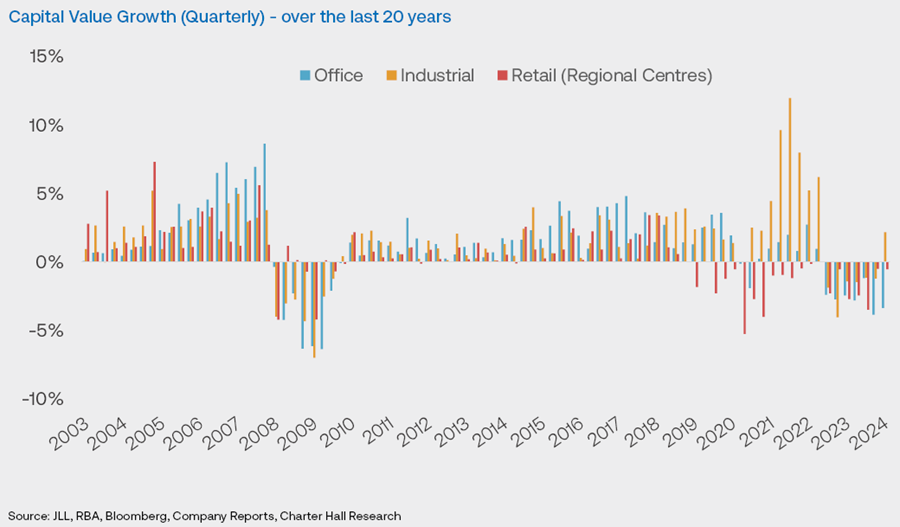

This resulted in the largest asset devaluations since the Global Financial Crisis, as shown in the chart below.

Over the near term, the positive contributions from sustained rental growth are expected to have a positive impact on returns. Looking further ahead, falling interest rates and lower borrowing costs should generate capital gains and promote investor confidence, following a period of an adjustment in purchaser pricing expectations and overall valuation declines.

2. Leasing demand

Leasing demand for high-quality real estate has been strong. The economic momentum has been boosted by surging population growth, a fundamental demand driver across real estate. The latest migration numbers reported another large net population increase, with the total number of permanent and long-term arrivals up 548,000 for the year to Sep-2023 - an all-time high. This large addition to the population adds to overall consumption requirements, generating increased demand across the market’s Retail and Industrial & Logistics real estate requirements.

3. Supply

Higher interest rates and tight labour markets have exerted material pressures across both existing and future development pipelines. Combined with Australia’s stringent and challenging planning controls, this significantly reduced construction activity over the past couple of years and will impact the overall development supply.

Insufficient supply and sustained demand intensified the scarcity of high-quality and modern commercial property assets. This is most evident across the Industrial & Logistics sector where low vacancy rates and sustained demand continue to drive strong rental growth of 18% nationally over the past 12-month period. Notable growth also emerged across certain Prime office markets. Over the past year, rents increased by 19% across the Brisbane CBD. This significant growth will help offset the negative valuation pressures from the adjustment to higher borrowing costs.

Similar trends have emerged across the Retail sector. Many retailers were forced to renew leases in existing assets given prohibitively high build costs and few alternate new asset opportunities. Notwithstanding this, existing assets also face greater functional obsolescence risks. Not all real estate is created equal, and a broad range of requirements can render assets undesirable to tenants. More recently, the credentials relating to technology and environmental sustainability have become more prominent in tenant demands. Managers of obsolete assets could face compounding issues of falling tenant demand and higher maintenance costs.

Ultimately, the immediate challenges can only be resolved by a notable reduction in construction costs or a sustained and significant growth in market rents. However, it appears that the challenges faced in new building supply could take years to resolve.

4. Macroeconomic factors

Other factors will also fuel consumption activity. As inflation continues to fall, real wages will increase. Incomes will also be boosted by a series of Government initiatives. The Stage 3 tax cuts are legislated to commence in July 2024 and will boost household disposable incomes. Additionally, the Federal Government is set to increase minimum and award wages from July which will likely be close to 4%. Moreover, conditions across the labour market have remained strong. Employment growth has been significant with approximately 900,000 jobs added over the past two years. Meanwhile, the unemployment rate has hovered between 3.5%-4.0% since mid-2022. This will continue to support growth across the major real estate sectors.

Outlook

The interest rate outlook, leasing demand, supply and macroeconomic factors are being factored in by the listed A-REIT market – and point to current conditions being positive for sustained rental growth across high-quality real estate.

If the Goldilocks conditions continue, we can anticipate improved returns in the medium term for Australian commercial property. This follows one of the most challenging periods for the sector in the last decade.

Industrial & logistics indicative valuations moved back into positive territory over the recent quarter, with the positive impacts of rental growth outweighing the drag from capitalisation rate adjustments. The sustainability of this recovery will be more evident as a larger number of managers undertake valuations. Notwithstanding this, the recent result certainly signals the stabilisation in conditions and approach to inflection points.

Sasanka Liyanage is Head of Research and Patrick Barrett is a Portfolio Manager, Listed Securities at Charter Hall Group, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.