Imagine overseeing a return of over 28% in a year and beating your benchmark, only to see all of that relative gain (and more) wiped out by something that isn’t under your control.

That’s exactly what the story has been at AFIC (ASX: AFI) recently, as its investments have outperformed but its discount to NTA surged to 10%.

You could spend all day coming up with reasons why the discount has become so large compared to history. But it’s probably just supply and demand – because you could speculate that demand for AFIC shares is probably being hit from three sides.

Number one: there is an alternative again

Those seeking income in retirement have alternatives to equities again. They can get a 4% yield in bonds instead of needing to jack up their risk profile.

AFIC is not your average LIC when it comes to its historical discount (it has often traded at a premium), but Andrew Mitchell and Steven Ng’s article that featured on Firstlinks in June showed a convincing connection between higher interest rates and higher LIC discounts on average.

Number two: the continued rise of passive

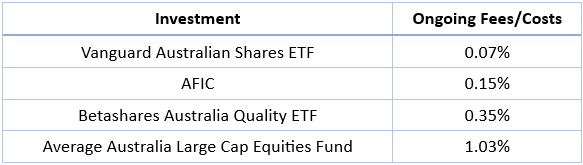

With total costs of just 0.15% last year, AFIC is a remarkably low-cost way to own many of Australia’s biggest companies. But, then again, so are index-based ETFs. Given that passive ETFs are very much in vogue and LICs are very much out of vogue, which option has been more likely to woo investors seeking that kind of low-cost exposure?

Number three: attention shifting overseas?

Instead of primarily investing in Aussie shares and considering different options for that, investors are tilting more towards global shares.

The data below from ASX and Vanguard might be skewed a bit by the fact that ETFs are especially attractive for those seeking international equity exposure because they minimise issues like currencies, higher trading commissions that come with owning foreign stocks. But Australia's strong (and growing) appetite for global exposure is clear.

Could this have sucked away some demand for AFIC shares too? Overall, I don’t think it’s crazy to suggest that AFIC’s discount has faced a triple-headwind from three of the biggest investing trends post-2022: higher interest rates, the continued rise of passive investing and ETFs, and increasing demand for international shares.

Passive ETFs versus LICs – an unfair fight, but for how long?

The past few years have been a dream environment for passive ETF adoption. Markets have generally been on the up and up and returns from many markets (especially in the US) have been concentrated in the biggest players.

This is a very tough environment to beat the index and provides a tailwind for those selling investors the lowest cost exposure to it. On the other hand, the potential benefits of a low-cost LIC like AFIC versus a passive ETF – and, yes, there are some – haven’t had a chance to shine recently.

Let’s start with dividend protection. If you own an ASX200 index fund through an economic slump, the underlying companies are likely to cut their dividends. As a result, you will probably receive less income that quarter or year, income you may have been relying on.

A well-known benefit of LICs is their ability to hold cash and franking credits to support the dividend in weaker years. This allowed AFIC to maintain a flat dividend through the payout cuts of early Covid and during the GFC.

In his interview with me last week, CEO Mark Freeman told me that AFIC regularly assesses its ability to repeat this trick in future crises. With its current franking balance and reserves of retained profits and realised capital gains, he said AFIC could maintain its current fully-franked dividend even if none of its holdings paid a dividend for 18 months.

Is that the kind of benefit that is forgotten in bull markets? When the big four banks have increased dividends handily for several years? And when mining and energy shares delivered a dividend bonanza in 2022/23?

Another obvious difference between AFIC and an ASX200 tracking index is that AFIC can pick and choose what it invests in. As AFIC’s portfolio manager David Grace put it, “the index is the last buyer at high prices and the last seller at low prices”.

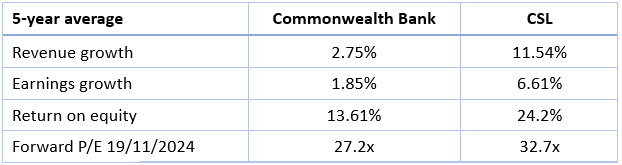

Grace sees the relative valuations of CSL (ASX: CSL) and Commonwealth Bank (ASX: CBA) as a prime example of how an index can keep bidding up one name while shunning another, based on nothing but share price action.

How, given the far superior growth and returns profile of CSL, he says, can these two companies trade at a similar P/E ratio?

Does AFIC suffer from its headline similarity to ASX200?

Apart from a few big-ish overweights like CSL, Macquarie (ASX: MQG) and Transurban (ASX: TCL), AFIC’s top 10 holdings did not look vastly different to those of the S&P/ASX 200 index as of October 31.

The ASX holdings below are based on the iShares Core ASX200 ETF. If a holding did not appear in both top tens, I have shown the percentage held in that share by the other product in brackets.

I am not bashing AFIC’s portfolio by pointing this out. Far from it. These companies, by and large, are high quality businesses with strong competitive positions. They align with AFIC’s approach.

AFIC has held many of these companies for decades, benefitted from their growth, and has capital gains tax to think about for shareholders. These companies also contribute to an important component of AFIC’s dual goal of capital growth and income through the payment of fully franked dividends.

I do wonder, though, if potential investors might be put off by the similarity at first glance. In that case, why not pay even less in fees for an index fund without needing to worry about a discount or premium to asset value?

I put this question to Freeman and co. Their take was that AFIC’s portfolio actually is rather different to the ASX200. Especially once you look beyond the top 15 holdings or so.

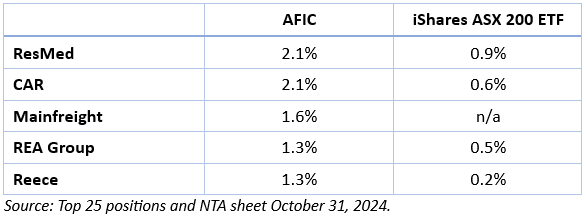

They pointed to the fact that AFIC only held a total of 56 names versus the benchmark’s 200 as of the last annual report. And to their far bigger positions in some of their favoured smaller-cap firms like ResMed (ASX: RMD) , REA Group (ASX: REA), Reece (ASX: REH) and CAR Group (ASX: CAR) than the index holds.

Over the long run, they hope that continuing to hold companies of this ilk – and adding to them in periods of share price weakness – will benefit AFIC shareholders in the same way that holding onto names like CBA has benefitted them in previous decades.

For now, though, I see a chance that investors could just glance at AFIC’s biggest holdings and not see much scope for performance that is vastly different from the market average.

Will the discount ever close?

The big question for many AFIC shareholders – especially those who bought at a premium – is what might narrow the current discount.

If the interest rate theory holds water, you could argue that elements of the discount are cyclical. But are rates likely to go that much lower again? When I look at any kind of historical chart, I constantly have to remind myself that the zero interest rate policy era was anything but normal.

In our conversation, Freeman and co didn’t seem to be relying on that. Instead, they feel that marketing and education could bridge some of the gap. They also think that advisors could have an easier time recommending AFIC to clients now that it doesn’t trade at a premium.

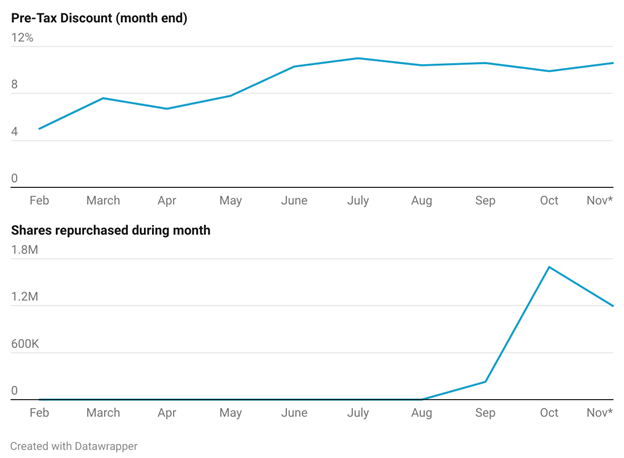

They are also buying back some shares. As Freeman put it, “we look at opportunities every day and don’t see anything cheaper”. Looking at AFIC’s share repurchases since February, when it announced its latest buyback authorisation, makes two things clear:

- AFIC has ramped up buybacks since September, from zero shares repurchases to over 3 million shares bought back at the time of publishing.

- These buybacks still seem like a drop in the ocean. 3 million shares represents less than a quarter of one percent of the total shares outstanding!

AFIC discount and buybacks since February 2024

Potentially attractive, but not for the discount alone

I can't stop thinking that AFIC trading at 5 or 10% discount to NTA doesn't make any less sense than it trading at a 5 or 10% premium did. In fact, it probably makes a lot more sense. I have absolutely no idea why anyone would buy a LIC at a 5 or 10% premium.

Given the headwinds AFIC could continue to face on the demand front, I would be more confident in the discount merely not getting much worse than it returning to NTA or a premium. And for that reason, I don’t think I would buy AFIC purely because of the historically big discount.

I still see plenty to like about AFIC, though.

First of all, it offers incredibly low-cost exposure to Australian companies of an above-average caliber. At 0.15%, its cost is only 8 bps more expensive than the management fee of Vanguard’s passive Australian Shares Index ETF. Its costs are lower than the fee on active "factor" ETFs focused on higher quality shares of the kind AFIC focuses on. And, of course, it is streets cheaper than most managed funds.

AFIC has also proven itself as an excellent long-term steward of capital. Let's not forget, either, that a smoothed dividend could also seem a lot more important in the future than investors seem to think it is now. In an expensive equity market, investors looking for income and a long-term approach to capital growth might find the 10% discount attractive. Just don’t bet the house on it closing.

Joseph Taylor is an Associate Investment Specialist at Morningstar.