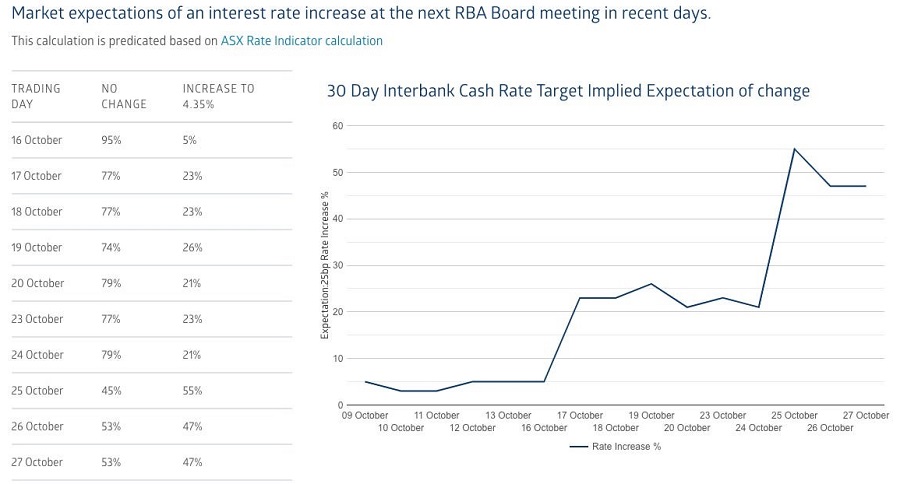

In the quest to decipher the how the RBA might adjust interest rates, the ASX's RBA Rate Tracker is a handy tool. Developed by the ASX, the page translates the price of the interbank cash rate futures into a straightforward probability regarding the RBA's potential movements in the interest rate. Essentially it publishes the financial market predictions for the RBA’s cash rate.

At present, the futures market suggests an even split in the probability of the RBA either raising interest rates in November or maintaining them at their current level.

However, divergence emerges when one consults betting platforms like Betfair or Sportsbet. These platforms, which also provide odds on interest rate movements, indicate a more than 60% likelihood of a rate hike (accounting for their profit margin).

What could be the root of this discrepancy?

You might be inclined to question the integrity or liquidity of the small-scale betting platforms, hypothesizing that their implied probabilities might be unreliable. That would be a reasonable guess as they are dwarfed by the size of the interbank cash rate futures market. However it is the ASX rate tracker which is at fault.

The house always wins

The crux of the issue lies in the contractual language of the interbank cash rate futures, the foundation of the ASX's published probabilities. The cash rate futures pay out according to the value of the cash rate averaged over the calendar month - not what the RBA actually targets the cash rate to be.

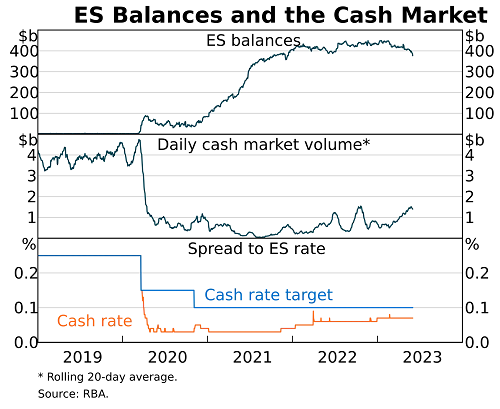

Historically the actual cash rate has tracked the target closely. For instance, if the RBA aims for a cash rate of 4.10%, the monthly average cash rate would typically aligned almost exactly with that 4.10% target. But the introduction of quantitative easing has disrupted this close surefire aim. The gap between the target cash rate and its actual average opened up during Covid as show in the bottom panel of the chart below.

The RBA's recent note on this issue highlights that this gap has reduced to an average of 3 basis points and predicts it will eventually revert to zero once quantitative tightening is fully implemented.

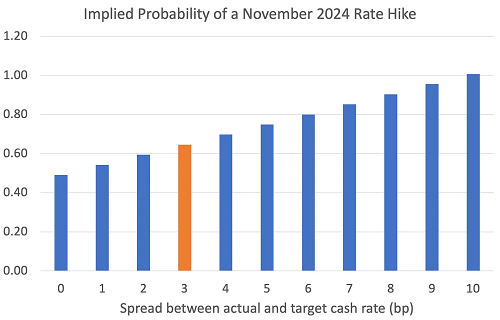

This seemingly minor gap of 3 basis points can significantly alter the probabilities when determining the likelihood of a 25 basis point movement in the cash rate, a standard unit for an interest rate adjustment. Incorporating this spread into the ASX's calculations, the probability shifts from an even 50-50 implied probability to a 65% likelihood of a rate hike. It thus appears that betting markets like Betfair have adeptly factored in this statistical bias! Chalk up another win for the efficient markets hypothesis.

Considering the prolonged timeline anticipated for the completion of quantitative tightening and the widespread reliance on the ASX's figures by RBA watchers, including journalists, it would be prudent for the ASX to recalibrate its formula to reflect the evolving monetary policy landscape. Until such adjustments are made the unconventional realm of online betting will offer a more accurate barometer for interest rate expectations than the ASX’s implied odds!

Dr Isaac (Zac) Gross is a lecturer in economics at Monash University. This article was first published via Zac’s blog, Gross National Product, and is reproduced with permission.