Periodically, pundits declare the death of the 60% stock/40% bond portfolio. Their voices have grown louder lately, amid sharp declines in both stock and bond prices. But we’ve been here before. Based on history, balanced portfolios are apt to prove the naysayers wrong, again.

Approaching the midpoint of 2022, market, economic, and geopolitical conditions all appear fraught. Inflation is hitting 40-year highs, the US Federal Reserve is sharply reversing monetary policy, the pandemic hasn’t gone away, and supply chain woes have been exacerbated by COVID-19 lockdowns in China and Russia’s invasion of Ukraine, with the latter putting the Western bloc the closest to a war footing in decades.

Not surprisingly, this perfect storm of negative market drivers has pushed stock and bond prices south in lockstep, impairing the normal diversification of risks in a balanced portfolio.

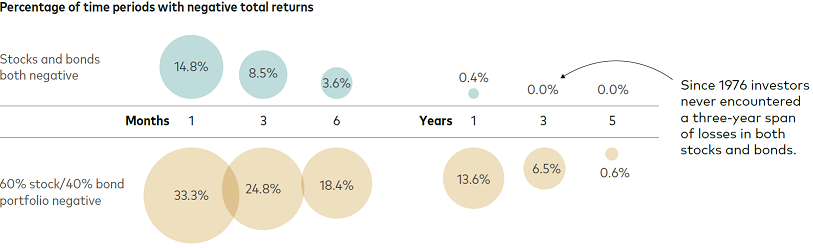

While the chart below focuses on U.S figures, the underlying theory still holds for financial markets globally.

Stock-bond diversification in historical context

Brief, simultaneous declines in stocks and bonds are not unusual, as our chart shows. Viewed monthly since early 1976, the nominal total returns of both U.S. stocks and investment-grade bonds have been negative nearly 15% of the time. That’s a month of joint declines every seven months or so, on average.

Extend the time horizon, however, and joint declines have struck less frequently. Over the last 46 years, investors never encountered a three-year span of losses in both asset classes.

Historically, stock-bond diversification recovers within a few months

Source: Vanguard. Data reflect rolling period total returns for the periods shown and are based on underlying monthly total returns for the period from February 1976 through April 2022. The S&P 500 Index and the Bloomberg US Aggregate Bond Index were used as proxies for stocks and bonds*. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

As our chart shows, drawdowns in 60% stock/40% bond portfolios have occurred more regularly than simultaneous declines in stocks and bonds. This is due to the far-higher volatility of stocks and their greater weight in that asset mix. One-month total returns were negative one-third of the time over the last 46 years. The one-year returns of such portfolios were negative about 14% of the time, or once every seven years or so, on average.

But we need to remind ourselves of the purpose of the traditional balanced portfolio.

The math behind 60/40 portfolios

Catchy phrases like the ‘death of 60/40’ are easy to remember, require little explanation, and may even seem to have a ring of truth in the difficult market environment we are in today. But such statements ignore basic facts of investing, focus on short-term performance, and create a dangerous disincentive for investors to remain disciplined about their long-term goals.

Keep in mind:

- The goal of the 60/40 portfolio is to achieve long-term annualised returns of roughly 7%. This is meant to be achieved over time and on average, not each and every year. The annualized return of 60% U.S. stock and 40% U.S. bond portfolio from January 1, 1926, through December 31, 2021, was 8.8%.* Going forward, based on simulations run at the end of April 2022, the Vanguard Capital Markets Model (VCMM) projects the long-term average return to be around 7% for the 60/40 portfolio. Market volatility means diversified portfolio returns will always remain uneven, comprising periods of higher or lower—and, yes, even negative—returns.

- The average return we expect can still be achieved if periods of negative returns (like this year) follow periods of high returns. During the three previous years (2019–2021), a 60/40 portfolio delivered an annualised 14.3% return, so losses of up to –12% for all of 2022 would just bring the four-year annualised return to 7%, back in line with historical norms.

- On the flip side, the math of average returns suggests that periods of negative returns must be followed by years with higher-than-average returns. Indeed, with the painful market adjustments year-to-date, the return outlook for the 60/40 portfolio has improved, not declined. Driven by lower equity valuations, the VCMM’s projected 10-year returns for U.S. stocks have increased by 1.3 percentage point since year-end 2021. And with higher interest rates, the VCMM’s projected 10-year U.S. bond returns have increased 1.6 percentage point from year-end 2021. Overall, the 10-year annualised average return outlook for the 60/40 is now higher by 1.3 percentage points than before the market adjustment.

- Market timing is extremely difficult even for professional investors and is doomed to fail as a portfolio strategy. Markets are incredibly efficient at quickly pricing unexpected news and shocks like the invasion of Ukraine or the accelerated and synchronized central bank response to global inflation. Chasing performance and reacting to headlines are doomed to fail as a timing strategy every time, since it amounts to buying high and selling low. Far from abandoning balanced portfolios, investors should keep their investment programs on track, adding to them in a disciplined way over time.

No magic in 60/40 but in balance and discipline

I’ve focused here on the 60/40 portfolio because of its touchstone status. In our view, 60/40 is a sound benchmark for an investment strategy designed to pursue moderate growth.

Prominent and useful as a benchmark though it is, 60/40 is not magical. And talk of its demise is ultimately a distraction from the business of investing successfully over the long term.

The broader, more important issue is the effectiveness of a diversified portfolio, balanced across asset classes, in keeping with the investor’s risk tolerance and time horizon. In that sense, '60/40' is a sort of shorthand for an investor’s strategic asset allocation, whatever the target mix.

For some investors with a longer time horizon, the right strategic asset allocation mix may be more aggressive, 80/20 or even 90/10. For others, closer to retirement or more conservative-minded, 30/70 may do it. The suitability of alternative investments for a portfolio depends on the investor’s circumstances and preferences.

Whatever one calls a target asset mix and whatever one includes in the portfolio, successful investing over the long term demands perspective and long-term discipline. Stretches like the beginning of 2022—and some bear markets that have lasted much longer—test investors’ patience.

This isn’t the first time the 60/40 and the markets in general have faced difficulties—and it won’t be the last. Our models suggest that further economic travails lie ahead and that market returns will still be muted. But the 60/40 portfolio and its variations are not dead. Like the phoenix, the immortal bird of Greek mythology that regenerates from the ashes of its predecessor, the balanced portfolio will be reborn from the ashes of this market and continue rewarding those investors with the patience and discipline to stick with it.

Roger Aliaga-Díaz is chief economist, Americas, and head of portfolio construction at Vanguard, a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any individual.

For more articles and papers from Vanguard, please click here.

*Source: Vanguard calculations using data from Standard & Poor’s, Dow Jones, MSCI, CRSP, Morningstar, and Bloomberg. U.S. stock returns are represented by the S&P 90 beginning in 1926; the S&P 500 Index from March 1957 through 1971; Dow Jones U.S. Total Stock Market Index (formerly known as the Dow Jones Wilshire 5000 Index) from January 1972 through April 22, 2005; MSCI US Broad Market Index through June 2, 2013; and CRSP US Total Market Index thereafter. U.S. bond returns are represented by the Dimson-Marsh-Staunton database from Morningstar, Inc., beginning in 1926; Bloomberg U.S. Aggregate Bond Index from January 1976 through December 31, 2009; and Bloomberg U.S. Aggregate Float Adjusted Index thereafter.