With the best post-election day performance for the S&P 500 in decades and a continued bid for stocks in the days after, investors are enthusiastic about the policies that may be put forth during a second Trump term.

Investors have particularly welcomed Trump’s focus on deregulation and for the federal government to play a smaller role in the economy and financial markets.

The government has been a very large player

The purpose of capitalism is the allocation of societal resources by the private markets. Instead of bureaucrats, capitalist systems prefer to allow the 'wisdom of crowds' to determine what projects should be funded and where capital should be pulled from to drive societal growth.

How much has government been involved in this process? Since the global financial crisis (GFC) of 2008, the answer is a lot.

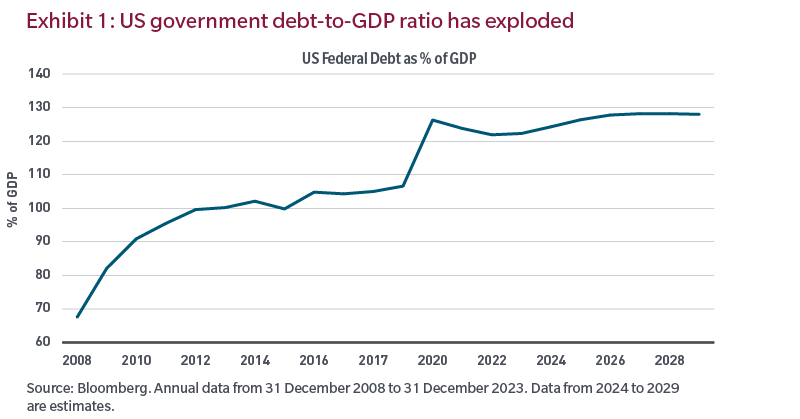

Exhibit 1 charts the ratio of US government debt to GDP, which has grown from 68% before the financial crisis to an astonishing almost 130% today.

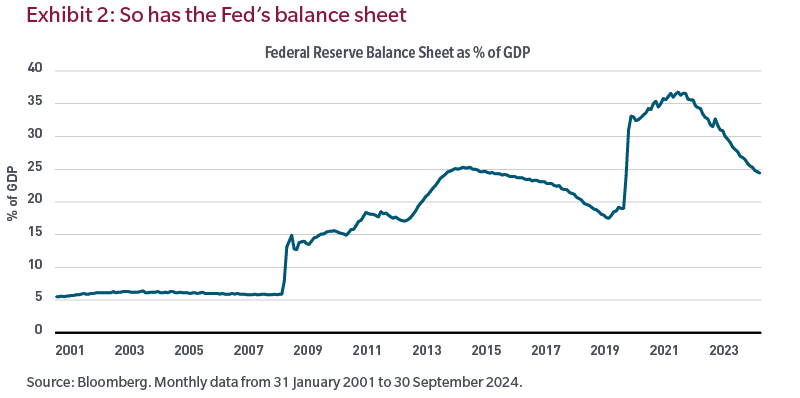

Exhibit 2 captures the growth of the size of the US Federal Reserve’s balance sheet as a percentage of the economy since the turn of the century. From its average of 5% pre-GFC, it has ballooned to 25% today. Twenty-five cents out of every dollar of GDP is held by the US central bank. Said another way, the supply of money has exploded.

Finally, COVID stimulus policies, from the CARES Act to the American Rescue Plan, resulted in over US$5 trillion being fed into the US economy, culminating in a fiscal deficit rivaling only wartime periods.

For those surprised that the US avoided recession in the last year or two, the explanation is simple: The economic soft landing the US is experiencing was purchased at great cost.

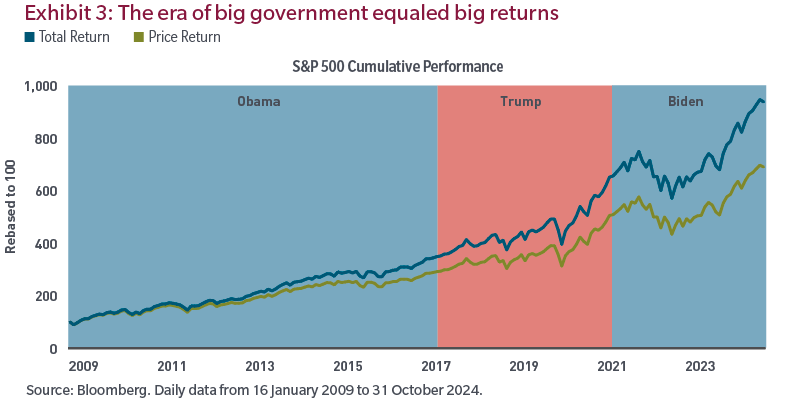

How did stocks fare during this period of exponential government growth? Starting at the beginning of the Obama administration to the end of October 2024, the S&P 500 returned 839% for an annualized return of around 15%.1 Whether under President Obama, Trump or Biden, stocks greatly exceeded normal historical return and risk profiles.

Via monetary and fiscal policies, the US government’s involvement in the private sector effectively allowed for the privatization of wealth in good times and for the socialization of losses in bad ones.

This has reduced the ability of the private sector to efficiently price risk and allocate capital and resources under both Democratic and Republican administrations. So where might we go from here, with deregulation ahead, but also tariffs?

The look ahead

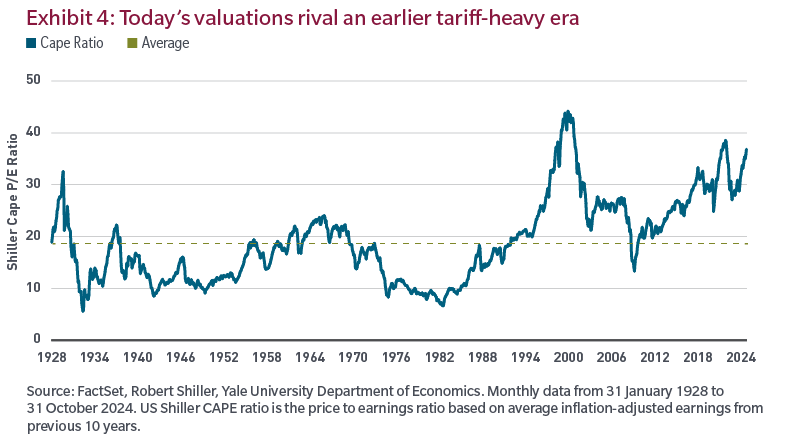

While most (certainly me) welcome less regulation and intervention by policymakers, investors need to consider our starting point today. The exhibit below, which is the cyclically adjusted price-to-earnings ratio for US equities over the last 100 years, may help.

While prices today aren’t as high as they were during the 1990s internet bubble, given the historical return of risk assets, we shouldn’t be too surprised to see that they compare to the levels of the late 1920s. However, I’m not suggesting a redux of October 1929, or another Great Depression, as there are too many differences between the periods.

While valuation is one similarity, valuation alone can be a dangerous investment signal. Importantly, investors need to consider the pathway of future earnings, the denominator in the chart above, and the prime determinant of the prices investors will pay. Which brings me to one other similarity to the late 1920s: tariffs.

In 1929, investors began to discount the Republican Congress’s plans to tariff over 25,000 goods entering the US. This mattered to investors because, while tariffs make US goods more attractive to domestic buyers, they drive up costs for US producers sourcing goods outside the country as well as consumers. While there were other catalysts heading into October 1929, the prospects of the Smoot-Hawley tariffs were a factor that changed both how investors thought about future profits and what they were willing to pay.

To be fair, long before the 2024 election, input costs had risen as capital and labor costs jumped. But companies were largely able to offset those pressures by passing on higher prices to customers and cutting spending in non-mission critical areas. What has changed is consumers have begun substituting goods and services where necessary, driving prices and inflation down, and lowering corporate spending in unnecessary areas. With the low-hanging fruit already plucked, profit margin protecting maneuvers will be harder to achieve in the future, bringing forward a new paradigm with far greater return dispersion in benchmarks.

In conclusion, less government involvement in the economy and markets is long overdue and welcome. But I think investors need to consider what a reduced government role may mean for the profitability of projects and businesses that are unable to offset rising cost pressures. As a result, I think Trump 2.0, specifically smaller government, may upend the performance dominance of passive investing.

Endnotes

1 Source: Bloomberg, S&P 500. Cumulative and annualized return calculated using monthly data from 31 January 2009 to 31 October 2024. Returns are gross and in USD.

Robert M. Almeida is a Global Investment Strategist and Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.