The run-up in Australian bank stocks has some investors confounded: do they continue to hold them in expectation of further gains - or sell and take profits now?

As at September 13 2024, Commonwealth Bank had reached over $230 billion in market capitalisation and recently surpassed BHP to become Australia’s most valuable company. In July, the Commonwealth Bank was considered by the Australian Financial Review to be one of the most expensive banks in the world with a price/earnings multiple of some 24 times – 30% above its average over the past five years. It also had a price-to-book ratio approaching three times, seemingly out of line with other leading global banks.

Will it continue to do so? That question has been the focus of many conversations between investors and their financial advisers.

With the big four banks accounting for nearly 20% of the local S&P/ASX200 index, if you are invested in any index fund or exchange traded fund (ETF) you cannot easily drop the banks from a portfolio. Other investors may not want to realise the tax consequences of selling, while others may not want to lose the consistent dividend income.

There is an option

One way for investors to help protect their bank stock holdings is by using options.

Over the first quarter of this year, AUSIEX has witnessed an increase in the put/call ratios of short-dated big four banks' options heavily weighted to calls, with around 1.6 calls open for every put and net calls materially short. Longer dated options, while more thinly held, are weighted towards puts with net puts materially long.

This suggests that some investors are already protecting the long-term value of their equity holdings – or seeking downside exposure – and funding these puts with short calls that are rolled on an ongoing basis.

Writing covered call options (a ‘covered call’ strategy) can also potentially provide income from the premiums received from writing these contracts, while also securing an exit price should the position expire ‘in the money’.

This type of strategy consists of buying or holding stock and selling a call option on those same securities. The sale of the option contract provides the writer with a premium, which helps to lower the breakeven point on the underlying investment.

While there may be some foregone upside potential, the premium helps this strategy perform in volatile markets – while also generating income. As for risks, removing some of the upside potential can reduce gains if the stock rallies well above the option strike price.

The buyer of a put is able to secure their sell price should the stock pull back, though is required to pay the premium for the benefit. Acquisition of these contracts provides significant flexibility for fund managers, better enabling them to enter or in this case exit their positions.

Similarly, investors who may not wish to realise significant capital gains in selling bank shares, can take long puts (‘long put’ strategy) that will assist in offsetting losses should the underlying shares pull back.

Options can help advisers manage risk on behalf of clients. Consider a 'collar’ strategy, which combines covered call and long put strategies and involves selling a covered call option and at the same time purchasing a put option. The idea is the income received from selling the covered call helps fund the purchase of the put option.

This ‘collar’ strategy will cap any further upside in the stock to the strike price of the sold call option. The put option provides downside ‘insurance’.

There are several other ways advisers can help investors reduce volatility in their portfolios, ranging from minimum volatility exchange traded funds (ETFs), inverse ETFs and more – as highlighted below.

Minimum volatility ETFs

There are several exchange traded funds (ETFs) listed locally that seek to reduce risk by investing in portfolios which may lose less than the overall market during downturns.

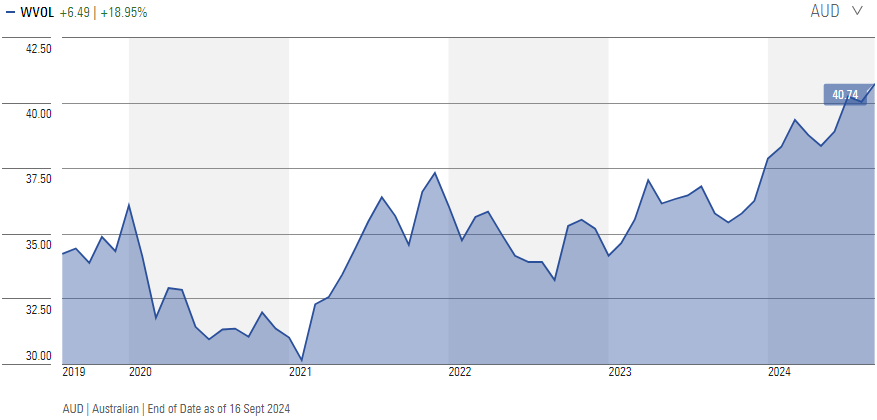

iShares’ MSCI World ex Australia Minimum Volatility ETF (ASX:WVOL), for example, tracks the MSCI World ex Australia Minimum Volatility (AUD) Index. The index is designed to measure the performance of developed market equities that, in the aggregate, have lower volatility characteristics relative to developed markets as a whole.

The fund’s top holdings include telco T Mobile US, pharmaceutical company Johnson & Johnson, Berkshire Hathaway and health care company Merck & Co. It returned 15.66% in the year to July 31 and 6.79% in the five years to the same date.

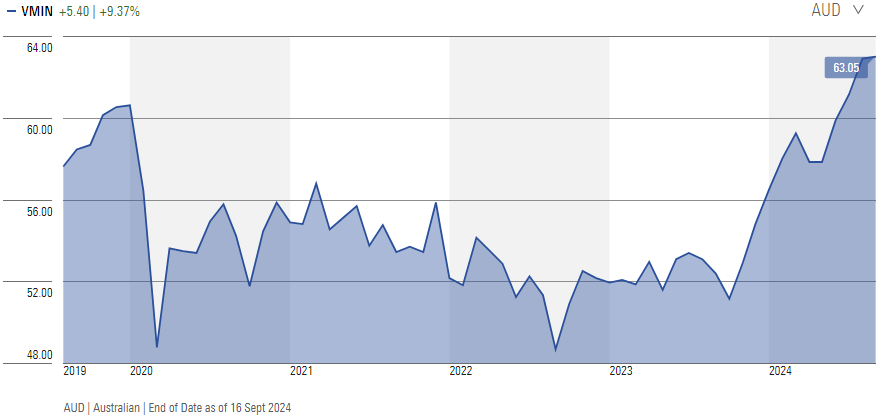

Vanguard’s Global Minimum Volatility Active ETF (ASX:VMIN) instead has a portfolio of global shares that includes Australian companies. It is an active fund that aims to provide long-term capital appreciation with lower volatility than the FTSE Global All Cap Index (AUD Hedged). Close to 60% of its holdings are in US companies, following by Japan (10.4%), the United Kingdon (6.9%) and Australia (3.6%).

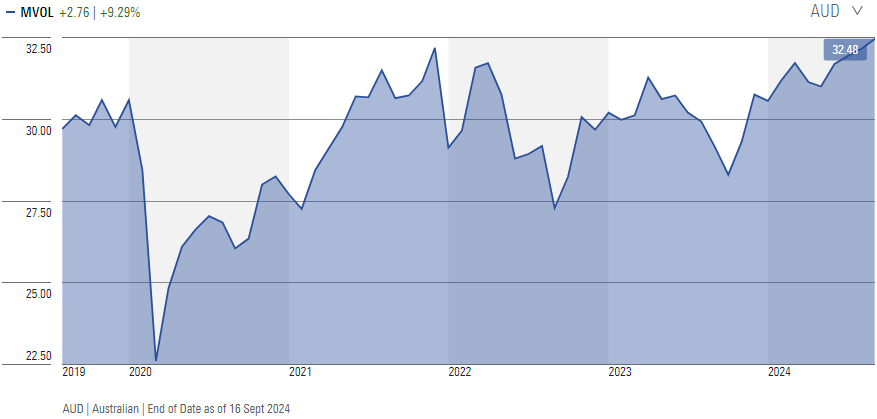

Blackrock also offers the iShares Edge MSCI Australia Minimum Volatility ETF (ASX:MVOL), which tracks the MSCI Australia IMI Select Minimum Volatility (AUD) Index.

Inverse ETFs

Advisers and investors with a particularly bearish outlook – and an understanding of short selling – might consider using inverse ETFs to profit from falling markets.

BetaShares – which operate three inverse ETFs – suggests this style of investment should be monitored daily. Its Australian Equities Bear Hedge Fund (ASX:BEAR) expects to generate a gain when the S&P/ASX200 Accumulation Index falls on a given day, and a loss when it rises. A 1% fall in the Australian sharemarket on any day can generally be expected to deliver a 0.9% to 1.1% increase in the value of the fund.

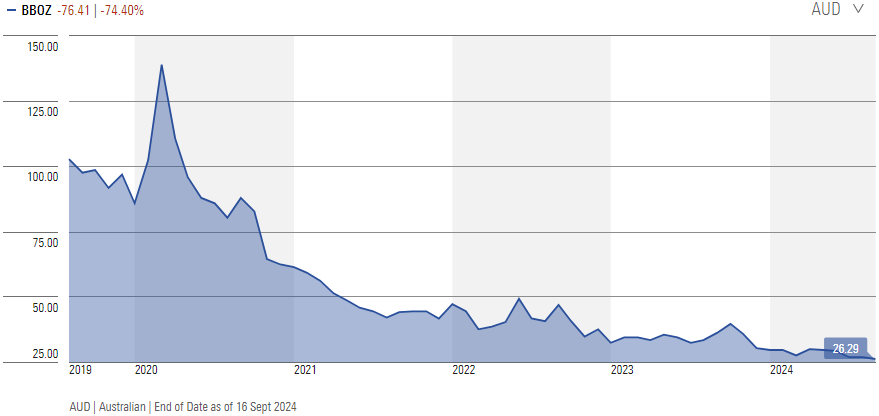

BetaShares’ Australian Equities Strong Bear Hedge Fund (ASX:BBOZ) takes a higher octane approach by offering geared short exposure to the local sharemarket. A 1% fall in the Australian sharemarket on a given day can generally be expected to deliver a 2% to 2.75% increase in the value of the fund (and a corresponding decrease in value if the local market rises).

Other inverse ETFs have the potential benefit of allowing investors to protect a portfolio of US shares from market declines without having to sell shares.

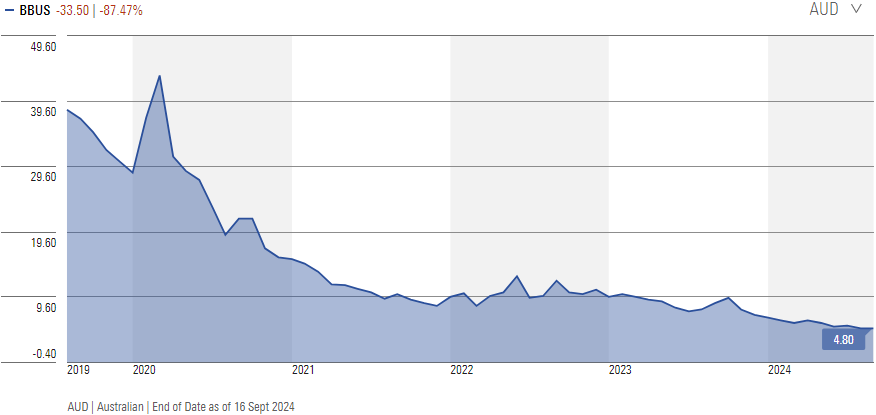

The BetaShares US Equities Strong Bear Hedge Fund – Currency Hedged (ASX:BBUS), again uses gearing and is linked to the performance of the S&P500 Total Return Index.

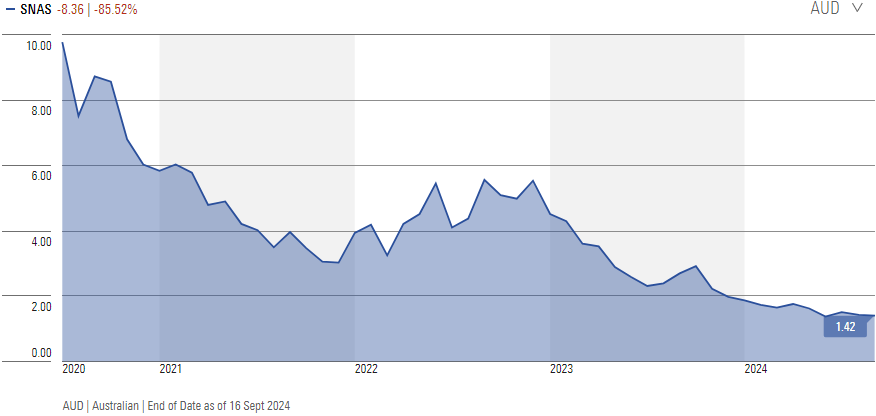

Similarly, the Global X Ultra Short Nasdaq 100 Complex ETF (ASX:SNAS) aims to provide geared returns that are negatively related to the returns of the Nasdaq 100 index. Unsurprisingly, it hasn’t had a great run in the AI boom – its total return -36.5% in the year to the year to July 31.

Overall, there are a range of options that can help advisers help their clients reduce volatility in their portfolios – and in short, using options provides options.

Te Okeroa is Head of Sales, Trading and Customer Relationships at AUSIEX. This information contains general information only and has been prepared without taking into account your objectives, financial situation or needs.

All charts sourced from Morningstar.com.au.