After 11 consecutive positive months to August 2021, Australian stock indices will probably fall in September. Although the market has recovered well during the pandemic, it's a reminder that equity investors must tolerate short-term volatility.

On average, the Australian stockmarket falls about one year in every four or five years. It has delivered a 10% fall at some stage every couple of years since 1950, including three falls over 50%:

- 1 November 2007 to 6 March 2009, down 55%

- 4 March 1974 to 30 September 1974 down 52%

- 21 September 1987 to 11 November 1987 down 50%.

The ASX200 index fell over 30% at the start of COVID in March 2020. Will such falls happen again? Certainly.

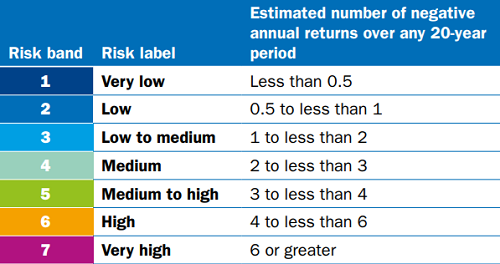

Retail fund managers that offer a range of funds with different risks must include a statement in their offer documents advising clients how often a fund is expected to deliver negative returns. For example, Colonial First State includes this table, where Australian and global equities are given a ‘Very high’ risk label, meaning they are expected to lose money in six or more years in every 20.

However, there are investments on Australian stockmarkets that substantially limit downside risk while leaving much of the upside. This article explores options and convertible notes issued by many Listed Investment Companies (LICs) and defines the maximum loss possible.

(Options over specific stocks are also discussed at the end).

1. Options on LICs

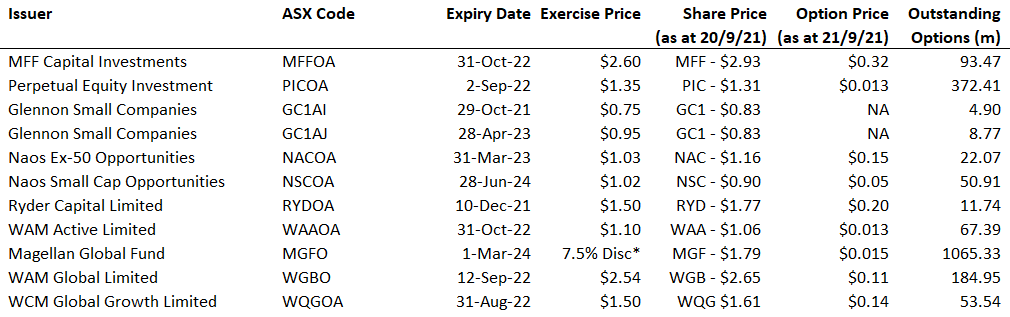

The table below shows the range of LIC options listed on the ASX (and full disclosure, I own some of these options, although that should not be considered a recommendation).

This article explains how they work and for further details, see also the accompanying article by Rodney Lay. We both use the same example for consistency and it is the largest option issue in the market (other than Magellan Global which is not a usual option exercisable at a fixed price).

Perpetual Investments manages an equity LIC (ASX:PIC). In June 2021, PIC issued options (ASX:PICOA) to buy a share in PIC at $1.35 exercisable on or before 2 September 2022.

Here is where the market stands at the time of writing (20 September 2021):

- The latest Net Tangible Assets (NTA) of PIC as at 17 September 2021 is stated as before tax at $1.43 and after tax at $1.35.

- The option to buy PIC at $1.35 was trading at $0.013. Note that is not 13 cents but 1.3 cents. That is, you could buy (subject to liquidity) 1 million options for $13,000, 100,000 options for $1,300 or 10,000 for $130 if on a tight budget. Plus brokerage.

- PIC itself (the underlying shares) are trading at $1.30/$1.31.

- So this option is slightly in-the-money based on both pre-tax and post-tax NTA, it has 12 months to run, and it costs 1.3 cents.

The most an investor can lose is 1.3 cents on each option, plus brokerage. An option gives the right but not the obligation to buy. If PIC is trading at less than $1.35 in a year and the investor logically does not exercise the option, the loss cannot be more than 1.3 cents per option.

However, this is not an option over the value of the index such as the ASX200. It is an option over a specific LIC, and it can trade at a discount to the NTA. So even if the market rises, if the discount widens, the option may go out-of-the-money.

This article makes no judgement about Perpetual Investments, a traditional value manager with a long history. This article is explaining options, not recommending managers.

The features of the following table include (with the PIC example on the second line):

- How long the option lasts, the expiry date. For an investor, the longer the better (the more time value).

- The price at which the option can be exercised, in this case, buying a share in a LIC.

- The current share price at time of writing.

- The current price at which the option itself is trading.

- The volume of outstanding options. If many options are exercised at cheap prices, holders of the underlying shares are diluted. Rodney Lay explains this in more detail.

As other examples, investors can:

- Pay 14 cents per option for the right to buy WCM Global Growth (ASX:WQG) at $1.50 until 31 August 2022, and it is currently trading at $1.61.

- Pay 1.3 cents to buy WAM Active (ASX:WAA) at $1.10 and it is now trading at $1.06.

Check the ASX website for latest NTAs and ensure the concept of dilution is understood.

Listed Investment Company Options

* 7.5% Discount to NAV, not comparable as not fixed exercise price.

Options give wary investors some skin in the game without committing the full share price. In fact, as the table shows, options often cost less than 1% of the current share price, although the relationship with the exercise price is most important. For example, MFF Capital (ASX:MFF) has an exercise price of $2.60 but MFF is already trading at $2.93 so the option is more expensive at $0.32. Options do not earn dividends until exercised into shares.

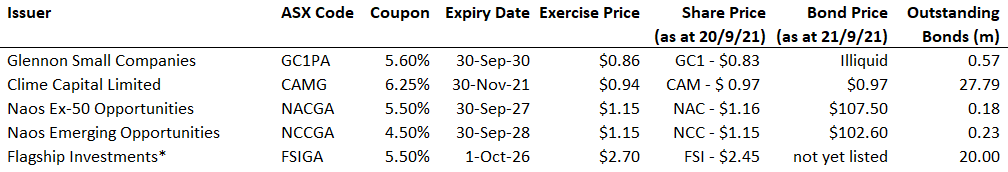

2. LIC Convertible Notes

Convertible notes are debt instruments which can be converted into shares under certain conditions. They are not common on the ASX but some have emerged. The advantage of these notes is that investors can treat them as fixed income bonds, and the share price gain is a bonus if it pays off.

For example, Flagship Investment (ASX:FSI) has issued a $20 million note (ASX:FSIGA) with the following terms. Again, I am not recommending either the note or the manager, just showing how it works:

- Total offer size: $20 million

- Offer price: $2.70 per note

- Interest rate: 5.50% paid quarterly until Step Up date of 30 September 2024

- After Step Up date if not redeemed, rate increases to 6.50%

- 1 Convertible Note converts to 1 ordinary share

- Maturity date of 1 October 2026 (5 years) if not converted or redeemed earlier

- Loan-to-value (LTV) cap of 50%. Coupon steps up 2% and dividends cannot be paid on FSI if this level is breached.

The investor buys a note for $2.70 that ranks ahead of ordinary shareholders. The note pays 5.5% for the first three years with the right to convert each note into a share in FSI, which is currently trading at $2.45. The notes are unsecured debt of the issuer which has a current market value of about $60 million, although FSI could borrow up to 50% of the value of FSI.

Which means FSI could halve in value and noteholder should be covered, assuming no other problems with FSI. The terms above are a summary to illustrate the point.

Here is the range of listed notes available. The notes issued by NAOS are trading above their issue price so the yield on the notes has fallen.

Listed Investment Company Convertible Notes

* lists on 29/9/21, coupon steps up to 6.5% after 2024.

The current range of convertible notes is small as other issues have already matured so investors may need to wait for new issues (and Clime matures soon so it is probably not worth bothering with given its low liquidity). The three others listed in the table are recent issues and new opportunities do arrive.

3. Listed options on specific stocks

In addition, a wide range of options are traded across dozens of stocks with different strike prices and terms, mainly by professional traders, as previously explained in this article, while this article showed how to use options to protect downside. This professional pricing and trading of options using implied volatility is beyond the scope of this article.

Thanks to Rodney Lay of RRMetrics and Hayden Nicholson of Bell Potter for some of the data in this article, although errors remain my responsibility.

Graham Hand is Managing Editor of Firstlinks. The author owns some of the investments described in this article, but this is not a recommendation and investors must do their own research. As the Rodney Lay article shows in more detail, options have many characteristics and react to market conditions in different ways. This article is general information and does not consider the circumstances of any individual.