To date, over 800 readers have responded to our survey. This article is a summary of the overall results, but as ever, the most-revealing parts of the survey are the thousands of comments. These are too long to include in an article and are loaded into this PDF document.

We are leaving the survey open for a few more days to allow further comments, and we will publish a highlight selection next week. Many thanks for your participation.

***

"Many difficult choices will need to be made."

In the past, Reserve Bank Governor Philip Lowe was unwilling to venture outside his responsibilities for monetary policy, refusing to answer questions on government spending and fiscal policy generally. Last week, appearing before a Federal Parliamentary Committee, he changed his tune. He said governments must either reduce services or increase taxes, or find other ways to reform the economy. He said:

“Each of those are very difficult. Taxes, cutting back and structural reform. We have to do one of those three things, maybe all three of them ... You can raise more taxes to pay for the things the community wants. You can cut back in other areas. Or we can get the economy to grow more strongly, so the pie is bigger ... We can’t pay for these things on the national credit card … I would hope during this term of parliament that you could start addressing probably each of these three things."

Then quoted in The Australian Financial Review, EY Chief Economist Cherelle Murphy said high government spending needs to fall from emergency levels in recognition of an economic bounce back. She said:

“Arguably in an economy running as hot as Australia’s is, this level of spending is inappropriate as it uses up resources that the private sector may otherwise need for expansion ... in 2022, with the economy bouncing back and lockdowns over, government spending has remained high. This is for a number of reasons, including ongoing health system spending and flood-related recovery. There are structural reasons spending is high too, such as the NDIS needs.”

Our Reader Survey is therefore timely, especially with a Federal Budget on 25 October 2022, and many thanks to the over 800 people who responded. See last week's article for an introduction to the issues.

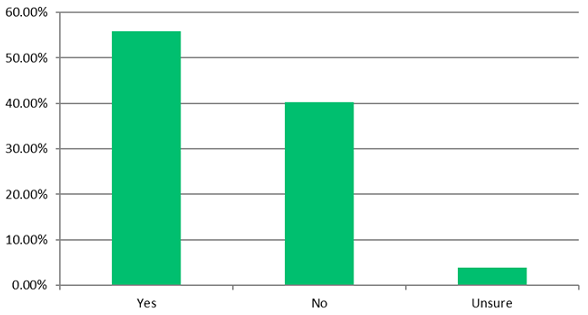

Q1: Should the Stage 3 tax cuts be cancelled?

With 55% in favour of cancelling the cuts and 41% wanting to leave them (4% undecided), there's a clear winner but plenty of views on both sides. Typical comments were about the need for financial incentives and an obligation to meet election promises versus the changed economic outlook.

"The top marginal rate remains too high which restricts our ability to compete for talent."

"It was enacted in different economic times with an expectation that the budget would be in surplus. Great pity the previous government didn’t put some caveat’s around what the budget status needed to be for the tax cut’s to proceed."

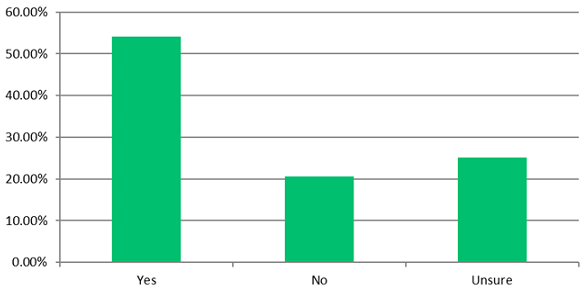

Q2: Are prices increasing due to embedded inflationary expectations?

The Reserve Bank Governor has expressed dismay at the prospect of inflation becoming embedded in corporate and consumer decisions, and based on the survey results, his concern is justified. A healthy majority at 54% believe inflation is embedded with 21% unconvinced but a high 25% unsure. Typical of the 'yes' case was:

"The bulk of cost increases have genuine cause but I think it has been much easier to implement cost increases and also get away with a bit of extra thrown in to take advantage of the situation."

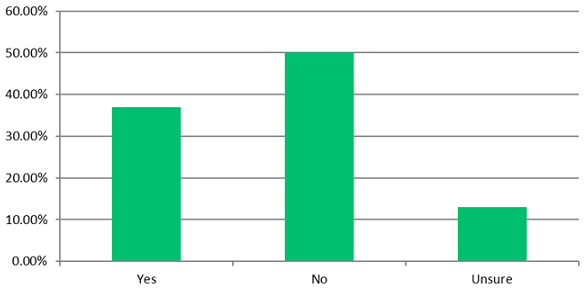

Q3: Should the childcare subsidies be brought forward to 1 January 2023?

Half of respondents supported the view of Treasurer Chalmers that the new childcare subsidies should be delayed, while only 37% were in favour of moving the date to 1 January 2023 despite claims of productivity and economic improvements. There were many strongly-worded comments about family priorities and the best way to look after children but also this type on encouraging workforce participation.

"Australia needs to better mobilise its available human resource and better childcare to those who cannot fund the present scenario and who could add a meaningful measure to our human capital in the workforce skills and intellectual fields."

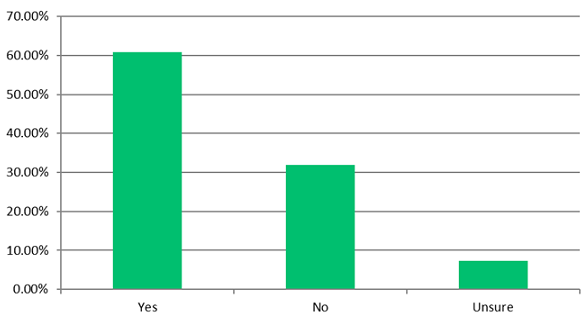

Q4: Should a mining super profits tax be introduced?

Strong support for a super profits tax at 60% with only 32% against. A range of comments included the opaqueness of who is benefitting, whether the mining companies misled governments about the extent of reserves and the sovereign risk to investments if taxes are introduced retrospectively. This is a balance of both sides of the argument:

"I think this is reasonable but of course the question is also about the definition of a "super profit". I've always worked in the mining industry and all mining companies pay royalties based on mineral revenue. It is difficult to move the goal posts just because previous State governments applied too low a royalty measure at the approval stage of a project. But it would not be unreasonable to seek a fairer distribution in times like we are currently seeing and where those circumstances have resulted in somewhat artificial opportunities for mining companies to make more profit through no extra effort of there own personnel. So perhaps when selling prices were outside the bounds of say 2 sigma of the real past 10 years then tax on revenue could be imposed. Cost to produce could be a key issue and so perhaps the revenues might need to be indexed to allow for cost increases. But in my view if the state and it's people want to grab some of the upside then they should be expect to chip in and support the companies when mineral prices are extraordinarily low. I can't see governments or the average Australian being prepared to do that. But fair is fair."

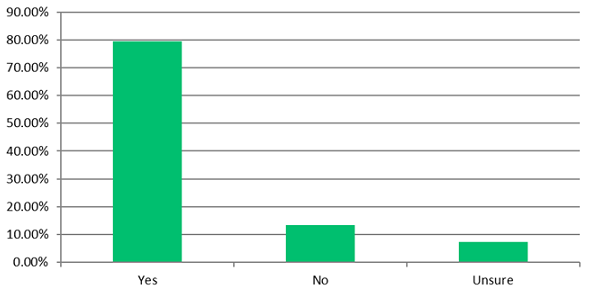

Q5: Should gas supplies be reserved for the East Coast domestic market?

The strongest view in the survey results with almost 80% in favour of a gas reserve and only 13% against. There is a lot of anger and criticism of past governments for poor negotiation skills and failing to recognise the need for energy security.

"It is a farce that the eastern state governments were so shortsighted that they did not insist on some energy supplies that arguably belong to the people of Australia, were not set aside for domestic use."

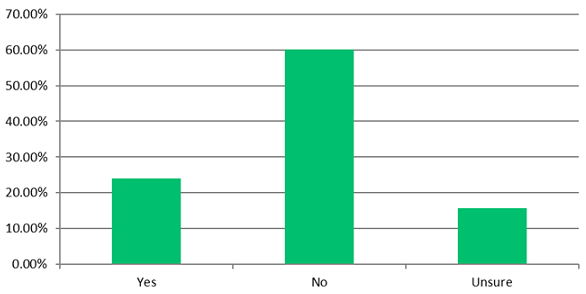

Q6: Should the October 25 Budget include additional cost-of-living concessions?

Many readers accept the need to tighten their belts, with only 24% in favour of additional cost-of-living relief and 60% against. Many comments on a focus on needs not wants or helping only low-income earners.

"We must learn to live within our means. Having low government debt allowed us to withstand several crashes now, and the more debt the government carries, the less robust we are to shocks. I don't want Australia in the same position as our major allies who are now in a hopeless situation with respect to government debt. We still have the opportunity to get on top of the debt."

A final question asked about other policy issues and received hundreds of responses, as reproduced in our full report.

Thanks again for the excellent comments and response rate.