In conjunction with Graham Hand’s article, OK Boomer: fessing up that we’ve had it good, we asked both Boomers or Non-Boomers: Do you agree the Baby Boomer generation has been favoured?

[Note: This survey is now closed]

An impressive 1,800 people shared their opinions and circumstances, and while Boomers clearly outweighed Non-Boomers among respondents (68% to 32%), the yes/no responses were a little more balanced.

|

|

Boomers

|

Non-Boomers

|

|

Percentage of total respondents

|

68%

|

32%

|

|

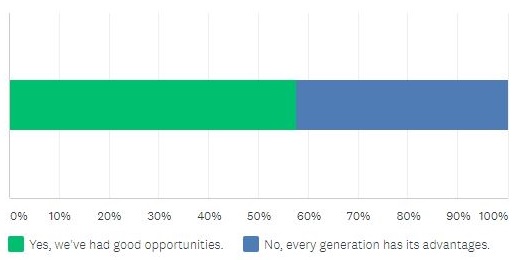

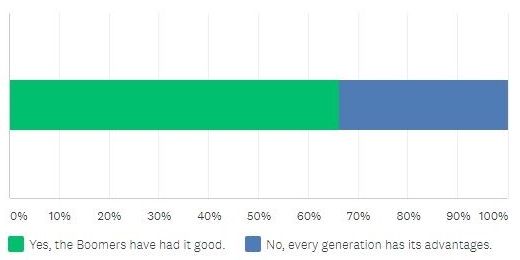

Yes, the Boomers have had good opportunities

|

58%

|

66%

|

|

No, every generation has its advantages

|

42%

|

34%

|

For the Baby Boomers (born 1946 to 1964), do you agree your generation has been favoured?

For the Non-Baby Boomers, do you agree they have been favoured?

Republishing comments in full

Many of the 600+ additional comments were heartfelt and passionate, including examples of personal struggles, as well as responses taking one side of the debate versus the other.

We have produced this report from the survey containing results and all the comments.

Leisa Bell is Assistant Editor at Firstlinks.