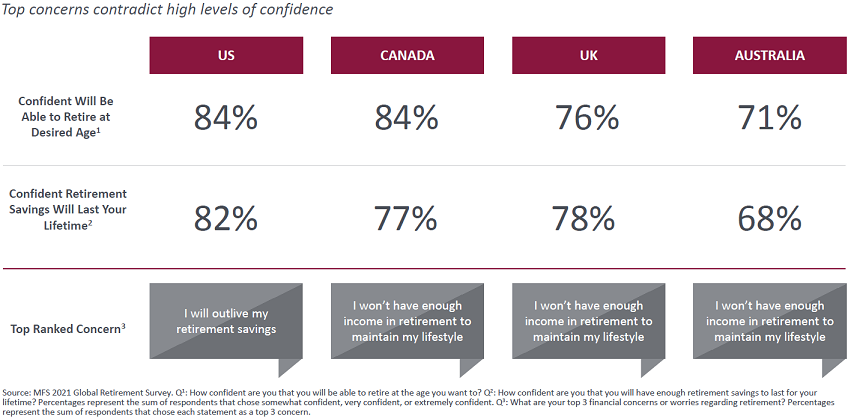

Australians remain optimistic about retiring comfortably, yet their confidence levels significantly lag those of retirement savers in the United States, Canada, and the United Kingdom, according to the latest MFS Global Defined Contribution Participant Survey.

The study, which surveyed over 4,000 people globally, including more than 1,000 who contribute to an Australian superannuation fund, showed 71% of local savers are confident about retiring at a desired age, but less so that their retirement savings will last their lifetime, at 68%. This contrasts sharply with retirement confidence in the US, the highest of any market, where respectively 84% and 82% of savers are confident in realising their desired retirement age and income adequacy throughout retirement.

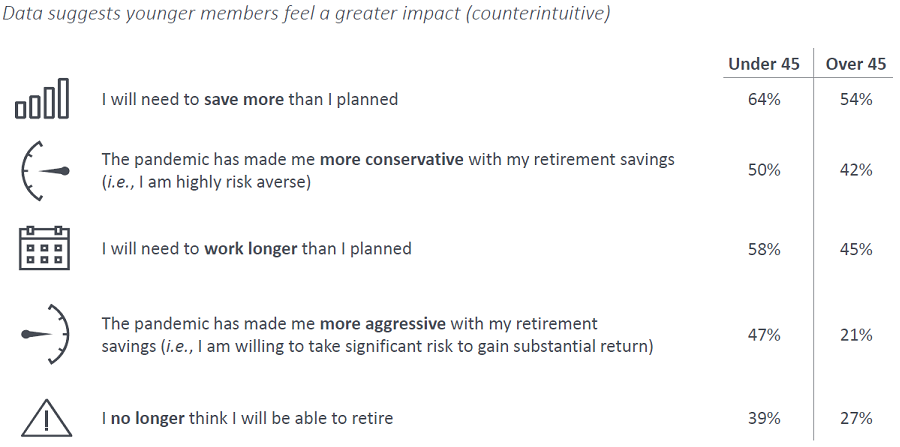

Longer working and retirement saving horizons due to COVID, felt most by under 45s

Australian investors are in step with global peers in believing they need to save more and work longer than planned due to COVID-19, particularly those under 45 years old. 64% of this younger cohort in Australia believe that they will need to save more for retirement, while 58% believe they will need to work longer to achieve their retirement savings goals. These younger investors are twice as bullish as their older peers, with 47% taking on ‘significant’ risk to gain a substantial return, compared to 21% of people aged over 45.

Source: MFS Global Retirement Survey, AU respondents.

Retirement age and income adequacy remain ongoing and highly complex discussions for Australia’s wealth industry, perhaps more so given the retirement investing psyche clearly appears quite sensitive and risk averse at present relative to other markets.

The shock and persisting uncertainty caused by the pandemic has undoubtedly left an indelible mark on younger retirement investors, and their concerns need to be properly addressed for them to get back on track, with a deeper appreciation that uncertainty and opportunity are often key to long-term investing.

With a growing spotlight on performance against a backdrop of YFYS policy, pandemic waves and escalating global risks, fostering investor confidence and active engagement in retirement saving decisions, with a focus on risk management, must remain a core objective for the whole, long-term investment industry.

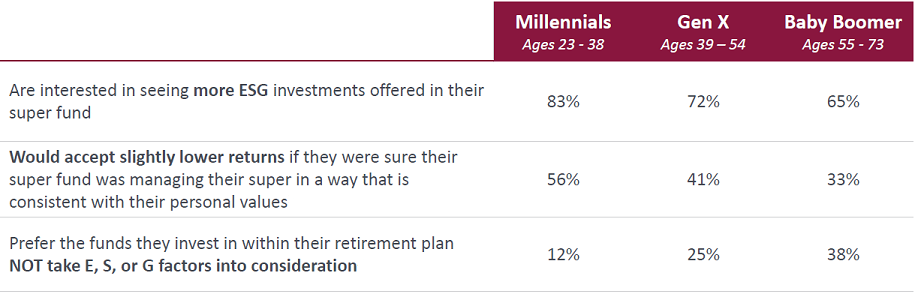

ESG appetite soars within superannuation

Like global investors, Australians want to see more ESG investments in their superannuation fund portfolios, a view expressed by 74% of all local respondents, including 83% of local millennials. Generation X and baby boomers followed with 72% and 65%, respectively.

Source: MFS Global Retirement Survey, AU respondents.

ESG investing continues to transform the way in which investors view and allocate their capital, and while quality long-term, purpose-focused investments inherently integrate ESG, superannuation funds are responding to demand for greater depth and diversity of investments that target change and impact. The associated noise however can be intense, and we see a growing role for advisers to educate investors on the many shades of green and ESG within offerings, along with pointing out the differences between asset managers that integrate ESG into their overall investment approach and those that approach it strictly from a product perspective.

Superannuation advice gaps

Australian respondents are also the most unsure about what levels of return to expect on their retirement savings and at what rate are they likely to withdraw funds during retirement, factors potentially contributing to low confidence levels. Almost one-third (32%) rely on their superannuation fund to help them make retirement contribution and planning decisions, 30% turn to a family member, while only 29% receive professional advice. Just over half of advised people elected their planner based on fees, followed by years of experience and retirement planning expertise. 46% of all prefer to receive advice in-person with their planner, including video calls.

Applying a gender lens, 34% of men turned to a financial adviser for retirement advice, compared to 24% of women.

Sources, quality and consistency of advice vary widely. We see enormous potential for advisers to provide a greater and more specialist role in providing asset allocation advice to superannuants, especially women who remain under-advised despite their working lives typically being more varied and punctuated by life events.

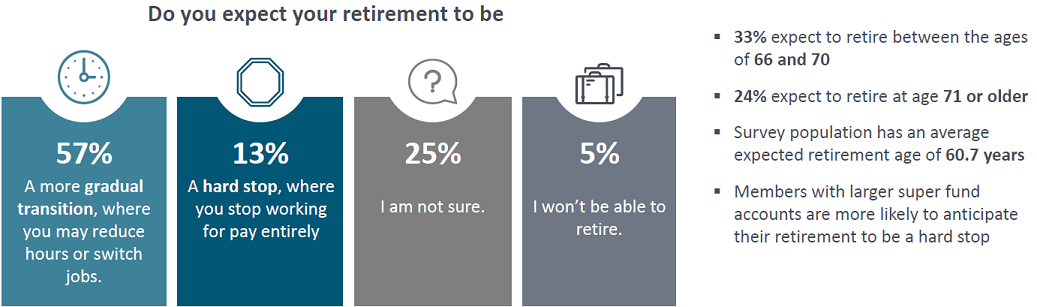

Concept of retirement is evolving

The survey found that the average Australian expects to retire at the age of 60.7 years; however, almost one quarter (24%) expect this to be closer to 71 or older. Only 13% expect a hard stop retirement, with the overwhelming majority (57%) expecting to reduce working hours or switch jobs.

Source: MFS Global Retirement Survey, AU respondents.

Our research shows that retirement is not the hard stop, party event that some may have once envisaged. The findings, gleaned through multiple waves of COVID, are a reminder that retirement is an evolving concept shaped by a myriad of factors, which will continue to change the composition and delivery of wealth management and financial advice.

Marian Poirier is Senior Managing Director, Head of Australia and New Zealand at MFS Investment Management. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

About the MFS 2021 Global Defined Contribution Member Survey

Dynata, an independent third-party research provider, conducted a study among Defined Contribution (DC) plan participants in the US, Canada, UK, and Australia on behalf of MFS. MFS was not identified as the sponsor of the study.

To qualify, DC plan participants had to be ages 18+, employed at least part-time, active workplace retirement plan participants / members: in the US, actively contributing to a 401(k), 403(b), 457, or 401(a) / in Canada, actively contributing to DC Pension Plan, Group Registered Retirement Savings Plan, Deferred Profit Sharing Plan, Non-Registered Group Savings Plan, or Simplified Employee Pension Plan / in the UK, actively contributing to a Defined Contribution Scheme, Master Trust, or Individual Savings Account. / in Australia, actively contributing to an industry, retail, corporate or public sector super fund or a self-managed super fund. Data weighted to mirror the age / gender distribution of the workforce in each country.

1,020 US, 1,012 Canadian, 1,017 UK and 1,011 Australian plan participants answered the survey, which was fielded between March 31 – April 13, 2021.