Much has been made of the renewed case for fixed income in recent months and appropriately so in our view. Not enough has been said however about the case for active management.

Within fixed income markets, behavioural and structural inefficiencies exist that present opportunities for active managers to enhance returns. Various pitfalls of investing passively can also serve to increase risk, underscoring the importance of addressing these via active approaches to ensure fixed income’s defensive profile delivers to the best extent possible.

We’ll review the structural and behavioural factors that have proved fertile ground for active management within the Australian fixed income market and show evidence that the asset class continues to provide opportunities to harness attractive risk-adjusted returns.

Investor inefficiencies

The Efficient Market Hypothesis (EMH) is predicated upon all market participants acting rationally, with a mutual objective of maximising risk adjusted returns. In practice this does not fully hold, allowing skilled managers to capitalise on market mispricing.

Fixed income is comprised of a broad investor base with disparate objectives not always aligned with return maximisation. Behavioural biases can also influence demand and supply. These include:

Asset and liability matching: A common objective of insurance companies, investors seek specific securities with yields and duration that precisely match their liabilities, regardless of the securities true fundamental value.

Benchmark tracking: Passive investors seeking precise exposure to benchmarks will bid for securities without regard for relative value opportunities. Benchmarks can be difficult to emulate efficiently due to their size, the number of securities, and frequency of compositional change.

Economic regulation: Central banks seeking to influence liquidity and the cost of borrowing through policies such as bond buying programs, sales (quantitative easing/tightening) and yield curve control, can skew market pricing away from fundamentals.

Offshore investor influences: Offshore investors may include currency gains as a driver of investment decisions on unhedged portfolio holdings. Japanese annuity products for example include product features such as total return triggers which can result in selling pressure for bonds with strong fundamentals and attractive pricing simply due to changes in the value of a currency.

Structural inefficiencies

Structural inefficiencies of fixed income indices also promote discrepancies between the market prices of securities and their intrinsic values. Index construction and rating methodologies, as well as regulatory constraints all play a significant role in creating opportunities for active managers to identify undervalued or overvalued assets.

Debt weighted indices: Fixed income indices are weighted according to the amount of debt outstanding. Unlike equity indices that rely more heavily on market factors (like share price and number of shares issued), fixed income indices follow a debt-weighted approach without full consideration for an issuer's creditworthiness. This approach leads passive investors to favour issuers that have the largest amount of borrowing, rather than being the most valuable companies in the case of equity indices. In addition, index weightings can allow for increased exposure to issuers who have deteriorating credit quality due to increased leverage or high levels of debt issuance.

Influence of credit rating agencies: Credit agencies play a pivotal role in fixed income markets and their influence can be seen in the following instances:

- High-yield or sub-investment grade securities: These may be ineligible for inclusion within indices/benchmarks. Active managers can take positions in ‘rising stars’, sub-investment grade securities with ratings upgrade potential. Rating downgrades (from investment-grade to sub-investment grade) or upgrades, can cause significant selling or buying pressure. Active managers with the ability to conduct thorough research and include off-benchmark holdings can take advantage of the associated price volatility.

- ‘Stale’ ratings: Security fundamentals can change rapidly especially in times of crisis resulting in ratings that no longer reflect the fundamentals of the security (‘stale’ ratings). Credit rating agencies have finite resources and cannot publish updated ratings that reflect all information in real time. Active managers have the ability to react as information becomes available, potentially ahead of ratings-guided investors and benchmarks.

Regulatory requirements: Regulations governing which securities can be held by fixed income investors, their minimum ratings, and the associated capital charges are notable. In Australia for example, securities deemed High-Quality Liquid Assets (HQLA) may be favoured by banks, which can skew market dynamics and pricing.

Case study – Semi-government versus supranational yields

Budget deficits associated with COVID lockdowns and fiscal stimulus have seen large amounts of semi-government bond issuance in the past few years. Deteriorating credit fundamentals and credit rating downgrades have resulted in some cases.

Since semi-government issuance has been high relative to the wider market, index construction rules result in a higher weight in the benchmark. Concurrently, regulatory changes to the securities that Australian banks are required to hold have increased demand for semi-government securities. This has arguably pushed credit spreads, or compensation for risk of these securities, lower than what true fundamentals would imply.

Conversely, supranational entities have been more conservative in their bond issuance, maintaining relatively robust fundamentals in comparison. Unlike major Australian state issuers, which typically hold an AA rating, supranationals often boast a AAA rating, indicating superior creditworthiness.

Even with those higher ratings, supranationals offer a yield premium to semi-government issues of the same term. Since COVID, demand for semi-government securities has been strong from Australian Authorised Depository Institutions (ADIs) and the RBA.

Looking forward, net issuance will remain elevated but ADIs who have sufficient holdings to satisfy regulatory requirement, as well as limited demand from the RBA, will mean a separate cohort of investors will be required to absorb additional new supply of semi-government debt to the market. Without additional investor demand, prices would be expected to fall (spreads will widen).

Active managers that can recognise technical factors are in a strong position to deliver superior risk-adjusted returns.

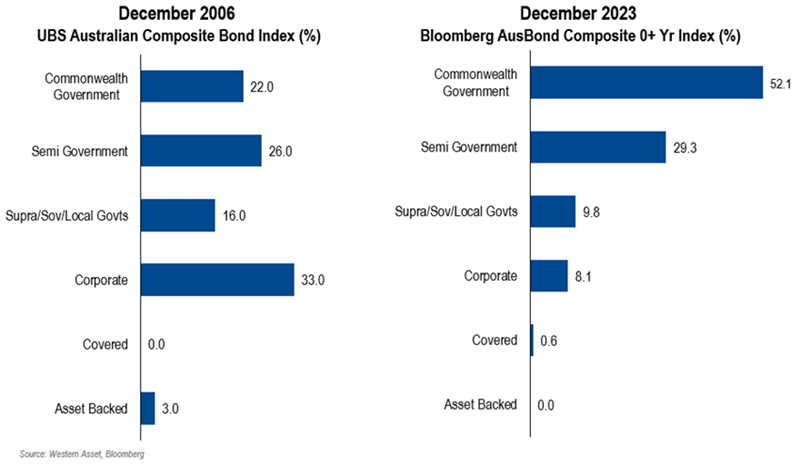

Australia’s changing fixed income landscape

The composition of the Australian fixed income market has changed dramatically over the past two decades. Whilst corporate debt outstanding has grown modestly, the sheer weight of government and semi-government issuance has dwarfed corporate issuance and crowded out credit in the benchmark.

A similar outcome has transpired for the supranational sector. Lower sector diversification, reduced exposure to credit and changes to the risk attributes of the index are the result.

Passive investors have inherited lower corporate exposure and thus less yield buffer. In an investment grade dominated, high quality market, that additional yield buffer has proven to be a valuable tool against the negative impacts of rising rates, with a negligible increase in default risk.

Increasing weights to these high-quality corporates without significantly increasing the risk of the portfolio, nor decreasing the average quality is possible through active management. Active managers can also position appropriately to maintain the attributes that investors are seeking in a core fixed income allocation: liquidity, defensive yield, correlation benefits and portfolio diversification.

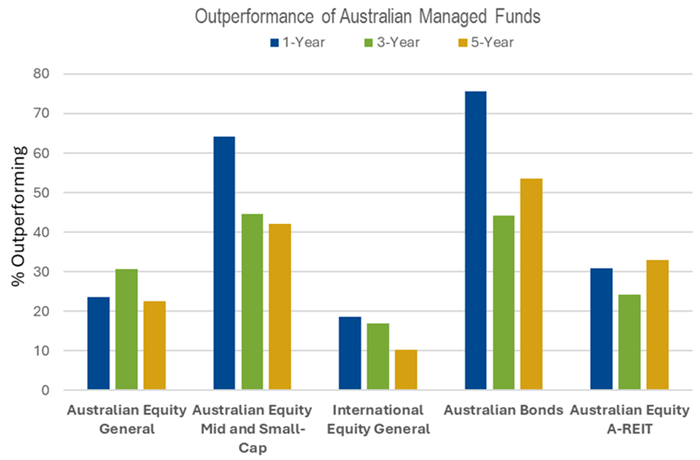

Evidence of persistent outperformance

Recent data highlights the success that active managers have had within Australian fixed income. As shown in an S&P study, active management has been rewarded more often than not, over one and five-year periods. The report underscores active management’s success within Australian fixed income when viewed against other asset classes in which most managers have underperformed their benchmarks over 1-, 3- and 5-year periods.

Source: S&P SPIVA Scorecard as at 31 December 2023, Western Asset

Summary

The resurgence of fixed income's defensive characteristics is acutely apparent. Less obvious, but no less important is the role that active management can play in navigating rapidly evolving market conditions effectively and defending against poor portfolio outcomes.

Jonathon Costello, CFA is a Client Service Executive at Western Asset Management, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is for information purposes only and does not constitute investment or financial product advice. It does not consider the individual circumstances, objectives, financial situation, or needs of any individual.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.