Global asset owners have historically allocated capital to two distinct equity asset classes: global large cap (as represented by the MSCI All Country World Index or the MSCI All Country World Large Cap Index) and/or global small cap (as represented by the MSCI Global Small Cap Index). As a long-tenured, seasoned active global small/mid- cap managers, we are often asked, “Why the global small/mid-cap asset class instead of the more common small-cap approach?”

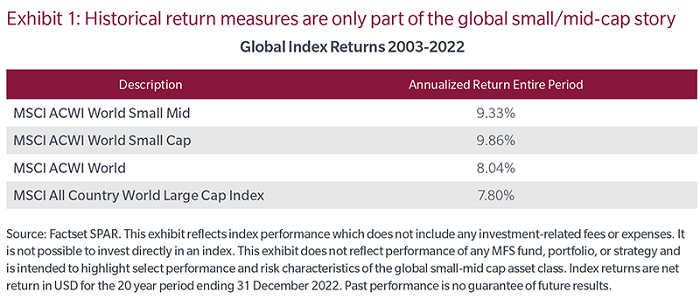

Over the past two decades (2003–2022), both global small-cap stocks and global small/mid-caps have outperformed their large-cap counterparts. At the same time, while global small-caps have slightly outperformed the small/mid-cap asset class, we believe that a global small/mid-cap approach may offer a number of potential benefits and features for asset owners not readily apparent when simply looking at historical return metrics.

Potential benefits of a small/mid-cap approach

Although past performance is no guarantee of future results, similar historical performance results for time period shown above across asset classes, what might be the potential advantages of utilizing a global small/mid-cap strategy vs. a small-cap only approach? Here are a few.

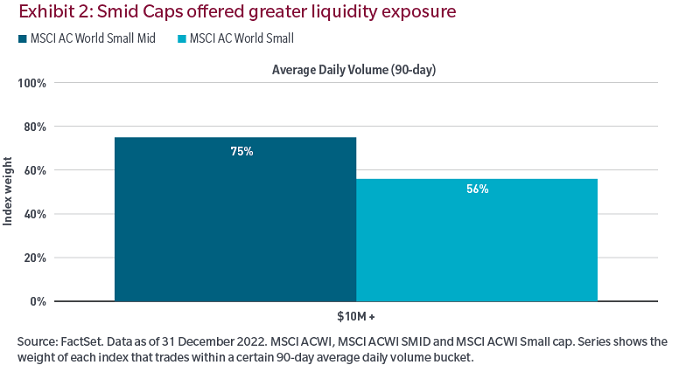

Improved liquidity

The addition of mid-cap stocks to the investable universe can potentially allow for exposure to more liquid names without paying a 'liquidity premium' for this added benefit1. In fact, as of 31 December 2022, the MSCI ACWI Small Mid Cap Index traded at a discount to the MSCI ACWI Small Cap Index while offering a larger percentage of stocks with greater than $10M USD in average daily trading volume, as shown in Exhibit 2.

|

Date

|

MSCI AC World Small Mid - P/E - NTM

|

MSCI AC World Small Cap - P/E - NTM

|

|

12/31/22

|

13.80

|

14.04

|

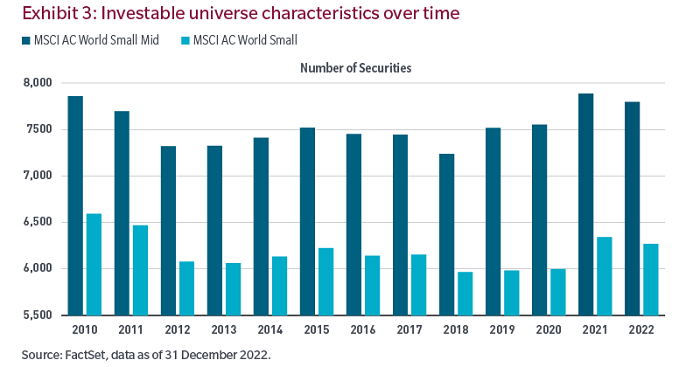

Expanded universe

A global small/mid-cap approach also meaningfully increases the opportunity set for active management. With over 7,500 companies in the MSCI AC World Small Mid Cap Index, making it significantly larger than the global small-cap index that consists of approximately 6,000 names, the associated universe provides abundant opportunity to attempt to uncover unique businesses trading at compelling valuations, as shown in Exhibit 3.

Less risk, greater flexibility

Midsize companies have tended to be early or midway through a growth phase of a new product or market, or dominant players in smaller but very attractive end market. As such, we have tended to find less risk in these often more mature businesses than in new and emerging companies. Plus, midsize companies are still small enough to have years of growth potential ahead of them. Additionally, the ability to hold onto solid companies in the portfolio allows for a longer investment time horizon and the potential for active management to take advantage of short-term market inefficiencies.

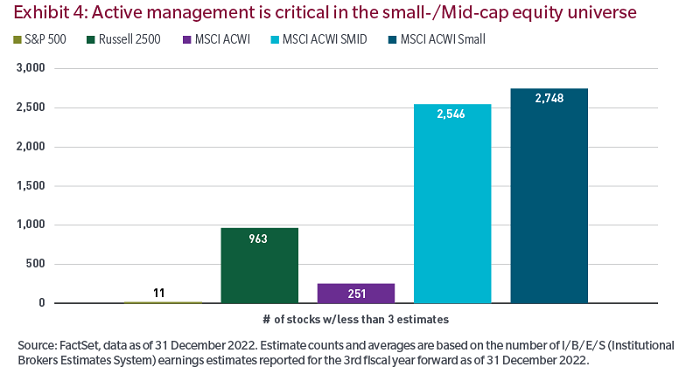

Highly inefficient asset class

From a research coverage perspective, the global small/mid-cap universe may offer meaningfully lower sell-side coverage than large-cap stocks (both globally and in the United States) and the US universe of small/mid cap stocks, as well as modestly less coverage relative to global small-caps, as shown in Exhibit 4. This lack of coverage in the small/mid-cap space may allow for increased inefficiencies, which in turn create opportunities for skilled active managers to offer differentiated portfolios, identify new investment ideas and the potential to generate alpha2.

Endnotes

1 'Liquidity premium', in our view, refers to the fact that stocks that offer more liquidity in the marketplace often trade at a higher multiple than stocks with less liquidity. All else being equal, investors tend to value the ability to trade an asset.

2 MFS believes that skilled active managers are those who demonstrate conviction through high active share and long-holding periods, manage risk thoughtfully and bring together different perspectives.

Nicholas J. Paul, CFA is an Institutional Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.