Gerard Noonan (left, below) and Graeme Russell, colleagues who became good friends, were a great pairing at Media Super. They had the sort of relationship, as Chair and Chief Executive, that organisations crave.

They agreed on most things to do with the fund, which survived and thrived during their tenure together, except for one major thing – whether or not the fund should merge with a bigger fund.

To merge or not to merge?

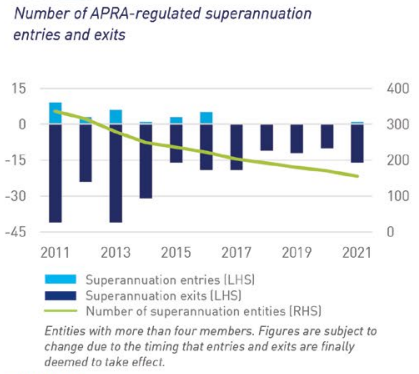

In Noonan’s view, APRA had shifted its stance from being neutral on mergers to one of actively promoting them. In some cases, aided by the introduction of the Your Future Your Super legislation, APRA has engaged in coercion to rid the industry of what it determines a ‘dud’ fund.

Source: APRA 2021 Year in Review

But more importantly in his eyes, Noonan had increasingly come to the realisation that notwithstanding Media Super’s solid and continued above-average performance, there was a small coterie of very big funds which consistently outperformed by up to 1% per year. Noonan has said:

“Graeme took the view that we could still outperform, whereas I had shifted in my view.”

While he did not win that now-unwinnable argument, Russell was at least able to demonstrate how a small fund could outperform. After former CIO Jon Glass left Media Super in March 2014 and until Michael McQueen joined in January 2020, Russell was both Chief Executive and CIO. The fund did, in that time, jump a few notches up the ladder, joining the top-quintile ranks in some metrics for several periods.

Industry and fund knowledge

Russell trained as an accountant and had a career in management and business consulting prior to becoming the Chief Executive of a super fund, the timber industry’s First Super, before taking that role at Media Super in 2013.

While not a classically trained investment professional, Russell knew Media Super and its members perhaps better than anyone except Noonan. He had been a trustee director of the fund for two years before becoming Chief Executive and a trustee of its predecessor fund, JUST Super, for 19 years. Noonan, a renowned journalist who exits along with the rest of the board in April 2022 with consummation of the merger with Cbus, has notched up 30 years as trustee, starting with JUST, with 12 of those as Chair. Susan Heaney, who runs a large printing company, became Chair in October 2020.

Russell was quoted as saying on his retirement:

"I think it's disappointing that government and the regulators don't understand the important contribution that industry-specific super funds make to their industries, beyond superannuation.”

He said, as the first wave of Covid-19 was biting hard in June that year:

"We're about to see that clearly, as funds like Media Super step up to support members and companies struggling through the current economic dislocation and job losses."

It's not only in times of crisis that the single-industry fund - what was commonly termed a ‘craft fund’ - can provide additional comfort to its members. The better access to management and their understanding of the members’ interests, affords members greater peace of mind.

Noonan understands the benefits that a craft fund offers, as well he should. He often tells the story of when he was The Sydney Morning Herald’s Education Editor sitting in the big open-plan newsroom while a trustee for the craft fund was there with a small queue of people wanting to ask him about their super.

“When you work in an office with perhaps 400-500 people, you are bumping into them all day every day. I had to keep reminding myself that I was actually employed there as a journo. They liked the access. They liked the idea that it was a ‘mutual’. Bigger funds couldn’t do that.”

Noonan, a Walkley Award winner who became the Editor of The Australian Financial Review for five years, best tells the story of his demise there at the hands of the company’s then part-owner Conrad Black in an article for the SMH first published in 2007.

He was able to wear his dismissal as a badge of honour, probably impressing his former colleagues and other media people more than winning that Walkley.

Number of large funds heading for single digits

Despite the hesitations about a merger with a much bigger fund, as many other industry funds will continue to do until the number of funds probably gets close to single digits, both Noonan and Russell had a lot of personal experience with mergers.

On 1 July 2008, for instance, Russell was a Trustee Director of JUST Super, which was in the process of merging with Print Super, as well as a trustee of what was then the timber industry fund TISS, which became FIRST. On that day, he says, he was involved in two concurrent mergers with five funds wrapped up in the transactions.

Noonan’s experience pre-dates even that. JUST’s first merger, in 1992, was with the fund representing actors and entertainers, JEST, which was prompted more by a merger of trade unions supporting the two funds than the separate cohorts of members.

The possibility of a merger between JUST and Print Super was mooted fairly early in the piece, but discussions did not become serious for more than a decade later, and even then took several years to consummate.

Both JUST and Print Super were formed in 1987, in the first rush of industry funds that followed the introduction of the 3% Award Super deal between the ACTU and the Hawke Government in 1986.

In a sense, a whole new industry grew up from that period, including the retail and institutional investment trade press with the launch of Money Management and Super Review titles also in 1987.

When they came together in 2008, with Noonan as the new Chair, JUST and Print Super had just over $3 billion under management. As they exit into Cbus, they have $7 billion (as of June last year), expanding the Cbus assets to about $72 billion.

The end of Media Super

Media Super held its third and final members’ annual meeting on 24 February 2022. It was a virtual meeting so it was impossible to tell whether any tears were shed among the 300-odd participants.

Most of the more-than 50 questions directed at the eight trustees plus executives present, were to do with personal financial matters and the logistics of the merger. Susan Heaney and Chief Executive Tony Griffin stressed the benefits which would start to be seen from 26 April which is the scheduled date for Cbus services to kick in.

Mergers are complicated. At a technical level, Media Super’s 74,000 members will be given new account numbers as they are transferred to Cbus’s admin platform (from Mercer to Link). More complicated than that has been Cbus’s investment structure changes to accommodate Media Super’s unit pricing system with the bigger fund’s crediting rates system.

Heaney said that size would deliver more benefits to members. There would be a greater range of investment options; it would be easier to diversify investments and increase returns. Fees and charges could be lower.

Later this year, the handful of members who had chosen Media’s infrastructure option, which was closed in 2020 because it had become uneconomical to administer, would be able to access Cbus’s new unlisted version, as well as an unlisted property option.

She said that the Media Super ‘brand’ would also be retained, which is becoming common practice in such mergers. Maritime Super, another of the few remaining craft funds, will retain its brand when it undertakes a full merger with HostPlus next year. It is unclear what this means in practice and how long it will last.

More importantly for Media Super, especially those members who like the notion of being part of a group of like-minded people, Cbus has undertaken to form a Media Super advisory committee to its own board. This is expected to consist of some former Media trustees alongside Cbus representatives.

When Media was canvassing the field to ascertain which big fund it should pursue as a merger partner, it appointed the former Rice Warner actuarial advisory firm (now a part of Deloitte) to assist. The decision was thought to be very close, with Cbus pipping AustralianSuper at the post and with the proposed advisory committee allegedly an important factor in the decision.

Greg Bright is a freelance journalist and publisher specialising in funds management and superannuation. He is a co-founder of Super Review, now published by FE fundinfo. He was a contributing employer to both JUST and Print Super since 1987.