Debt recycling is a powerful strategy for those juggling the seemingly competing goals of debt reduction and building an investment portfolio. Many people have a natural instinct to pay off the home first, then consider investing later. However, waiting to invest can be a wasted opportunity. Through debt recycling, you can tackle both financial goals in a smart way, with significant benefits.

Online searches and forum posts reveal huge misunderstandings about debt recycling, in many cases because it’s not just one single strategy – there are several twists or varieties to the central theme. Here's an outline of the basics of debt recycling and how it can be used.

What is debt recycling?

At its core, debt recycling is a financial strategy that allows you to replace non-deductible home loan debt with deductible investment debt. It’s a powerful strategy for paying off your home sooner AND building an investment portfolio at the same time.

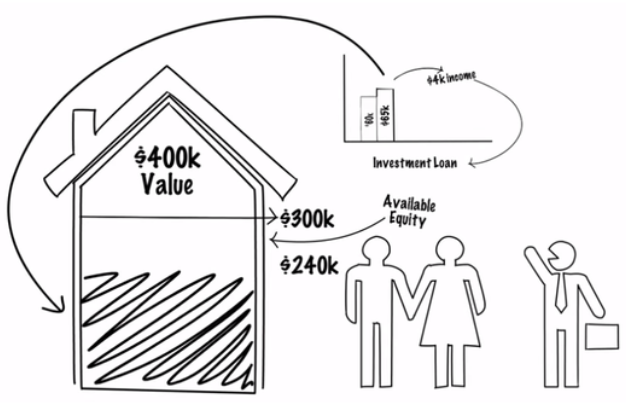

Typically, the debt recycling process involves using home equity borrowings to invest in income-generating assets, such as shares or managed funds. Income from these investments is used to pay down your mortgage, while the capital value of your investments typically grows, accelerating your wealth-building efforts.

Plain vanilla debt recycling

In its most basic form, debt recycling starts with paying down debt with surplus cashflow and borrowing back equivalent amounts to invest. Imagine a couple who have an existing $300,000 mortgage, and $1,000 per month surplus cashflow, which they direct towards additional mortgage repayments. After 12 months, that $12,000* is available for redraw. In conjunction with their lender and/or an experience mortgage broker, that available amount is split off into a separate loan account, then borrowed back for investment purposes (say some ETFs or managed funds). Their total debt is still $300,000, but it’s a combination of $288,000 non-deductible debt, and $12,000 of tax-deductible investment debt. Income from the investments can be used to pay their home loan down further, and each year they repeat and compound the strategy. Eventually, the non-deductible debt will be down to zero, and the investment debt up to $300,000, meaning their debt is fully recycled. Over this time the shares, ETFs or managed funds ought to have increased in capital value.

This ‘plain vanilla’ strategy is fairly non-threatening – there’s no actual increase in debt levels relative to the starting position. The benefits of tax and market exposure are slow to begin with, but it’s the routine and compounding nature of the process that makes this quite a powerful strategy over time, especially compared to a ‘pay off the home first and invest later’ approach.

Care should be taken to ensure the loan structure keeps personal and investment debt separate at all times.

*In practice, interest savings on their loan will give them slightly more than $12,000 available.

Vanilla with a dash of spice

To kick off a debt recycling strategy with a bit more gusto, it’s quite common to apply for an increased loan facility and invest an initial amount on day one. I always suggest “a big enough amount to be meaningful, but not so much that it’s scary.” We’re essentially introducing some extra leverage at the start, so compared to the vanilla debt recycle, there’s the potential for increased investment returns over time, assuming the investment portfolio outperforms the net cost of borrowing. This is only possible if the client has enough equity and loan servicing capacity to borrow the additional amount – otherwise they need to create the borrowing capacity via extra repayments in the vanilla scenario. The amount chosen for an initial investment can be placed in a single transaction or fed in gradually to reduce timing risk.

A modest vanilla Debt Recycle with an initial $60,000 extra gearing

The one-off debt recycle with existing assets

Existing assets, such as employee share parcels, and ETFs and managed funds acquired either before the mortgage, from an inheritance, or from spare cashflow (not borrowings) represent an additional opportunity for debt recycling. Remember we’re aiming to reduce non-deductible debt and replace it with tax-deductible debt. So, imagining we have $100,000 of available existing assets that did not involve borrowings, that’s $100,000 of debt we could recycle (less potential Capital Gains Tax). After calculating the CGT (let’s imagine it’s $10,000) the benefit from this one-off debt recycle would be $90,000 x loan interest rate (say 6%) x Marginal Tax Rate (say 47% including Medicare) = $2,539 of tax saved per annum, or approximately a four-year break even. Lower CGT (eg employee shares immediately sold on vesting, investments with low gains etc) present an easy decision, as do assets that you want to dispose of anyway. Replacement assets, acquired with borrowed funds, might be the same, similar, or completely different investments according to preference - just be careful with the ATO’s wash-sale provisions.

Debt recycling property

The previous concept can also apply in some cases to property assets – for instance, former principal places of residence or investment properties with significant equity.

These cases really do require detailed analysis, as there can be significant transaction costs to sell and buy, and investment properties would likely incur significant CGT.

However, knocking $1 million off your home loan through sale of another property and buying a replacement investment property, thereby recycling $1 million of debt, can bring a $28,200 per annum (p.a.) tax saving – so it’s worth a thought. Even more so if you want to exit that particular property or location for whatever reason.

Properties that are most likely to be suitable for a debt recycle include former principal residences (due to no CGT) that were largely paid off, inherited properties that pre-date CGT or were themselves a principal place of residence, as well as properties owned as a principal place of residence before commencing a new relationship.

Property recycle with a trust

One last variation that also involves property comes in where a former principal place of residence is intended to be retained as an investment property, but where there is a desire to maximise tax deductible debt. With this strategy, the property is sold to a trust structure, with full borrowings, releasing maximum equity for non-deductible debt reduction. Costs to be considered include stamp duty on the transfer, annual accounting costs for the trust structure and usually land tax, but the savings include sale costs on the property and stamp duty on a replacement property (assuming the alternative was to follow the previous property Debt Recycle strategy). As per the previous example where the fully paid off property is worth $1 million, when sold to a unit trust under this strategy, the $1 million of debt that is made tax deductible generates tax savings of up to $28,200 p.a. (less the costs of running the trust and land tax).

Conclusion

Many people have financial goals that include a debt-free home as well as a decent nest-egg and tackling them both via a debt recycling strategy can make those goals happen faster. It’s important to think outside the box and realise that there are several different types of debt recycling, which have a common theme of applying any available cash (from surplus cashflow, investment income, or disposal of existing assets) against non-deductible debt, and then borrowing funds back to invest (resulting in tax-deductible debt).

We highly recommend working with financial planners, accountants and mortgage brokers who are experienced with all forms of these strategies to ensure the right outcomes.

Alex Berlee is a financial adviser with AGS Financial Group Pty Ltd.