Strongly rising residential property prices have increased the wealth of home-owning households significantly over the past two decades, resulting in Australia now sitting comfortably in the top three nations globally for median household wealth.

This national bias toward holding wealth in bricks and mortar may, however, have consequences for those approaching retirement in the form of growing mortgage debt levels being carried into later life.

At the end of the 2024 financial year, the value of ‘land and dwellings’ on household balance sheets stood at $11.2 trillion, according to the Australian Bureau of Statistics (ABS).

The superannuation system was $3.9 trillion at the same point, made up of some $2.7 trillion in APRA-regulated funds and $990 billion in self-managed superannuation funds (SMSFs), with the balancing $225 billion held in exempt public sector super schemes and life office statutory assets.

Elsewhere, the combined valued of all companies listed on the Australian Securities Exchange (the market capitalisation of the ASX) totalled some $2.9 trillion at the time.

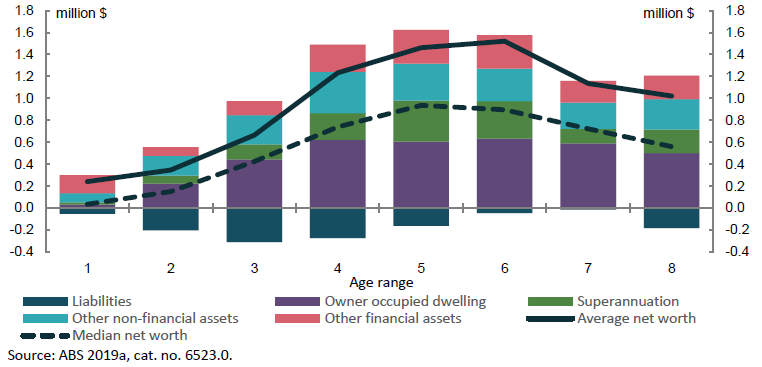

In essence, the value of residential land and housing is 2.9 times greater than the entire super system at present, and 3.9 times greater than the stock market. That in turn shapes how the composition of household wealth shifts with age, as the Retirement Income Review illustrated in 2020 below.

Figure 1: Composition of Household Balance Sheets by Age Cohort

The key takeout is that from the 30s onwards, owner-occupied dwellings (the purple segment above) dominate the median (middle) household balance sheet over other asset types, and by a clear margin.

A median national dwelling price of some $800,000 will have that effect.

The growing debt burden

As at June 2024, the total amount of long-term loans sitting on household balance sheets (primarily mortgage debt) was around $2.9 trillion, identical in size to the ASX market cap and some $200 billion more than the assets held in APRA-regulated super funds.

The final Retirement Income Review report acknowledged housing’s importance in Australia’s retirement income system, noting that “outright home ownership supports retirement by reducing ongoing expenses and acts as a store of wealth that can be accessed in retirement.”

The difficulty, increasingly, is in attaining ‘outright ownership’ unencumbered by mortgage debt prior to retirement. The evidence points instead to more Australians entering their pre-retirement years (broadly 55 to 64) significantly mortgaged.

For example, the ABS Survey of Income and Housing (SIH) shows that for this age group, the percentage of homeowners with a mortgage has risen, from a low of under 20% in 1996, to sit at 54% in the (latest) 2019 iteration. The average mortgage then held by the typical homeowning 55 to 64-year-old was around $230,000.

In short, more than half of all pre-retiree homeowners (around 77%, the remainder are renters) are now still dealing with non-trivial mortgage debt as retirement approaches.

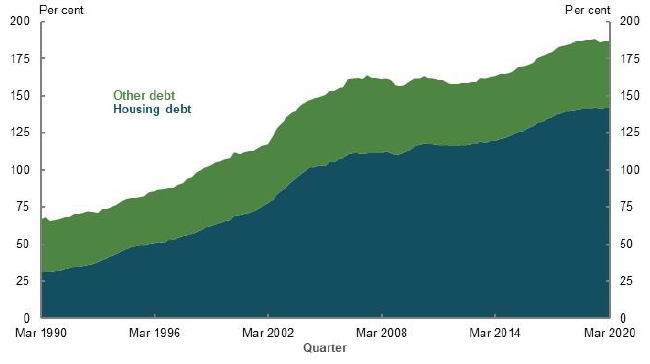

According to SIH data, the mortgage debt-to-income ratio for mortgagors aged 55 to 64 years rose from 72% to 138% between 1990 and 2020, while aggregate household debt has also ballooned, as the below chart illustrates.

Figure 2: Household debt as a percentage of disposable income

Source: Treasury, Retirement Income Review, 2020

The upshot of all this, as noted in the Retirement Income Review, is that:

“Increasing mortgage commitments have coincided with more owner-occupier households holding a mortgage at older ages. The median age for paying off a mortgage increased from 52 in 1981 to 62 in 2016.”

Or in layperson’s terms; half of owner-occupiers aged 62 or older still had a mortgage in 2016. The median age of mortgage extinguishment is only likely to have increased since then.

Lump sum withdrawals – the joker in the retirement income pack?

Households approaching retirement with material mortgage debt outstanding have three main choices: extend their time in the workforce in a bid to reduce/extinguish that debt; accept they can’t and aim to service it in retirement; find a source of capital to extinguish it at or prior to retirement.

There is a growing pool of evidence that many retirees are choosing the third option and using their super to do so.

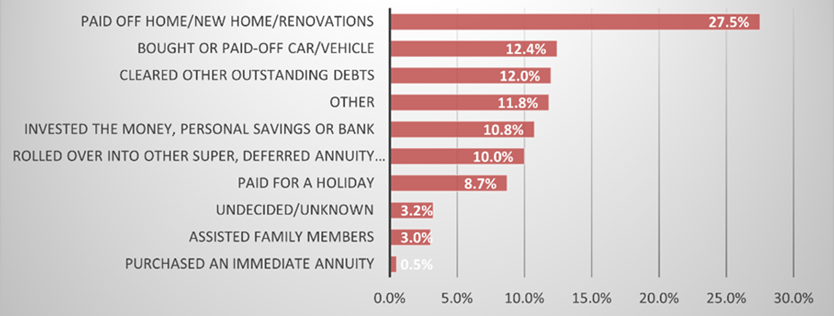

The survey of retirement and retirement intentions conducted by the ABS provides insights into the retirement plans for people aged 45 and over, and shows a clearly accelerating trend of Australians withdrawing their super to meet property related expenses.

In 2013 around 25% of lump sum super withdrawals were used to pay off a mortgage, acquire a new home or renovate an existing one. By 2017, that had increased to 29%.

The latest survey data shows the main uses of super lump sums, across all participants surveyed, as follows.

Figure 3: Main uses of super lump sums, 2022-23

Source: Author’s calculations from ABS Cat 6238.0 (Retirement and Retirement Intentions) – Table 8

Of the individuals surveyed, around 63% had taken some amount of super as a lump sum withdrawal during 2022-23. As before, paying off a mortgage or acquiring/renovating a home was the most cited use of super withdrawals.

A thorny issue for super funds

To be clear, mortgage debt approaching retirement is unlikely to concern the top 20% of near-retirees by wealth and income. Particularly so SMSF members aged 60 – 64 with, according to the most recent Australian Taxation Office (ATO) data, combined couple median balances close to $1.8 million.

But for median homeowning 60 – 64-year-old couples in APRA-regulated funds, with combined super balances closer to $400,000, material mortgage debt at retirement will increasingly be the norm, not the exception.

As the Treasury noted in its 2023 Intergeneration Report, the fact that a non-trivial amount of this combined super appears to be extinguishing/reducing mortgage debt clearly “impact[s] patterns of how superannuation is drawn down”.

It is very likely that many APRA-regulated superannuation funds will, depending on the sociographic nature of their membership base, increasingly be impacted by Australia’s growing mortgage indebtedness.

Super funds would do well to revisit the long-held industry presumption of unencumbered home ownership at the point of retirement and adjust their retirement solutions accordingly. They should also be looking at ways to obtain, estimate, forecast or otherwise establish the home ownership status/equity of their members.

Factors such as whether a property is likely to be owned outright or with a mortgage at the point of retirement, or whether a member is more likely to be renting, are insights that forward-thinking funds should be developing as part of their retirement income covenant obligations.

Armed with this data, funds might be able to forecast a ‘Net Pension Generating Super’ (NPGS) value for members; that being the total forecast accrued super at the point of retirement less any likely property-related withdrawals, ideally at the household level.

That’s a more pragmatic starting balance from which to make retirement income projections for most fund members today.

Housing equity will continue to dominate household wealth into the future, with super narrowing the gap as the system reaches full maturity over the next few decades. We need to stay vigilant to the interplay between the two; ensuring that mortgage debt doesn’t negate super’s retirement income enhancing ability for everyday Australians.

Harry Chemay has over 27 years of experience in both wealth management and institutional asset consulting. Initially a private client adviser with an SMSF focus, he has since consulted across wealth management, FinTech and superannuation, with a focus on improving post-retirement outcomes.

This article broadly encapsulates the key themes of a presentation delivered at the recent 2024 IBR Post-Retirement Conference entitled ‘Housing and Retirement: In Search of a Unified Approach’.