Observers of this year’s Federal Budget would have thought it was light on aged care reforms, and they’d be right. But I’d remind them that last year’s Budget delivered an aged care reform package with a five-year timeline. This year, the government reinforced its commitment to that plan and committed an additional $20.1 million in funding. That brings the total additional spend to $18.8 billion over five years, on top of the $21.5 billion-plus per year we already spend on aged care.

Whether enough is being spent on aged care, or whether we’re spending the money in the right places, is a contentious issue. But you can be sure this year’s Federal election is gearing up to be a debate on aged care:

- The current Government is promoting its current program of reform – i.e., the five-year plan that is already one year into reform

- The opposition is promising improvements in services and care

- Unions are pushing for wage rises

- The aged care industry is pushing for more funding to help stem the operational losses arising from increasing costs of care and wage pressures, and

- The general public are confused.

What the Government announced

In this year’s Budget, the Government reconfirmed its commitment to the five-year plan announced in the 2021 Budget. This included a five-year, five-pillar package of reforms.

Demand for home care continues to increase, and the next tranche of 40,000 new home care packages (to be released over 2022-23) will continue to increase availability and reduce waiting times. While waiting times have reduced by approximately 25%, the reality is that waiting time for a Level 3 or Level 4 package is still estimated to be 6-9 months.

Navigating home care should be easier when the current Commonwealth Home Support Program (CHSP) and Home Care Packages are combined into one new Support at Home Program from 1 July 2023. Details are yet to be developed, with advisory committees and older Australians providing input into the development.

In residential aged care, concerns around adequate funding levels continue to dominate discussions. Last year, the Government introduced an additional supplement of $10 per day per resident to help care providers improve the quality of services, particularly food and nutrition. This $10 came with increased reporting requirements to provide data on services provided.

A new funding model to reset the cost of care for residents is currently being trialed (called AN-ACC), with implementation set for later this year. In this year’s Budget, an extra $20.1 million in funding was announced over the next three years.

The 2021 Budget also committed to a minimum of 200 minutes per day of care on average for every aged care resident.

Across the 2021 and 2022 Budgets, the government has committed to reforms costing $18.8 billion over a five-year period, and these reforms picked up on 126 of the 148 Royal Commission recommendations, with 12 more under consultation.

Labor’s Budget reply

The Budget reply from Labor outlined an intention to improve aged care, based on recommendations made by the Royal Commission:

- A mandatory requirement to have a registered nurse on site at all times

- A minimum of 215 minutes of care per day for every aged care resident

- Support for the 25% pay case lodged by aged care workers with the Fair Work Commission, and a commitment to fund the outcome

- Better food for aged care residents

- Increased powers for the Aged Care Quality and Safety Commission and increased reporting requirements for aged care providers.

Labor has costed this reform package at an additional $2.5 billion over four years. But, this does not include funding pay increases for aged care workers. Given that wages represent around 70% of the costs for residential care, any wage increase will require significant amounts of extra funding and well over the $2.5 billion quoted.

Who is going to pay?

Neither party has addressed the ‘election killer’ issue of consumer contributions.

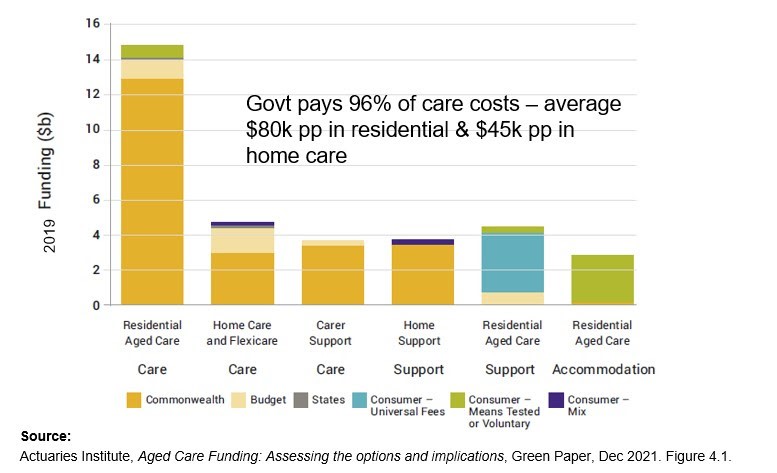

The government (which means we as taxpayers) currently pays 96% of all care costs – across the combined areas of home care and residential care. Whether consumers can afford to pay more and whether they should pay more are big questions still looming on the horizon.

The options any government has to increase aged care funding are:

- Increase tax revenue

- Reduce spending on other areas to redirect to aged care

- Raise an aged care levy (like Medicare levy) to fund aged care as suggested by the Royal Commission

- Dive further into debt

- Shift some of the cost to consumers, or

- Create efficiencies within the aged care system to reduce cost pressures.

The costs of aged care will only continue to increase as the Baby Boomer generation moves into their frailty years, increasing not only the demand for services but also higher consumer expectations around quality of service. Add to this an increasing level in the care needs of those who make the move into care.

Whichever party comes to power in May, there is a chance that in the new mini-Budget or the Mid-Year Economic and Fiscal Outlook statements we might expect to see some reforms to consumer contributions.

What individuals need to do

We need to start the hard conversations about frailty planning. Aged care is no longer an issue that can be ignored when planning for retirement. If people are not prepared for their frailty years, it can leave them exposed for around 15% - 25% of their retirement. This is a major gap. Australians need to start planning for how to contribute towards their cost of care. Even today, with money and financial resources the range of choices is wider and provides better quality of life.

Louise Biti is a Director of Aged Care Steps.