Welcome to the 567th edition of Firstlinks. The Weekend Edition includes two extra articles from Morningstar.

As we are somehow already past the halfway point of 2024, it’s a natural time to take stock of what’s happened so far.

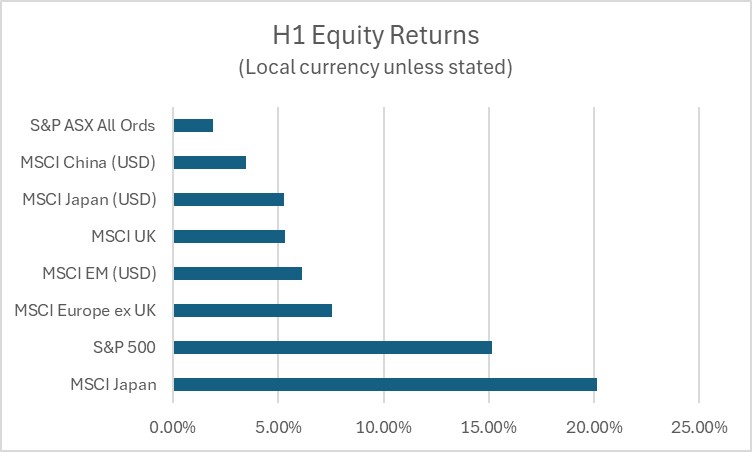

Except for Australia, it’s fair to say that most of the major equity markets have started well:

The return of Japanese equities in H1 falls from over 20% to around 5% once you adjust for the weak yen by using a US dollar return.

This brings Japan in line with most of the other major developed markets and leaves a familiar outlier: the US. More specifically, it leaves us with the continued outperformance of US large-caps.

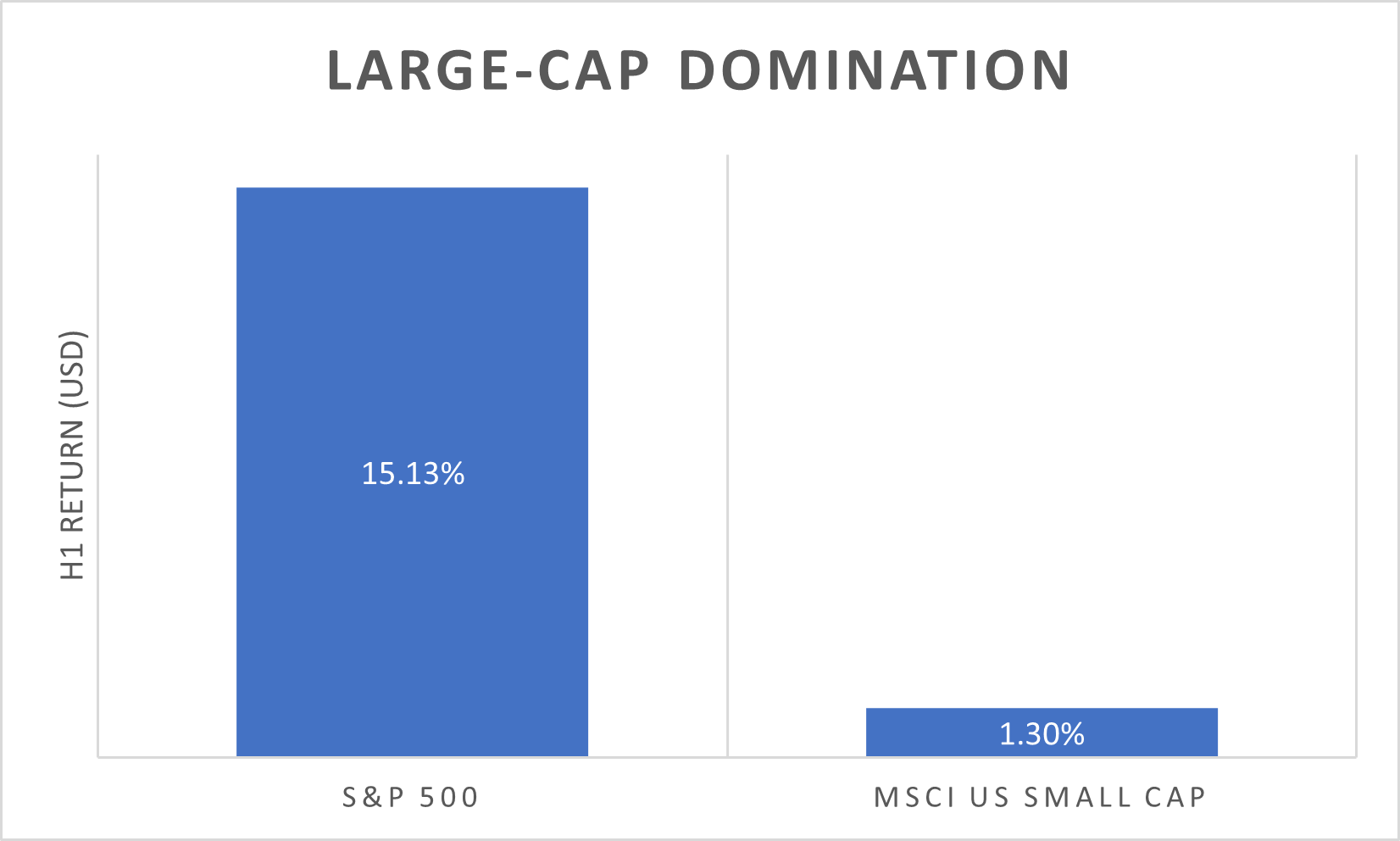

Here is the performance of the S&P 500 index of large-caps versus the MSCI US Small Cap Index in the first half:

I’m not going to comment on whether the dominance of the US market and its biggest stocks can continue. If the past 18 months have taught us anything, it’s that making that kind of call – let alone profiting from it – is a fool’s errand.

At the start of 2023, most commentators were expecting a US recession. Some argued this would be bad for US stocks. Others argued it would be good because it could lead to an earlier peak in interest rates.

Either way, most people agreed that there would be a recession. What actually happened? US GDP grew 2.5%. The Fed hiked four more times. The S&P 500 rose 24% regardless.

The other big macro call at the start of 2023 was that China would reopen. This proved correct. A lot of investors assumed this would cause a rally in Chinese shares. This proved to be dead wrong. China shares didn’t rally. Instead, the MSCI China index fell by 13% in US dollar terms.

2024's biggest macro prediction is also off to a terrible start.

By the end of December 2023, CME Group’s Fedwatch tool estimated 70% market confidence that the Fed would cut by at least 100 bps over the next twelve months. That, so the theory went, could be good for stocks.

As of July 2, the Fed has delivered exactly zero basis points in cuts. That would be bad for stocks, right? Apparently not. The S&P 500 Index is up 15% in six months and Nvidia is up another 150%.

This is why trying to profit from macro calls or predicting some economic event usually fails. You don’t just need to be right about the event. You also need to be right about how markets will react.

With that in mind, there’s something to be said for concentrating on what you can control. This is something the writer of today’s lead article has taken to heart in her investment approach.

Shani Jayamanne’s job title at Morningstar features the words Investment Specialist. She is passionate about investing and doubly passionate about teaching the benefits of strategically sound investing to others. Yet when it comes to her own investments, Shani takes a deliberately uninterested approach.

If history is a guide, it’s hard to bet against that paying off. See why caring a little less about your investments (but not about your investing) could be the most profitable top-down call you can make.

James Gruber

Also in this edition of Firstlinks...

Listed infrastructure valuations are lagging even though earnings forecasts are up and private buyers continue to covet quality assets in the sector. First Sentier Investors recently sent two of their Global Listed Infrastructure team to the US to assess the outlook. Their findings could have big implications for stocks in a traditionally low-growth sector.

Holding unlisted assets like property and private companies in your SMSF attracts extra attention from the ATO. It also brings responsibilities that, if not met, could lead to a fine or your SMSF losing its complying status. This primer from Julie Steed reviews valuation rules for SMSFs and what they mean for trustees in practice.

Big super funds and other institutions have piled into private credit over the past decade, helping the asset class grow from peanuts to $3.5 trillion in 2023. Despite solid returns from private credit over the past decade, retail and SMSF investors have mostly stayed on the sidelines. Peter Szekely from Tanarra Credit Partners makes a case that individuals should consider following the lead of big investors.

You’ll often hear financial commentators comparing today’s US tech stock rally to the late days of the dot-com boom. But are Nvidia and co really partying like it’s 1999? Que Nguyen from Research Associates thinks we’re far closer to being in 1996. If she’s right, that means the AI investment boom could run a lot further yet. Investors can still position themselves to benefit over the long-term, even if – like usual – the boom results in widespread capital destruction.

Our next contender isn’t an article, but a survey from the Firstlinks team. We’d love to hear your thoughts on our content and how we can make it better for you. If you’d like to help us out in a just a couple of minutes, please go here to share your thoughts.

A new report from Michael Woods and Nicole Sutton of the University of Technology Sydney claims that over 60% of aged care providers are failing to give residents the level of care they need or are entitled to. The crisis is especially acute in direct care, despite millions of dollars in extra tax funding and several providers running at a surplus. Go here to see the report’s key findings.

This week's white paper comes from the Franklin Templeton Institute on where investors should look for earnings based on value versus projected earnings.

Two stories from Morningstar this weekend. Joseph Taylor explores the case for Siteminder being Australia's next big technology winner and Shani Jayamanne highlights three cheap ASX stocks with fully franked dividends.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website