by Michael Woods and Nicole Sutton, University of Technology Sydney

New analysis has revealed many Australian aged care residents are not receiving the levels of care they need and are entitled to.

The UTS Ageing Research Collaborative, which we are involved in, recently released its 2023–24 mid-year report on Australia’s aged care sector.

A particular focus of this edition was on the level of direct care being delivered in aged care homes by nurses and personal care workers to residents. In sharing this analysis, we acknowledge there is a well-documented shortage of workers across the economy, with the unemployment rate at a near-historical low. And even given these workforce pressures, many aged care providers are delivering very high levels of care.

But a significant number are not. Nearly two-thirds of aged care homes are failing to meet mandated levels of direct care. And yet taxpayers have paid millions of dollars to providers to deliver that care. Some providers are making large surpluses as a result.

New standards for direct care

In response to the findings of the Royal Commission into Aged Care Quality and Safety, the federal government committed to setting minimum standards for the level of direct care time that residents were to receive. In 2022, all providers were given a year to raise their level of staffing to reach these standards and were funded to do so.

These standards require a sector-wide average of 200 minutes of direct care per person per day (from registered and enrolled nurses and personal care workers). And 40 minutes of this care has to be delivered by a registered nurse. The minimum level each resident should receive varies above or below that 200 minutes depending on their assessed needs.

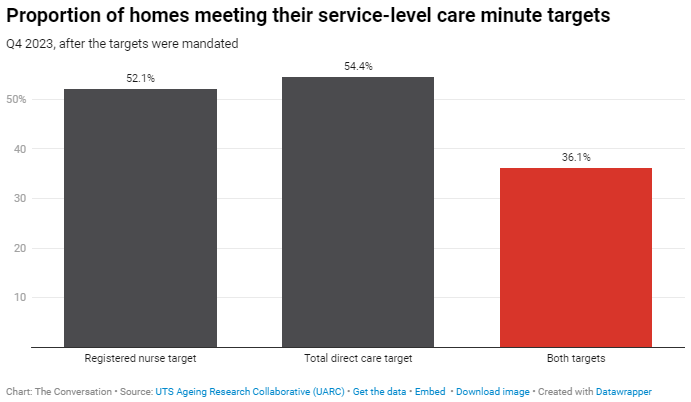

These standards became mandatory on October 1 2023. For the first three months after the targets were mandated, only half of all providers met or exceeded either of their care targets (the total direct care minutes or the registered nurse target). Only 36% met both.

Funding the costs of care

Residential aged care is funded for three main activities:

- direct care such as nursing and personal care, including bathing, dressing, toileting and personal grooming (almost wholly funded by taxpayers)

- everyday living services such as food, laundry and cleaning (paid mainly by residents and capped at 85% of the single age pension)

- accommodation (paid by the government for those of limited means and self-funded by those with higher incomes and wealth).

On the advice of the Independent Health and Aged Care Pricing Authority, the government has increased the direct care funding for each resident living in an aged care home. The assumption is the home will spend that money to employ enough staff to meet its care level targets.

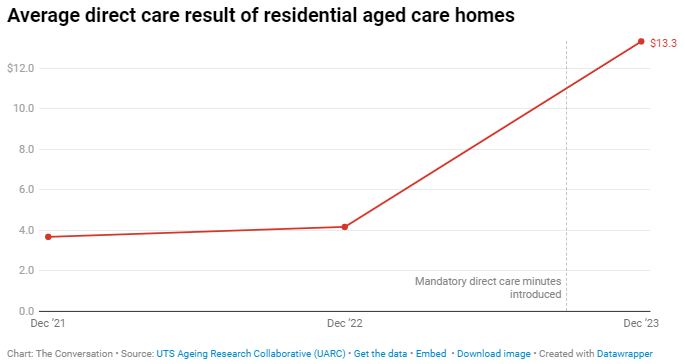

The report shows the difference between each aged care home’s average funding for direct care and its expenditure on that activity. Comparing the mid-year results for the past three years, in 2021 and 2022 homes produced, on average, a small surplus where revenue was slightly greater than wages and other expenses. This situation, where funding is just above costs, is the intended result of the new pricing reforms.

But things have changed for the most recent period. The government has significantly increased funding to meet the costs of staffing to achieve the mandatory care levels. It has also increased funding in light of the pay rises to direct care staff, primarily nurses and personal care workers, which was decided by the Fair Work Commission.

This taxpayer funding has been provided to each home regardless of whether they are employing the required number of staff.

Because of the failure of some providers to meet their mandated targets to December 2023, the sector, on average, generated a significant direct care surplus of more than A$13 per resident per day. Some providers have been using the money to cross-subsidise losses they incur for their everyday living services and accommodation.

Which homes are not meeting their targets?

We found homes that were not delivering their mandatory care minutes were, on average, achieving significant financial benefits from their direct care activities. Homes that had staffing care levels well above their required number were making a loss from their direct care.

Further, the homes that were not delivering their mandatory care minutes were more often in metropolitan and larger regional centres. They were also more likely to be operated by for-profit providers.

In essence, while we acknowledge the tight labour market and the effort many homes are making to meet or exceed their mandatory requirements, a large number of residents are not receiving the care they need. This also means taxpayers are funding direct care that is not being delivered.

With the minimum sector average level of direct care due to rise to 215 minutes per resident per day on October 1 this year (and registered nurse care to rise to 44 minutes), this situation may get even worse.

Michael Woods, Professor of Health Economics, University of Technology Sydney and Nicole Sutton, Associate Professor of Accounting, University of Technology Sydney

This article is republished from The Conversation under a Creative Commons license. Read the original article.