Since 2022, when the market slumped, I have repeatedly highlighted the possibility of stocks rising despite fears of a recession, which I assessed to be unfounded, and despite rising interest rates, which I believed would necessarily have to peak.

The reason for the optimism was simple; that economic growth would remain positive, albeit anaemic, and that disinflation would rule the day. As an aside, disinflation exists when prices are still rising but at consecutively lower rates of growth. The reason that combination of circumstances produced a bullish bias disposition in me was that since the 1970s, whenever positive economic growth and disinflation have joined forces, they have produced good conditions for equities, particularly the shares of innovative companies with pricing power.

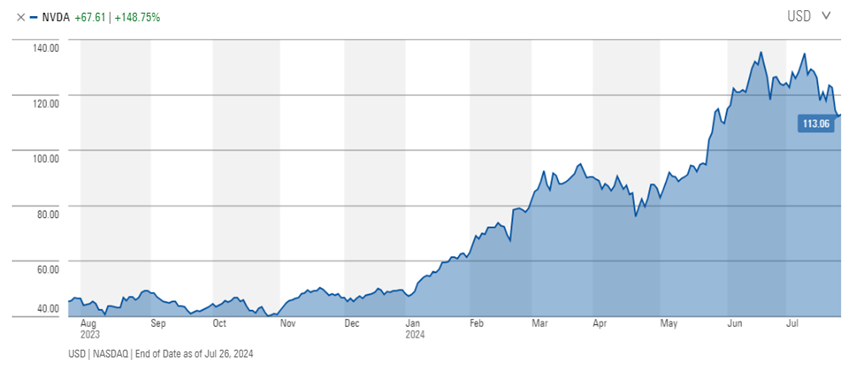

Many of those innovative companies have indeed soared since 2022. I don’t need to list the returns of shares in Google, Meta, Apple, Microsoft and Nvidia over the last two years, or Spotify over the last twelve months. Innovative companies that can raise their prices without a detrimental impact on unit sales volume have indeed been the beneficiaries of a desirable combination of those two economic indicators.

Nvidia

Spotify

Source: Morningstar.com

I further believe it takes a few years for the prior bearish sentiment to turn 180 degrees and become a fully-fledged boom or even a bubble. This is because the unwinding of the bearishness that pervaded 2022 needs to overcome investor inertia, an uneven distribution of information and even the reassurance of rising prices needed by many investors. By the end of the switch in the narrative from bearish to bullish, microcap stocks, cryptocurrencies and even art, wine and collectible cars could all hit unprecedented highs.

Inevitably there are bumps along the way and few reputable investors are suggesting a big bump is coming.

The bear case

Indeed, warnings from reputable investors about an impending market correction are becoming increasingly prominent. Ruffer LLP, a UK-based investment firm, has already made its largest-ever bet on cash, reflecting its growing concerns about a violent market reversal driven by shrinking US liquidity. Similarly, Mark Spitznagel, known for his multi-billion dollar wins hedging against market downturns, echoes these concerns, predicting a severe market crash. And macroeconomic research house BCA Research has most recently forecast the S&P 500 to drop to 3750 points, equating to a 33% fall from the market’s mid-July high.

Ruffer LLP, managing approximately £22 billion, has allocated two-thirds of its assets to cash, a record high. The firm is funnelling the income from this cash into insurance policies, such as credit default swaps and US stock options, designed to profit from a significant decline in Wall Street.

Back in April, while discussing the subject with Bloomberg reporters, the firm predicted the predicted market reversal could happen within the next three months due to the Federal Reserve's ongoing reduction of liquidity. That would bring us to a correction this month. Recent volatility in prices, which has seen the S&P500 fall nearly 5%, and the NASDAQ nearly 8%, could render Ruffer LLC very prescient indeed, particularly if the slide continues.

Perhaps unusually for a fund manager, Ruffer takes a highly discretionary approach to managing its portfolios and concentrates its investments in a handful of asset classes, including a very successful bet on Bitcoin in 2020. The company’s approach also helped it achieve a 16% return during the 2008 financial crisis. But not every year is a success, with its funds missing out on the 2023 rally in equities, producing a 6% loss for the calendar year.

Ruffer argues that excessive optimism over potential future US interest rate cuts has left markets priced close to perfection, creating Black Monday-style liquidity risks. The firm believes that structural changes in inflation and interest rates indicate a higher trajectory for both, and as the US central bank winds down its QE-powered bond-buying program, liquidity dries up, and the risk of a market correction looms larger, with a 1987-style meltdown on the list of the firm’s possible scenarios.

Another bear is Mark Spitznagel, a protégé of Nassim Taleb and head of Universa Investments. He shares a similarly bleak outlook to Ruffer LLP. Universa provides long-only equity investors with hedges against fat tail risks – low-probability but high-impact market declines. Spitznagel's credibility is bolstered by Universa's performance, which has outpaced the S&P 500 over many years, and especially during the COVID-19 sell-off.

Spitznagel has consistently warned of an impending market crash worse than the Global Financial Crisis (GFC). He describes the current market as being in "the greatest credit bubble in human history" and predicts that stocks could lose up to 50% of their value. His strategy involves taking the opposite side of complex hedging tactics like Put-Spread Collars, which he deems unnecessarily complicated and expensive.

Despite his dire predictions, Spitznagel advises investors to remain passively invested in stocks, arguing that those who continue steady contributions to a fund despite alarming headlines will fare well in the long term. He believes the market is currently in a 'Goldilocks phase', with the rally likely to continue for several months, driven by a dovish Federal Reserve and bullish market sentiment. However, he cautions that rate cuts often signal an imminent market top, followed by a reversal.

Perhaps his advice – 'stay long, but something bad is coming' – is unsurprising; his firm does sell hedges against fat tail risks to long-only fund managers.

Best to ignore the doomsayers

I would not entertain warnings from the usual crowd of Henny Pennys that the sky is falling in because their secret to being successful with their predictions is simply to forecast often. The growing chorus of warnings from reputable investors like Ruffer LLP and Mark Spitznagel however suggests we should sit up and take notice.

I believe that as long as economic growth remains positive and inflation continues to slow, the conditions are positive for innovative growth companies. Perhaps the mega-cap tech stocks give ground to small caps, where many innovators reside and whose prices have not soared to anywhere near the same levels as the mega-cap tech stocks noted earlier.

As prices rise, however, the risks of setbacks also rise. This suggests, at a minimum, a heightened awareness of potential market risks is wise. While Ruffer prioritises capital preservation in anticipation of a market correction, Spitznagel advises staying long in the market and adding to portfolios when prices sell-off. As both firms adjust their strategies to navigate any uncertainty and volatility, we should at least pause and reflect on our own approaches.

Roger Montgomery is the Chairman of Montgomery Investment Management and an author at www.RogerMontgomery.com. This article is for general information only and does not consider the circumstances of any individual.