As the custodian of other people’s money not only are we focusing on the preservation of capital, but we are constantly seeking out relative value opportunities as well. These opportunities, which present constantly, are largely a function of a combination of the complexity of the underlying securities and the relatively unsophisticated investor base that populates the market.

To help us identify relative value we break the market down into sectors identified by term (to maturity) and issuer type. Breaking down the market in this way allows us to compare the performance of the different sectors over time as well as determine the pricing relativities of each sector.

As an example, data extracted from our data base on in early March calculated that the average weighted traded spread margin of the sector we have identified as ‘short-term major bank issuer’ was priced at a miserly 82bps or 0.82%. This compares with the average weighted coupon margin of approximately 3.00%. The “so what” is that a traded spread margin of 0.82%, represents a yield to maturity (YTM) of about 5.00%. No matter which way you slice or dice it this is not particularly attractive when you can “invest” in a risk-free major bank term deposit of a similar term at a yield of around 4.5%.

As a result, we instead favour other sectors comprising hybrid securities of longer term that we have identified as representing better value.

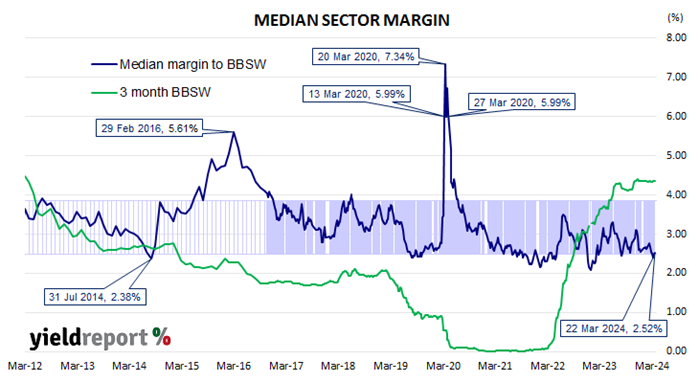

Source: Yield Report 25 March

While median traded spread margins of the broader market are approaching the bottom of the range at approximately 250bps over 90day Bank Bill Swap Rate (BBSW), the average annual coupon rate currently presents at the top of the range at approximately 7.35% (i.e 90day BBSW of 4.35% + 3.00%). The difference between the median traded spread margin and the coupon margin reflects the magnitude of the premium investors are willing to pay for annual cash flows exceeding 7%. It shows the median traded spread margin (blue line) with the green line representing 90day BBSW.

Why hybrid capital is priced at a premium

One of the key reasons why investors are paying a premium for the cash flows has its beginnings in the events of the immediate Covid period when the RBA, cut the cash rate to 0.10% and embarked on a program of unparalleled quantitative easing, all the while, risk averse households saved the proceeds handed them by the government. This meant that banks were awash with cheap money provided by both the central bank and households.

So instead of having to “pay up” for domestic based term funding, as they were required to do by the banking regulator in the post GFC era, the banks, suddenly had a surplus of it, which they chose (for whatever reason) not to lend to the broader economy. These surplus monies found their way on to the RBA’s balance sheet bolstering exchange settlement account balances at the RBA by a factor of 15.

The upshot of this is that the banks have no incentive whatsoever to pay up for term deposit funding. While the ground rules were established during the Covid period, they became entrenched when cash and near cash proxies such as 90day BBSW rose as inflationary pressure began to emerge. So, as the cash rate and cash rate proxies moved higher, so too did the coupon rates on floating rate investments such as hybrids.

Granted, term deposit yields rose too, but they did not rise at the same pace as the coupon rates of floating rate instruments simply because banks were awash with term deposit funding. As long as the banks have no desire to pay up for term deposit funding - which looks likely for a while yet - investors will continue to pay a premium for the higher yielding but riskier hybrid instrument.

Yield differentials between hybrids and term deposits have stabilised

As it is notoriously difficult to predict the future direction of interest rates, we keep a close eye on what the broader market is thinking as a guide. While the broader market is predicting interest rate cuts, it is not predicting wholesale interest rate cuts.

One thing however, you can be assured of, is that when the RBA cuts the cash rate the banks will cut term deposit rates in lock stock which means that the margin that currently exists between the annual hybrid coupon rate and term deposit rates will likely remain as it is.

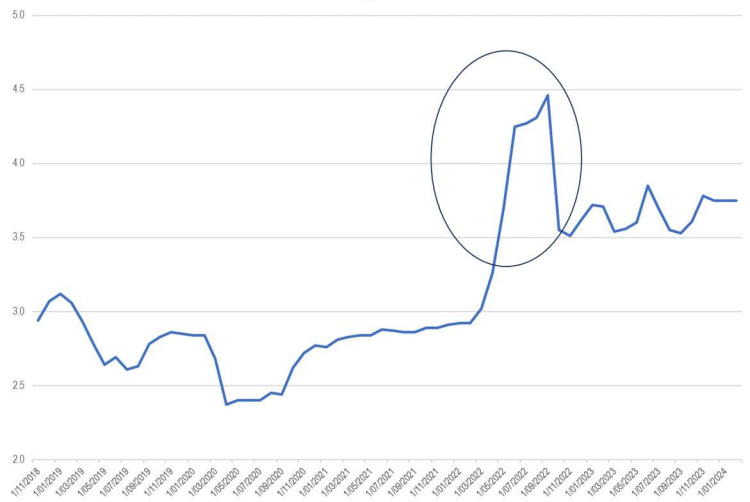

We have shown the chart below before, but it bears repeating as it is one of the key drivers of why investors are presently prepared to pay a premium for hybrid capital. The chart details the margin between the annual hybrid coupon rate (assuming a fixed coupon margin including the value of franking of approximately 3% over 90day BBSW) and the RBA’s All Terms Average Special Rate. The circle highlights the period when 90day BBSW jumped sharply higher as the money markets, pre-empted that the RBA would be forced to raise the cash rate to contain inflationary pressures which were benign at the time. This was the period, readers will remember, when the then RBA Governor insisted that the cash rate would remain at 0.10% through until 2024! The margin looks (now) to have stabilised around 375bps or 3.75%.

Difference between annual hybrid coupon rate and RBA All Terms Average Special Rate

(last data point 29 February 2024)

What the equity market has to say about bank equity tells a tale

With their Tier 1 and alternative tier 1 equity (hybrid capital) now exceeding 14% of risk weighted assets (RWA), and with an abundance of funding surety, there can be no denying the balance sheet strength of the Australian banks, which are the majority issuers of hybrid capital.

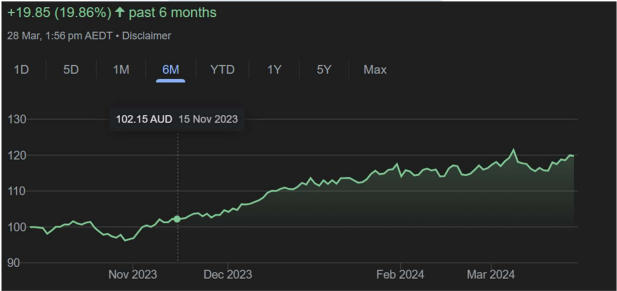

As an investor in hybrid capital, which of course ranks above equity in the capital structure, what interests us is what the Australian equity market now thinks of bank equity. After a fairly benign period bank share prices have risen sharply over the last 6months or so.

The chart below is of CBA bank share price over that period. The share price has risen by just under 20%. If the equity market had any concerns whatsoever about the CBA bank, including its underlying credit quality, then the share price would almost certainly not have risen by 20% over that period. As the equity market is barometer of what will likely happen in the future it is a reasonable to say with a degree of confidence that the runway looks clear.

Perhaps investors in hybrid capital have come to the same conclusion, as they price hybrid capital, particularly short-term hybrid capital, closer to risk-free government guaranteed term deposits and senior secured instruments of the same issuer? This is yet another reason why the current premium expressed in the hybrid market is likely to stay in the foreseeable future.

CBA bank share price (last data point 28 March 2024)

A positive rerate of the Australian banking system by S&P

And finally, as a postscript, which we extracted from Westpac’s Around the Grounds” commentary of April 4 on the strength of the Australian banking system published by S&P garners yet another reason for the markets to price hybrid capital at a premium and closer to more senior instruments of the same issuer. In S&P’s words and in italics:

- “We now assess the institutional framework for the banking industry in Australia at the lowest risk level on our scale, and in line with that in Canada, Hong Kong, and Singapore.

- Consequently, we raised our long-term issuer credit ratings on most of the non-major Australia-based banks and other financial institutions.

- We have also upgraded all the rated Additional Tier 1 and Tier 2 instruments issued by Australian banks and their New Zealand banking subsidiaries.

- Despite a one-notch improvement in their stand-alone credit profiles (SACPs), our issuer credit ratings remain unchanged on some financial institutions, including the four major Australian banks, Macquarie Bank Ltd., and two foreign-owned banks”.

Norman Derham is Executive Director of Elstree Investment Management, a boutique fixed income fund manager. This article is general information and does not consider the circumstances of any individual investor. Elstree's listed hybrid fund trades under ticker EHF1.