Six months. That’s roughly the time frame that the Reserve Bank’s governor, Michele Bullock, has given for when the RBA’s board is likely to feel more comfortable around cutting interest rates. Indeed, Australia may well be one of the last of the major developed countries to start cutting rates.

For investors seeking long-term diversification with high-quality bonds, it may be a case of make hay now while the sunshine from higher interest rates is still burning bright.

Bonds tend to outperform after rates hit their peak

While there may be flexibility around the timing of rate cuts in Australia – which will ultimately come down to how quickly inflation levels fall back inside the RBA’s target band – it’s likely we’re at or near the end of the rate hiking cycle, which has historically been associated with a peak in yields. This is good news for bonds, which have typically performed strongly in the years following the peak.

What happens when rate hikes end?

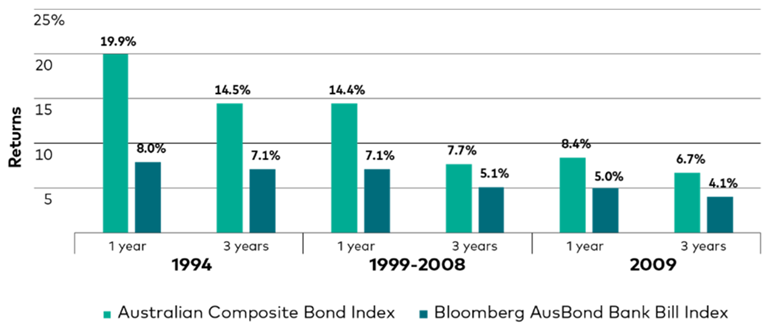

Figure 1: Annualised performance following the rate hike cycle*

Notes: 1994 rate hiking cycle, which commenced July 1994 to first Tuesday of December 1994, so 30 November is used as a start date for 1994. 1998-2008 rate hiking cycle, which commenced October 1999 to first Tuesday of March 2008, so 29 Feb 2008 used as start date for 1998-2008 hiking cycle. 2009 rate hiking cycle, which commenced September 2009 to first Tuesday of November 2010, so 31 October 2010 used as a start date for 2009 hiking cycle.

Source: Vanguard and Bloomberg

For those entering the bond market now, there’s an opportunity to enjoy historically higher yields while potentially benefitting from short-term price tailwinds when rates do start to fall.

Given that bonds have only recently emerged from a tumultuous period of rapidly rising rates, it’s understandable that some investors may be cautious. Many investors may be waiting for the RBA and other central banks to finish hiking—or even begin cutting—before they jump back into bonds. But, as is also the case with equities, trying to time market movements is always a risky venture. Waiting for the ‘right’ moment to review your bond exposure may mean missing out on a price boost when expectations shift to looming rate cuts. Moreover, it could mean missing out on the rate peak and the full benefits from higher yields.

What if interest rates stay high?

Even when rates do move lower, we don’t foresee a return to the COVID levels when Australian interest rates were at historical lows, nearing zero. That was an extraordinary time.

The return to sound money – when interest rates are above the rate of inflation – may be one of the most important developments in financial markets in the past two decades. According to Vanguard’s research, the neutral (or equilibrium) rate has increased by around 1% on average across developed markets, mainly driven by ageing demographics and higher structural fiscal deficits. While higher-for-longer rates might be painful for borrowers, they’re a good thing for investors over the long run, particularly for bond investors. In fact, we expect investors to be better off because of (not in spite of) higher rates.

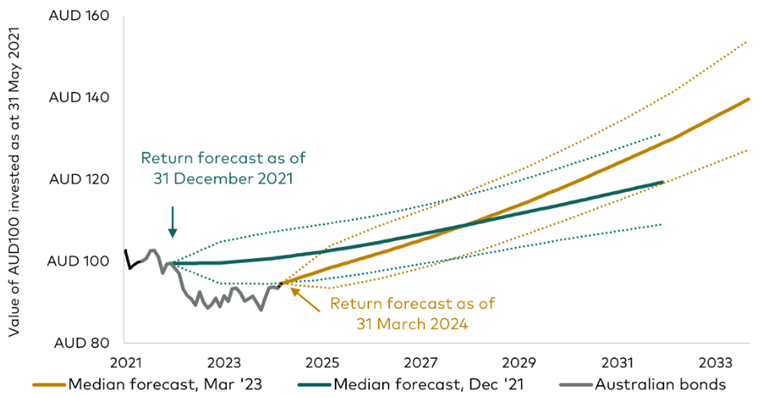

As the chart below shows, bond prices were pushed down by rising rates in 2021 and 2022. However, higher yields and coupon payments make up for short-term principal losses over time. That’s why we now expect bond investors who remain invested to be better off in end-of-period wealth terms by the end of the decade.

Figure 2: Australian bonds forecasts*

Important: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modeled asset class. Simulations as of 31 December 2021, and 31 March 2024. Results from the model may vary with each use and over time. For more information, please click here.

Notes: The chart shows actual returns for the Bloomberg Australian Aggregate Bond Index along with Vanguard’s forecast for cumulative returns over the subsequent 10 years as of 31 December 2021, and 31 March 2024. The dashed lines represent the 10th and 90th percentiles of the forecasted distribution. Data as of 31 March 2024.

Sources: Vanguard calculations, using 31 March 2024, VCMM simulations and data from Bloomberg.

This doesn’t mean that investors won’t potentially realise losses in the short term as yields move around, or that they’re guaranteed profits in the long term. But when assessing the impact of higher yields, your time horizon as an investor matters a lot.

Investors are returning to bonds

If we take a look at exchange traded fund (ETF) flows, it’s clear that investors have been returning to the bond market. In 2023, strong renewed interest in bond ETFs saw fixed income flows reach almost 45% of total market flows. Australian bond ETFs received $3.81 billion in cash flows in 2023, a 37% improvement year on year. Global bond ETFs also attracted $1.5 billion over the year, up 99% year on year. This momentum continued with a further $1.5 billion added across Australian and global bond ETFs in the first half of 2024.

We anticipate bond ETFs will remain popular with Australian investors throughout the remainder of 2024 and beyond, particularly as our domestic bond return expectations have substantially increased since 2022 from 1.3%–2.3% per annum to 4.1%–5.1% per annum over the next 10 years.

Similarly, for global bonds, we expect returns of 4.3%–5.3% per annum over the next decade, compared with a forecast of 1.6%–2.6% per annum when policy rates were low or, in some cases, negative.

With higher yields, the benefit to long-term investors of being invested in bonds should outweigh the cost of being a little early should yields remain flat or even edge up slightly before the rate cuts hit.

Timing the market is often harder than we think, and getting timing decisions wrong can mean limiting your returns in the long run. For most investors, a prudent asset allocation that includes both equities and bonds, matched with a long-term investment plan, may present a better chance for investment success.

* Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Jean Bauler is Head of Fixed Income at Vanguard Australia, a sponsor of Firstlinks. This article is for general information purposes only. Vanguard has not taken your objectives, financial situation or needs into account when preparing this article so it may not be applicable to the particular situation you are considering.

For more articles and papers from Vanguard Investments Australia, please click here.