We are told that Australia has the fastest growing economy in the developed world. True, but at 2.7% in the year to March 2016 and the same growth per annum over the past five years, we are not growing as fast as the average for Australia over the past 50 years (3.2% pa) or the 20th Century (3.5% pa). The slower growth is due to a lack of reform to our labour market, taxation and the parliamentary process, and having the worst broadband speed and capacity in the developed world - a disgrace in an age of digital disruption.

Australia should be part of the New World in Asia

It is small comfort to know that the rest of the developed world is growing slower than we are, has different problems such as national debt levels, larger government deficits, excessive taxation, and excessive legislation. This is less relevant when we realise we are not part of the old rich world of the European Union and North America, but are part of Asia which is bigger in GDP as well as population than both those regions and growing three times as fast as they are. And at more than double our speed. Asia is our new economic and demographic arena. It is where we are competing and need to be compared.

But, we do have a modern economy in terms of our mix of industries, and we do have growth in enough of them in terms of value-add and employment to keep the show on the road.

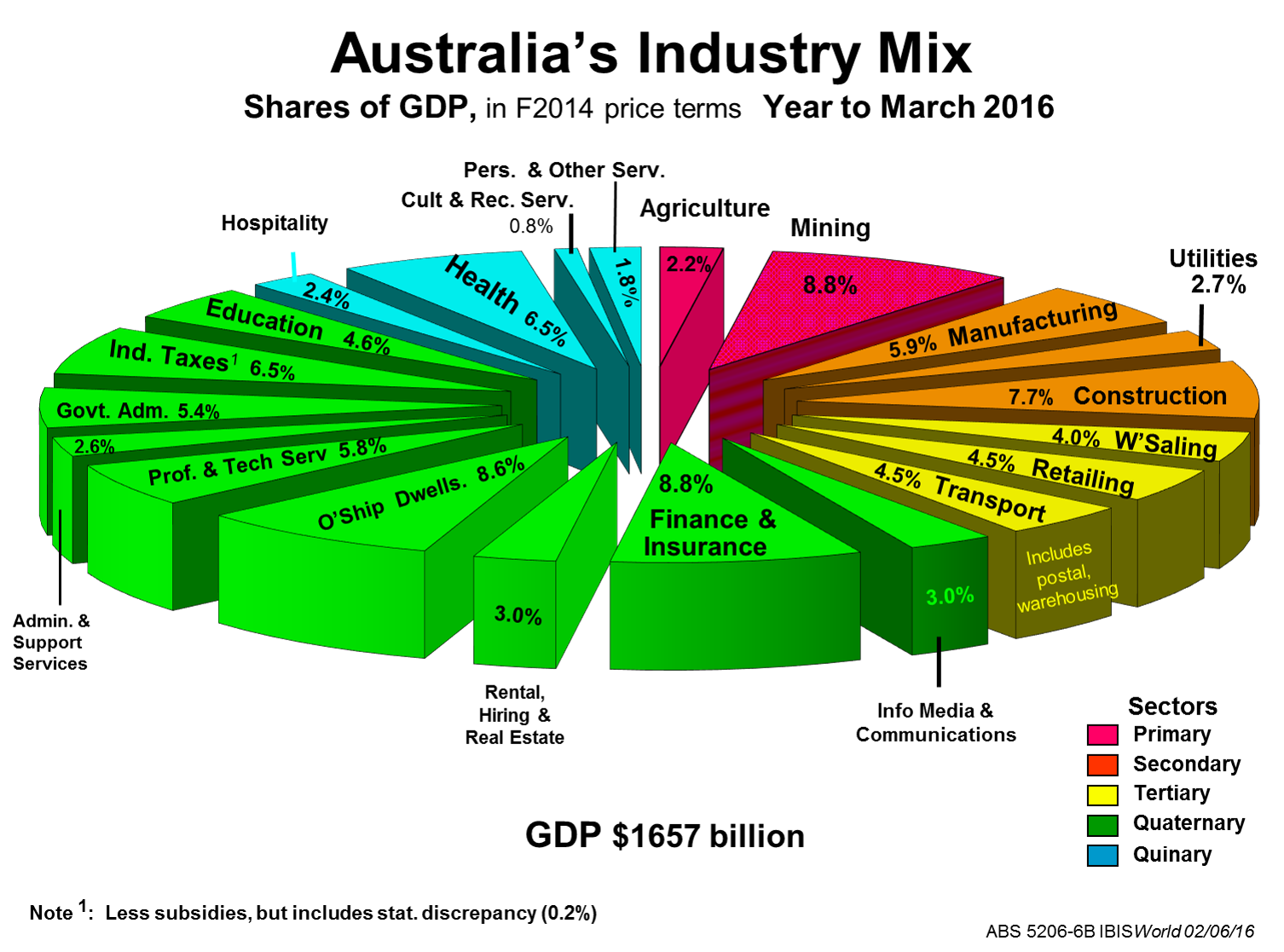

The first chart below shows the mix of industries as recorded by the ABS in the most recent National Accounts release (click on any image to enlarge it).

It is a mix dominated by service industries, as are all the developed economies of the world. Manufacturing is poised to fall to 5% of our GDP soon, having been almost six times that share at 29% in the early 1960s. However, our standard of living (real GDP/capita) is three times higher than in 1960, so clearly manufacturing has been replaced by more wealth-creating industries.

Where is Australia’s growth coming from?

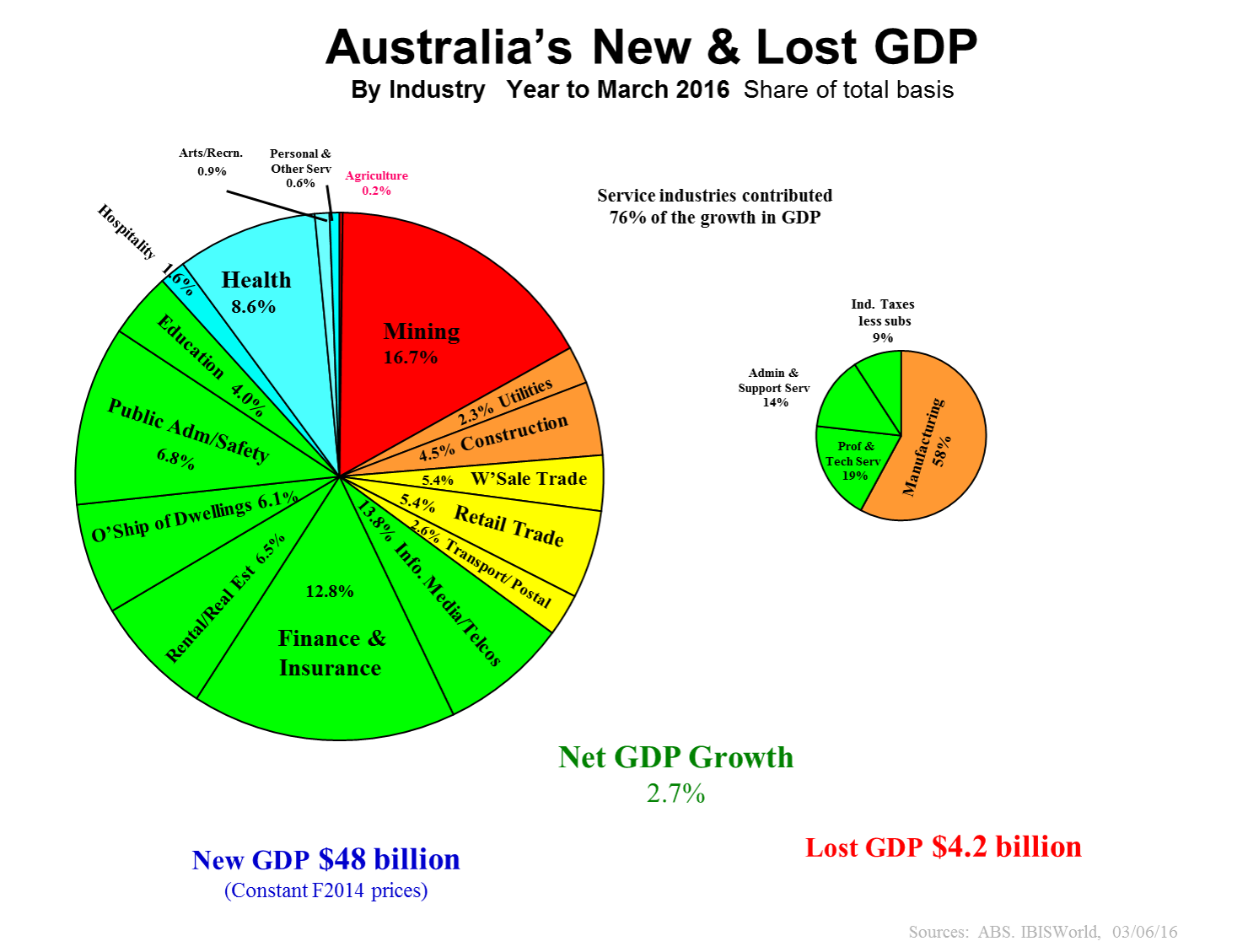

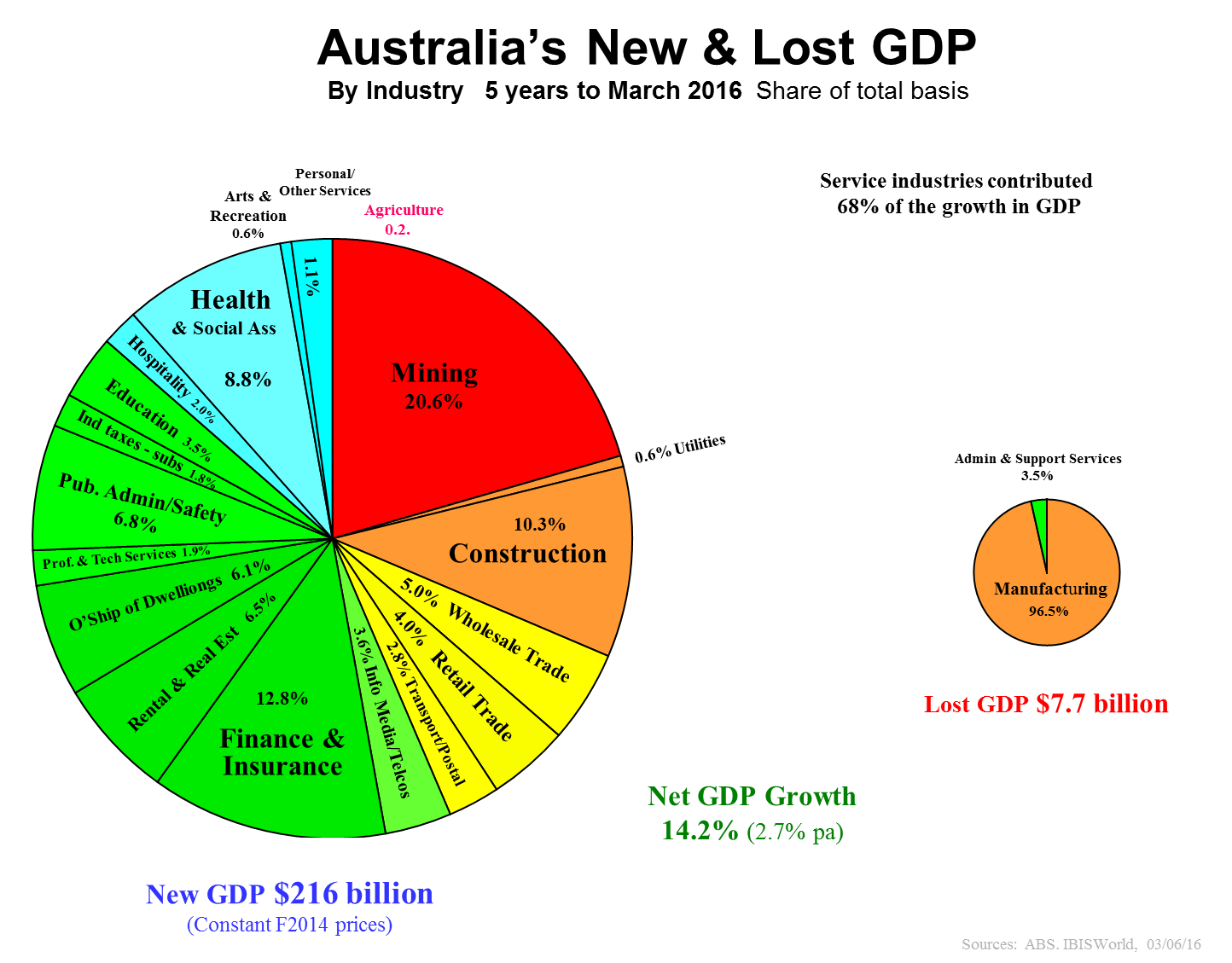

The next two charts show where the growth has come from over the most recent year and five years.

The only goods-based industries contributing to our growth are mining and, to a lesser extent, construction. Most of our losses are in manufacturing. Mining of course has had an horrific fall in prices over the past few years, but volumes (upon which real GDP is measured) continue to grow. However, some 70% of all growth over the past five years has come from our service industries.

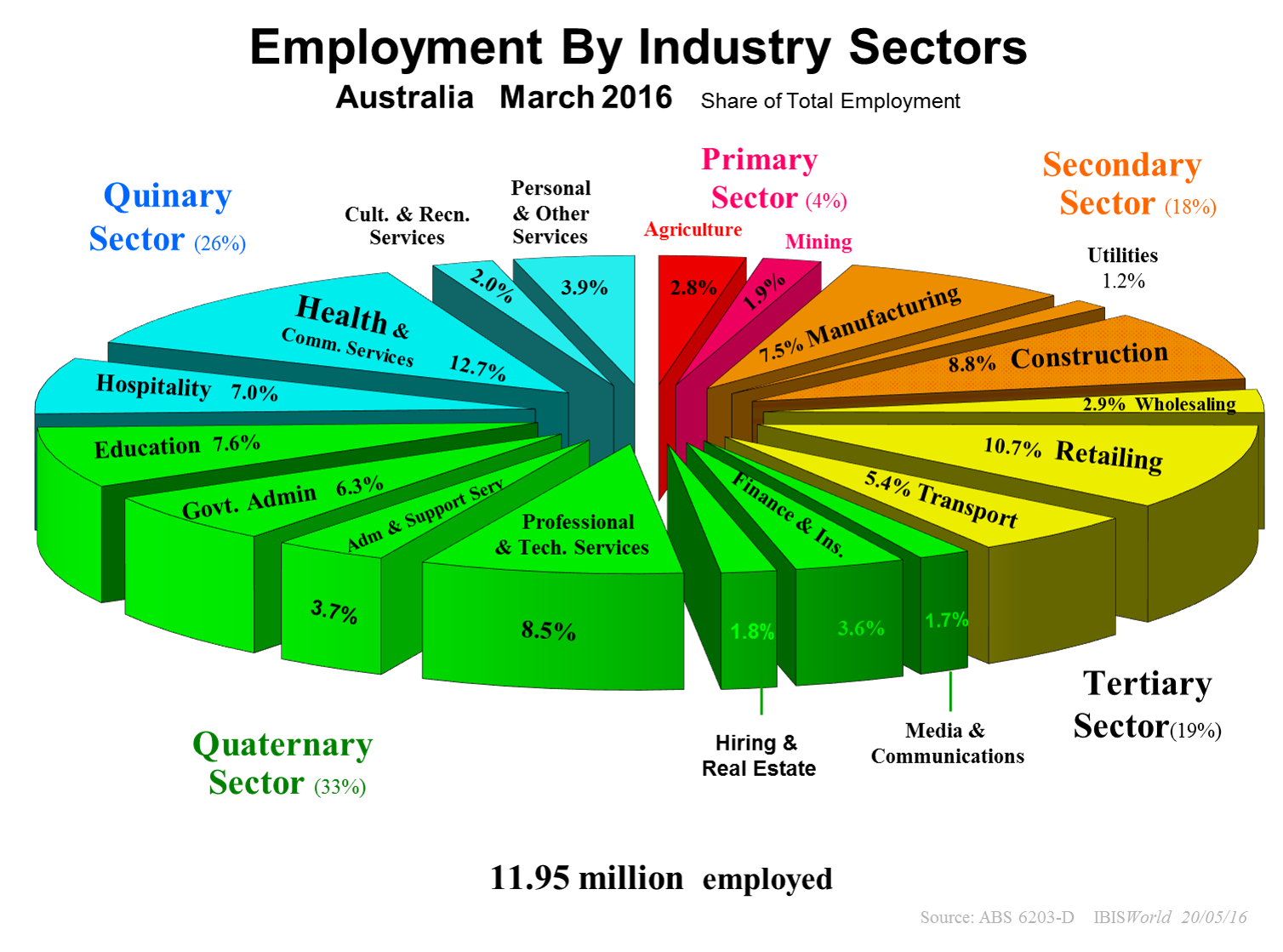

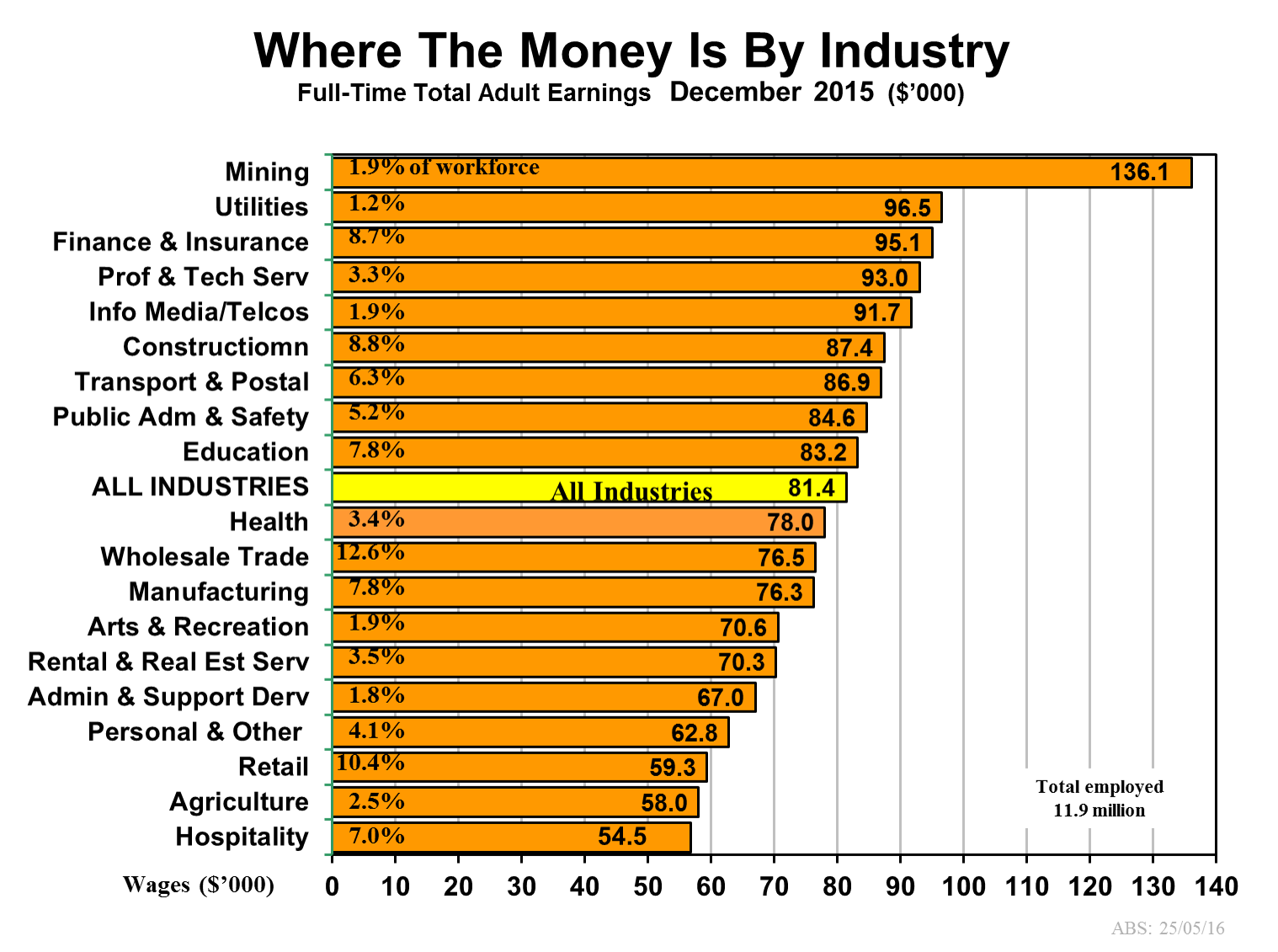

A not dissimilar picture emerges when we examine the structure and growth of our industries in employment terms. The first chart below shows where our 12 million employees were in March 2016, and the second exhibit reveals what sort of total earnings were being enjoyed in each of the nation’s 19 industry divisions in 2015.

(Note: Quaternary is defined as information &/or finance based, and Quinary is defined as more recently outsourced personal and household services, mostly in the post-industrial age.)

Again, it is a nation where the workforce is dominated by service industry jobs. And contrary to common belief, there are more above-average earnings in the service industries than in the goods-based industries. Manufacturing is well below the national average nowadays. Why do we still have some politicians suggesting we should go back there? Regressive economics.

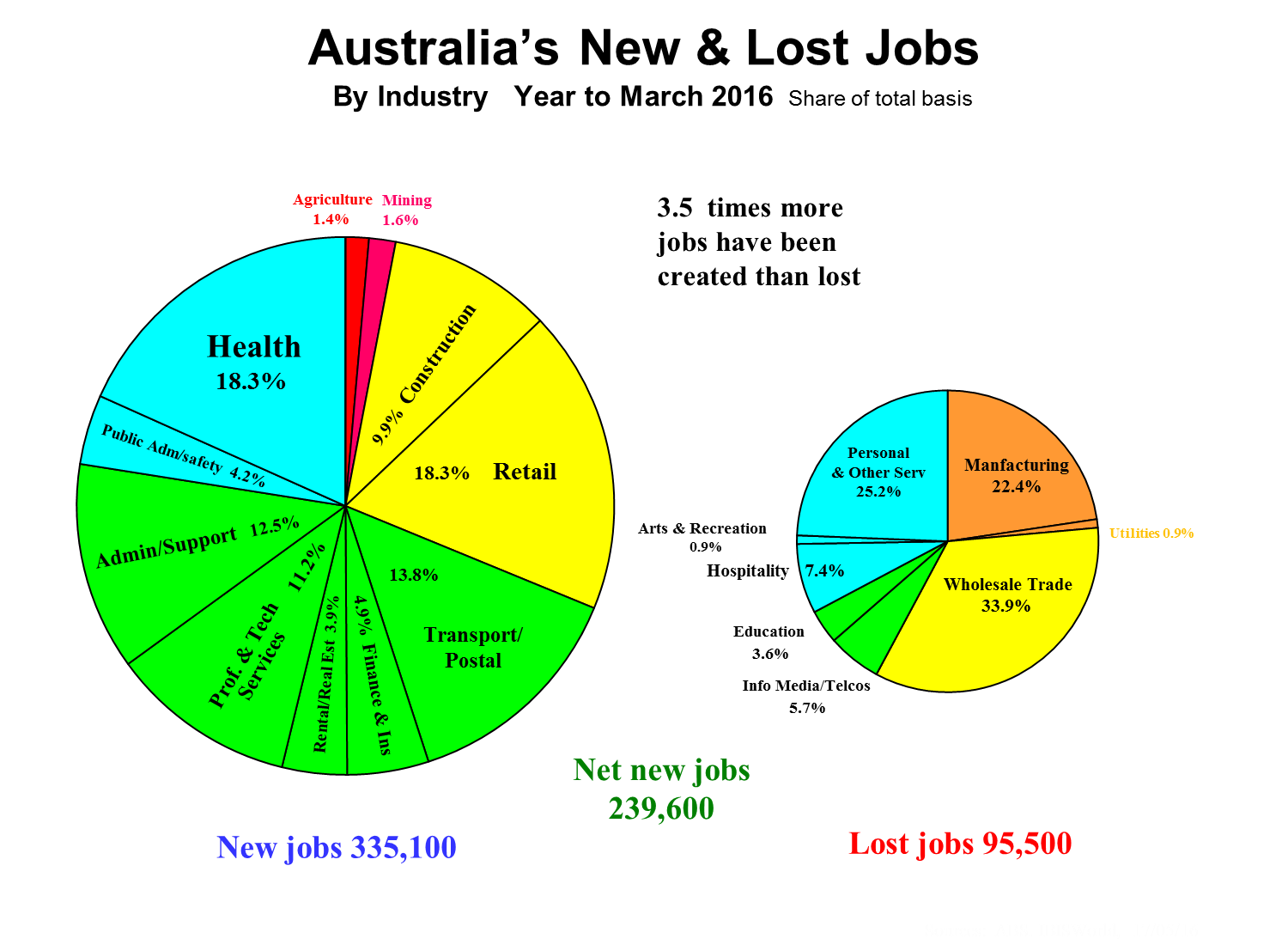

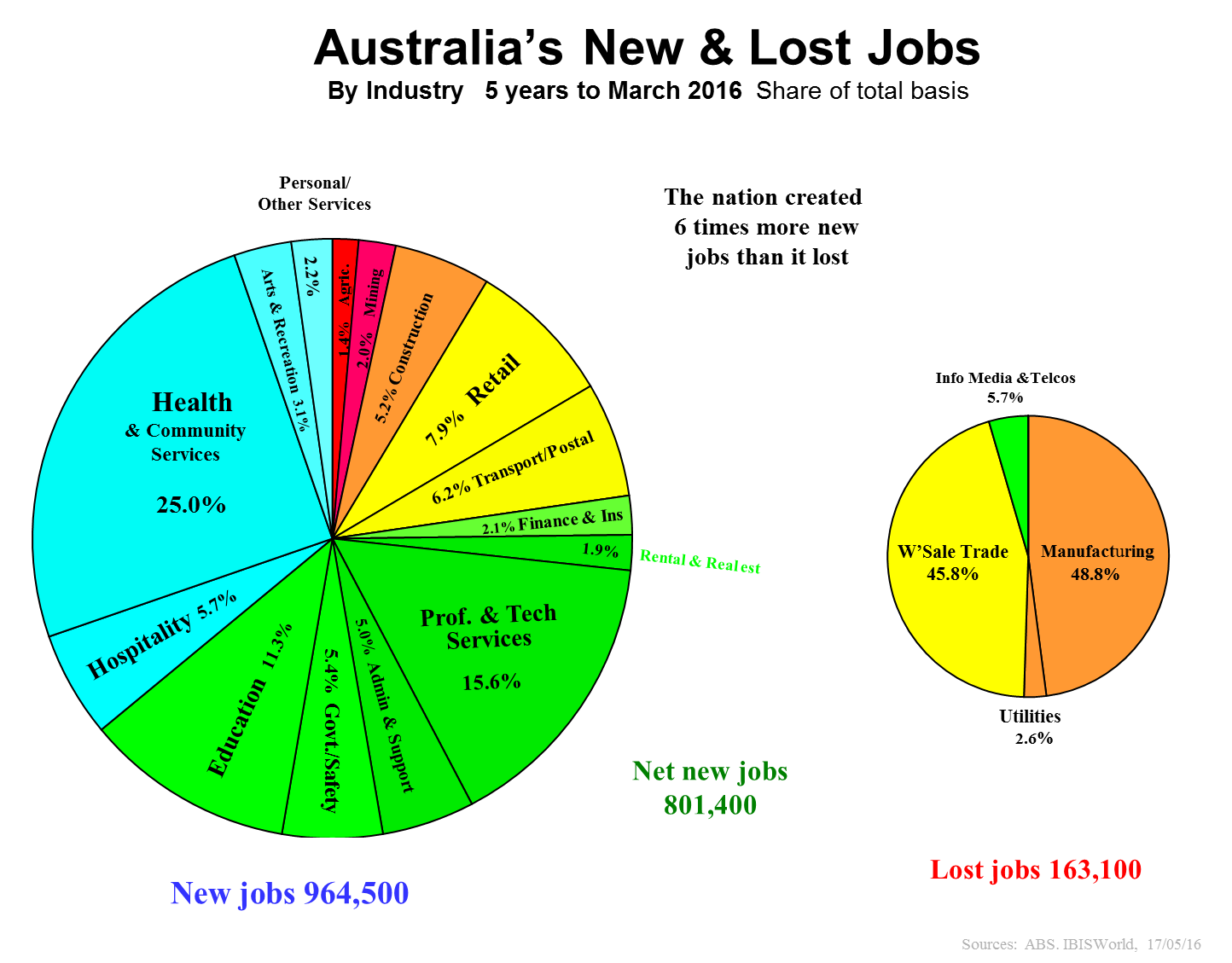

The good news - that is not publicised enough to a society nervous about jobs for themselves and their children - is that we are creating far more jobs than we are losing. This is abundantly clear in the two exhibits below that cover the year to March 2016 and the five years to the same time.

In the latest year, we created three-and-a-half times more jobs than we lost, and in the past five years, we created six times more than we lost. So why on earth do we make big song-and-dance and hand-wringing routines about job losses, but practically no celebration of our new jobs?

We have a lot to cheer about, but we cannot be complacent about urgent and overdue reforms.

Phil Ruthven is Founder of IBISWorld and is recognised as one of Australia’s foremost business strategists and futurists.