If 2021 was characterised by conditions normalising post COVID-19 and companies benefitting from the economic re-opening, then 2022 has been the year of macroeconomic factors leading to more idiosyncratic trends and rewarding stocks that have levers within their control. The year to date has been characterised by fiscal stimulus waning, geopolitical tensions growing, ongoing (though easing) supply chain constraints globally and central banks walking a tightrope on inflation. The bond market, which has driven so much of the volatility felt in equities over the past year, has continued to shake market sentiment.

This backdrop has reinforced the need to maintain a well-balanced portfolio of quality companies as we continue to navigate one of the most unpredictable markets in history. Broadly, the past 12 months have been about moving away from the COVID winners and positioning for a more inflationary environment. This has meant focusing on companies which have more flexibility at their disposal to manage their own outcomes. In other words, they are less worried about what the market or the economy does and are better able to control their own destiny. Some examples would be Bapcor (ASX:BAP), Healius, (ASX:HLS) and A2 Milk (ASX:A2M).

So, where are we today?

Fiscal stimulus is again a dirty phrase because we've got this issue with inflation. When applied correctly, fiscal stimulus can generate lots of GDP growth but, in a globalised world where we're happy to trade with one another, it needs to happen at the lowest cost. With fiscal stimulus and geopolitics occurring concurrently, you have a deglobalisation occurring and it’s no longer about the lowest cost. It has become about certain assets being more strategic in value than they were before. What COVID did was to bring forward several years of demand into two years, and now we're trying to clear that out. The problem is, we are trying to do this while global systems are a lot less efficient. And when there's less efficiency, there’s greater cost. As a result, inflation is being ‘baked in’.

We believe that inflation will normalise at some level, but I think 2% is unrealistic. Already we are seeing parts of the economy starting to normalise. Global supply chains are starting to unclog a bit and materials are starting to move. Global shipping rates are starting to normalise. For example, there were about a hundred ships off the port of Los Angeles in July and that's pretty much cleared. Closer to home, the focus remains on the speed of the rate hike cycle, which may take several months to work its way into the economy, and whether the rate hikes will hit households hard as Christmas approaches.

We are positioned with the expectation of higher rates of inflation and the potential for recession. With low unemployment in Australia and the US, the Fed and the RBA have few levers to pull and all they can do is impact demand by limiting the ability to consume. They are doing this by lifting rates to such a point that people have to cut their discretionary spending down, which we feel will be counterproductive because they’re likely to do far more damage than what they're trying to solve for.

How we're positioning the portfolio

In terms of the portfolio, we are looking at the metals sector, because it has underperformed quite a bit recently. By looking closely at the capital cycle of the commodity sector, you can get a sense of when they are overinvesting and when they are underinvesting. You want to own the commodity sector when they are underinvesting, which they have been over the last 10 years. The copper price has fallen from $4.50 to about $3.30 and most of the copper miners are cutting production. The reason they can do this is that they have very good balance sheets – either net cash or they generate a lot of free cash flow. Commodity stocks do a little bit better in a higher-inflation-through-the-cycle period.

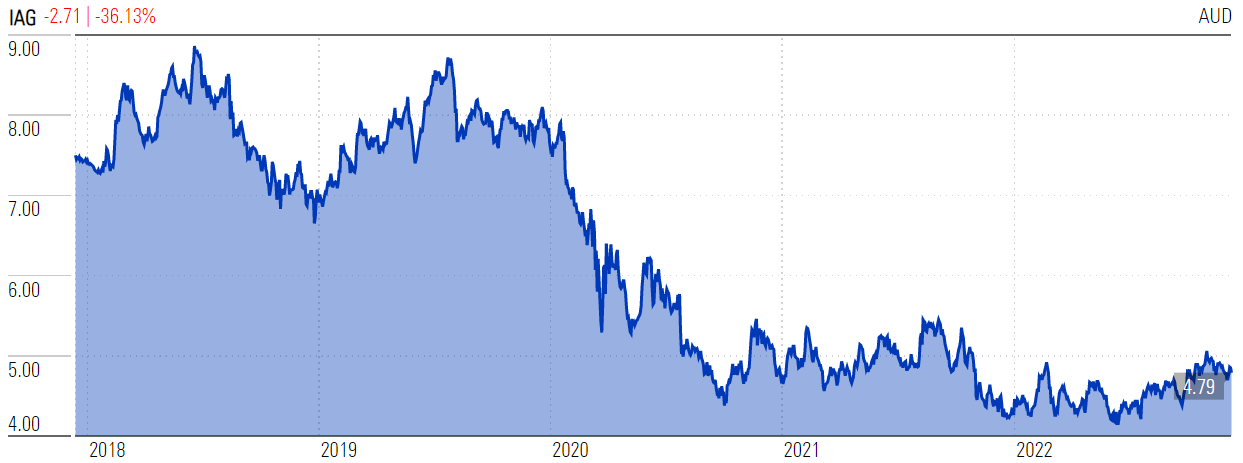

We also like insurance as a defensive play and while the likes of IAG may be a bit boring, the last few years of very low interest rates damaged insurers because they collect premiums every year. The technical reserves, which are held in fixed income, were flat because government bonds were close to zero. But as rates go up, they get a bit of a free kick on top of home and car premiums, which have been raised across the board this year.

Source: Morningstar

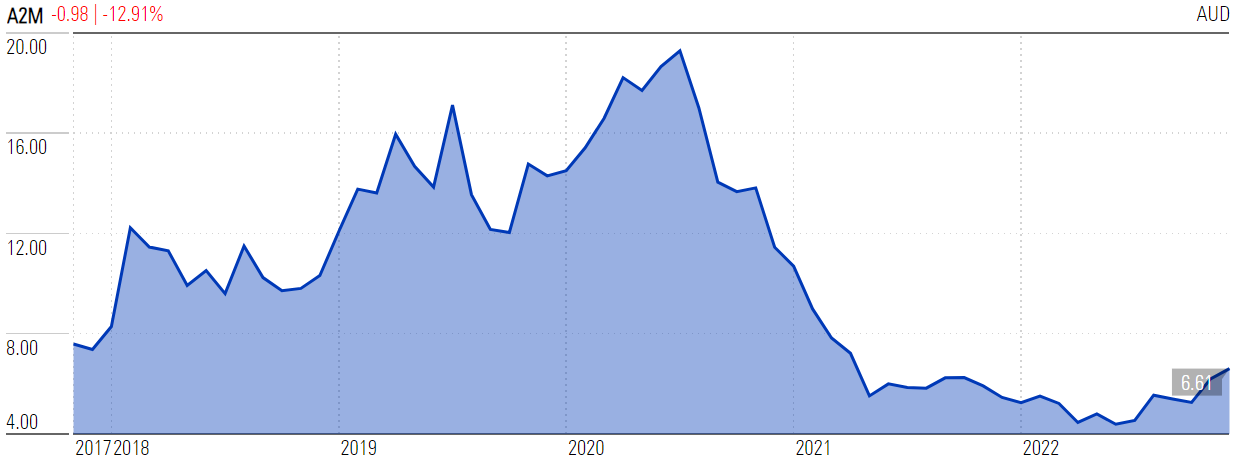

I mentioned idiosyncratic stocks, as in more company-specific, and A2 Milk, in which we took a position last year, as an example. There has been a management change there and the new team is doing a great job. The new CEO has centred the infant milk formula business, developed the strategy, and reinvested back into distribution in China.

Source: Morningstar

The results are starting to show and A2 is about 5% of the Perpetual Equity Investment Company (ASX:PIC). Aside from good management, it's got a net cash balance sheet of $900 million. The market cap is $4 billion, so nearly a quarter of the market cap is sitting in cash. They are the sort of business we like, especially when operations are turning around.

Vince Pezzullo is a Portfolio Manager and Head of Equities at Perpetual Investment Management, a sponsor of Firstlinks. This article contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs.

For more articles and papers from Perpetual, please click here.