The first lines in the Treasurer’s Budget Speech would make ACDC proud:

“Tonight, I announce that the Budget is back in the black and Australia is back on track ... our nation is again paying its own way.”

Expect a repeat of this message many times in the next month’s lead up to the election. It is due to “charting a responsible path to surplus” and “a long road from where this process started when the Government was first elected.” The so-called Underlying Cash Balance, which is the measure used for the ‘surplus’, is forecast at $7 billion in 2019/20, the first surplus after a decade of deficits. But it is next year, so it's not yet 'delivered'.

Source: The Australian

(Details on superannuation, investing and retirement saving in the 2019/20 Budget are summarised in another article).

Budget surplus and economic parameters

On economic parameters over the forward outlook, there is an expected pickup in wages growth from the current 2.5% to 3.5% by 2022/23, but consumer prices (at 2.5%) and unemployment (at 5%) are forecast to remain steady. With the anticipated steady growth of surpluses until 2028/29, net debt (not gross debt) is projected to be eliminated within a decade. In reality, this is unlikely to happen, with net debt currently $373 billion, and its elimination would require four government terms of favourable financial conditions and fiscal discipline. Real GDP will grow at 2.75% over the next two years, taking Australia into 30 years of uninterrupted economic growth by 2021.

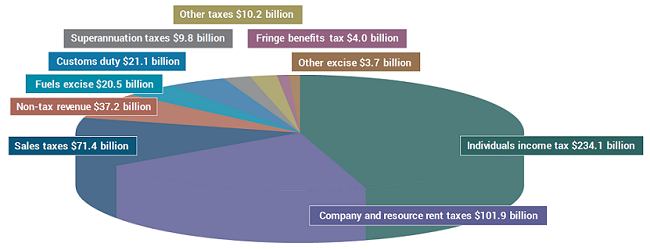

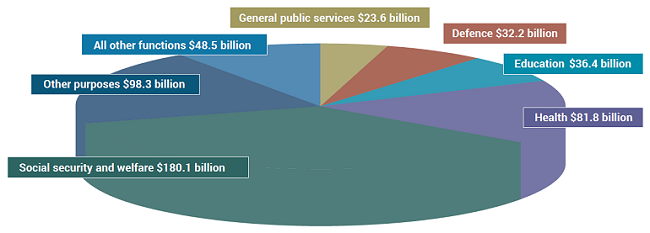

The Budget is a good reminder of where the revenue comes from, and where the spending goes. Total revenue for 2019-20 is expected to be $514 billion, with total expenses of $501 billion.

Where revenue will come from, 2019-20

Where money will be spent, 2019-20

Income tax relief

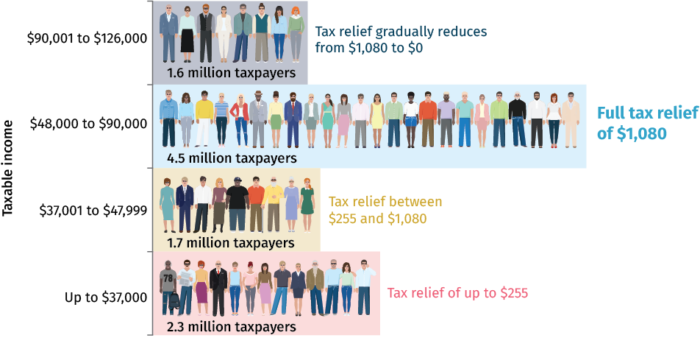

The cornerstone of the election spending in the 2019/20 Budget is lower personal income taxes. Immediate tax relief goes to low- and middle-income earners, worth up to $1,080 a year for singles and $2,160 for families. About 4.5 million Australians will receive the full benefit in the 2018/2019 financial year.

Tax relief by taxable income bracket

From 2024/25 (a wait of six years), the middle tax bracket will reduce from 32.5% to 30%, which together with the abolition of the 37% bracket, will mean 94% of taxpayers pay a marginal tax rate of 30% or less. But six years is a long time in politics.

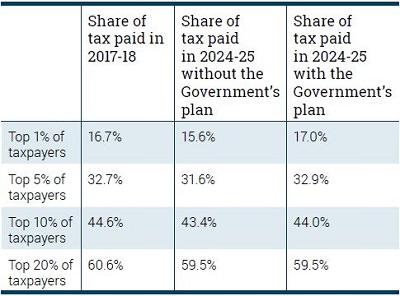

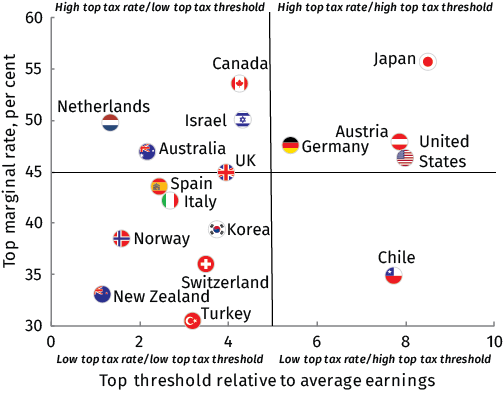

The Government stresses that the tax system remains progressive and internationally competitive after the 2024/25 cuts. For example, Australia’s top marginal tax rate clicks in at around 2.2 times average full-time earnings, lower than Canada, UK, Germany and the US. The top 5% of taxpayers will pay a third of all personal income tax collected.

Share of personal income tax paid by the top 1%, top 5%, top 10% and top 20% of taxpayers

Current top marginal tax rates comparison, selected OECD countries

Instant asset write-off

Expect to see a lot more vans and utes priced just under $30,000, with the instant asset write-off threshold rising to this level from tonight until 30 June 2020. It applies on a per asset basis. This has been a popular stimulus in the past, with more than 350,000 businesses already using it. It has also been expanded to include medium-sized businesses by increasing the annual turnover threshold from $10 million to $50 million.

Integrity of the tax system

The Government claims impressive results will be achieved by focussing on tax collection from multinationals and the black economy. The ATO Tax Avoidance Taskforce is estimated to raise a further $4.6 billion in tax liabilities over the next four years. The impact on the black economy is estimated to return an extra $5 billion to the budget.

From 1 July 2019, increased attention will be given to high-risk industries to prevent hiding of income, making it harder for businesses to pay cash wages to staff while also evading their obligations to report the income. The Australian Business Number (ABN) system will be strengthened and targeted.

Essential services

The Budget provides $528 million over the forward estimates for a Royal Commission to examine violence, abuse and exploitation of people with a disability, and $328 million for prevention and frontline services to reduce violence against women and their children. There is $525 million for vocational education and training, with added funding for employers to train apprentices. Defence capabilities will receive a mind-boggling $200 billion over the next decade. Annual funding for schools will grow from $20 billion in 2019 to $32 billion in 2029, while universities will receive $18 billion next year.

After the ‘medi-scare’ of the last election, there is a ‘guarantee’ to strengthen Medicare to ensure Australians access timely and affordable healthcare. Mental health care has higher priority and funding.

Total funding for aged care will increase from $22 billion next year to $25 billion in 2022/23, including support for in-home services.

Infrastructure

The headline number for infrastructure is a neat $100 billion investment for “busting congestion and ensuring our towns and regions are better connected.” Good luck with that on a lot of Sydney roads.

The big initiatives include:

- A new Road Safety Package of $2.2 billion

- Urban Congestion Fund increased from $1 billion to $4 billion

- A new Commuter Car Park Fund of $500 million

- Roads of Strategic Importance funding increased from $3.5 billion to $4.5 billion

- Major Project Business Case Fund of $250 million

- $2 billion to help deliver fast rail from Geelong to Melbourne

- Establishing the National Faster Rail Agency

- Fast rail business cases for Sydney to Newcastle, Sydney to Wollongong, Sydney to Parkes (via Bathurst and Orange), Melbourne to Greater Shepparton, Melbourne to Albury Wodonga, Melbourne to Traralgon, Brisbane to the regions of Moreton Bay and the Sunshine Coast, and Brisbane to the Gold Coast

- Melbourne to Brisbane Inland Rail of $9.3 billion

- Western Sydney (Nancy Bird-Walton) International Airport of $5.3 billion

- Melbourne Airport Rail Link of $5 billion

To further assist the reduction in congestion, the Migration Program will be reduced from 190,000 to 160,000 places for four years from 2019-20. The Government will also create incentives for migrants to settle in regional centres.

Climate change

The Government claims Australia will overachieve its second Kyoto Protocol target (2013–2020) by 240 million tonnes. To meet emissions reductions under the Paris Agreement, $3.5 billion will be invested in a new Climate Solutions Package, including a $2 billion Climate Solutions Fund. A $79 million investment in energy efficiency measures, including grants to businesses and communities, is expected to deliver 63 million tonnes of emissions reductions.

There is funding of $1.4 billion for the Snowy 2.0 project to bring 2000 MW of electricity generation into the system and up to 175 hours of energy storage that can meet the peak demand of up to 500,000 homes.

Graham Hand is Managing Editor of Cuffelinks. There is not much on superannuation and retirement incomes in the 2019/20 Budget, but the few changes are summarised in another article.