Late last year, Phoenix participated in an Investor Day, hosted by listed REIT, Mirvac Group, that focused on 'Living Sectors'. Aside from the joy of wearing a high-vis jacket, those with an eye for detail will notice the badge, clearly indicating that the occupant of the jacket is a 'Young Worker'.

Late last year, Phoenix participated in an Investor Day, hosted by listed REIT, Mirvac Group, that focused on 'Living Sectors'. Aside from the joy of wearing a high-vis jacket, those with an eye for detail will notice the badge, clearly indicating that the occupant of the jacket is a 'Young Worker'.

In this article we share with you some of the lessons learned by that young worker from the day.

Our housing problem

Australia has a housing crisis. We may have had an inkling of this one before the tour, but with an estimated 1,000,000 new immigrants expected to arrive in Australia over the next three years, requiring approximately 400,000 dwellings, we’re going to have to get cracking with the government’s new housing targets.

The chart below puts these figures into the context of what has been delivered in the past. The key takeaway for us is that the Australian Government may well be having another Utopia moment.

With demand likely to remain robust, and rental markets as tight as a drum, the opportunity for an entity such as Mirvac Group to deliver product into this environment is compelling.

What is “Build to Rent”?

Build to Rent (BTR) is the creation of residential dwellings, typically apartments, which instead of being strata titled and sold to individuals, remain institutionally owned, professionally managed, and represent high quality rental accommodation, often including a higher level of amenity than competing product. Furthermore, a resident has security of tenure, not just through a lease, but because the entire building forms part of a long-term residential community.

An investor in BTR benefits from typically high occupancy rates, with multiple tenants delivering low volatility of income and stable valuations. Well-designed buildings should certainly benefit from relatively low maintenance capital requirements, at least initially, and certainly do not suffer from the requirement to incentivise tenants with expensive fit outs that plague the office leasing market.

While BTR may be a relatively new concept in Australia, it is a mature property sub-sector in offshore markets, particularly in the US, where it is referred to as 'multi-family'.

Mirvac is pioneering BTR in Australia

The BTR sector is embryonic in Australia, representing less than 0.5% of housing stock across the country. This compares with a ~12% penetration in the US and around 5.4% in the UK. The opportunity set is therefore large.

Mirvac has branded its BTR product with the “LIV” name, and delivered LIV Indigo, its first project in Sydney Olympic Park back in September 2020. That project is now 94% occupied. LIV Munro, opposite Queen Victoria Market in Melbourne’s CBD is the second completed project which opened at the end of last calendar year and is now 70% occupied. LIV Munro is pictured below.

The tour showed investors around LIV Munro enabling us to get a feel for the amenity, including pool, gym, dining areas, podcasting rooms and rooftop BBQ and relaxation facilities and to meet the on-site staff responsible for the community experience. We were impressed.

We also visited LIV Aston, a project under construction on the corner of Spencer Street and Flinders Street West, also in Melbourne’s CBD. Hard hat required! With a total of 474 apartments, the construction project was on time and budget and is expected to compete before the end of the current financial year. This project is almost adjacent to another, yet to be competed, BTR project currently being developed by Lendlease. It will be interesting to see these projects go head-to-head when they are both operational.

Alongside the three projects referred to above, Mirvac has another 2 projects under construction, one in Melbourne and the other in Brisbane, which will bring their collective exposure to BTR to approximately 2,200 apartments across 5 projects.

Financial metrics are interesting

Financial modelling for BTR is made a little tricky by some big movements in construction costs over the last few years, which ordinarily would lower returns, combined with some offsetting and also significant market rental increases in the residential sector. For Mirvac, the end result is a stabilised yield on cost of 4.5-5.0%. Along with rental growth, maintenance costs and ancillary income, the investment return (Internal Rate of Return) is estimated to be around 7-7.5%.

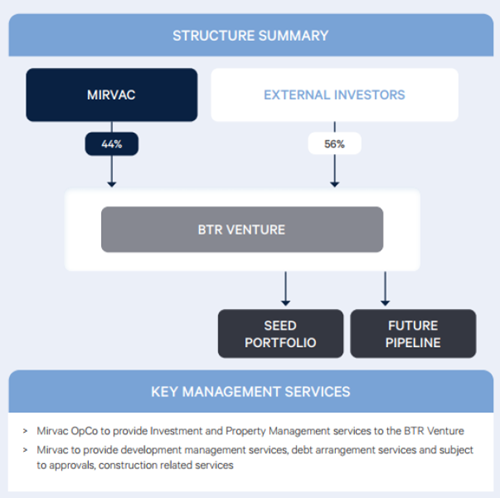

Mirvac’s investment in the sector is structured in a joint venture as shown in the diagram below.

External investors sit alongside Mirvac, and enjoy investment returns that benefit from active management of the assets.

In addition to the returns on capital invested in the joint venture, Mirvac also earns funds management, development management and asset management fees across the platform. This fee stream is more volatile but adds to the returns that Mirvac's shareholders enjoy.

Phoenix assumes that Mirvac is able to build out its current pipeline of BTR opportunities and will be able to identify future projects to reach its medium-term target of 5,000 apartments on the platform. Importantly, we also assume that the company will be able to continue to partner with external investors to deliver a solid outcome for all stakeholders.

We expect the BTR market to get more competitive, but with penetration rates so low and the demand for housing so high, we forecast a solid runway for the foreseeable future. The only sad thing about the day was the discovery that BTR is typically targeting the affluent renters, aged between 25 and 39. The “young worker” on this tour is more likely a target for the over 55 land lease portfolio, which we will write about in future.

Stuart Cartledge is Managing Director of Phoenix Portfolios, a boutique investment manager partly owned by staff and partly owned by ASX-listed Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.