Australia’s chronic shortage of housing is prompting widespread calls for changes in a wide range of policies that affect the demand and supply of places to live. A forecast net intake of 700,000 migrants over two financial years to 30 June 2024 (and 1.75 million by June 2028) at a time of construction shortages and rising rates has created an historically-low rental vacancy rate. Contrary to expert predictions, house prices have risen in 2023 as home demand outstrips supply.

At such times, two policies targeted for criticism in favouring investors over owner-occupiers are negative gearing and the capital gains tax (CGT) discount.

With negative gearing, where costs of owning a rental property exceed revenues, the ‘loss’ can be charged against other personal income. Some people seem to think the loss itself is a good thing because it reduces their tax, but the tax savings only reduces the loss: it is still a loss. This is little comfort to the aspiring homeowner who is beaten at an auction by an investor happy with the income offset in return for future capital gains.

As if that wasn’t enough, investors also receive a 50% CGT discount if they sell after holding the asset for longer than 12 months. Little wonder Australians love investing in real estate.

But why should a dollar made as a capital gain be taxed at a lower rate than a dollar earned as income? Nobody can claim a personal income tax deduction if they’ve held a job for longer than 12 months. That seems a ridiculous notion.

Why do we have a CGT and a discount?

CGT was introduced almost 40 years ago in Australia in 1985 to stop schemes that converted income into capital to exploit its tax-free treatment at the time.

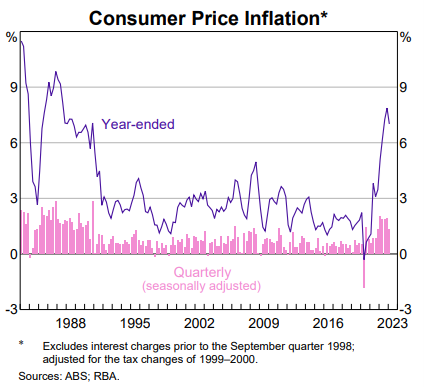

The CGT discount started as a recognition that in calculating capital gains, it is fair to tax the real increase in the value of the asset, after allowing for inflation. Any asset which only keeps up with inflation is not really increasing in value. For example, the annual Consumer Price Index reached 7.8% in December 2022, the highest for three decades. If an asset was bought for $100,000 a year earlier, its value would need to rise to $107,800 to retain its real value. That is, in December 2022, it cost 7.8% more to buy goods than in December 2021, so it is legitimate to adjust a capital gain for inflation. As the chart below shows, inflation adjustment matters again.

So where does the 50% discount come from?

Prior to 1999, the calculation was based on an adjustment to the cost base for CPI, but it was considered overly complicated. Investors needed to calculate the inflation adjustment between buying and selling dates. This seems a trivial reason, as online data and calculators could easily be provided by the Australian Taxation Office (ATO) and others. But at the time of the 50% discount introduction, it was justified on simplicity grounds. And the 15% tax on superannuation in accumulation mode receives a 33% discount, giving a tax at 10% instead of 15%.

It is easy to see who benefits and who loses from the move from CPI to 50%.

Winners: Investors who hold an asset for a little over 12 months when inflation is low.

As with most developed countries, Australia went through a golden period of low inflation starting in about 1996 and running until the pandemic. The timing of the 50% discount was of great benefit to many investors.

Losers: Investors who hold an asset for a long time during high inflation.

It's not all win-win in investor land. Using the Reserve Bank inflation calculator, an asset bought for $100,000 in 1992 and held for 30 years until 2022 would need to rise in value to $212,610 to retain its real value. The cost base would rise by $112,610 under a CPI adjustment. If the asset sold for its CPI-adjusted level of $212,610, the CGT would be zero under the old system. Under the 50% system, half the gain or $56,305 would form part of the investor’s taxable income.

So in certain circumstances, the 50% discount is unreasonably low. Now we have a return to higher inflation which looks like sticking around for some years above the Reserve Bank target range of 2% to 3%. Online calculators debunk the idea that the calculation is too complex, and it seems a fairer system to adjust the tax base for inflation.

The CPI adjustment also encourages holders who do not flip investment properties every year or two, and it’s easier to sell politically. The 50% number sounds generous, and it was in a low inflation environment. Everyone can understand the legitimacy of a CPI adjustment.

What are some of objections to the CGT discount?

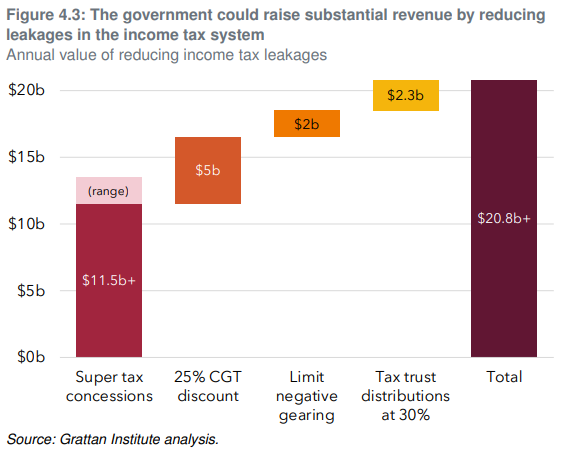

In its 2023 paper, ‘Back in black? A menu of measures to repair the budget’, the Grattan Institute argued that successive Australian governments cannot continue to massively spend to keep voters happy while not collecting more revenue to pay for it. Among a range of measures was a proposal to reduce the CGT discount to 25% to raise $5 billion a year.

The main rational for the change was:

“If income taxes are applied to nominal capital gains, inflation can erode part of an investor’s wealth. But given low inflation for most of the past decade, the 50% CGT discount overcompensated many investors for inflation. The policy has also over-zealously protected savings at the expense of competing considerations. The economic benefits of tax neutrality for savings are small, and the 50% CGT discount encourages investors to focus too much on investments with capital growth rather than annual income. This is a major distortion which, together with negative gearing, encourages property speculation over more efficient investments. The current discount also compromises income tax integrity by encouraging artificial transactions and makes the tax system less progressive. The 50% CGT discount for individuals and trusts should be reduced to 25%, with a gradual phase-in (rather than grandfathering).”

Earlier modelling showed the top 10% of households by income receive nearly three-quarters of tax benefits.

Other critics argue Australians do not need these tax incentives to buy property, and it disadvantages people without the resources to invest in property at the expense of more productive businesses. The discount is available to people who are wealthy enough to own capital and they should not pay less tax than someone who relies on income.

The Henry Tax Review recommended reducing the 50% CGT discount to 40%, but like much of Henry, this was rejected. However, this needs to be read in the context of Henry's sweeping changes, which recommended a move to a broad 40% discount on many forms of personal savings to remove distortions and incentives. The Henry Review said of the different ways income and capital gains are taxed:

"There is considerable evidence that such tax differences can have large effects on the assets in which a household’s savings are invested. The large variations in tax treatment can therefore alter the allocation, ownership and the management of the nation’s savings. This can have adverse impacts on overall economic efficiency, capital market stability and the distribution of risk between individuals. The tax advantages from borrowing to invest in a rental property, also relevant for shares, leads to investors taking on too much debt and distorts the rental property market. A move to a broad 40% discount for income from bank deposits, bonds, rental properties, and capital gains and for certain interest expenses would address these problems by providing more consistent tax outcomes. Savings would be allocated more productively, distortions to rental property and other markets would be reduced, and household investment and financing choices would better suit their circumstances and risk-preferences."

While economists such as Saul Eslake supported this proposal, a 2016 paper by Professors George Fane and Martin Richardson noted:

‘the simplest way to repair the capital gains tax is to return to the pre-1999 arrangements’.

Note also that investors can add to the cost base the expenses incurred in acquiring the asset such as inspections, surveyor costs, stamp duty or costs of transfer. The ATO has a detailed list here. CGT discounts are available to individuals and trusts but not companies.

A discount is justified

As various policies relating to housing and tax are kicked around for change, we can debate the amount of the discount – 25%, 40%, 50%, linked to CPI – but the justification for some level of discount is strong. The CPI adjustment to allow for the real value of the asset seems easiest to justify and explain.

However, the impact on housing supply is uncertain. While owner occupiers would prefer fewer competitors on auction day, renters would not want a policy that materially reduces the availability of rental properties.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor.