This is an edited transcript of an interview between Magellan account manager, Nicole Morell, and Ben McVicar and Ofer Karliner, two of the company's Infrastructure Managers.

Nicole Morell: One of the big themes in the economy is the rising interest rates, rising living costs, and the pressure that this is putting on household budgets. Are you seeing any sign of governments pushing back on price increases from companies in the infrastructure sector?

Ben McVicar: So certainly this is one of the big themes we've seen in global markets. Global economies in recent years has seen both rapidly increasing in prices, as well as really strong interest rate responses to that. What that has meant is very often consumers and households, who are least able to deal with this often, are dealing with what is a rapidly rising cost of living.

So how does this impact infrastructure? Well, ultimately you think about the nature of what infrastructure is, what we're doing, it's about delivering essential services to consumers. So I should add, this is exactly why we're in this space. The provision of essential services makes for a great investment because this is really where we can get reliability of demand. When you're selling essential services, people need this day in, day out. The other factor as well is these are monopoly businesses, often near monopoly-type businesses. So really reliable investment.

And the way that governments often deal with this, this sort of monopoly power is by price regulating these businesses. So if you think about toll roads, often what they do is they have a price path that's defined in a contract. I think in France as an example, you've got a CPI times 70% uplift of prices each year. Electric utilities, very common in the US to pass through the cost of the electricity generation so you don't have to bear that inflationary pressure. Overall, that can still work as a solid investment.

The risk you face in all of this as investors is that in a period of rising prices, obviously there's the risk that the governments decide to politicize this process, and that creates risk as investors. The thing that we're seeing at the moment, as an example, we are seeing some of this starting to occur.

In France at the moment, what we're seeing is press reports that the government there is looking to create effectively a new tax that they're going to apply to the motorways there. Now, what is interesting here is they're looking to potentially try to sidestep the way the contracts are written. And in order to do that, what they're going to do is potentially tax all of the concessions in the market - rather than just a specific tax, which is not allowed in that country. That's obviously a risk. And by the way, when we've done the analysis on that, it looks like it's pretty minor in terms of the impact on valuation, but obviously it's a net negative in terms of the trajectory.

But what is interesting here is I think it's what the government's not doing. They're not trying to tear up the contracts, they're not trying to rewrite the contracts unilaterally. They're working within the contracts to find ways to increase this tax. This is a common thematic.

We're seeing the same thing in New South Wales. The Labor government here with their toll pricing policies certainly acknowledged and respected existing contracts that were in place.

And going all the way back to your initial question around the ability to increase prices as per these contracts, globally, we're seeing this is very consistently being allowed by governments. We're not seeing that pressure because of the way we invest, focusing on those really high quality jurisdictions.

Nicole Morell: All right. Well, let's change gears a little here and move to the topic of electric vehicles. And this one's for you, Ofer. What would a global shift to electric vehicles look like? And I guess the bigger question is how would the current system cope, if at all?

Ofer Karliner: Yeah, in very basic terms, the system couldn't cope right now with a shift to electric vehicles. It's a multifaceted problem, so you have a number of things we need to solve to get there. The generation has to increase significantly: the grid. Transmission distribution has to be significantly enhanced, and charging infrastructure needs to be in place.

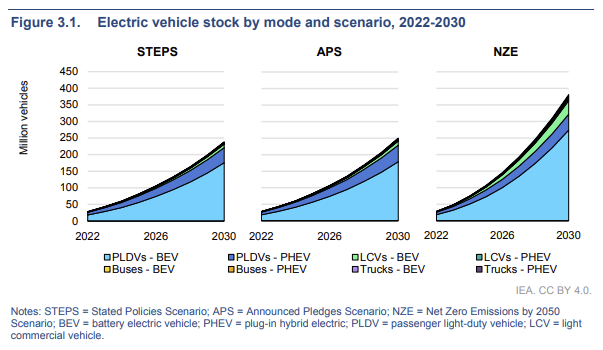

Now, there's not a lot of good data on what this is going to cost in isolation for electric vehicles to 2050. It's more about the whole transition costs. But there's some really good data to 2030 that gives you kind of an idea and it's quite instructive of the quantum of the changes that need to be made.

The IEA, International Energy Agency, estimates that about 30 million electric vehicles are now on the roads. They expect that to be between 240 and 250 million by 2030. That's out of a global car fleet currently of 1.45 billion.

IRENA, the International Renewable Energy Agency, estimates that at a 20-25% penetration, we need 37 million public charges for recharging cars. At the end of last year, there were 2.2 million. That's not including the quarter to half a billion private charges that need to be built. And they estimate that alone will cost between 900 billion and 2.2 trillion just to get to 20-25% penetration. Again, quite a big number.

We then get to the generation and grid piece. Well, there's an Australian government report from 2021 that looked at their high case scenario of 20-25% penetration again of electric vehicles by 2030. In that case, they estimate about a 3 to 4% increase in total electricity demand, which in and of itself doesn't sound like a lot and it's not really a problem.

The problem becomes that people get home from work around the same time and plug in their cars all around the same time. They estimate it could lead to a doubling of peak demand. So when you're building a grid, all those things, all those components and if you built for that peak load, so a generation has to double, the transmission system needs to be reliable enough to cope with that additional electricity. The grid needs to be enhanced, not just for the amount of electricity, potentially for two-way flows. So that 20 to 25%, you're looking at four to five times scaling up to 100%. Not quite that simple because cars could be used as home batteries, and you could be selling a power back to the grid. But even then you have to upgrade the grid systems to deal with that.

Globally, there's tens of trillions of dollars need to be spent. And one of the reasons we really like electric utilities is this really long-lived theme of growth. It's really low-risk way to play what is a multi-decade story of growth, and we think it's not reflecting the share prices of a lot of these companies.

Nicole Morell: So the shift to electric vehicles, and electrification more broadly, is one theme that is obviously of interest to you as infrastructure investors.

Ben, can you step us through the key themes that are running through the infrastructure strategies currently, where you're investing and what interests you about those?

Ben McVicar: Yeah, certainly. One is obviously the thing we just pointed out, which is that this net-zero transition creates a lot of investment required in the utility sector. And Ofer just spent a bit of time talking about the impacts from electric vehicles. Now broaden your thinking on that topic to think about what if we want to take gas-powered or gas heating, electrify that. What if we want to take some industrial loads and electrify that? And you can start to see how this multiplies out to be just a huge, huge load that gets put on the grid.

And when we think about the portfolio as it stands today, this is one of the themes that we really like, the utilities stand to benefit significantly. Electric utilities in particularly, these are regulated businesses. Historically you'd be looking at these things as a low-growth but very reliable return. The nice thing now is they're very reliable returns, but we're starting to see the growth rates and the guidance from companies in recent years looking like a sustained 5, 6, 7% per annum EPS. It's not going to shoot the lights out in the year, but it does add up over time. And the nice thing is about this investment opportunity is that really drives their business for the decades to come. And so that's a significant part of the portfolio. Over a third or around a third of the portfolio is invested against assets with significant exposure to electricity.

One of the other thematics, if you want to call it that, that we like at the moment is really around the toll road space. Toll roads represent around a quarter of the strategy. The thing that's quite attractive about these assets is number one, there's a valuation opportunity that we see.

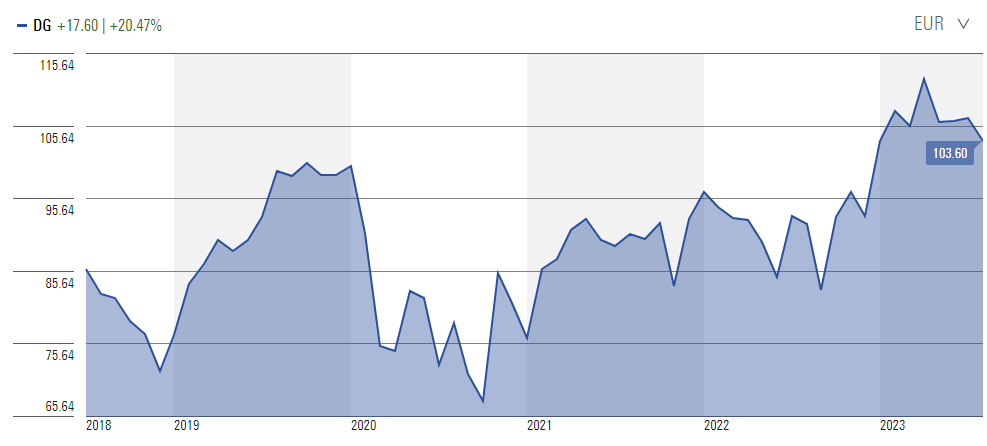

The next piece that's quite interesting is obviously like a lot of transport assets, there's really been a catch-up coming out of the COVID era as they sort of get back to those 2019 levels of traffic. And most motorways we look at, you're kind of back at that level of traffic. And so a couple of examples in that space be like a company called VINCI in France, they have a demonstrable portfolio of toll roads in France. They also have a very large airport platform.

VINCI share price

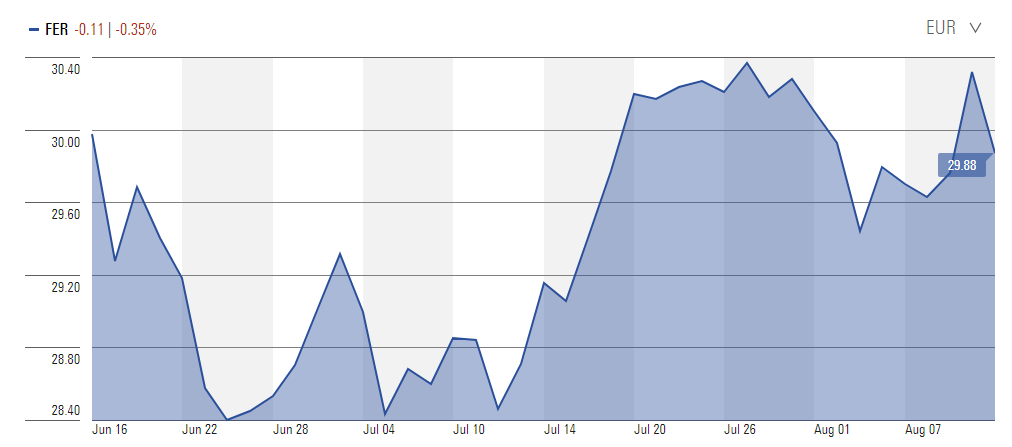

Another company, Ferrovial, who's a European based management team, but they're primarily a North American business these days. Some really nice toll roads in that market, a really particularly attractive one in Toronto, in Canada, which is a really, really nice long-lived asset in that market. So it gives you a sense. And the other thing as well, obviously they're really inflation protected type assets.

Ferrovial share price

The last piece that sort of fits into that general situation is airports. And airports, again, the recoveries gaining ahead of steam, and they're representing just under 10% of the portfolio.

Ben McVicar and Ofer Karliner are infrastructure portfolio managers at Magellan Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Magellan, please click here.