The term robo-advice is now widely used within wealth management circles, but exactly what does it mean? If that question was directed to someone on the street corner their response would be more likely to include R2-D2 or C-3PO rather than a computer telling the user how they should invest their money to achieve their financial goals.

Wikipedia defines robo-advisors as “a class of financial adviser that provides portfolio management online with minimal human intervention. While their recommendations may vary, they all employ algorithms.”

The key words there are portfolio management and algorithms. Portfolio management indicates it has something to do with investing while the algorithm component refers to “a finite set of instructions that can be performed in a prescribed sequence to achieve a certain goal and has a recognisable set of end conditions.” (Source: thefreedictionary.com)

Split robo-advice into three groups

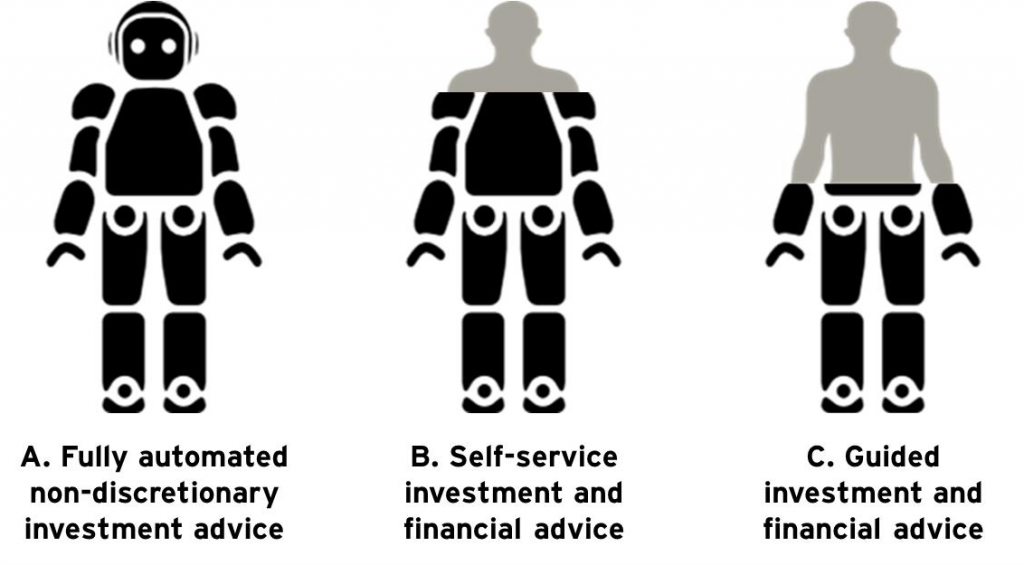

The term robo-advice has quickly evolved to cover a broad range of automated advice and investment solutions. But the underlying principle is the use of a formula or set of rules to assist a customer in finding the optimal approach to their investments, savings, retirement, or protection of assets. In practical terms, robo-advice can be split into three distinct groups and each has tremendous application for wealth managers and their customers.

A. Fully automated non-discretionary investment advice

This refers to an individual subscribing to wealth guidance and advice that is implemented without the customer’s explicit consent. Managed accounts fit this definition and dealer group model portfolios could probably be put here as well, particularly if the portfolio is rebalanced periodically without customer consent at each rebalance. The main distinction between these investment approaches and the new crop of robo-advice offerings is that the new kids on the block advise the customer which fund or portfolio to invest in. Traditional managed accounts, on the other hand, rely on an adviser to select the initial portfolio based on their clients’ personal circumstances and appetite for risk.

The new breed of automated investment solutions still apply the principles of diversification, passive investing and regular rebalancing. Many also offer extended tools, including tax lot harvesting, to optimise capital gains tax outcomes. What really sets them apart though is an intuitive, clearly-defined and consistent investment approach which resonates with experienced and novice investors alike. As these solutions continue to innovate, they will increasingly appeal to a wider audience.

B. Self-service investment and financial advice

This group provides digital tools to support customers in identifying, scoping and creating wealth advice and guidance, typically in relation to a specific goal or range of goals such as an income stream in retirement or saving for education. They may use behavioural finance techniques to encourage customers to regularly monitor and contribute to their wealth journey. Some of these tools build on this even further by streamlining the goal setting process and providing default goals and timings.

The main difference between these robo-advisors and the automated investment options is that they optimise and allocate cash flow across goals. In Australia, optimising across goals is particularly difficult given the complexity of our income tax and superannuation systems. As an example, one question that sounds simple but is quite difficult for robo-advisors to answer could be whether a client should make voluntary contributions into superannuation or pay down the mortgage. If a robo-advisor can’t answer this fundamental question, then chances are it optimises on investment and not on strategy.

What makes these types of robo-advisors even more compelling is the aggregation of client data. This enhances the user experience and removes unnecessary friction from the goal setting process. Where the wealth manager already has personal and investment data for the user, it can be integrated into the tool. Alternatively, the front end tool could request the user’s various account details. This gives the robo-advisor a powerful advantage as it can link all the accounts together, monitor movements in the investments and track ongoing progress towards goals. At the very least, the robo-advisor could apply basic user information, such as their age and suburb, and provide an estimate of their income, expenses and assets.

C. Guided investment and financial advice

This option is typically focused on holistic strategies. It includes traditional face-to-face advice as well as remote advice delivered over the phone or by video. It also includes omni-channel advice, where a person is involved or ultimately responsible for the advice strategy.

There are a number of services available which provide online tools and access to a financial adviser for a one-off initiation fee and low monthly charge. The providers have embraced a user friendly and simplified approach to the financial advice process, with some even offering automated investment advice supported by a real financial adviser.

Robo-advisors versus real financial advisers

Will robo-advisors replace real financial advisers? The answer is, probably not. The more likely scenario is that robo-advisors will complement the work done by real financial advisers.

There is a huge gap between what regular households are willing to pay for advice and what advisers are willing to charge for advice. Robo-advisors will help to bridge that gap.

Where the two worlds are more likely to collide is in an adviser-led robo-advice tool becoming part of a dealer groups’ sales process. This has real merit and could revolutionise financial advice in Australia based on the principles of customer centricity, connectivity, contemporariness and compliance.

Adviser led robo-advice tools could help to close the gap around perceived quality of advice. The ASIC report 279 - Shadow Shopping Study of Retirement Advice found that 39% of advice examples were poor and failed to meet the requirements of S945A. Yet, in the same study, 86% of mystery shopper participants felt they had received good quality advice. From ASIC’s standpoint, adviser-led robo-advice tools could significantly improve the quality of advice. If customers continue to rate quality highly and ASIC starts seeing measurable improvements, the wealth management industry and financial advice profession will benefit in the long run.

Jeroen Buwalda is EY’s Asia-Pacific wealth and asset management advisory leader.

The views expressed in this article are the views of the author, not Ernst & Young. The article provides general information, does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Liability limited by a scheme approved under Professional Standards Legislation.