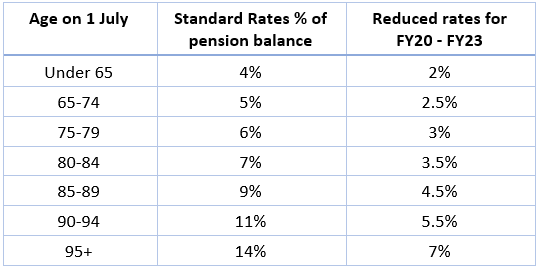

Pension paying super funds are required by the government to make minimum annual pension payments essentially to ensure they are being used to provide a retirement income rather than just being used as a tax-advantaged method of building wealth for beneficiaries. If a super fund, including SMSFs, fail this minimum pension test, they lose concessional tax treatment, and the tax rate reverts to the normal 15% rate applicable to accumulation superannuation accounts rather than the 0% applicable to a pension paying fund.

Many in retirement live a reasonably frugal lifestyle and those with large super balances find themselves with excess cash coming in each month. This will likely be exacerbated from 1 July 2023 if the rates revert to normal after three years of half rates. Just getting older exacerbates the situation as the required pension drawdown percentage increases.

The minimum pension drawdown

Consider a retiree couple that has $1.7 million each in pension mode in super, making it $3.4 million in total. They are both 76 years of age, which means they are each currently required to draw a minimum of 3% per annum from their super to fund their super pension, or $102,000. This is tax free income to them.

From 1 July 2023, the required minimum pension drawdown is likely to revert to 6% for a 76-year-old, after which the couple must make combined payments of at least $204,000 from their super for the 2023/24 financial year.

When the couple reaches 80 years of age, the standard rate increases again to 7%. If the pension balances for a couple managed to be maintained at $1.7 million each, the required combined pension payments amount to $238,000, tax free.

Due to indexation, those who start a pension from their superannuation after 1 July 2023 may have a pension account limit of $1.9 million, or up to $3.8 million for a couple. From this, they could be required to draw $190,000 per year at 5%, or $266,000 at 7% if they are over 80. This is after tax income to them.

Equalising superannuation balances

Since pension account caps were introduced from 1 July 2017, at a rate of $1.6 million per individual, it has made sense for those couples with large superannuation balances to aim to equalise their superannuation accounts or at least build each towards the $1.6 million limit. Prior to this, when pension accounts were not limited, there was no major incentive to do so. Due to contribution limits and limitations, equalising member accounts has been fraught with complication.

The requirement to pass a work test to contribute was often a difficulty. The removal of this for those aged between 67 and 75 for non-concessional (non-tax deductible) contributions from 1 July 2022 has certainly simplified the process of evening out superannuation accounts between a couple.

For example, for a couple in their late 60s early 70s where one has a $3 million balance and the other has a $1 million balance, the higher balance member could withdraw $110,000 (to be indexed) each year tax free, gift it to their spouse who then makes a non-concessional contribution to their superannuation account. Over time, the lower balance member can build towards the current limit of $1.7 million (to be indexed). This way a greater proportion of the couples combined superannuation can qualify to be placed in tax-free pension mode. It is also permissible to turbo charge the reallocation by doing a triple contribution in a given year, then sitting out the next two years.

As with all superannuation contributions, care needs to be taken to get it right. SMSFs can be handy when extra flexibility is sought and to enable easier access to withdrawals and contributions.

Where to put the excess from your pension drawdown

A retired couple can live a comfortable lifestyle with a mandated yearly pension drawdown and still have plenty of money to spare. So what can they do with that money?

An alternative could be to set up another non-superannuation investment account – either in joint names or, if there is other substantial wealth, in the name of a family trust or investment company. The pension payment can then be paid to that investment account and the couple can draw only what they need and invest the remaining balance. Depending on whether they have any other taxable income, investment earnings could attract very little tax due to the individual’s tax-free threshold.

The decision as to the name in which the portfolio is held will depend on a number of factors. For example, a personal or joint portfolio will be the simplest, but doesn’t provide asset protection or tax benefits. Income is just taxed at the individuals marginal tax rates. A tax return may need to be lodged in the future whereas maybe this hadn’t been required prior to the portfolio being established.

For larger portfolios it can be useful to use a structure, a family trust or a personal investment company, to house portfolios that can’t be added to a superannuation account due to limits imposed thereon. Family trusts and investment companies can be flexible and can add tax efficiency and asset protection advantages. However, there is a cost involved in preparing annual accounts and tax returns.

This strategy of having a secondary investment portfolio can be particularly useful when one spouse dies, and a large lump sum superannuation death benefit may be paid out. This death benefit can also be added to the non-super portfolio.

Some wealthy retirees also use the spare income to assist their children or grandchildren. Using a tax-free superannuation pension income is a great way to fund the part payment of a grandchild’s non tax-deductible school fees, for example.

You may even wish to donate more to your charities of choice and get to see the benefits conferred, rather than leaving bequests as part of your estate planning.

Whatever you do, all the money accumulated over a working life should be doing something useful, and not just sitting idle. You’ve worked hard for your money, and now that you’re in retirement, make it work for you.

Michael Hutton is a Partner of Wealth Management at HLB Mann Judd, Sydney. This article is general information and does not consider the circumstances of any individual.