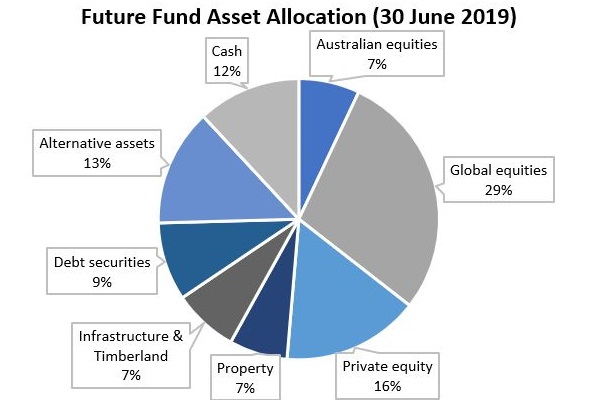

The latest update on the Future Fund's portfolio shows an asset allocation that differs from almost everyone else, and certainly most SMSFs. The stark variations versus individual investors are the heavier allocation to global instead of domestic equities and significant investments in private equity, debt securities, alternative assets, infrastructure and timberland.

We explore the Future Fund's investment strategies and the lessons individuals can learn, although its claims about low volatility are as much about unlisted assets as a measure of risk.

A standout feature is a move into different fixed income assets, including direct lending, emerging market debt, peer-to-peer lending, trade finance and bank capital relief financing. Director of Debt, James Waldron, told an Investment Magazine conference:

"It's a reflection of where we see value, where we see diversification and the types of risk premia we desire at the fund level as opposed to just wearing a credit hat."

Also on asset allocation, Gemma Dale reveals the share trading preferences of nabtrade clients, with a switch underway versus patterns of the past.

For those looking to equities to cover the loss of income on cash or term deposits, Michael Pricewarns it is not a process of simply maximising dividends and there are risks to manage.

Investing in a major demographic theme, Mike Murray identifies four companies on the ASX which are benefitting from increased spending on healthcare by an ageing population.

Ashley Owen explains why the results in the latest August reporting season were disappointing. It reflects Australian GDP which grew at only 1.4% in 2018/2019, the lowest since the GFC.

And Craig Day gives valuable pointers on how to maximise superannuation benefits by equalising balances within a couple. New rules on super means there's a lot to gain from some simple steps.

Cuffelinks gains thousands of new readers each year who may not know about our massive archive of articles. As a reminder of the new section in the middle of our website with Classic Articles from the past, we highlight one of the most popular by Chris Cuffe based on his decades of investing experience. We will rotate these classics online each week so take a look.

To mark Vanguard's 10 years of offering Exchange Traded Funds in Australia, this week's White Paper is their 'Roadmap to Financial Security: a framework for decision-making in retirement'. It's a great planning primer for anyone thinking about or in retirement.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.