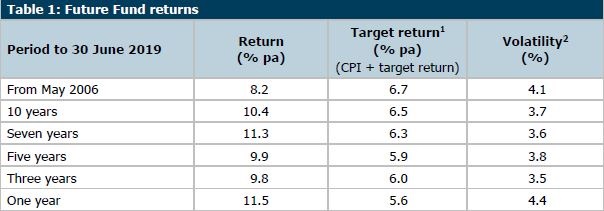

Established in 2006, the Future Fund is Australia’s sovereign wealth fund with assets now over $160 billion. The original seed capital was only $60 billion with no further contributions, demonstrating the power of compounding at 10.4% over the last 10 years.

In 2018/2019, the industry-wide rate of return for large super funds was 7.3%, with the top few almost achieving 10%. The Future Fund returned 11.5%. It’s worthwhile understanding how the Fund has delivered these impressive results.

Investment process

The Future Fund employs what is known as a ‘total portfolio approach’, with a strong focus on risk and return at the overall portfolio level. The Fund has developed an ‘Equity Equivalent Exposure’ where risk in all asset classes is measured in terms of an equivalent equity ‘beta’ or market risk.

The Fund operates under a set of fundamental beliefs which guide the way it invests, including:

- Expected returns and risks vary over time and therefore the amount of risk taken should also change over time.

- Higher expected return per unit of risk can be obtained from diversification.

- Investment risk is not captured by a single metric and additional risks must be assessed and managed.

To construct the portfolio, the Fund combines top-down views with bottom-up research. Top-down analysis involves forming opinions about the global economy, financial markets and geopolitics. Bottom-up analysis identifies attractive investments with compelling reward for the risk taken.

There is no fixed strategic asset allocation and therefore the portfolio is dynamic. In times of perceived favourable market conditions, the Fund is likely to increase allocations to riskier asset classes such as equities.

Asset allocation

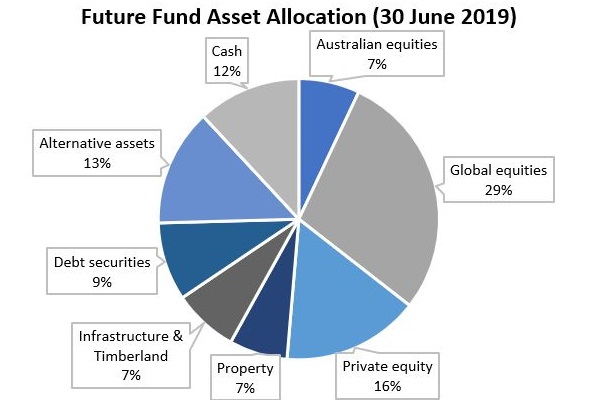

The Future Fund’s asset allocation reveals sizeable investments in private equity and real assets. As a long-term investor, private equity may help maximise returns by capturing an illiquidity premium and giving exposure to themes not available in liquid markets, such as disruptive companies or restructurings. Elsewhere, investments in infrastructure and timberland provide inflation protection and portfolio diversification. In fixed interest, the Fund has ventured into private debt, peer-to-peer lending, trade finance, bank capital instruments and distressed debt.

The Future Fund has historically employed a ‘barbell’ strategy, meaning there is a considerable allocation to cash but also a sizeable exposure to riskier strategies. Holding cash allows the fund to be opportunistic and buy cheaper assets in times of market corrections.

In stark contrast to SMSFs, the Fund has a much larger allocation to global equities (29%) than Australian equities (7%). The Future Fund’s asset allocation as at 30 June 2019 was:

Alternative strategies (such as relative value or macro-directional ‘hedge fund’ techniques) give exposure to a diversified set of markets to provide uncorrelated income streams and help manage risk.

Performance over time

The Fund has consistently outperformed its benchmark target return of CPI + 4.5% to 5.5% pa until 30 June 2017 and CPI + 4% to 5% pa thereafter.

Source: Portfolio update at 30 June 2019, Future Fund

Risk and its measurement

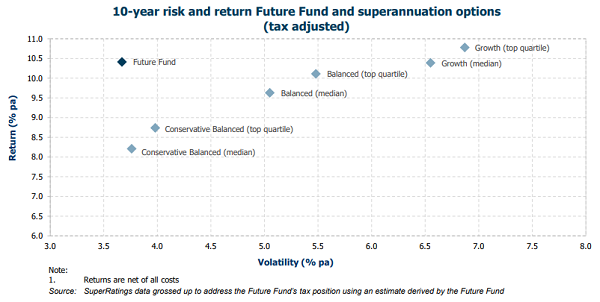

It is in the measurement of risk that the Future Fund’s numbers demand scrutiny. Measuring return against volatility, the best place in the following chart is the top left corner. The combination of low volatility and high returns is ideal. The Future Fund claims it takes about half the risk of a median or top quartile growth fund with equal returns.

In fact, the Future Fund's Chief Investment Officer, Raphael Arndt, told The Australian Financial Review: "The story is in the risk and not in the return.”

How does it make such good returns with less risk? Acting in its favour is the relatively high proportion of assets held in unlisted markets, which are not revalued as regularly as listed. Assets such as private equity (16% of portfolio), alternative assets (13%), and any unlisted property (7%) or infrastructure and timberland (7%) which are revalued less frequently than daily market movements create a perception of a lower level of price volatility. Eventually, however, there is no difference in the value of an airport or toll road whether it is listed or unlisted.

Sam Sicilia, Chief Investment Officer at Hostplus, tweeted (in his personal capacity) in response to the report:

"The problem is using volatility as a measure of risk. It is NOT. Unlisted assets cannot be valued frequently, so their Vol is mostly zero. Hence nonsensical use of Vol for those assets. But that’s not a case against unlisted assets, it’s a case against Vol as a risk metric."

Nevertheless, the results are impressive. They made some good calls with a more defensive stance early in the financial year then more aggressive into 2019. They allocated to hedge funds where the results are not dependent on market direction. Even the defensive assets such as long bonds performed well. Infrastructure and property delivered further strength on the back of falling bond rates. The Fund carries high exposure to an asset class that is difficult for smaller investors to both assess and access: private equity allocations, especially venture capital. Finally, global equity markets performed well. The Future Fund keeps its costs down in equities by using factor indexes rather than paying active fund managers whose style might simply be capturing a market ‘factor’, offsetting the high cost of its ‘alternative’ strategies.

The Fund does not reveal returns by asset class, but the amount in private equity increased by about 24% over the last year, suggesting either strong returns or greater allocations, or both. Three former staff members have set up a new private equity business called Potentum Partners, and they claim to have generated net returns over 10 years of 17% plus.

Lessons for individual investors

Of course, replicating past investment success with a similar asset allocation is no guarantee of future performance as market conditions will be different. Even the Future Fund expects lower future returns from its strategy. And some assets are simply not available to retail investors.

Nevertheless, the experience of the Future Fund offers investors valuable lessons in long-term investing.

1. Diversification is key

A diversified portfolio enables an investor to maximise returns for a given level of risk. Investing in a set of uncorrelated income streams can help to manage risk and make a portfolio less 'volatile'.

The Future Fund thinks about its entire portfolio as one risk position. High cash holdings allow for market exposure elsewhere, while alternatives might have low expected correlation to equities. A heavy fall in one sector should not severely damage the portfolio, although obviously losses are possible. In extreme markets, correlations can rise quickly and there are few perfect hedges.

While it can be easy to find attractive standalone investments, it is more difficult to construct a coordinated portfolio of individual bets.

2. Identify your risk tolerance and competitive edge

As a long-term investor with patient capital, the Future Fund can accept short-term market volatility and focus on identifying investments likely to perform well over the long run, such as private equity and infrastructure.

Retail investors with the right mindset can have competitive advantages of their own. For instance, they do not need to worry about the performance of benchmarks and peers and instead can focus on generating absolute returns within their own financial plan and risk tolerance. A 50-year-old investor can plan for a 30- or 40-year investment horizon if they have the patience.

In reality, many retail investors panic when markets fall and cannot take advantage of a long-term horizon.

3. Cash provides optionality

While cash is typically the lowest-returning asset class, it gives the ability to take advantage of market dislocations or attractive opportunities as they arise. When markets are oversold, investors can opportunistically deploy capital at attractive prices.

4. Don’t overpay for something you can obtain cheaply

The Future Fund identified which of its asset managers were delivering what they call “lazy risk premia strategies such as momentum” and cancelled their mandates. That is, an active manager may be charging fees to deliver a return which is easily replicated in a ‘smart beta’ index for a much lower cost.

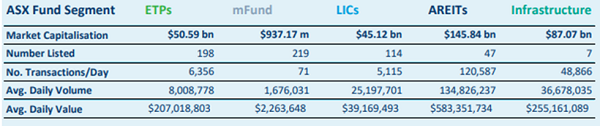

The main equivalent for a retail investor is an active manager charging 1% to hug the market index. This shows up in low tracking errors, where results always follow the market. It is now easy for any investor to replace such ‘index huggers’ with a cheap index fund or Exchange Traded Fund (ETF) in either listed or unlisted form.

5. Find non-traditional sources of return

Until recent years, it was difficult for retail investors to access alternative assets such as corporate bonds, securitisations, infrastructure, long/short funds and smart beta. The available range has dramatically expanded with hundreds of funds listed on the ASX, accessible in the same way as any listed share (except for mFunds which is an execution service for unlisted funds).

For a large list of reports on ETPs and Listed Investment Companies (LICs) in many different guises, see our Education Centre on the menu bar of our website.

These two articles in Cuffelinks, for example, explain dozens of ‘non-traditional’ investments available to retail investors in listed markets:

It must be emphasised, however, that these are general lessons and it would be impossible for an individual to replicate the Future Fund portfolio.

But a warning, dynamic asset allocation is tough

The Future Fund argues it can enhance returns by market timing and dynamic asset allocation. Even the best market professionals struggle to achieve this consistently, and retail investors are warned that switching investments in anticipation of market moves has brought many strategies undone. Let’s leave the final words to two investment legends:

Warren Buffett and his offsider, Charlie Munger

"Charlie and I spend no time thinking or talking about what the stock market is going to do, because we don’t know. We are not operating on the basis of any kind of macro forecast about stocks. There’s always a list of reasons why the country will have problems tomorrow.”

Ray Dalio, Founder of Bridgewater Associates

“You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.”

Graham Hand is Managing Editor of Cuffelinks. Thanks to Wilbur Li for his research assistance. This article is general information and does not consider the circumstances of any investor.