The FTX story has a bit of everything. Fraud, greed, lust, political connections, a relatively new concept in cryptocurrency, wealthy families, large financiers considered ‘masters of the universe’, suckers, the Bahamas and multiple other locations of business subsidiaries. That’s not to mention the employees and average investors who’ve been caught up in the downfall. Also, the lawsuits and court drama which are no doubt to follow. Knowing America, books and movies on the subject are already in the offing.

For Australian investors, it might seem the drama is too movie-like to have any relevance to them. However, I think there are many lessons to take away from FTX. Some obvious; others not-so-obvious.

Obvious lessons

Some of the key lessons include:

Ideas don’t make investments. The idea of a cryptocurrency exchange may appear like a great idea. What’s not to like about taking fees via a trading platform in the then hottest idea going around? There are lots of ideas for businesses; many of them are sound ones. Ultimately, though, business is all about execution, and FTX had none of that.

Do due diligence. A big question mark hangs over the funds which invested in this company. One of them, Singapore’s Temasek, has defended its due diligence process saying it did eight months of work on FTX before investing. I’m not sure what work they did but it clearly wasn’t enough.

Always look at balance sheets. It’s alleged that when investors asked to see financial statements beyond profit and loss statements, they weren’t forthcoming. No wonder – they didn’t have any cash left. The lesson is that balance sheets and cashflow statements are just as important as the profit and loss.

Don’t follow the crowd. It seems likely that the funds which invested in FTX thought others had done due diligence on the company and therefore they didn’t need to do any themselves. Big error.

Be sceptical about your ‘network’. This is related to the prior lesson. I’ve previously written about how ‘networking’ and having a ‘network’ are overrated when it comes to investing and life. It’s especially the case when big money is on the line. Do your own work and be sceptical of others piling into investments.

Invest in people with a track record. This may seem obvious, and it is. But the people who invested in Sam Bankman-Fried invested in a guy who was a junior trader for three years and had no track record in anything.

Keep on top of your investments. When you invest in something, it’s not a case of set and forget’. You need to keep track of the investment. In the FTX case, Caroline Ellison, who headed the related company Alameda Research, bragged about regular methamphetamine use on social media in May last year. A red flag, one would have thought.

A less obvious lesson

There is a less obvious lesson from FTX and the cryptocurrency sector which I believe is more important than the obvious ones mentioned above. Investors should be wary when significant money is flowing into a sector. Particularly if there are a host of company IPOs in the same sector at around the same time.

The process often goes like this:

- There is a hot new idea or technology. Startups raise money, which leads to further money raising. That leads to institutions investing alongside venture capitalists. Which leads to more startups trying to raise money in the space.

- Investment banks will want a piece of the action, so companies will IPO to raise more money and/or cash in for themselves and their investors. After IPO, these investment banks will put buy ratings on companies, and more investors will pile in.

- All of which results in significant investment in the industry, and often, over-investment. That can lead to lower returns, increased regulation, investments fleeing the sector, cost cutting and eventually, industry consolidation.

This cycle has played out many times before cryptocurrency came along. There was TMT in the late 1990s and subprime lending in the US prior to 2008.

In Australia, it’s recently played out in industries such as aged care and fintech. Think about Afterpay and all the Afterpay wannabees. In essence, these are subprime lenders who’ve been marketed as extending credit to the average person.

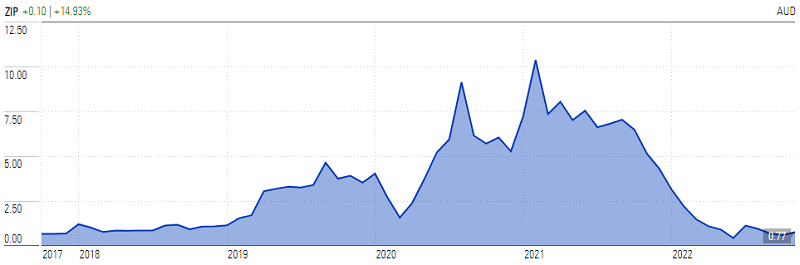

Venture capitalists piled into these digital payment providers from 2015 and a slew of companies IPO’ed on the ASX and the Nasdaq. More investors got on board and investment banks promoted their virtues with buy ratings. That got the attention of mum and dad investors. And the share prices of these companies skyrocketed.

About 12 months ago, online spending growth started to come down from the highs of Covid, the share market started to decline, and large question marks came upon these digital payment providers. Investors have since fled the sector.

Price chart for Zip Co Ltd (ASX:ZIP). Source: Morningstar

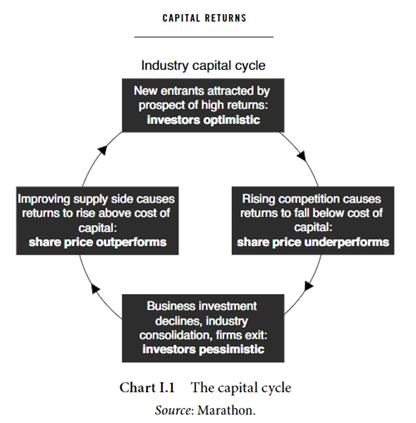

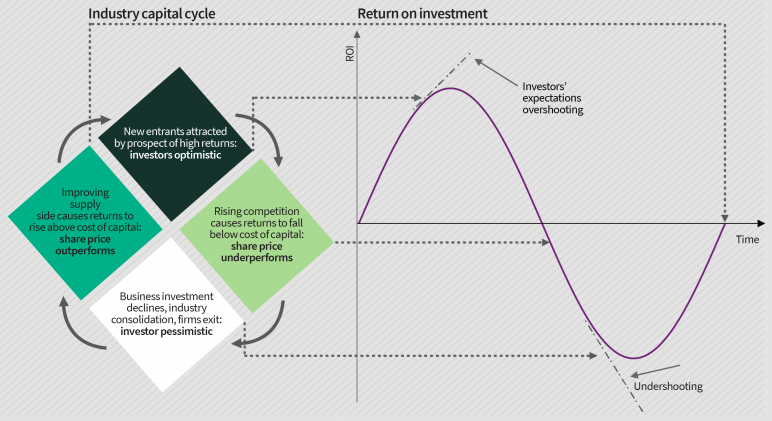

The capital cycle theory

This whole process of industry investment, over-investment and creative destruction isn’t new: it’s related to two well-known economic theories: Porter’s Five Forces and Joseph Schumpeter’s process of creative destruction.

Recently, it’s been successfully adapted to the share market by a London-based funds management firm called Marathon Asset Management and given a name: the capital cycle theory. The firm’s capital cycle theory has gained a wider following after the publication of two books on the subject (Capital Account and Capital Returns) by well-known finance author Edward Chancellor.

In the book, Capital Returns, Chancellor provides a hypothetical example of the capital cycle theory at work:

“Here’s how the capital cycle works. Imagine a widget manufacturer — let’s call it Macro Industries. The firm is doing well; so well, that its returns exceed Macro’s cost of capital. The firm’s CEO, William Blewist-Hard, was recently featured on the front cover of Fortune magazine. His stock options are in the money, and his wife no longer complains about being married to a boring industrialist. Of the nine investment bank analysts who cover Macro’s stock, seven have buy recommendations and two have holds. The shares are trading at a price-earnings multiple of 14, below the market average. Macro’s stock is held by several well-known value investors.

Macro’s strategy department anticipates strong demand growth for its products, especially in emerging markets where widget consumption per capita is less than one-tenth the level found in the advanced economies. After discussions with the board, Macro’s CEO announces his plans to increase manufacturing capacity by 50 percent over the next three years in order to meet growing demand. A leading investment bank, Greedspin, arranges the secondary share offering to fund the capital expenditure. Stanley Churn of Greedspin, a close friend of Macro’s Blewist-Hard, is the lead banker on the deal. The expansion is warmly received in the FT’s Lex column. Macro’s shares rise on the announcement. Growth investors have lately been buying the stock, excited by the prospect of rising earnings.

Five years later, Bloomberg reports that Macro Industries’ chief executive has resigned after longstanding disagreements over corporate strategy with a group of activist shareholders. The activist, led by hedge fund Fantastic Investment, want Macro to shutter under-performing operations. Macro’s profits have collapsed, and its share price is down 46 percent over the last twelve months. Analysts say that Macro’s problems stem from over-expansion — in particular, its $2.5bn new plant in Durham, North Carolina, was delayed and over budget. The widget market is currently in the doldrums, suffering from excess supply. Macro’s long-established competitors have also increased capacity in recent years, while a number of new low-cost producers have also entered the industry, including Dynamic Widget, whose own shares have disappointed since its IPO last year.

The market for widgets is suffering from the recent slowdown in emerging markets. China, the world’s largest consumer of widgets, has vastly expanded domestic widget production over the last decade and has lately become a net exporter. Macro is reportedly considering a merger with its largest rival. Although its stock is trading below book, analysts say there’s little near-term visibility. Of the remaining three brokerages that still cover Macro, two have sell recommendations with one hold.”

Conclusion

It’s easy to get caught up in the drama of the FTX saga and wonder how sophisticated investors got caught up in the firm’s downfall. The capital cycle theory helps explain how such events happen and what investors can do to avoid similar things happening to them.

James Gruber is an Assistant Editor at Firstlinks and Morningstar.