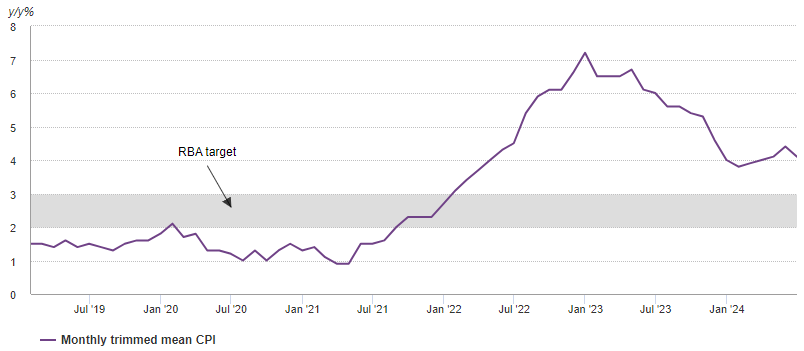

Following two consecutive months of hotter-than-expected Australian CPI prints, it was a surprise to many that June inflation eased (Chart 1). The headline June inflation (trimmed mean) came in at 4.1% y/y, down from 4.4% in May. Meanwhile, the RBA’s Q2 trimmed mean inflation figure was down to 3.9% y/y, lower than both Q1’s 4% and the consensus (4%).

Chart 1: Inflation pressure cooled marginally in June

Monthly Australian trimmed mean CPI & RBA inflation target*

* Note: Trimmed mean inflation measures are preferred by the RBA, see Consumer Price Index, Australia, June Quarter 2024 | Australian Bureau of Statistics (abs.gov.au)

Sources: Bloomberg, World Gold Council; Disclaimer

While inflation remains well above the RBA’s target range of 2-3%, signs of deceleration encouraged investors. Following release of the June and Q2 inflation data, market expectations of the RBA’s rate path took a 180-degree turn: from rate hikes to potential cuts by late 2024.

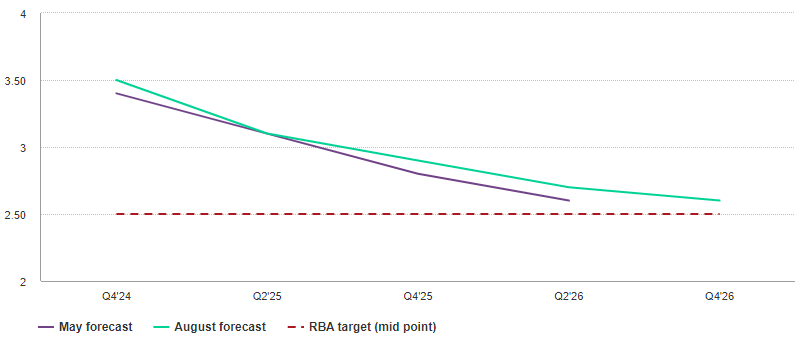

But these expectations were short-lived. The RBA monetary policy meeting on 6 August the following week dashed investor hopes by maintaining rates at their 12-year peak and stating that it expected inflation to take longer to return to target compared to prior forecasts (Chart 2). The bank cited a strong demand outlook, elevated wage growth and the still tight labour market as the main drivers behind its conclusion. At the media conference after the meeting, Governor Michele Bullock mentioned that there would be no cut on the agenda for the next six months and that the RBA will remain open to further tightening due to the upside risks of inflation.

Chart 2: The RBA expects inflation to remain above target for longer

RBA forecasted CPI and RBA inflation target*

*Based on RBA monetary policy meeting materials in May and August.

Sources: Reserve Bank of Australia, World Gold Council; Disclaimer

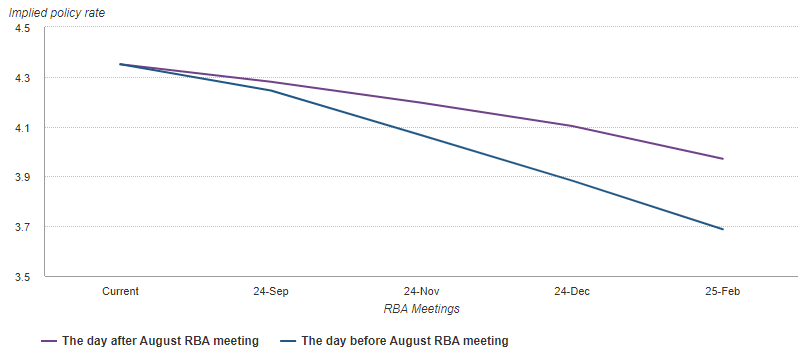

As a consequence, future rate path expectations in Australia have changed yet again. As shown in the below chart, the overall curve of future interest rates priced in by investors has shifted up notably (Chart 3).

Chart 3: Investors delay expectations of RBA rate cuts

Policy rate implied by cash rate futures on 5 August and 7 August

Sources: Bloomberg, World Gold Council; Disclaimer

What does this mean for Australian portfolios?

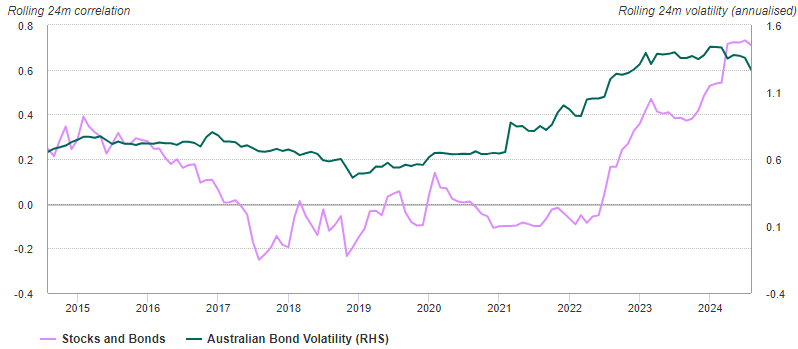

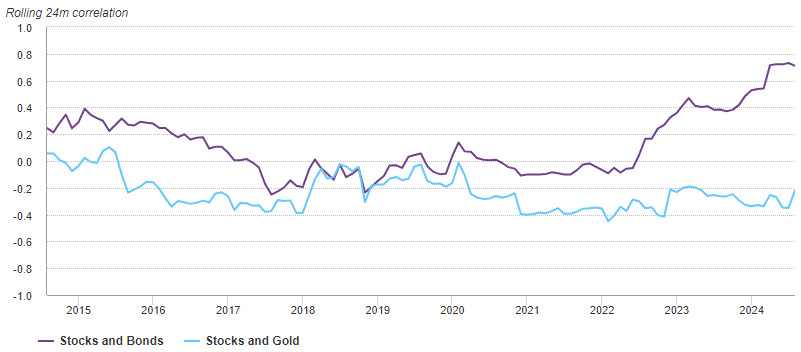

We believe that these events have two main implications. First, in the near term, when upside risks of inflation remain elevated, the correlation between bonds and equities is likely to stay high. We have been witnessing such a pattern between 2022 – when the RBA started hiking – and now (Chart 4).

Second, government bonds yields may become volatile depending on the course of inflation and on how much the central bank’s sentiment shifts – similar to the pattern we have seen recently. While local bond volatility has already been pushed to a multi-year high, the aforementioned uncertainties may keep it elevated.

Chart 4: Heightened bond volatilities and a very high correlation between bonds and equities*

*Monthly data based on ASX/S&P 300 Index, Australian 10-year Government Bond Index and 10-year Australian Government Bond Yield between July 2014 and July 2024.

Sources: Bloomberg, World Gold Council; Disclaimer

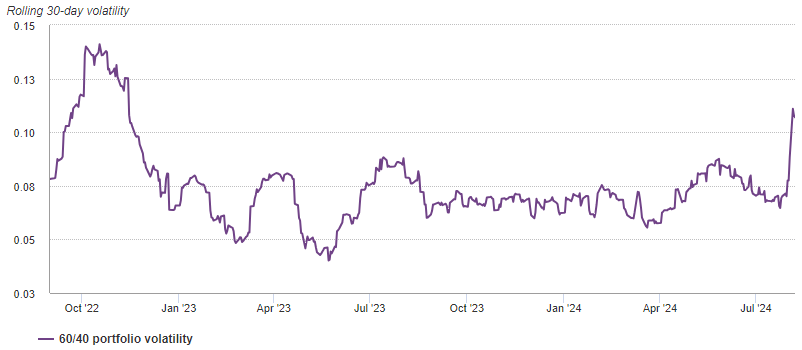

This will likely have implications for Australian portfolios. Recent rapid changes in yields, amid notable shifts in rate expectations and the turbulence in equities, have led to a volatility surge in a traditional 60/40 portfolio (Chart 5).

Chart 5: The volatility of a traditional 60/40 portfolio has been surging

Rolling 30-day volatility of a hypothetical portfolio (60% in Australian equities and 40% in 10-year government bond)*

* Based on daily data of ASX/S&P 300 Index and Generic 1st Australian 10-year Government Bond future. As of 6 August, 2024.

Sources: Bloomberg, World Gold Council; Disclaimer

Gold as a strategic component in Australian portfolios

In the face of rising volatilities, we believe gold can provide diversification benefits for Australian portfolios. Unlike bonds, gold has demonstrated a consistently low correlation with Australian equities (Chart 6). This is mainly because gold’s valuation is not determined by any one country thanks to its diverse sources of demand – which spreads across regions and sectors – and supply.

Chart 6: The correlation between Australian equities and gold, in AUD, has been consistently low over the past decade*

*Based on monthly data of ASX/S&P 300 Index, Australian 10-year Government Bond Index and LBMA Gold Price PM. All calculations in AUD. As of July 2024.

Sources: Bloomberg, World Gold Council; Disclaimer

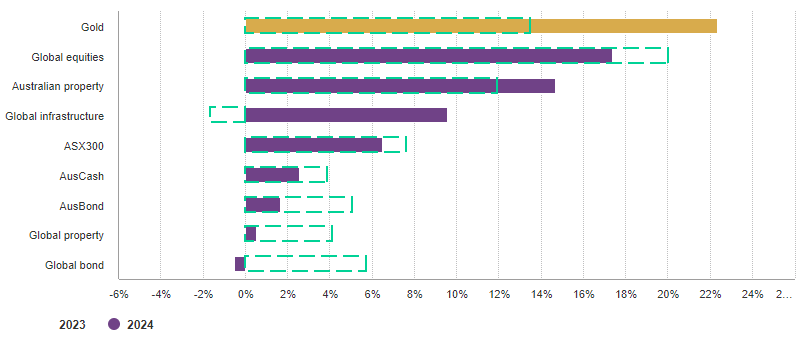

Contrary to the perception that “gold generates no returns”, gold has, in fact, been the top performer among major global and Australian assets so far in 2024 (Chart 7). Strong global central bank buying, robust Asian investment demand and elevated geopolitical risks have combined to support gold’s performance in H1. And it is worth noting that gold has generated positive returns every year since 2016, averaging 10% per year in AUD.

Chart 7: Gold continued to shine in 2024

Major asset performances (in AUD) in 2023 and so far in 2024*

*As of July 2024. Based on LBMA Gold Price PM, MSCI World Index, ASX REITs Index, Bloomberg AusBond Bank Bill Index, ASX300 Index, FTSE Global Infrastructure Index, Bloomberg AusBond Composite Index, Bloomberg Global Agg Index and FTSE Nareit Developed Index. All calculations in AUD.

Sources: Bloomberg, World Gold Council; Disclaimer

Looking ahead to H2, gold is likely to draw further support as other major central banks continue their easing policies. Already, western ETF inflows have strengthened in response. And the factors that supported gold in H1 are highly likely to continue into H2, further enhancing gold’s allure, as we explain in our Mid-year Gold Market Outlook.

Conclusion

As global financial markets witness increased volatility, geopolitical risks show no signs of abating and, in Australia, uncertainty remains about the future path of interest rates, Australian investors face challenges in their quest to effectively manage their portfolios. Gold offers a low correlation with local equities and attractive return prospects while acting as an effective hedge against geopolitical risks. As such, gold is an ideal asset to enhance return and reduce risk in Australian portfolios.

Ray Jia a Senior Research Analyst at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.