(In response to Chris Cuffe's article last week on the CGT discount).

Housing affordability continues to dominate the headlines, and as usual, there is no shortage of suggestions how to make housing more affordable. Unfortunately, most of these ideas are impractical – implementation of any of them would simply increase the ability of first home buyers to buy a home and so increase demand. The only possible outcome of increasing demand is to push prices up even further, and continue the vicious cycle.

Think First Home Savers Grant, reduced stamp duty for first home buyers, and the ludicrous suggestion currently being debated that would allow first home buyers to access their superannuation for a house deposit.

Just last week we even had the Governor of the Reserve Bank, Phillip Lowe, hinting that consideration should be given to reducing the capital gains 50% discount that is currently available for investors who have owned an asset for over a year.

My view on CGT changes

Capital gains tax (CGT) was introduced by the Hawke Keating Government on 20 September 1985 as part of a general reform of the tax system. Prior to that, tax could be levied at full marginal rates on capital profits if the ATO decided that the owner’s purpose when acquiring the asset was to re-sell it at a profit. This was a grey area, and many investors simply did not know what the taxation position would be on sale of an asset until the sale was completed and their tax returns were lodged. It was a nightmare.

There has long been general agreement that capital profits should be adjusted for inflation. This is why the Hawke Keating CGT legislation allowed investors to adjust the base cost for inflation before CGT was assessed.

But it was a different world then: interest rates were 14%, inflation 10%, and the top marginal tax rate was 60%, which cut in when income reached $35,001.

Given those numbers, it was quite a reasonable deal in 1985. The downside was that adjusting the base cost required onerous record keeping, especially with dividend reinvestment, requiring a separate cost base to be kept for each investment.

The Howard Costello Government simplified the system, effective from 20 September 1999, replacing the indexation method with what we have today – a 50% discount applying to assets held for more than 12 months.

Consider changing one year to five years

What is the logic behind calls to make housing more affordable by changing the 50% discount after 12 months? There is anecdotal evidence that some investors in Sydney are buying properties for a quick turnaround, and increasing the qualifying time for the discount may deter a few of them. But, given buying and selling expenses, you would need to make a hefty gross profit to make much real money, even with 50% off the CGT.

Being a long-time proponent of investing for the long haul, I have no problem with increasing the time that an asset may be held before the 50% discount is available. Even stretching the current one year to five years would not be unreasonable.

Faith in residential property would remain

But you are living in la-la land if you think that will make one iota of difference to housing affordability. The majority of investors in residential property are invested there because they are tired of the never-ending tinkering with the superannuation system, they do not trust shares, and they realise that money in the bank is never effective as a long-term investment. For them, residential property – usually held long-term – is the only way to go. Demand from these investors will continue until reasonable alternatives are available, which may be light years away.

Noel Whittaker is the author of Making Money Made Simple and numerous other books on personal finance. This article is general in nature and readers should seek their own professional advice before making any financial decisions. Email: [email protected].

Reply from Chris Cuffe

The key premise of my article is that adjusting CGT for indexation is more equitable than a simple discount factor. It was not meant to say that if you do this one single measure, it will DEFINITELY cool the housing market. Housing affordability will need a range of policy issues, but this would be one less reason for investors to use tax as a motivation for buying property.

I repeat the quote in the article from a leading tax expert in Treasury:

“The concessionary treatment of capital gains income is arguably the primary motivation for financial investment in negatively geared real estate, which aims to shift all of the investment return into the capital gain on the eventual sale of the asset.”

I would expect that if the CGT discount was changed to indexed gain AND negative gearing was restricted to the said property income (ie can’t reduce other income) THEN there would be a material amount of heat taken out of the market.

Following my article, I was referred to some research called ‘Mythbusting tax reform’ by Deloitte, and its detailed analysis of the CGT concession. A table and a chart are worth highlighting.

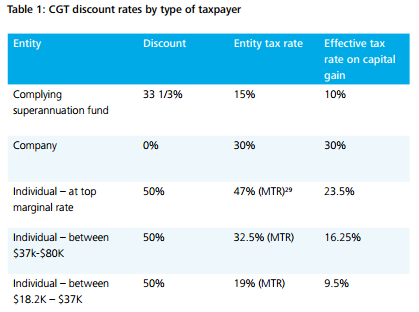

In the words of Deloitte: “Table 1 shows there are really big incentives for some taxpayers (such as high income earners) to earn capital gains, versus little incentive for others (such as companies).”

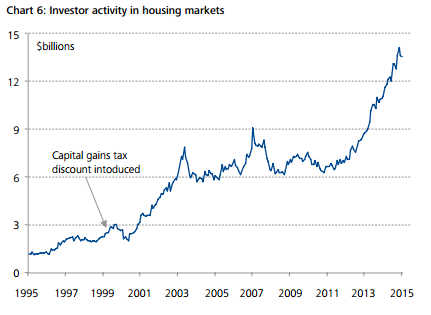

Chart 6 shows the rapid rise in investor activity in housing markets since the discount was introduced. Deloitte also shows that those earning more than $180,000 a year receive a larger share of net capital gains.

Deloitte concludes on CGT: “The discounts Australia adopted back in 1999 assumed inflation would be higher than it has been – and so they’ve been too generous.” Exactly my point.

If it’s true, as Noel says, that changes to the tax treatment would not change investor demand, then at least the budget would be improved by increased tax collections.

I’m also not as convinced as Noel that investors are only interested in residential real estate, as if it had no competition from other investments. Flows into managed funds are massive at the moment, motivated by investors having a last grab at the higher superannuation caps before the 1 July changes. Products such as ETFs and LICs are experiencing strong growth. ETFs in Australia had net inflows of $467 million in February 2017 alone, and there are three new LICs in the market hoping to raise a combined $1 billion. Additional boutique fund managers are still being launched every week, and share market investors have experienced excellent returns with lower volatility in recent years. I’m not doubting people are worried about global macro trends, but nevertheless, investors have driven the world’s largest exchange to an all-time high.