(We have left this article unedited despite the Coalition losing the 2022 election because it canvasses the issues on early access to super and home ownership, while the proposal to lower the age for downsizer was supported by Labor).

Following the announcement of the new Coalition policy to allow withdrawals from super to buy a first home, leading economist Saul Eslake wrote in Crikey:

"We now have almost 60 years of unambiguous and unequivocal evidence telling us that anything that allows Australians to pay more for housing than they otherwise would - first homeowner grants, stamp duty concessions, mortgage deposit guarantee schemes, shared equity schemes, preferential tax treatment for property investors, and indeed lower interest rates or reductions in credit standards - results, primarily, in higher house prices rather than higher rates of home ownership."

Another policy modification will reduce the age to 55 for making downsizer contributions to superannuation.

There is an unintentional symmetry in these two policy initiatives whipped up in the final week of the 2022 election campaign. First home buyers can take money out of super to buy a home from older owners who can put the money back into super.

Saul Eslake estimates the purchasing power for a couple may rise $500,000 (based on taking $100,000 from super adding to a deposit and borrowing four times as much), making it feasible to pay $500,000 more for a home which is almost the amount that an older couple can add to super.

It's a potential transfer of super from younger to older generations, regardless of how much the latter already holds in this tax-advantaged environment. Older, wealthier people with more in super and younger people with less ... is that what super schemes should facilitate?

It's your money

A week out from the election, Prime Minister Scott Morrison found a ‘wedge’ policy, something Labor will not match, giving him a point of contention with an “It’s your money” theme many aspiring homeowners will like.

The election campaign proves again that superannuation is never far from the headlines of Australian politics, especially when combined with the hot topic of housing. However, a deeper look at the changes shows the debate is barely worth the profile as a major issue in the final days. The policy will help a small number of people to own a home sooner compared with genuine initiatives to make home ownership more affordable over the longer term.

Details of the two new superannuation policies

Let's look closer at the two so-called ‘gamechanger’ policies.

1. First home buyers can withdraw up to $50,000

The new policy allows first home buyers to withdraw up to $50,000 from super provided it is less than 40% of the super balance, requiring $125,000 in super to draw the maximum. Money taken out must be put back when the house is sold, including a proportion of capital gain.

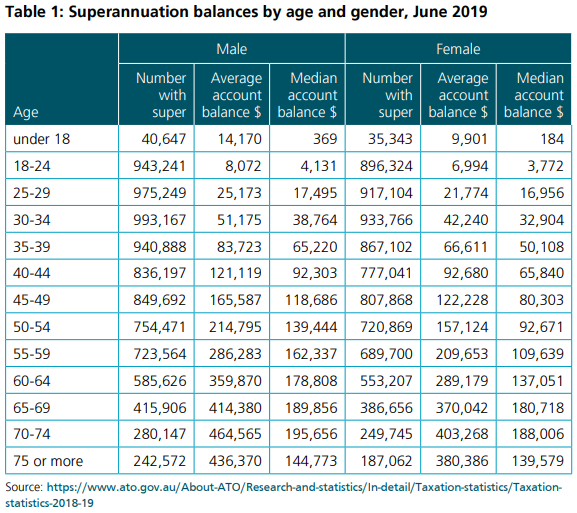

The ASFA table below shows average super balances for people aged 30 to 34 are between $51,175 for men and $42,240 for women (it's from 2019 but the latest available). It's only when men are over 40 and women are over 45 that average balances exceed $120,000. With a 10% super guarantee, a person earning a healthy $100,000 putting $10,000 a year into super compounded at 5% annually would take 10 years to reach $125,000.

On the campaign trail, Scott Morrison has issued many statements about offering flexibility and choice with super: “This is about increasing the choices available to you, with your super. It’s your money.” He told Tracy Grimshaw on A Current Affair, when she said super is for retirement: "I’m sorry, it is their money. It’s not owned by the super fund, it’s not owned by the government, it belongs to them."

Criticisms came from many quarters, especially within the superannuation industry, due to:

- Upward pressure on house prices

- Loss of superannuation intended to fund retirement

- Possible extension to other worthy schemes, such as buying an electric vehicle or starting a business.

There is already a First Home Super Saver (FHSS) scheme which allows voluntary super contributions of up to $15,000 each financial year and from 1 July 2022, up to $50,000 can be released. That means a couple could take up to $200,000 from super. Compulsory contributions under the SG are not included.

It is also already possible to purchase an investment property with superannuation funds (such as through an SMSF) but members are not permitted to live in it.

Many younger people will withdraw money from super if given the chance. The Government allowed access to up to $20,000 at the start of COVID. Qualification was relatively easy and almost $38 billion was released based on 4.8 million applications.

However, superannuation was designed to provide money to live on in retirement, which is why there are complex preservation rules that allow some access at 55 but most must wait until 65. By invoking an 'it's your money' philosophy, the Government is undoing the original principles of superannuation. Mr Morrison said that superannuation belonged to Australians and “We’re not going to tell them what to do with it, they’ll make their own decisions”.

This is a false claim to justify the policy. Other than in limited cases, superannuation is locked away for retirement until a Condition of Release is met. We do tell people "what to do with it".

2. Allow people over 55 to make downsizer contributions

The Prime Minister also announced that the Coalition will allow Australians aged 55 and over to contribute up to $300,000 ($600,000 for a couple) to their superannuation when they sell the family home. This contribution is not subject to the usual cap on superannuation amounts.

In fact, the money does not need to come from the sale. A house can be sold for $1 million and another bought for $1 million, and a couple can put $600,000 into super from another source.

It is a variation on the existing downsizer contribution which currently applies for people aged 65 years or older, but the eligible age is moving to 60 on 1 July 2022. The new rule extends this to the age of 55. It looks like an election gimmick as the agreed move from 65 to 60 is not even effective yet.

This ability to increase super has been a good benefit for older retirees. Since 1 July 2018, downsizer contributions totalling almost $10 billion have been made into tax-advantaged retirement savings vehicles.

This policy is likely to be used by retirees who are not receiving the age pension as the net proceeds from the sale of a home transfers capital into super, which is measured in the age pension eligibility test. It is of best use to people with over $1.6 million in super who currently cannot make additional non-concessional contributions.

But it adds little to retirees below the cap. Using the bring-forward rules, from 1 July 2022, someone aged 55 could put $330,000 into superannuation every three years already. They could sell their house now and put it into super.

So this policy is helping the already-wealthy with large super balances who will be able to protect another $600,000 from high marginal tax rates.

Home versus super in retirement

Many economists warn that further releases to buy homes will add to property prices. For example, CPA Australia’s General Manager, Jane Rennie, told the AFR:

“We caution against implementing any demand-based solutions that may inflate house prices further, such as the Coalition’s Super Home Buyer Scheme or Labor’s Help to Buy policy. We don’t support the use of mandatory superannuation contributions for purposes which are unrelated to retirement savings, like home ownership."

However, buying a home does contribute materially to financial independence and ultimately retirement saving. Although superannuation comes with significant tax benefits, so does owning a home, especially in retirement. The family home is excluded for eligibility for the age pension and also capital gains tax and other social security rules.

When the industry body, ASFA, quotes its retirement standards for modest ($38,997) or comfortable ($59,837) annual incomes, it assumes retirees own their own home and are in good health. It is a massive step to financial security for people to own their own house rather than rent when they no longer earn a salary.

Scott Morrison is correct that helping people buy a house is a major retirement issue. He said:

“The best thing we can do to help Australians achieve financial security in their retirement is to help them own their own home.”

What he refuses to acknowledge, which even Superannuation Minister Jane Hume conceded, is the extra purchasing power may be eaten up in higher prices. The measure is yet another demand-side initiative. The McKell Institute estimates that buyers accessing an additional $40,000 from their super will add between $31,000 and $100,000 to prices depending on the capital city.

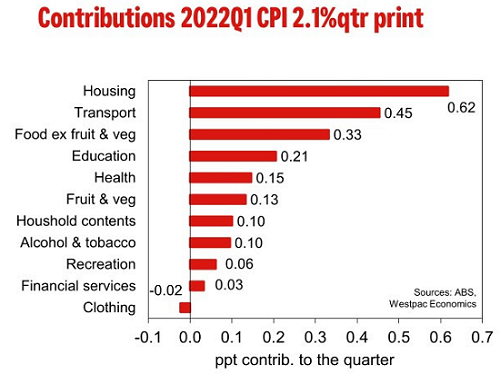

Another possible impact is further fuel on the inflation fire, and the Westpac table below shows a major factor in the recent spike in inflation was housing costs. While interest rates are rising at the moment and pushing prices down, this policy is not due to come into effect until 1 July 2023 when the rate rise cycle may have paused.

The devil in the detail

As a policy announcement rushed out in the last week of the campaign, many questions remain unanswered.

1. Does a person need to record the value of the share of the home belonging to super to ensure the amount in super for retirement is accurate?

2. What is the process of allocating the super fund's share, given the vast number of major and minor improvements made to a family home over decades? Will there be a deduction on the improved value for the cost of a new fence, paving the courtyard or replacing the lights?

3. What are the reporting obligations? How will the ATO ensure the correct value is returned to the super fund in 30 years?

4. Will the amount returned to super be exempt from all contribution cap rules in the relevant year?

5. How will the policy affect labour mobility and future house purchases when sale proceeds are not available for the next rung on the housing ladder?

And watch for property spruikers promoting super access as a way to enter an overheated market.

At some stage, it would not surprise if the monitoring and measurement complications remove the need to return the money to super, or at least allow a rollover to another home.

A two-tier opportunity?

For most people, home ownership in retirement is vital for security and wellbeing, and policies should assist this goal. Many young people will be happy to trade off future super balances for earlier home ownership.

Whether it is financially beneficial depends on a complex mix of rates of return on super versus house prices, costs of renting, borrowing expenses, relative taxation treatments and social security implications. Buying a home also comes with significant leverage. In Australia where leases are short and renters are regularly moved out at little notice, there is considerable 'psychic income', as economists call it.

But it’s likely the first home owner policy is another step to inequality in housing and superannuation balances. Eslake goes as far as saying the policy will be:

"Greeted with despair by first home buyers who will see it rightly as pushing their dreams further out of reach."

The average age of a first home buyer is 36, and they make up about 30% of the market. For those with the average super for a 30- to 34-year-old of about $50,000, access to 40% or $20,000 will not help much towards the average house costing $1 million, even if doubled for a couple. This policy will not bring lower-paid workers or those without substantial other savings into the system.

However, a couple earning more money, perhaps a little older, might have $100,000 each in super and can access $40,000 each or $80,000. This is a decent boost to add to their own, say $120,000, giving a deposit on a $1 million home. Borrowing capacity is also enhanced by a larger deposit.

But this wealthier couple was already well on their way to owning a home, so it's likely to purchase was brought forward. The policy has no income or property value caps. As Crikey revealed, the 1998 budget measures paper reported:

"A superannuation for housing scheme could not be targeted efficiently to those individuals who would not otherwise achieve home ownership before retirement. It would also reduce retirement incomes and national savings."

The question is whether there are enough of these people that prices will be driven up. A particular risk appears around 1 July 2023 when additional buying power is injected into the home market in a particular segment.

Add the relaxation of the downsizer age to policies offering broader access to the Seniors Card and cheaper medicines, Labor's dumping of capital gains tax and negative gearing changes, and the continuing favoured status of the family home, and we have another election favouring older voters. It’s as if the Government wants to transfer super benefits between generations and the older folk win again. OK, Boomer.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor, and is based on an understanding of the proposals at time of writing.