The old adage ‘time in the market, not timing the market’ is frequently used in articles like this one, with good reason – it often holds true. One of the key elements of successful investing is patience, as a long-term mindset is required to achieve investment goals. Returns in the short-term can be unpredictable and volatile, so investing with a short-term focus produces difficulties and can be counterproductive. It is easy to be fixated on the daily market movements and become distracted from long-term investment goals. It is often better to take a step back and allow investments to grow steadily over time.

Returns over different time horizons

To highlight the merits of having a long-term perspective, we assessed the historical returns after fees and tax of a ‘balanced’ superannuation strategy over three distinct time intervals: rolling one-month, rolling one-year, and rolling 10-years.

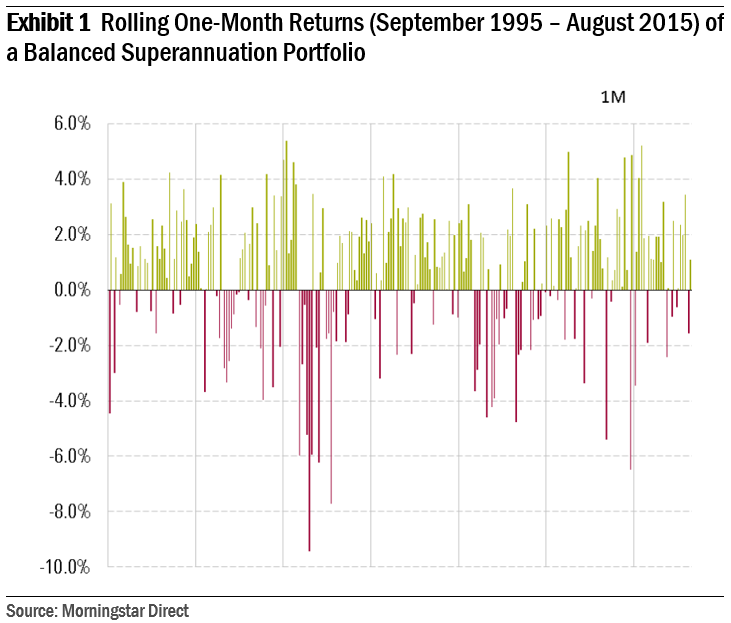

Exhibit 1 shows the rolling one-month returns or the portfolio's individual month-to-month performance. The green bars above the x-axis represent positive performance and a gain in the portfolio's value. A red bar below the x-axis represents negative performance and a loss in the portfolio's value.

There are no clear patterns or sequence to the returns. In the short-term, even a well-diversified portfolio exhibits volatile and unstable returns.

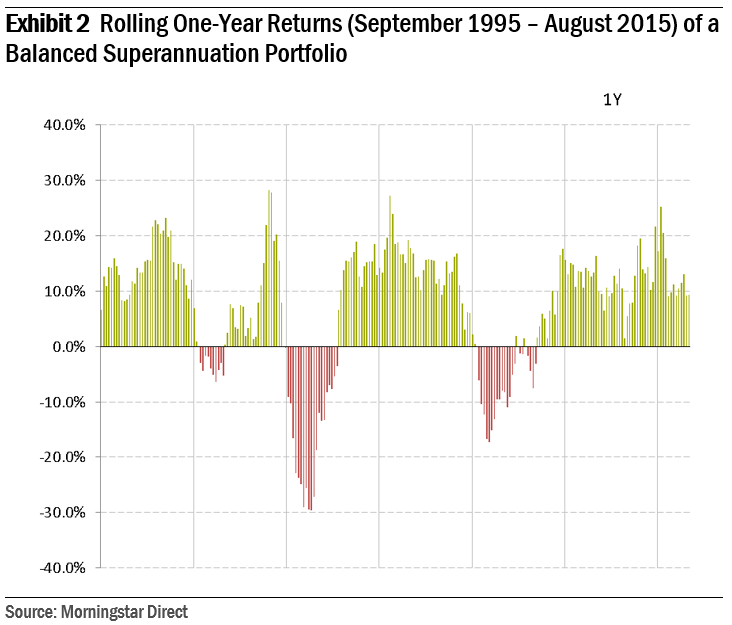

Exhibit 2 illustrates the rolling one-year returns, so each bar includes 12 months of performance.

Here we observe smoother and more persistent positive returns over time, with less frequent periods of negative performance.

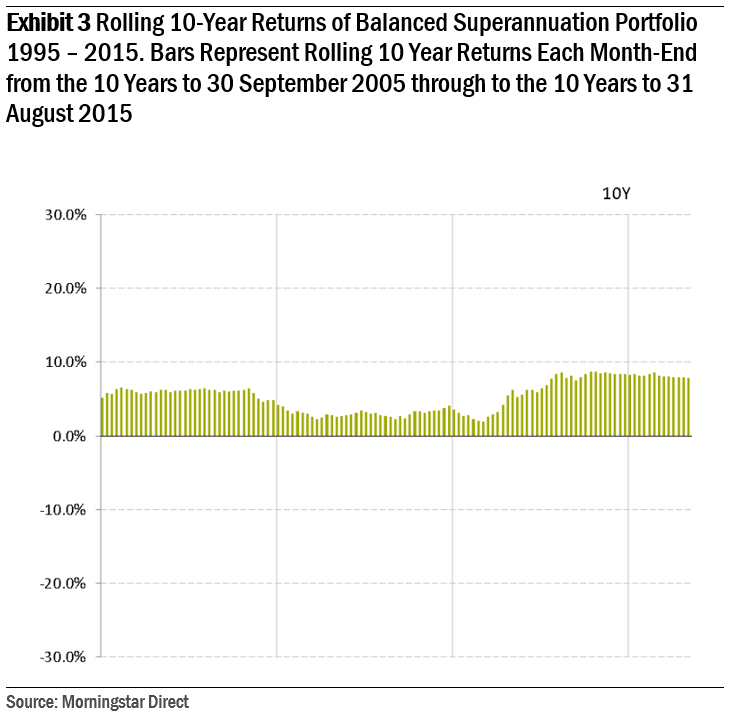

Exhibit 3 depicts the balanced portfolio's returns over rolling 10-year periods and each bar accounts for 10 years of performance. The benefits of long-term investing become apparent, with two important takeaways:

- In this period, there are no periods of negative returns, which means that no matter what 10-year period an individual was invested over, the portfolio delivered positive performance. This is because the well-diversified balanced strategy recovered from any losses or periods of underperformance within each 10-year window.

- The returns are significantly smoother and considerably less volatile compared to shorter time horizons. Investors can see past the haze of short-term market movements and focus on achieving long-term investment goals.

Peter Gee is Research Products Manager with Morningstar Australasia. Information provided is for general information only, and individuals should seek personal advice before making investment decisions. The objectives of any individual have not been considered in this article.