Like the proverbial middle child, global mid-caps tend to be overlooked and underappreciated. However, mid-caps occupy a ‘sweet spot’ - offering potentially more growth than large caps and potentially less risk and volatility than small and micro-caps.

This asset class offers excellent opportunities for investors looking for global equity exposure, and a dedicated allocation to mid-caps might go a long way to improving a portfolio’s risk and return outcomes.

What makes mid-caps so appealing?

Diversification

One of the features of the global mid-cap universe is that it is far more diversified than the large cap MSCI World index. Today, the MSCI World index is dominated by a small number of mega cap technology stocks, known as the MANAMA stocks (Microsoft, Apple, Netflix, Amazon, Meta, Alphabet). This exposes the index to a high level of risk if any one (or more) of these stocks underperforms.

In the mid-cap universe, there is no single or group of stocks that dominate, and no stock comprises more than a small percentage of the overall market. At a sector level, the market is also more diverse. This diversification offers mid-cap investors a greater breadth of opportunity, as opposed to the large cap market which is driven by those few large tech stocks, making it harder to ‘pick the winners’.

Market size

There are a number of misconceptions about the mid-cap universe and the size of the stocks that occupy it. For instance, it is commonly assumed that global mid-caps are small, illiquid, and difficult to trade. However, this is not the case.

The MSCI World Mid Cap index consists of around 900 listed companies with a market cap range of around US$1 billion to US$40 billion. Outside of this index, there are around 3000 additional listed mid-cap companies. When you compare this to the MSCI World index - which has around 1,600 listed companies in the market cap range of US$1 billion to US$2900 billion - the mid-cap market clearly offers a lot more choice.

The MSCI Mid Cap index puts the total market size of the global mid-cap universe at approximately US$8.3 trillion. Both the number of listed companies, and market size, reinforce the abundance of opportunities for investors.

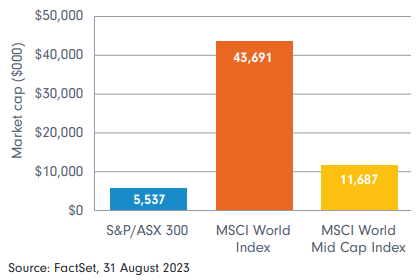

Additionally, when comparing the average market cap range of the global mid-cap index to the ASX 300, the mid-cap index has a larger average market cap (see Figure 1).

Figure 1: Average market cap of different equity indices

Despite the ASX 300 holding larger companies than the global mid-cap index, the global mid-cap index is still significantly larger on an average basis across all the companies it holds. For investors, this should alleviate any concerns that global mid-caps are small, illiquid and difficult to trade.

Low stock research

Another reason the mid-cap universe is appealing, is that it is less researched than its global large cap counterparts. With fewer analysts researching these mid-cap names, it increases the likelihood of high-quality businesses flying under the radar, allowing smart investors to seize upon mispricing opportunities. Investors can also ‘miss the forest for the trees’, and not realise that there are well-established businesses with strong track records alongside the more obvious listings of newer companies and business models.

The significantly lower analyst coverage of stocks in the mid-cap universe compared to large caps provides excellent opportunities for active management to add value by rigorous bottom-up research.

Company leaders

Unlike large caps many mid-cap stocks are businesses that are founder-led. These companies are more likely to have management teams which are innovative, agile, and with interests that strongly align with that of shareholders.

In Fidelity’s experience, the best ideas or ‘future leaders’ in the global mid-cap universe are typically business models that are either structural winners, technology disruptors, innovators, category killers and/or brand leaders.

A dedicated mid-cap portfolio exposure

It’s common for large cap global equity managers to have some exposure to the mid-cap market in their portfolio. Data from eVestment shows that the median large cap global equity manager typically holds 20-25% of their portfolio in mid-cap stocks.

While some investors consider this exposure ‘ticks the box’ for mid-cap allocation, there is a strong argument that investment portfolios should include a dedicated mid-cap exposure.

With the mid-cap market less researched than the large cap market, and with many more stocks to select from, it does beg the question: are large cap managers equipped to manage mid-cap investments?

Large cap managers tend to focus their time analysing the performance of the biggest stocks in their portfolios to determine how performance compares to the benchmark large cap index. Mid-caps are not generally their focus.

An attribution analysis from eVestment (Figure 2) bears this out. It looks at the median performance of 305 global large cap equity managers and shows that over five years, large cap equity managers underperformed in the mid-cap portion of their portfolios relative to the benchmark index.

From a portfolio construction perspective, we believe global mid-caps provide excellent complementary exposure to a global large cap equity portfolio, but having a dedicated mid-cap manager is likely to be an advantage.

Figure 2: Medium performance of mid-cap element of global large cap equity managers vs index

Sitting in this sweet spot, there is a compelling investment case for global mid-caps. The sector offers exposure to the broad global equity asset class, but also the opportunity for superior returns, and superior risk adjusted returns, compared to global large cap equities. And contrary to common belief, mid-caps are also on average more liquid than the Australian large cap universe.

In short, global mid-caps offer the opportunity for an excellent diversifying exposure with a greater probability of above-index performance over medium and longer time periods.

James Abela is Co-Portfolio Manager of the Fidelity Global Future Leaders Fund at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.