With the future of the age pension thrust into the spotlight by pre-Budget speculation, the debate on retirement adequacy is running hot. After years of focus on the accumulation stage, the drums are at last beating about post-retirement and, specifically, what sort of lifestyle can be funded through retirement savings where superannuation is just one part of the equation.

Towers Watson and the University of Melbourne have created research that factors in other forms of savings as well as the age pension to get a fuller picture of retirement adequacy – and the result is sobering.

The first tranche of this research focused on a representative sample of Australians aged 40 to 64 and was based on the Household, Income and Labour Dynamics in Australia (HILDA) Survey data collected in 2010. A significant chunk of this age group is likely to fall well short of a ‘comfortable’ level of retirement income, as defined by the ASFA Retirement Standard, even when super, the age pension and other savings are taken into account.

The importance of retirement savings outside super

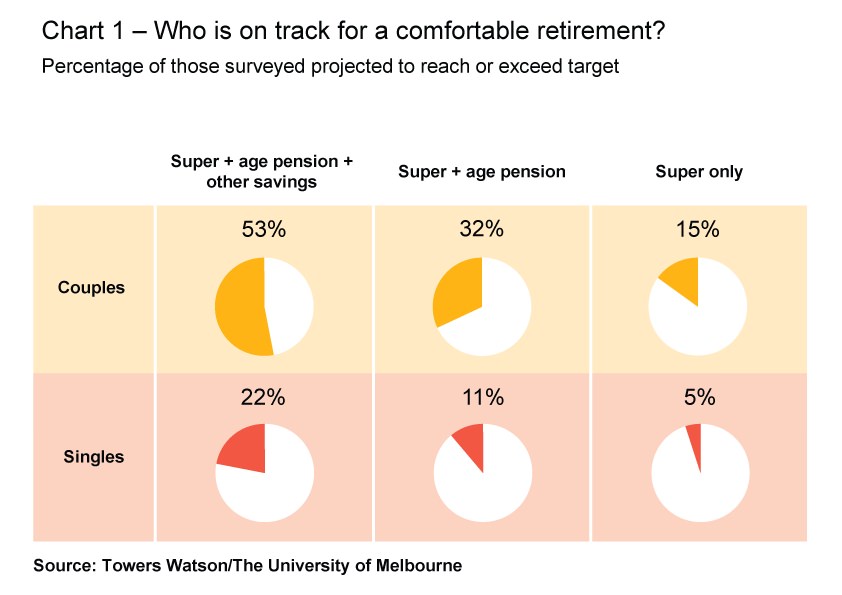

On this basis, our initial findings show that 53% of couples and 22% of singles in this age group are on track for a comfortable level of retirement income. We will release further research covering younger age bands later this year.

The debate on retirement adequacy and post-retirement income has come into sharp relief not only because of the federal government’s signals that the current welfare system is unsustainable but also the superannuation industry’s desire to engage members, innovate in post-retirement products and educate people on the need to create an income stream in retirement.

If we were only to rely on super, and ignore the age pension and other savings, only 15% of couples and 5% of singles would meet the standard. The importance of adding the age pension is clearly illustrated because the percentages more than double – 32% of couples and 11% of singles then meet the standard. When we also include other sources of saving, 53% of couples, but only 22% of singles, achieve the retirement standard.

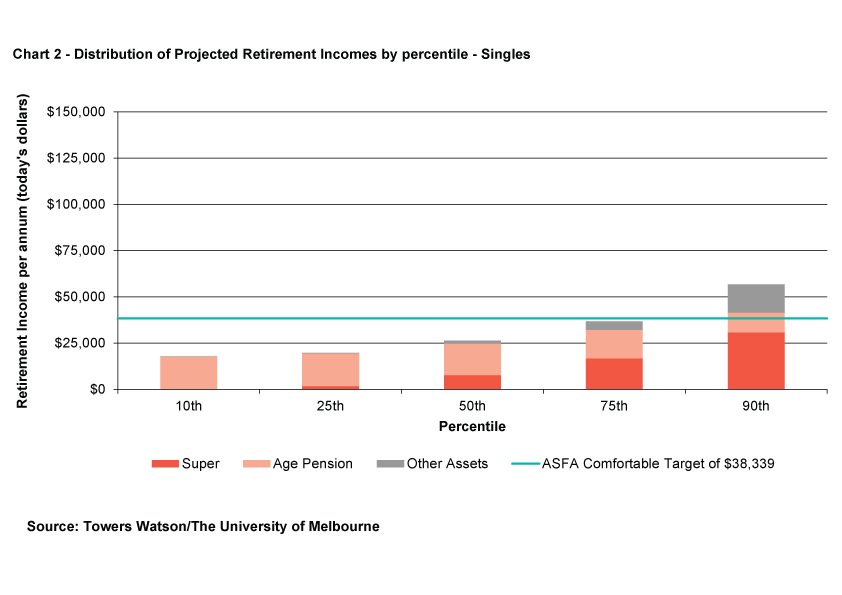

To further understand the breakdown of the projected retirement income, we look firstly at the people covered in the survey who are expected to receive the median projected retirement income, before considering those with higher or lower projections.

Need to add all components

We found that couples near to the median projected retirement income are expected to reach 100% of the target, but only if superannuation, the age pension and other retirement savings are all considered. In this instance, superannuation delivers 51%, the age pension delivers 40% and other retirement savings deliver 9% of the retirement income. While 100% of target is an impressive figure and a good outcome, we must remember that this is the median result, and 50% of those surveyed are below this level.

The position for singles is not as strong. The median projected retirement income here is expected to reach 68% of the target. There are many contributing factors, including relatively lower balances for singles in superannuation and other savings, as well as the relatively higher target income level required for singles – 73% of the target for couples, but with only one saver.

Looking more broadly, to those on higher or lower projected retirement income levels, we see the results in these charts.

Once again this highlights that couples are in a relatively stronger retirement adequacy position when compared with singles. Singles are also more heavily reliant on the age pension than couples. This is shown at the 25th percentile, where the age pension comprises 90% of the projected retirement income for singles, while for couples it is 63%. This is also observed at the 75th percentile where the age pension comprises 42% of the projected retirement income for singles, while for couples it is 22%.

Provide a retirement income projection

What are the opportunities for superannuation funds and financial service providers? The research highlights how important it is for superannuation fund members to be aware of their projected retirement income from all sources, not just super. Some funds are providing retirement projections to their members but this is still in its early stages and by no means widespread.

If the projections don’t mesh with their retirement lifestyle ambitions, then fund members need to take steps while they are still working and able to improve their position. It’s an important conversation for funds to have with each of their members.

The evidence suggests that most members currently don’t receive any information on their projected retirement incomes. Online calculators and financial planners are unlikely to solve this gap alone, unless more members become aware of the issues they may be facing.

Providing all members with a retirement income projection each year is a significant step in reaching a wider audience. Annual projections will be a vital starting point in raising awareness and should encourage members to obtain more detailed projections either online or assisted by financial planners.

Issuing annual benefit projections in accordance with ASIC’s Class Order is one of the ways of proceeding. Whichever approach is adopted, there are options available for funds to raise member awareness about their projected retirement income.

About the research

John Burnett and Nick Wilkinson from Towers Watson partnered with Professor Kevin Davis, Associate Professor Roger Wilkins and Dr Carsten Murawski from The University of Melbourne in this research which uses data from the HILDA Survey, to provide retirement projections based on an extended methodology of the retirement planner that Towers Watson built for ASIC’s MoneySmart website.

Using this model, we project the retirement savings for 5,124 individuals aged 40 to 64 residing in 3,519 households to the assumed retirement age of 65 and then the age pension eligibility is calculated each year in line with means-testing requirements. During this post-retirement period, superannuation and other retirement savings are then drawn down so that this wealth is exhausted by age 90. We calculate the level of retirement income that is maintained in real terms over the period from age 65 to age 90.

The current status as either a home owner or renter is assumed to continue into retirement. Where home ownership applies, we assume this continues to at least age 90 and do not draw on this asset when projecting retirement income in this research.

While there are many ways to measure retirement adequacy, in this research we have adopted a target of $52,472 for couples and $38,339 for singles. This is based on the ASFA Retirement Standard ‘Comfortable’ level (December 2012 figures) deflated to 2010 dollars to be consistent with timing of the HILDA data used. These targets have been indexed to allow for wage inflation in future years so the same target applies in real terms.

More detailed information on the initial research is available here.

John Burnett is a senior consultant and Nick Wilkinson a consultant in the Towers Watson Australia Retirement team.