Introduction: In this report commissioned by the SMSF Association, researchers at the University of Adelaide used data provided by BGL Corporate Solutions and Class Limited from over 318,000 SMSFs between 1 July 2016 and 30 June 2019, to identify the minimum amount of capital required for an SMSF to achieve comparable investment returns with much larger funds.

When coupled with research by the actuarial firm Rice Warner in late 2020, which found SMSFs with balances of $200,000 or more were cost effective compared with industry and retail superannuation funds, it supports the competitiveness of SMSFs with balances of $200,000 or more compared with larger funds.

The research also found SMSFs generate greater variation in fund-level performance relative to APRA-regulated superannuation funds. SMSFs with more diversified asset allocations achieve higher returns.

***

Investment performance comparisons between SMSFs and APRA funds have historically been difficult to make. APRA relies on information from financial statements to generate a Rate of Return (ROR) for APRA regulated funds, whereas SMSFs are regulated by the Australian Taxation Office (ATO), which produces a Return on Assets (ROA) measure for SMSFs based on data collated from SMSF annual returns.

The research took anonymised financial statement data and calculated an annual ROR for each fund in the data sample. A median ROR for the SMSF sector was then derived from the individual fund RORs. To compare against SMSF median ROR, a similar approach was used for the APRA fund sector with a median APRA fund ROR derived from APRA’s annual fund-level superannuation statistics back series.

Key findings

1. SMSF ROA consistently underestimates actual SMSF performance, with evidence suggesting this gap is widening over time.

The table below compares the differences between the ATO’s published ROA returns for the SMSF sector and the ROR calculated for each individual SMSF in the data sample for the period 2017 to 2019.

|

|

2017

|

2018

|

2019

|

|

Median ROR (via this research)

|

6.9%

|

6.0%

|

6.2%

|

|

Median SMSF ROA (via ATO)

|

5.0%

|

4.0%

|

4.3%

|

Source: Understanding SMSF performance, table 3.

The research found the ATO’s median ROA calculation underestimates the SMSF median ROR on average by more than 1.9% over the 3-year period from 2017 to 2019. This is over 50% larger than what was presented to the Productivity Commission for the period 2006 to 2016.

There are fundamental and irreconcilable differences between SMSF annual return data and SMSF financial statement data. While in recent times the ATO has made adjustments to align their ROA calculation measure more closely with ROR, ultimately it is not possible for the ATO to fully replicate APRA’s ROR calculation.

While it may be appropriate to use the ATO’s SMSF median ROA and average investment return figures to compare the performance of the SMSF sector with other years, these figures should not be used to compare the performance of the SMSF sector with other sectors

2. SMSFs with net assets of more than $200,000, that are not concentrated in cash and term deposits, outperformed APRA regulated funds in two out of three years between 2017 and 2019.

When comparing the headline performance of APRA funds with SMSFs, at the median APRA funds outperformed SMSFs in two out of three years between 2017 and 2019.

However, when small cash-heavy SMSFs are excluded, the opposite result is observed – SMSFs outperformed APRA funds in two out of three years between 2017 and 2019.

|

|

2017

|

2018

|

2019

|

|

All SMSFs

|

6.9%

|

6.0%

|

6.2%

|

|

APRA funds

|

7.8%

|

7.6%

|

6.2%

|

|

SMSFs with more than $200,000 and with less than 80% cash or term deposits

|

8.0%

|

6.6%

|

6.5%

|

Note: All returns in the above table are median RORs. Source: Understanding SMSF performance, table 6.

Of particular interest in this research study is the investment performance of SMSFs which actively invest. Excluding SMSFs which, either by default or choice, abstain from making investment decisions, provides a more useful indicator of performance.

Similarly, SMSFs with balances below $200,000 are more likely to lack the critical mass required to keep pace with larger funds (see research result 5).

Excluding SMSFs which meet either of these conditions (i.e. SMSFs with balances below $200,000 or with more than 80% of the fund balance invested in cash and term deposits) provides a more meaningful comparison of performance relative to APRA funds.

The research found SMSFs with significant cash holdings were associated with significant performance impairment for the three years between 2017 and 2019. The research also found a strong positive relationship between fund size and fund performance for balances up to $200,000. These results indicate the overall performance of the SMSF sector could be improved by identifying and assisting investors with small, cash heavy SMSFs.

3. SMSFs generate greater variation in fund-level performance relative to APRA funds

SMSFs have a higher propensity to outperform and a higher propensity to underperform relative to APRA funds.

While this is a feature of the broader range of investment options available to SMSF investors, it is also a feature of the significant difference in population sizes between the two cohorts.

The greater variation in fund-level performance, and a higher propensity to outperform relative to APRA funds, presents opportunities for advisers to add value, and deliver higher rates of return for suitable superannuation investors.

It also presents opportunities for advisers to assist SMSF investors who have a higher propensity to underperform.

4. In aggregate, SMSFs with more diversified asset allocations achieve higher returns

The performance benefits of adding a second, third or fourth asset class are strong and consistent across the 2017–19 period. Each incremental increase in asset classes (up to 4) is associated with an improvement in median ROR of between 1% to 3%. Diversification beyond 4 asset classes (up to 7) also improves aggregate SMSF performance, but at reduced marginal rates.

The results are consistent with standard finance theory. Higher levels of diversification are correlated with improved levels of investment performance.

The research results provide tangible evidence of the benefits of diversification. The research results underline the benefits of a properly formulated investment strategy and supports the regulatory focus on SMSFs with inadequate levels of investment diversification.

5. SMSFs achieve critical mass at balances of $200,000 or more

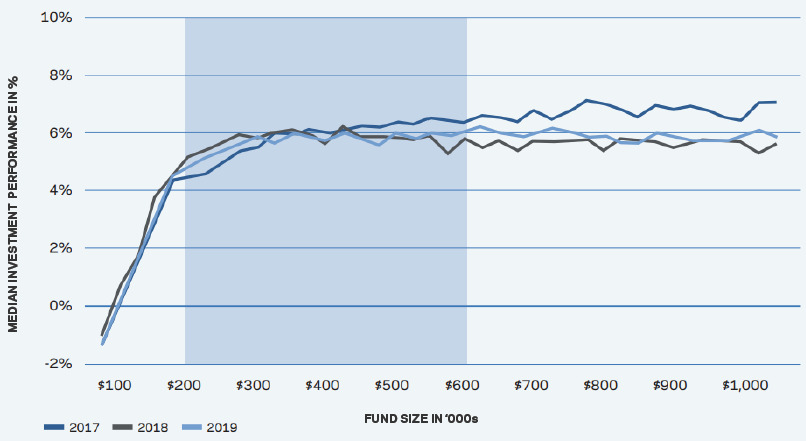

The performance of a typical SMSF improves as the balance of the fund approaches $200,000. Once this threshold is reached, the performance of the fund is comparable with SMSFs with much larger balances as illustrated by the flat line in the shaded zone in the figure below.

Source: Understanding SMSF performance, figure D2.

The research supports the regulatory focus on fund size, but it also suggests that current guidelines around minimum SMSF balances are poorly calibrated. The research data revealed no material differences in performance patterns for SMSFs between $200,000 and $500,000, so the notion that smaller SMSFs in this range deliver materially lower returns, on average, than larger SMSFs in this range, is not supported by the research results.

Fund size is important, but mainly for explaining the performance of SMSFs with balances up to $200,000. Beyond this threshold, fund size does little to explain fund performance, at least for the period 2017-2019.

This result complements research released by Rice Warner in 2020 on the cost of operating an SMSF which found SMSFs with balances of $200,000 or more, are cost competitive with both Industry and Retail funds.

In relation to fund size, prospective and existing SMSF investors (and their advisers), should have confidence in the performance prospects if they have $200,000 or more in net assets.

Peter Burgess is Deputy CEO and Director of Policy & Education at The SMSF Association. George Mihaylov is a Lecturer at The University of Adelaide’s International Centre for Financial Services. The full research paper can be downloaded here. This article is general information only.