For those seeking regular income, it’s tougher going in today’s markets. In Australia, the ASX 200’s current dividend yield of 3.5% is near its lowest in 25 years. Worse, the dividends aren’t expected to grow much over the next 12 months as earnings flatline.

Overseas, it’s no better. The S&P 500 is yielding just 1.25%. At least, the US has stronger forecast earnings growth of 15% for 2025, some of which should flow through to dividends.

Given this, where can investors go to find regular income in stocks?

A dividends primer

Many people don’t understand where dividends come from and how they grow, so here’s a brief guide to get you up to speed. Put simply, dividends come from earnings. So, firstly, you want to own a company that earns a profit. Second, you ideally want a business that is growing its earnings over time. Third, you also hope that the stock will pay out dividends from the growing earnings stream.

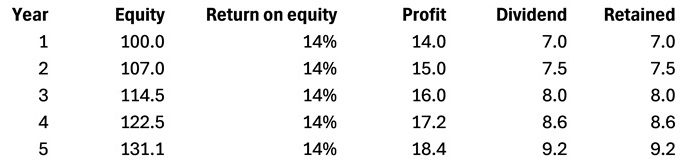

Let’s look at the example of theoretical company, XYZ:

Source: Firstlinks

XYZ has shareholders’ equity of $100, from which it makes $14 in profit in year one. Of that profit, it pays out $7 in dividends, equivalent to a dividend payout ratio of 50%. It retains the remaining $7 to fund future growth or improve operations by paying down debt or building a cash reserve for a rainy day.

The company maintains a healthy return on equity of 14% in future years as well as a dividend payout ratio of 50%.

By year five, it’s a pretty picture. Equity and earnings have grown nicely, as have dividends. The dividends have increased each year, and amount to $9.20 by year five, compared to $7 at the end of year one.

If I was an income investor in XYZ, I’d be happy.

The ASX’s dividend problem

The current issue with Australian shares is that unlike XYZ, they’re barely growing earnings, and they’re paying out less of those earnings out as dividends. Last financial year, the dividend payout ratio for the ASX 200 fell to 53%.

The market is also putting a heftier price on those earnings and dividends. The current price-to-earnings (P/E) ratio for the ASX 200 is 21.6x, more than 20% above its long-term average.

That’s resulted in the dividend yield for Australian stocks falling to 3.5%, almost two standard deviations below its average since 2000. Put another way, the dividend yield has only been lower about 5% of the time over the past 25 years.

The other problem is that growing dividends may prove more challenging going forward. Bank earnings aren’t expected to grow much more than mid-single digits over the next 12 months after falling in recent years.

The other index heavyweights, mining companies, are dealing with falling iron ore prices, and both BHP (ASX:BHP) and Rio Tinto (ASX:RIO) are highly leveraged to these prices. That means there is likely to be more dividend cuts from resource firms in 2025.

Where, then, can investors go to find income? Here are some ideas.

Idea 1: High yield dividend ETFs

An obvious idea is to own high dividend yielding ETFs. For instance, the largest dividend ETF, Vanguard Australian Shares High Yield (ASX:VHY), sports a forecast dividend yield of 4.8%, which equates to 6.4% grossed up. That compares to the ASX 200 dividend yield of 3.5%.

VHY tracks the return of the FTSE Australia High Dividend Yield Index and invests in companies with higher forecast dividends versus the average ASX company. It pays quarterly distributions, though the dividends aren’t fully franked. Franking was 66% in 2024 and 97% in the prior year.

There are a couple of issues with VHY to be aware of. First, it’s even more heavily weighted in financials and commodities than the ASX 200. Almost 75% of the ETF is exposed to these two sectors. That means future dividend streams are likely to be volatile - they may go up and down.

Second, like most high yield ETFs, VHY invests in high dividend yielding companies, and largely neglects those businesses that can grow dividends over time.

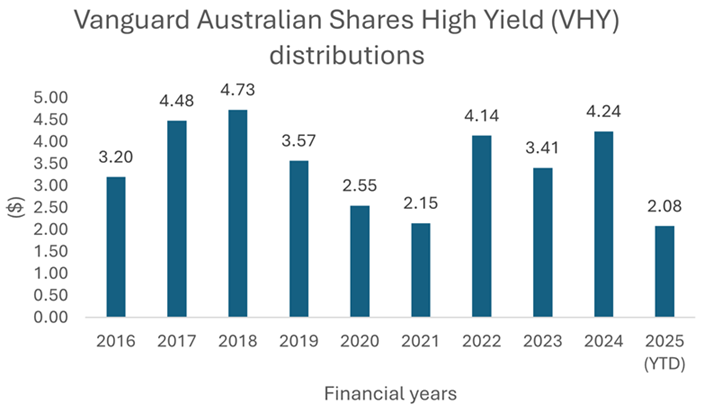

Both these issues can be gleaned from the chart below.

Source: Vanguard, Firstlinks

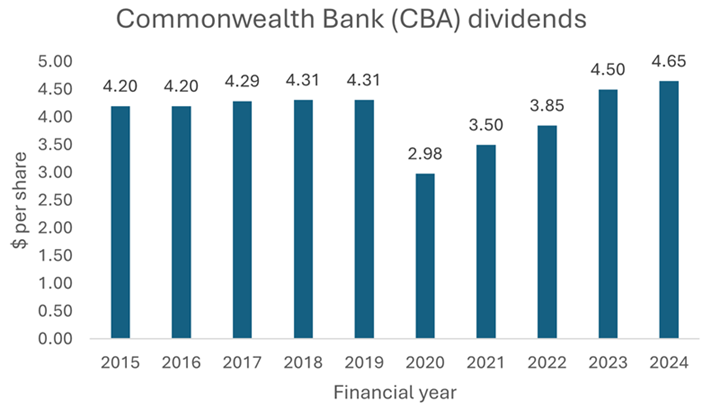

The chart shows VHY dividends by year. As you can see, dividends have bounced up and down. Part of that can be attributed to Covid, though not all of it. Note also how the dividends haven’t grown a lot over the past decade. That’s what happens when you heavily invest in banks such as CBA, which have struggled to grow earnings and dividends.

Source: CBA, Firstlinks

Despite these drawbacks, VHY or other equivalent ETFs are still worth considering for those seeking regular income. After all, grossed up yields of 6.4% for VHY remain relatively attractive.

Idea 2: Stocks with rising earnings and dividends

The next idea is to invest in Australian shares which are expected to grow profits and dividends. How do you do this? Well, you probably need to look outside of the banks and miners.

One possible option is listed investment company, Whitefield (ASX:WHF), which invests solely in industrials – essentially the ASX 200 minus commodity companies - and has a long track record.

You can also get exposure to faster growing stocks by investing outside the largest companies by market capitalization. For example, Betashares Australian ex-20 Portfolio Diversifier ETF (ASX:EX20) owns just businesses outside the top 20 of the ASX 200. There are also well-run managed funds, such as Auscap’s ex-20 Australian Equities Fund, that can achieve similar things.

Another idea is to invest in an equal index weighted ETF. For example, VanEck’s Australian Equal Weight ETF (ASX:MVW) offers exposure to the largest ASX companies, but weighted equally rather than by market cap. This results in holding less of the banks and miners, and more of the rest of the ASX.

Of course, you don’t have to invest in ETFs and can own stocks directly instead. I won’t go into too much detail here as I’ve outlined many dividend stocks in previous articles, but companies with decent, growing yields on reasonable valuations that I currently like include Telstra (ASX:TLS), Medibank (ASX:MPL), Aurizon (ASX:AZJ), Charter Hall Retail (ASX:CQR), Lottery Corp (ASX:TLC) – all sporting dividend yields from 3.3% to 7.6%.

Idea 3: International stocks

Those seeking income can also invest overseas. Unlike Australia, the US has so-called dividend aristocrats – companies that have not only paid dividends but grown them in each year for at least 25 years. The ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL) tracks these companies. The downside is that the current dividend yield for this ETF is just 2.25%. And its total return of 11% over the past decade has trailed the S&P 500’s 13.4% (which isn’t a big negative given the outperformance of tech companies over everything else).

Another way to invest internationally for income is to just own the S&P 500 index or world index itself. For example, the top 500 companies in the US have grown dividends by almost 8% per annum over the past decade. Of course, past performance is no indicator to the future, though American companies have historically grown earnings by 5% per year in real terms.

Another idea is to get income via thematic investing. I like infrastructure as a theme as many of the companies in the sector - airports, utilities, railroads, toll roads and the like - have critical assets with CPI-adjusted pricing. There are Australian-based global ETFs that capture this theme, including Vanguard’s (ASX:VBLD) and VanEck’s (ASX:IFRA). There are also managed infrastructure funds with decent track records such as First Sentier, Resolution Capital, and Magellan.

It's worth noting that international investing has some complications that Australian-based investing doesn’t. One is tax - dividends here offer franking credits, while those overseas don’t. The tax paperwork for overseas dividend paying stocks can also be exhaustive. A further issue is exchange rate fluctuations. Whether to hedge the currency or not is a key decision when investing overseas.

Final considerations

Hopefully this gives you some ideas for getting regular income from stocks. How you build your dividend portfolio will depend on your personal circumstances, so get advice if you need it.

Full disclosure: some of the funds and ETFs mentioned in this article are Firstlinks’ sponsors, including Magellan, Resolution Capital, First Sentier, Vanguard, and VanEck.

James Gruber is Editor of Firstlinks.