Retirement security globally is under increasing pressure, as inflation, a volatile market environment and low interest rates impact retirement balances. The recently-released 10th annual Natixis Global Retirement Index (GRI) reveals 2022 could be the most-challenging year to retire in recent history. The GRI examines the factors that drive retirement security, combining key indicators essential for people to enjoy a healthy and secure retirement.

This article is a summary of the full GRI Report which can be downloaded from this link.

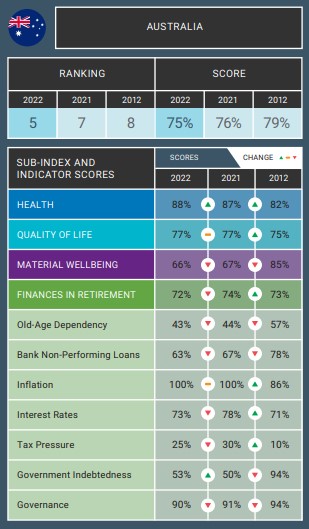

Australia's ranking

Retiree risk in 2022 arises not only in taking retirement income from an already depleted pool of assets, but accepting greater risks in portfolios to make up the ground already lost.

The GRI includes 18 performance indices, grouped into four thematic indices. Australia ranks as follows in 2022:

- 4th for Finances in Retirement (4th in 2021 and 8th in 2012)

- 9th for Health (compared to 10th in 2021, and 20th in 2012)

- 15th for Quality of Life (15th in 2021; 21st in 2012)

- 19th for Material Wellbeing (compared to 23rd in 2021 and 4th in 2012)

These four indices use the following factors:

- Health – life expectancy, health expenditure per capita, non-insured health expenditure

- Finances in Retirement – old-age dependency, bank non-performing loans, inflation, interest rates, tax pressure, governance, government indebtedness

- Quality of Life – happiness, air quality, water and sanitation, biodiversity and habitat, environmental factors

- Material Wellbeing – income equality, income per capita, unemployment

Here are the recent movements in Australia's scores.

The impact of inflation

For most of the past decade, inflation has been exceptionally low. Between 2012 and 2020 inflation for the 38 OECD member countries averaged just 1.76%. However, in the first half of this year, inflation rose for those 38 countries, reaching 9.6% in May 2022.

In Australia, inflation is expected to peak at an annual rate of 7.75% by the December quarter of this year and to fall gradually, however the current level of 6.1% is the highest rate recorded since 1990.

The speed at which costs have increased around the world gives reason to rethink fundamentals in retirement planning. Significant price rises for oil, food, and housing are reducing the purchasing power of retirees and presenting a core economic lesson to those planning for retirement.

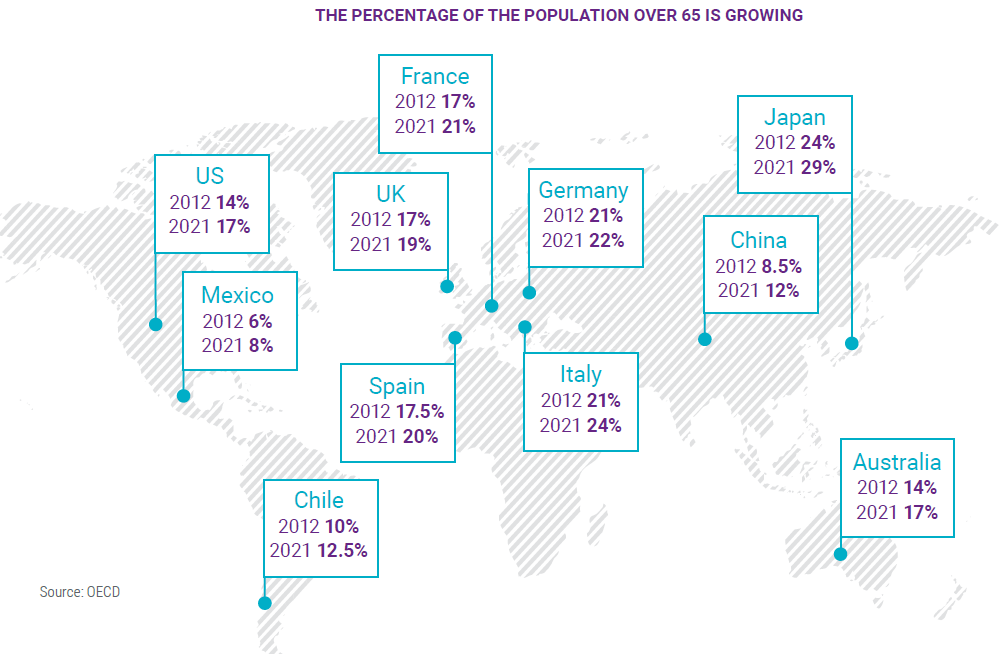

Further, financial professionals around the world say underestimating the impact of inflation is the number one mistake investors make in their retirement planning. The OECD projects the over-65 population will increase from 17% of the total in 2019 to 27% by 2050, increasing the strain on retirement security, and putting additional pressures on healthcare and long-term care systems.

10 years of the Global Retirement Index

When we introduced the Natixis Global Retirement Index in 2012, the world had just emerged from the global financial crisis and memories of market turmoil were still fresh. Inflation was low, but so was growth. Central banks had slashed interest rates to all-time lows. Balance sheets had ballooned from asset repurchase programs. And public debt had swelled to record highs around the globe.

On top of it all, the first wave of the Baby Boom generation had just reached retirement age, indicating that pay-as-you-go retirement systems around the world would soon face a stress test like no other. It all raised the question of whether the models for those systems would be sustainable in the long term.

In 2022, the world finds itself recovering from another global crisis. Inflation is running at levels not seen since the 1980s. Balance sheets and debt levels have soared even higher. Central bankers again are turning to interest rates as a stopgap, only this time they’re raising rates. After a decade-long bull run, the markets are more volatile, with indexes and investors around the world experiencing losses. The Boomer retirement wave is at its crest, and the Millennial generation is making its presence known in the workforce.

Interest rates and income: long-term gains, short-term pain

Low interest rates have been the bane of retirement security for well over a decade but there are a lot of advantages to living in a low-interest-rate world. Low rates helped propel global growth from $75 trillion to $104 trillion over the past decade. They’ve helped drive equity markets to record highs, helped business grow, and helped individuals attain homeownership.

Those investing for retirement most certainly benefited, but low rates have not helped retirees in equal measure. In fact, low rates have presented retirees with some difficult choices.

In the simplest terms, low rates have made it hard for retirees to generate income off their savings. With rates in low to negative territory, many were not able to follow the golden rule of 'Never touch the principal'. Instead of waiting for bonds to throw off a sustainable income, retirees were forced to dip into the principal of their nest egg when they might normally seek to preserve their capital.

This puts them in the difficult position of lowering their expected income, accepting that their assets may run out too early, or taking on more investment risk to make up the difference. Each decision takes on heavier consequences in 2022’s volatile markets.

Risks at every turn for retirees

With inflation running at a 40-year high, those on a fixed income will already find it difficult to keep pace with rising costs, let alone find room to cut their income. Longevity adds to the challenge. People may be living longer, but nobody knows how long they will live. As a result, there’s a crucial piece missing to the equation that tells you how much income you can take from your savings while ensuring it will last the rest of your life.

In the long run, retirees may gain some hope for higher income in the future, but not without some pain along the way as markets weather the change. Unfortunately, few investors may understand what rising rates hold in store for them. In 2019, the Natixis Center for Investor Insight conducted a quiz with 9,000 investors in 27 countries. We asked them what two things happen when rates go up. They weren’t sure.

Professionals may recognise that with rising rates there’s a greater chance for higher income in the future, but that the present value of the bonds you currently own goes down. Only 3% of investors worldwide understood both sides of the equation. One-third didn’t understand either.

Individuals and institutions will find the hope for higher income and improved funding ratios in the long run, but the ancillary effects of rate increases can result in a lot of pain in the here and now.

Demographics: the good and bad of living longer

It’s no secret that the population in Japan, Europe and the US is aging. The drumbeat of concern has been loud and clear since statisticians first realised that the massive post-World War II Baby Boom generation would eventually enter their 60s and that wave would put a strain on retirement systems.

In 2012, the earliest wave of the Baby Boom generation was just reaching retirement age as the 2.1 million individuals born in the US in 1946 inched closer to age 66. Since then, the number of people age 65+ in the US has grown to 16% of a population of 331 million. In Europe, that population represents an even bigger piece of the pie at 20.8% of the 750 million EU residents. The number is bigger still in Italy (23.5%), Finland (22.7%), Greece (22.5%), and Portugal (22.4%).

Even regions with young populations could soon face similar challenges as improved nutrition, healthcare and environmental factors contribute to longevity and low birth rates help push the overall population ever older. This is the case in both China and Latin America in 2022.

Older for longer

Adding to the sheer volume of individuals who would be entering retirement is how long they will live after they retire. OECD reports that the average life expectancy past age 65 in G20 countries reached 21.3 years for women and 18.1 years for men between 2015 and 2020. And while the gains in lifespans past 65 have slowed slightly since 2010, the average for women past 65 in these countries will reach 25.2 between 2060 and 2065, while it will increase to 22.5 for men.

As a result of increased life expectancy and slowing fertility rates, OECD projects the over-65 population to increase from 2019’s 17.3% to 26.7% by 2050. The percentage will be even higher in older countries. OECD estimates that this share of population will surpass 30% by 2050 in Greece, Italy, Japan, Korea, and Portugal.

Population growth doesn’t add up to retirement security

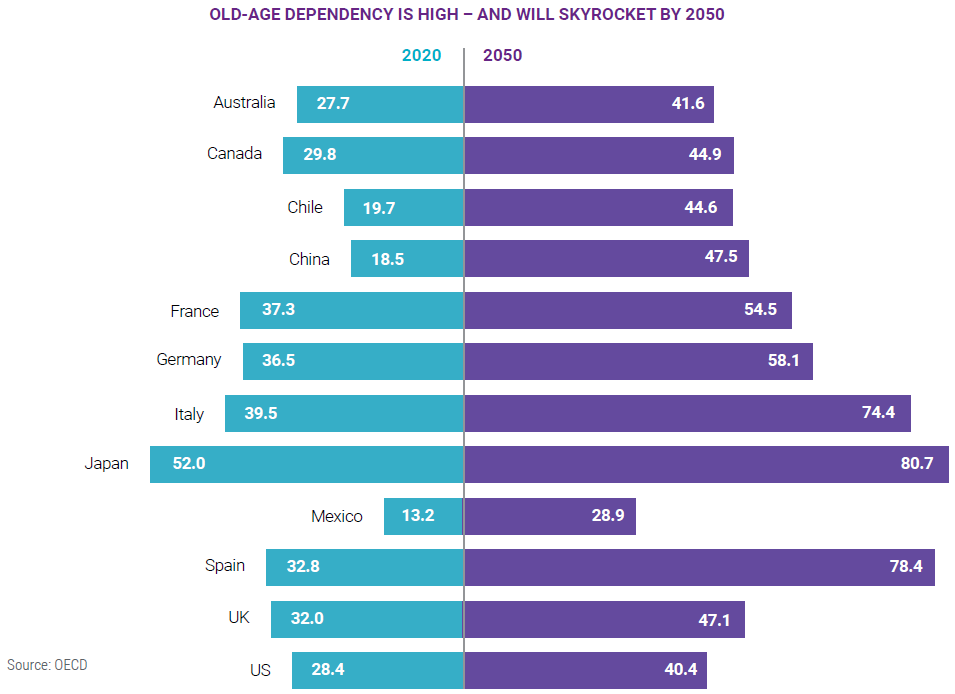

This is where maths becomes most concerning for policy makers. A larger population that will live longer breaks the formula behind most pay-as-you-go retirement systems. Many of these systems, like social security in the US, use payroll taxes to fund government retirement benefits. What makes them work is the balance between the number of working age people and the number of retirees – and others – drawing benefits.

The problem is best illustrated by old-age dependency ratio, which provides a simple statement on the number of retired people out of every 100 people within a population. For most of the developed world, that number has been climbing steadily higher for the past century.

In 1950, just 15 years after its social security system was created, the US had an old-age dependency ratio of just 14.2%. Seventy years later it reached 28.4%. By 2050 the over-65 population in the US will reach 40.4%.

A similar trend shows up in the perennial top three countries in the Natixis Global Retirement Index. Iceland will see its old-age dependency increase from 26.6% to 46.2%, Switzerland’s will go from 31.3% to 54.4%, and Norway’s will rise from 29.6% to 43.4.%.

Limited options for policy makers

Aging populations present limited choices for policy makers – choices that will be difficult as retirement benefits compete with a growing public debt burden. The debt to GDP ratio for OECD countries reached a record high of 95% in 2020, a figure that’s 73% greater than it was in 2007, before the Global Financial Crisis.

Down the road, policy makers could be forced into one of three tough decisions, none of which are real vote-getters. To make up for funding shortfalls they may need to:

- Raise payroll taxes: Hiking taxes is never popular and will be even less so should inflation continue to reduce consumer purchasing power as it’s done in 2021 and 2022.

- Raise the retirement age: Telling people they have to work longer than planned is an unenviable position. In 2020, French workers took to the streets to protest a proposed retirement age increase from 62 to 64. And in 2021, Swiss workers marched in Bern to protest retirement reforms including a proposed hike in the retirement age for women from 64 to 65.

- Reduce benefits: Maybe the least popular option, reducing benefits is not only a political loser, it’s also an economic nightmare for retirees, especially during inflationary periods when their dollars don’t go as far to begin with.

Aging also presents a critical healthcare challenge for both policy makers and retirees themselves. For example, in the US, where health expenditures already account for nearly 19% of GDP, those age 55 and older accounted for 56% of healthcare spending in 2019. Those 65 and older accounted for 35% on their own.

Rising costs are not limited to the US. The World Health Organisation reports that global healthcare spending topped $8.5 trillion in 2019, or twice the $4.2 spent globally in 2000. An older population can also translate into a slower economy. With large numbers of individuals leaving the workforce, OECD suggests that there could be significant economic consequences. Growth could be impeded as:

“there will be less working-age people in the population, older workers tend to be employed less, and may be less productive and entrepreneurial.”

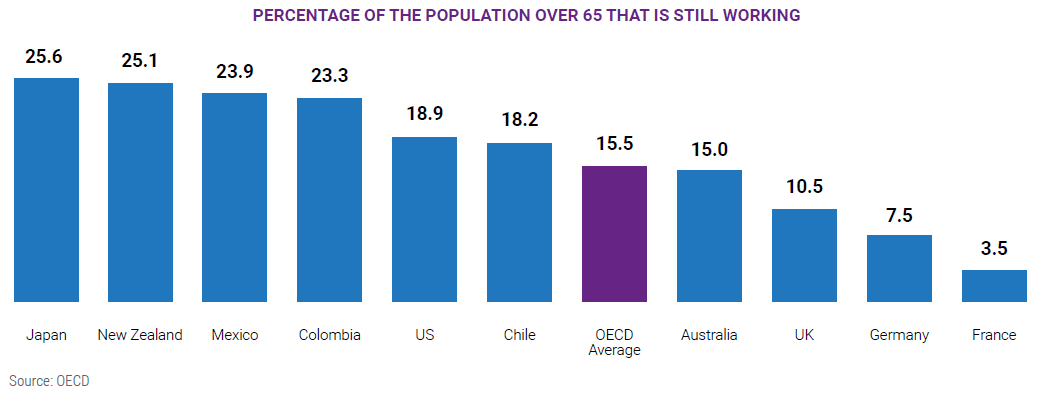

Retire or keep working?

For many individuals globally, the traditional view of retirement is fading. Many continue to work well beyond retirement age. In fact, results from the 2021 Natixis Global Survey of Individual Investors show that even as they plan to retire at age 62 on average, six in 10 believe they will have to work longer than they anticipated. This from a group of more than 8,500 individuals who already has at least $100,000 in investable assets.

To view and download a full copy of the report, visit link.

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world.

The team includes Dave Goodsell, Executive Director; Stephanie Giardina, Program Manager; Erin Curtis, Assistant Program Manager and Jessie Cross, AVP, Content.

This article is a summary of the full report which should be referenced for more details and source references. The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted.