The experience of investing in risk assets over the last six months has been a miserable affair for most involved, particularly in some corners of the market where we have seen a collapse in share prices. We question, however, why this might be a surprise for investors.

Many investors became conditioned by the environment that had prevailed for over a decade, with a smooth and clear road to higher prices for equities and most financial assets. The world’s key central banks had a specific goal of lower yields (higher prices) on financial assets since the great experiment of quantitative easing commenced. We have been in an era that has been less about investing capital efficiently and more about deploying capital to the beneficiaries of the great inflation in financial assets.

This era even had its own language: SPAC, FAANG, meme, NFT, crypto, FOMO, etc. Whether the current outcome is surprising or not, all investors are now faced with a new and ongoing challenge. In our view, policymakers no longer have our back and inflation – rather than the price of risk assets – is their number one priority. The road ahead will not be so easy.

Techniques to navigate gloomy markets

It is easy to become gloomy after the losses of the last few months, but there are reasons to be more optimistic about the prospects for compounding capital from today’s levels.

1. Recognise we have shifted to a rougher and more variable road

As investors in individual companies, we are constantly asked to differentiate between volatility that is either short-term angst versus a signal of change. We suggest always being open-minded to new information that could undermine a thesis.

The thesis is that we are seeing a regime change.

First, in the shorter term, inflationary trends are likely to ease as the pending rate-induced recession commences and supply chain pressures improve. On balance, however, structural energy undersupply, labour market constraints and military expenditures will all contribute to sticky inflation at rates likely to be above the 2-3% ideal for central banks. Risk-free rates will therefore remain at higher levels.

Second, geopolitics will likely remain problematic as the battles for technology dominance between China and the US, and the struggle for military supremacy in Ukraine, are likely to be prolonged. The free flow of capital across borders should no longer be assumed, the cost of borrowing in the world’s reserve currency will likely stay high and we need to be prepared for an increasing shift from certain actors, such as China, moving away from the US dollar as the currency of external trade in the years ahead.

In short, we believe that growth in the broader economy will be less certain and more cyclical, and as a result, the cost of capital will not return to the low levels of 2020–2021.

2. Realise that this new road may be best travelled in different vehicles

The good, albeit challenging, news for investors is that when there is a regime change, there is a high probability that there will be new leaders in the race ahead. The leaders over the last cycle were information technology, consumer discretionary and energy. Assuming they will automatically return as market leaders is a brave call based on this work.

New leadership is likely to emerge given the scale of surplus capital previously allocated to the winners.

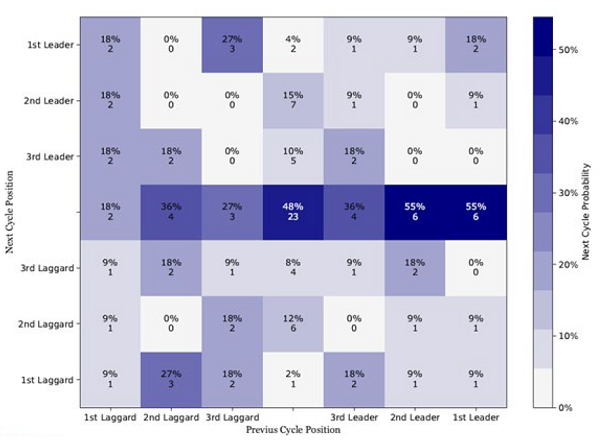

This following table looks at the probability of a sector in the equity market leading in the next market cycle having led in the previous one. After a 20% drawdown in markets, such as recently experienced, what are the chances that the prior leader can repeat the performance in the next market advance?

This study ranks sectors back to 1957 for the US market. It counts the bull cycle as the point of the price low after a 20% bear market to the subsequent price high before the next 20% drawdown. There were 11 such cycles in the last 65 years.

The probability of tech leading the market over the next five years or so is answered in the top right of the table with only a 27% chance of tech remaining in the top two sectors for forward returns. In fact, the top left shows that there is a somewhat higher probability that the next cycle may be led by those that have lagged the most. It underlines the need for investors to keep an open mind as to where market leadership will emerge.

Probability of maintaining leadership after-market drawdown over 20% (1957-2022)

Source: RENMAC

3. Stick to a few enduring principles

There are often some common traits in quality companies, and we highlight the following:

A) Invest in price makers versus price takers

It is not just the price for assets that has had favourable tail winds over the last decade, but also profitability. In the decade prior to 2021, about half of the improvement in profit margins for US manufacturers was down due to lower interest costs and taxes. Whilst lengthening of debt duration may dilute the impact of rising rates, there is now a clear headwind for interest costs and taxes similarly are heading upwards in many economies.

Gross margins are similarly challenged by rising labour inflation (and availability), a shift to more local and higher cost supply chains, rising raw material input prices and (particularly for those sectors previously benefitting from COVID-related revenue boosts) negative operating leverage as sales decline. On average, times are getting tougher for businesses, and franchise strength is being tested more fully. Where products and business models are unique, dominant or gaining share, the scope for passing on costs to customers and sustaining volume growth is greater.

B) Ensure capital funding is sustainable

The cost of debt is going up and the availability of debt could become more irregular. The degree of change in debt costs in US dollars is much greater than in other currencies, and given its reserve currency status, it raises the global cost of capital for many businesses. Self-funding growth (high free cash flow) and balance sheets with appropriate and long-duration debt, in our view, will be better placed to keep investing through the pending down cycle. Cash-burning, profitless business models likely won’t pass the test.

C) Focus on justifiable valuations

The penalty for investing at inflated prices and a lack of future cashflows can be quite onerous. Compounding capital from levels that can be politely described as ‘frothy’ is difficult. When the music stops, falls of 80-90% are common for the frothy crowd, and more often than not they stay down as profitability remains a dream rather than reality.

D) Find the future quality winners

Companies on a unique journey of improvement that can sustain high returns on invested capital over the next five years or more have always been the best starting point.

Energy transition

We retain our optimism that an enduring cycle of rising investment is now upon us as societies need to address the challenge of sustaining the still-necessary fossil fuel production, increasing supply from more trusted regimes, improving energy efficiencies, reducing emissions, and further developing alternative energy sources. The latter is key from a climate perspective, but also energy intensive in its own right, creating a circular requirement for the other drivers.

This quarter we have added Worley, an Australian-based provider of engineering consultancy and design services, and Linde, a leading global industrial gas provider. Both are expected to be price makers in their respective markets.

Enduring growth

We are increasingly cautious about the growth outlook for many consumer-facing companies. We believe that falling propensity to consume (due to greater spending on mortgage and utility costs) and prior COVID-led pulling forward of demand will be difficult and enduring problems to overcome.

Sustainable growth that is less impacted by consumer cyclicality. Our long-standing overweight in the healthcare sector highlights the fact that we see the demand backdrop for better and more cost-effective solutions across ageing societies as being very much enduring in nature.

In other sectors, we have also added new holdings with similar attributes, such as O’Reilly Automotive and beverage maker Diageo. The need to repair autos given the significant ageing of the fleet in the US will remain strong, and premium spirits will remain an affordable luxury with long-life inventory less impacted by the current rise in input costs.

Other recent additions include leading franchises in areas such as travel, where prior consumption has been constrained significantly by COVID and as a result, we added Amadeus IT, the world’s largest provider of travel booking systems, to our portfolios.

In summary, the benevolent investment conditions of most of the decade until 2021 are now gone and investors need to stick to stronger long-term principles that have succeeded in the past.

William Low is Head of Global Equities at Nikko Asset Management, part of the Yarra Capital Management Group. This article is of a general nature and does not constitute personal advice, nor does it constitute an offer of any financial product. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided.